| More Information | Stock Market Bots: Their Legal Status And Expected Returns |

So you want to make around 1% per day in the stock market. You think that over time this will allow you to create a massive snowball of returns that will make you rich. Over 90% of traders who attempt to do this will end up failing in the long run. If you want to be part of the 10% who achieve this then read on.

When it comes to trading and investing the goal is to make around 1% in the market a day. However, this can only be done with the aid of computer algorithms and on small portfolios of under 1 million dollars. Below are the 3 steps to doing this.

Here at Chronohistoria, I aim to teach people how to trade and invest in the stock market correctly. If at the end of this article you liked it then consider subscribing to the free newsletter and sharing it around the web.

Let’s jump right in. Here are the 3 steps to making around 1% a day in the stock market.

The 1% Per Day Investing Strategy Explained

Before we can begin with the steps it is important that we understand just how this investing strategy/methodology works. There really is only one way that you are going to get a return of 1% in the stock market and it is using this methodology.

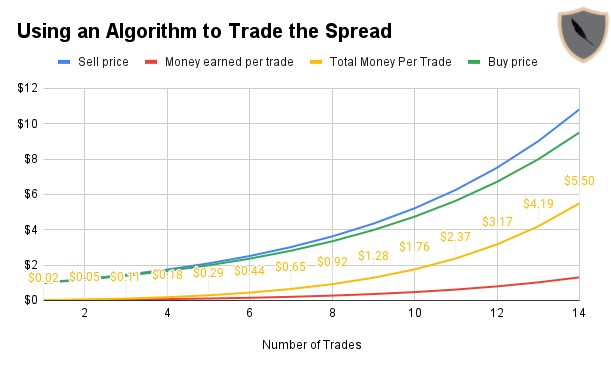

Here we are going to be using a computer algorithm to automatically buy and sell stocks. We are going to set up this algorithm to do something called ‘playing the spread’ on a volatility stock. If done correctly you will be able to make between .80-1% in one day. However, as previously mentioned this strategy only works on portfolio sizes of less than a million dollars.

This is the same methodology that large quant hedge funds such as Renaissance, Jance Street, and Voloridge employ. We are going to be rapidly buying a stock at the bid price and then instantly turning around and selling it at the ask price. Since we are going to have a computer do this we will be faster than the other traders who are manually entering their positions.

This will allow us to make the spread of the stock as profit! This investing strategy is amazing once you understand when and how to employ it properly. Which is why this article exists! If you build everything correctly you can easily return between .8%-1% per day in the stock market on a small portfolio.

The spread of a stock is the difference between the bid and ask price. For example, if we are buying and selling a stock where the bid price is $1.00 and the asking price is $1.01 then the spread is the difference between the bid and ask price or in this case $0.01.

We are going to be building out an algorithm that does just that! It instantly buys and sells a stock to play the spread. This will net us around 1% a day when done properly.

Step 1: Build Your Computer Algorithm

The first step to making 1% per day in the stock market is to build out your computer algorithm properly.

You have two choices here. First, In advanced trading terminals such as ThinkorSwim or Bloomberg, you can program in python directly into the terminal. This is great because you can import the scanner data almost instantly. If you have either of these programs I suggest you build out your program here first.

Second, if you know what you are doing then you can build out your own python script and inject it directly into your trading terminal. This is more advanced but you will keep your script a secret from the owners of the terminal.

Building the script is something you will have to do yourself. Everybody’s scripts are different. However, to get you started you should build out a program that can mimic the highest bid order on a stock and then instantly turn around and mimic the lowest ask price on the stock. This will allow you to buy and sell a position in a fraction of a second making a couple of pennies each time.

The reason I can’t help you build out the computer algorithm is that I am under an NDA with my firm. On top of this if I were to build out the algorithm for you then chances are you wouldn’t be able to build on top of it. To get you started here is a bot that somebody made in 2021 to automatically scan and place orders on Think or Swim. Read the GitHub and see if you can mimic some of his designs.

Step 2: Find The Stock to Trade

The second step in learning how to make 1% a day in the stock market is to find the stock that we are going to be running the computer algorithm on.

This step is just as important as building out the computer algorithm itself. Our investing strategy will only work on stocks that massive amounts of retail traders are looking at. The reason why this is important is that retail traders will manually enter their stock orders. This time delay is what allows us to automatically beat them in pricing. This allows us to play the spread and make a small percentage from each trade.

What makes this strategy work is one word I want you to remember; volatility. Volatility on small stocks means that more and more retail traders are starting to look at the stock and actively trade it. This is what we need to look for in the markets. Set your stock scanner up to scan the entire market for a stock with a large amount of volume along with increasing volatility. This will give you the stocks in the market where our algorithm can be successfully deployed.

This is going to take you some time to perfect. Don’t worry however because all you have to do is play around with some stock scanners. It might seem overwhelming at first but the longer you practice any skillset the better you will get at it over time. Stock trading is no diffrent. However, what is going to make us successful where other traders fail is that we are going to use algorithms to automatically trade for us.

Simply put, the reason we will be able to make 1% a day in the stock market is that we will be able automatically to trade the spread on a stock!

Step 3: Monitor and Adapt the Algorithm

At this point, you should be making around 1% a day in the stock market on a small portfolio. However, the final step is to continue to make sure the Python algorithm you build continues to work. The job of a professional stock investor/trader is never done.

After you deploy the stock algorithm that will play the spread of stock for you the final step is to continue to improve upon the algorithm and adapt it. This is why learning how to build out your own algorithm is so important to this process. If you gave me your Python script chances are I would not be able to easily read it or improve upon it.

At this point, you should be having your Python program print out reports on its accuracy on the spread. From this, you can fine-tune the algorithm to automatically trade for you and maximize its profit from each trade. When I use this investing methodology/strategy I tend to watch the first couple of hours of trading to make sure that nothing bad happens. After this, you can start to relax and wait for the algorithm to finish for the day.

However, while this is going on continue to build on it to implement conditions to continue to make that 1% a day. It is hard to keep up this return rate but if you are serious about making money in the market this is one of the easiest ways to do so. However, it takes time, a skillset, dedication, and a love of how capital markets work.

If everything is done properly you should return around .08-1% per day in the stock market. Sometimes this number will be higher and sometimes you might not return anything. The important part is that over time this will be your average return per day in the stock market.

Conclusion

There you have it; pretty much everything you need to know about making a 1% return per day in the stock market.

There are 3 steps to this methodology/strategy. It takes time to practice and learn them all but trust me it is worth it in the end. Here at ChronoHistoria I teach people how to trade/invest properly while making above-average market returns. If you liked this article then consider subscribing to the free newsletter and sharing it around the Internet.