Update

Since I have published this post LAND shot up from $23 to $34. A potential profit of 33% That’s amazing for a REIT stock.

LAND is the ticker for Gladstone Land Corp. A REIT company that invests in buying arable farmland. By investing in LAND you are setting up your portfolio to gain off two different markets. The first is the ever increasing value of land and the second is the rent from the tenant farmers.

How is a REIT different from a normal stock?

First, REIT stands for Real Estate Investment Trust. A REIT owns, operates, or finances real estate that generates income. REITs are modeled after mutual funds, meaning that they pool large amounts of investment capital together to pursue intangible assets such as land.

Typically a REIT is designed to offer a steady income stream to investors in the form of dividends and normally don’t offer much in the way of capital appreciation. This is due to the business model of REITS being forced by the SEC to give back 90% of their income back to investors in the form of dividends.

LAND is different. Let me explain to you why.

Business Model

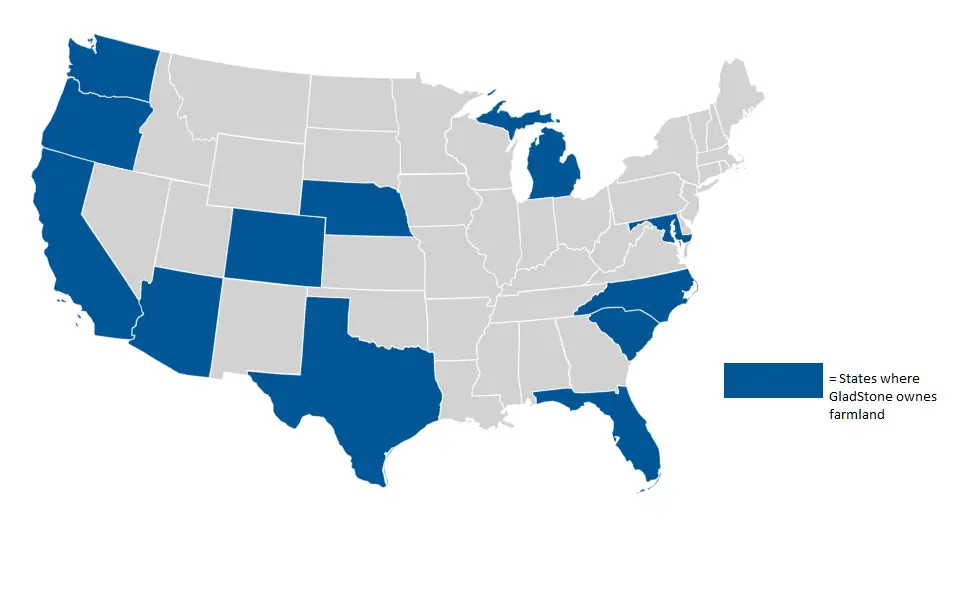

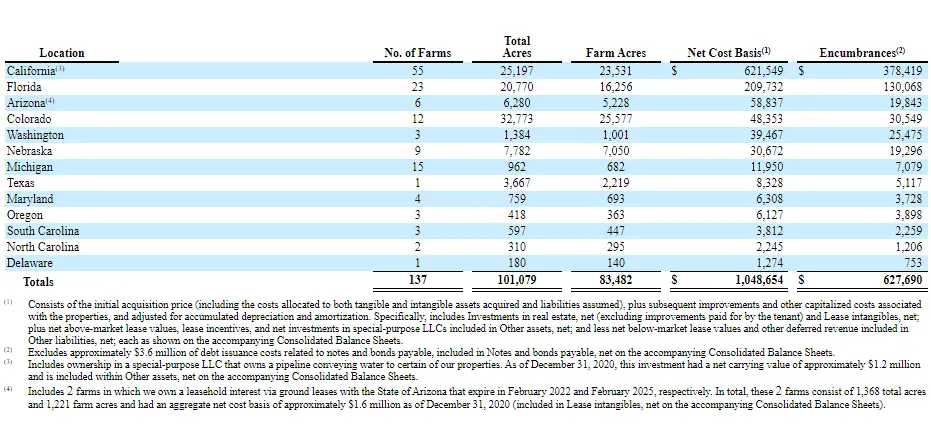

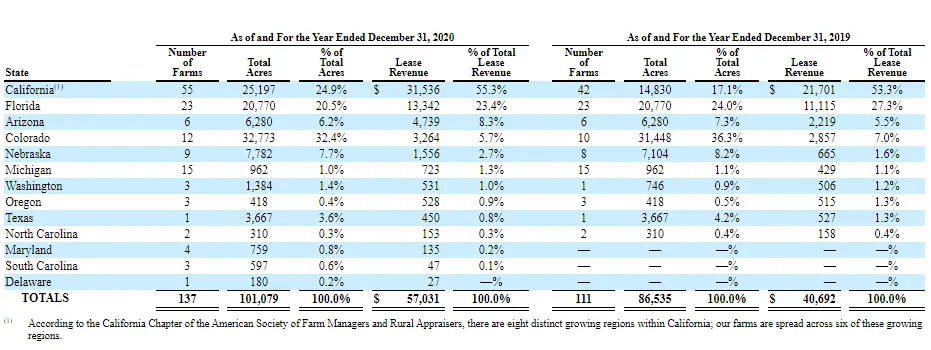

Gladstone Land Corporation was incorporated on March 24th, 2011 and IPO’d two years later on January 29th, 2013. LAND currently holds over 101,000 acres across 13 states in the United States. The main income generating element of LAND is the 137 small and mid tier commercial farming companies that operate, farm, and maintain the farmland. Gladstone collects rent from these tenants.

The tenants that farm Gladstone’s farmland primarily grow row crops such as vegetables and berries. These crops are harvested continuously throughout the year and as a result generate consistent revenue for the farmers on Gladstone’s land.

Recently LAND has begun to diversify its agricultural portfolio across several different crop classes. Since 2018 LAND has started growing almonds, blueberries, pistachios, grapes, corn and beans. These diversified crops not only give LAND more revenue but spreads out risk making LAND an even more stable asset.

LAND’s reinvestment strategy

Since LAND is a REIT 90% of its income is spread out among the shareholders. The remaining 10% is spent on administration and reinvesting into more farmland/farm assets. LAND seeks to maximize investor return by focusing on three main categories for capital generation.

- Renting out farmland to commercial farmers who farm the land and sell the product. LAND charges rent to these tenants and also collects a portion of the sale.

- Land will appreciate in value. Gladstone seeks to hold farmland for many years in strategic locations where the real estate market is set to expand.

- Strategically selling farmland through brokers.

This approach to capital appreciation works particularly well for investors for two main reasons. First, LAND does not do the farming themselves. As such there is no need to invest in costly salaries, insurance, tools, and personal. This cuts down tremendously on overhead and allows LAND to really save cash.

The rental rates that LAND charges is in the range of 5-7% of the real estates market value per year. This puts them on par with market average for tenant farmers. Further LAND eliminates part of the risk by having their renters pay on semi-annual or annual basis.

Second, the appreciation of the land itself. Since renting out farmland has such a high profit margin LAND can sit on farmland for an extremely long time. This essentially allows LAND to play the long game and wait for the right time to sell their strategically placed farmland.

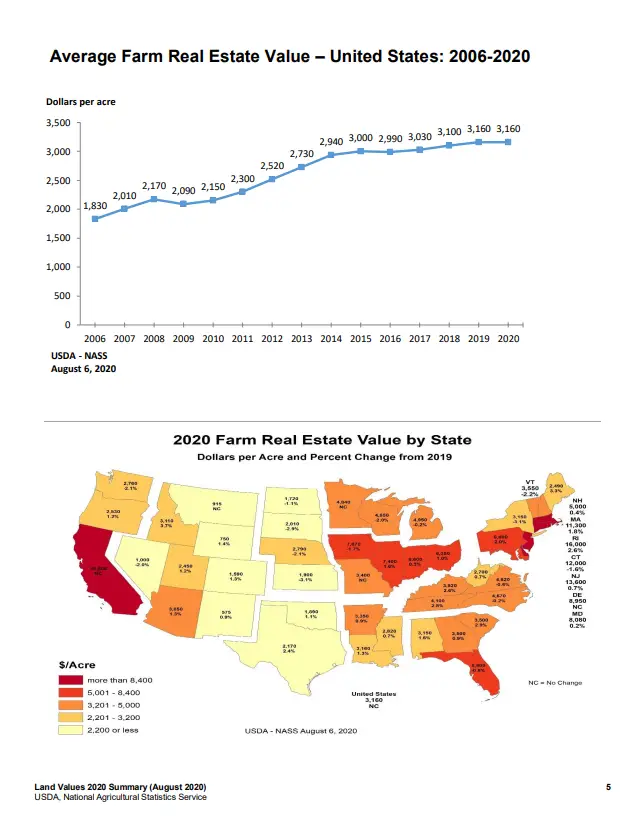

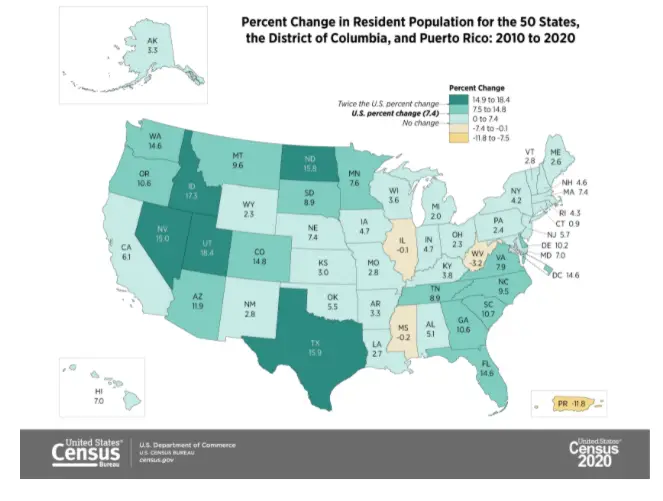

As we can see from the above image farming value in the United States has increased tremendously. Especially in locations where LAND has properties. This strategic buying of farmland to hold for several years allows risk to be further spread out on the value of the real estate itself.

As we can see LAND holds a massive amount of property across several key states where farmland’s value has exploded. LAND’s reinvestment strategy is one of the key facts that separate it from other REITS who’s underlying business model is to weighed down by maintenance, overhead, and market risk on the real estate value.

LAND’s Due Diligence when selecting property

This is the secret of LAND’s recent rise in value. Gladstone only buys farmland that has four key ingredients.

- Water availability: LAND looks to invest in land that has more then needed amounts of water available. Further LAND is interested in holding property that is self sustained through ample rainfall. This eliminates risk variables such as drought or someone taking away well rights.

- Soil Composition: Before LAND acquires a property for farmland they have several consulting firms perform soil composition tests.

- Location: LAND only purchases farmland in places where year round growing seasons for chosen crops exist. This provides predictable and sustainable revenue. Further, the local tenants available to LAND is taken into consideration. These tenants must have experience farming in the environment and have enough liquid capital to hedge against any downtrends.

- Price: Obviously price is a main factor in this selection. That being said since LAND expects to hold property for the long-term they can plan in and predict expanding urban areas which will drastically increase the price of the acquired land.

LAND has the ability to hold farmland for several decades into the future. They continuously acquire farmland near urban centers that are expected to grow in population, and as such the geographic proximity of the urban center/city will expand outwards. Every year that LAND sits on their farmland is another year that they make revenue and the farmland itself increases in value.

LAND’s current holdings

California and Florida are the primary real estate market that LAND is in. As a result of this strategic farmland acquisitions LAND is positioned to sell their farmland at insanely high prices. Both Florida and California rank in the top 5 states in the U.S where farmland is selling at an insanely high price currently.

Selected financial data

Gladstone is a stable company with stable revenue. Further its valuation on its farmland has gone through the roof in the past couple years. This trend is expected to continue for the foreseeable future as Gladstone has strategically bought property near growing urban populations.

Investment Thesis

Lets profit from this amazing REIT. The first step is to identify what will cause the value of LAND to increase in the long-term. The answer is straightforward.

The value of LAND will increase if the value of the underlying land increases.

So we need to look at the locations where Gladstone’s farmland is positioned. The major locations are Florida, California, and Colorado. Each one of these locations is undergoing massive urbanization and the environment allows for a near constant year round growing season.

This means that Gladstone can sit on their farmland and make a return that is directly proportional to the value of their land. Further, since Gladstone only invests in near self sustaining properties they eliminate a lot of risk that would plague other farming REITS.

Further, since the underlying value of LAND is based around farmland the population growth of the United States as a whole drives up the value of farmland. LAND is positioned handsomely to capitalize upon this upwards trend.

This increase in the value of land in the area where Gladstone has farmland will increase the value of the investors shares. Further, as the rent price increases so will the monthly dividend payout to shareholders. So not only are you going to get an appreciating asset you will get a monthly dividend check for holding this asset. You can mimic Gladstone and just sit on your hands while milking the ever expanding population of the United States.

Gladstone has a proven track record of land appraising, farmland maintenance, and a strong nose for picking out reliable tenants. This is a result of strong executive leadership who have several years of corporate networking experience in the agricultural industry.

Risk

With every investment there is risk. LAND is on exception. The risk present in this investment is outlined in the following list.

- Certain states could directly tax farmland REITS. This is highly unlikely as the rhetoric surrounding “farmers” has protected these REITS for a long time.

- Crop diseases. It is possible that a wave of crop diseases could sweep across the United States. LAND hedges against this by having a diversified portfolio.

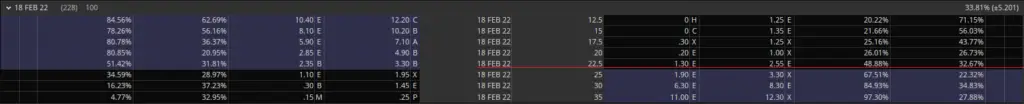

The Trade

Right now Gladstone is trading near its all time high of $26.04. Even with this rapid uptrend LAND is still a good investment for a long term position of around 5-10 years. As such I recommend buying shares and holding.

Right now you can buy 100 shares for $2,377 and then buy a put on the $22.5 strike price for $130. This will hedge you against any crazy down trends and allow you to sleep easy at night. As such your risk on the entire trade is around 10%.

Now let’s talk about upside. Because the value of Gladstone is tied to the underlying value of farmland we can see LAND rocket up. It would not be unheard of for this REIT to hit prices near the $40 range within 2-4 years.

Not only are you beating the normal market return with this REIT but you also are gaining a monthly dividend that you can reinvest back into the asset. This over time will significantly reduce the risk in the position to below the book value.

This is a 50%+ return in 2-4 years with only a 10% risk without even counting the monthly dividend…

Conclusion

LAND is an interesting opportunity. Normally REITS don’t make the investor that much money as the stipend that they have to pay back 90% of their income to the investors strangles the fund into oblivion. Here you have an appreciating asset with a solid monthly dividend.

As always if you like content like this then you should share on social media, like, comment, and subscribe to our newsletter.

-

How Long Does a Short Squeeze Last? (3 Answers)

What is the time frame for you short squeeze? Well here is everything you will ever need to know to determine how long it will last.

-

Why You Still Own a Stock After It’s Delisted and How to Sell It

Do you still own a stock after its delisted? How do you sell it? Don’t worry the stock is still worth money and here is how to sell.

-

Can You Make 1% A Day in the Stock Market? (3 Steps)

Making 1% a day in the stock market is hard but defiantly doable. Here are 3 simple steps to helping you achieve this return.

Until next time, I wish you the best in your investments!

Sincerely,