Finding low risk stocks with high growth potential has become a very popular investment methodology recently. Easily the most famous investor who specializes in this type of investments is Cathie Woods with her signature ARKK innovation ETF.

If you had bought Cathi Woods ARKK Innovation ETF in 2019 or 2018 and held until 2021 you would have seen close to a 300% return on investment over 3 years.

This is a huge Return on Investment (ROI). An investment of $25,000 put into ARKK in 2018 would of turned into $75,000 within three years. An investment of $1,000,000 would of turned into $3,000,000.

Its the goal of this article to give you 5 currently undervalued stocks that could net you returns on par with what we saw from ARKK. Each of these stocks are at or near market valuation and as such present little risk but huge economic gain.

Let’s jump right

GladStone Land Corp (LAND)

Company Website: https://www.gladstonefarms.com/

Currently GladStone Land Corp is a great buy.

The stock price of LAND is set to explode over the next decade. This is because LAND specializes in buying, holding, renting, and eventually selling farmland in and around urban areas.

They strategically buy up farmland in places where the urban center is slowly expanding outwards. These urban centers are located on geographically flat land with a history of farming.

While LAND holds their farmland they rent it out to farmers who farm and sell agricultural product. LAND collects a portion of the farmers income as rent. Year over year LAND has returned increasing rewards for investors in the form of dividends and stock price growth.

If you want a full run down on why LAND is a great investment then check out this post.

In all you can expect to see considerable growth in your portfolio over time. The risk on LAND is small because you are investing in a defensive sector, consumer staples (farming). Even if the market goes down, LAND will still retain its value.

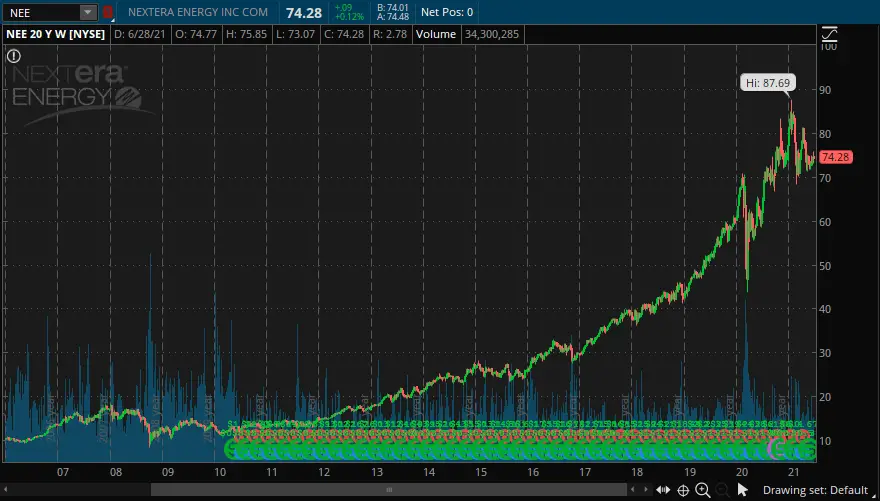

NextEra Energy (NEE)

Company Website: https://www.nexteraenergy.com/

NextEra Energy is an amazing company that generates, maintains, and distributes energy to consumers across North America.

They have a stranglehold on energy distribution in the state of Florida through their energy distribution sub-business Florida Power and Light (FPL). This generates considerable revenue for NEE and is expected to continue to grow as Florida’s population does.

NextEra Energy invests heavily into renewable energy generation. As time goes on we see more and more windmills, solar cell plants, and battery storage facilities come online for NEE. These facilities are great investments for NEE as they have low operational costs and long life expectancies.

This means that NEE can push other energy competitors out of the market by dropping the price per kilowatt hour down below their competition. NEE has been doing this successfully since 2010 and as such their stock price has exploded.

NEE is set to dominate the energy sector of the United States. They currently are erecting wind farms across the United States and selling this energy to third party distribution companies. Eventually NEE will come to dominate these areas as well.

As such NEE is a great investment. The risk in the investment is minimal because you are investing in the energy sector. The growth potential is massive and you could see a 100% increase in price over the next decade.

For a full run down on NEE check out the following post.

India…the WisdomTree India Earnings etf (EPI).

Company Website: https://www.wisdomtree.com/etfs/equity/epi

I know, I know. India?

Well yes. This is because India is quickly becoming the largest developed economy with the largest middle class population.

First, this emerging middle class is expected to have one of the largest discretionary incomes of any middle class in the developed world.

Second, discretionary income means a growing consumer economy. This consumer economy will then lead to massive GDP growth.

We saw this with the United States from the 50’s-90’s. The same thing is going to happen with India in the coming decades. Now is the right time to invest in WisdomTree’s India ETF…EPI.

EPI seeks to track the largest market cap companies in India. Think of it as the U.S version of the SPY. As India’s GDP grows so will these large cap companies. Investing in EPI exposes you to this growth.

Currently there is little risk in investing in India. The economy is growing, there is an emerging middle class, and India is becoming more open to foreign investments. This is a winning combination that can only mean growth.

For a full rundown on the EPI etf and how you can profit from it see the following post.

Coinbase (COIN)

Company Website: https://www.coinbase.com/

Coinbase is a leading crypto currency brokerage platform. They offer an easy to use software trading system that seeks to attract, retain, and profit off crypto investors.

Coinbase has first mover advantage in what will be an extremely lucrative market. Being a market maker for crypto currencies in the United States.

The reason behind this is both complex and simple at the same time. The United States has the largest economy that is powered by a middle class with way to much money. Further this consumption driven economy has one of the highest discretionary incomes of any developed economy.

Currently it is estimated that only 23%-30% of the U.S adult population even knows what crypto currency is and an even smaller portion invests in the risky assets. As more young people age and obtain discretionary wealth the market for crypto is expected to explode.

Coinbase has positioned itself perfectly to capitalize upon this explosion. This is because their trading platform is designed around ease of use. As such over 90% of new customer acquisitions comes from word of mouth advertising!

Further, COIN has seen income rise exponentially over the past 3 years. The crypto explosion has only started and it is here to stay.

This is why Cathi Woods and here ARKK ETF have invested considerable in ARKK over the past year. Its economic potential is just amazing.

The risk for Coinbase is minimal currently. The company has way to much money and it is investing heavily into further customer growth. We might be at the lowest point that you will see for COIN ever.

For a full run down on why COIN is a great investment see the following post.

Aspen Aerogels (ASPN)

Company website: https://www.aerogel.com/

Aspen Aerogels is a solid company.

For the longest time ASPN provided thermal protection aerogel products for the industrial and space sector. They have been around for a while and made their money pursuing U.S federal research contracts.

With the money from the federal contracts they would then apply the R&D product to the commercial market. This has made them a sizable fortune over the past five years.

Everything changed in 2019 however. ASPN had made so much money and its products were so widely used that they gave up the federal contracting side of their business to focus on a new sector.

The electric vehicle market….

This is because their flagship aerogel products make great thermal reduction barriers for lithium ion batteries. These batteries are the major energy component of electric cars and have been, for the longest time, the major bottleneck in the entire EV sector.

Thermal build up in EV lithium ion batteries results in a shorter lifespan, increased EV cost, fire hazards, and most importantly a shorter EV range. As such the thermal buildup present in EV’s have held back the entire sector.

Into this bottleneck steps ASPN with their thermal reducing aerogel products. In 2020 ASPN made the bold decision to walk away from federal contracts and begin networking with EV manufacturers in the United States.

In their 2020 annual report (10-K) ASPN announced that they had secured a deal with a major EV producer in the U.S to test their thermal reduction products in EV batteries. It was a success and since then close to 10 other manufacturers have approached them to engage in business dealings.

For a full run down on ASPN check out this post.

Conclusion

Each of the above stocks present amazing growth opportunity with little risk. I have covered each of them in detail in their own research posts. I highly encourage you to check them out if you have the time. They go over the business, fundamentals, and present a thesis.

As always if you like content like this you should share on social media (it helps a lot) and subscribe to the newsletter!

-

How Long Does a Short Squeeze Last? (3 Answers)

What is the time frame for you short squeeze? Well here is everything you will ever need to know to determine how long it will last.

-

Why You Still Own a Stock After It’s Delisted and How to Sell It

Do you still own a stock after its delisted? How do you sell it? Don’t worry the stock is still worth money and here is how to sell.

-

Can You Make 1% A Day in the Stock Market? (3 Steps)

Making 1% a day in the stock market is hard but defiantly doable. Here are 3 simple steps to helping you achieve this return.

Until next time, I wish you the best of luck in your investments!

Sincerely,