Learning what the spread is on a stock is vital to understanding how to place great purchase orders for shares/stocks.

The spread on a stock is the difference between the bid price and the ask price on the stock. For example, if a stock is trading at $1.00 exactly the bid might be $0.97 while the ask is $1.03. This means the spread between the bid and ask is $0.06!

Learning how to ‘play the spread’ is a great trading strategy to get stocks at a discount below their current price. Subsequently you can also sell your stocks for a higher price, thus making you more money.

Let’s jump right.

Understanding the Difference Between the Bid and Ask Price.

Before we take a deep dive into the spread we need to understand the bid and ask price definitions.

Definition of Bid Price

When you place an order for a stock a vast majority of retail traders simply press buy. This will place a buy order at market value for the stock. This tells your broker to fill your position at the best possible value, or at the ‘get me in now’ price.

Naturally, on fast moving stocks this could mean that your order will be filled at a much higher price then what you want; since you told your broker to fill at the next available opportunity regardless of price.

The best way to fix this is to place a bid order instead of a market order. Here you will tell your broker that you want your order to be placed at a certain price point. That you will not go above that price to fill the order.

This will take some time to fill properly as you are going to have to wait for people to sell their stock at your price. But if done correctly you will get shares for a cheaper price that is under the market price.

Definition of Ask Price

Likewise the ask price is the inverse of the bid price.

If you already have shares you can place an order to sell these shares at the asking price. This means that you will not sell your shares unless someone pays a certain amount.

By doing this you are guaranteeing that you will get a set price per share. However this will take longer as you will have to wait until a buyer wants to buy your shares at the asking price.

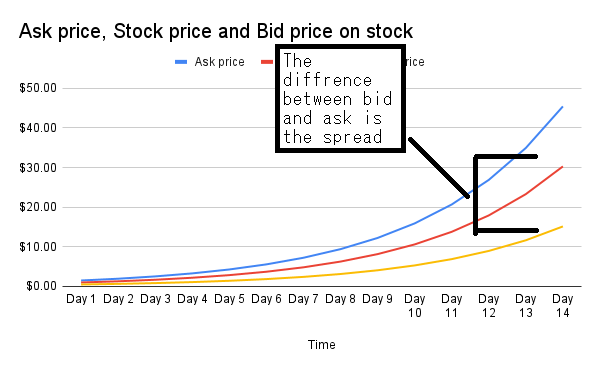

Visualizing the Spread

In the above image we have a stock that goes from $1 up to $30 over the course of two weeks. The blue line is the ask price and the yellow line is the bid price.

As we can see the ask price is always above the current stock price. If the stock’s market price is $2.00 then the ask will have to be above it. Likewise the bid price is always going to be below the market price of the stock.

This is one of the laws of markets. The sellers (ask price) always want to get more for their goods (stocks) while the buyers always want to buy the goods at a discount (bid price). In order for a transaction to take place both the buyers and sellers must agree on a set price somewhere between the bid and ask price. This is the current market price of the stock.

The red line is the current market price of the stock and as we can see it will always be between the ask (blue line) and the bid (yellow line). This will always be the case for any stock.

How to Play the Spread to Make Money

Now that we know what the spread is, how can we use this information to make money? Well I am going to show you a pretty cool trick.

Since we already know that a majority of retail traders only know how to buy at market order prices (the ‘get me in now’ price) we can make money off selling to these people.

What you are going to do is place an order just above the bid price and wait for it to be filled. Then the next step is to place a sell order for your newly acquired stocks just below the asking price. This will cause your orders to be filled before anyone else because you’re the closest to the market price.

Because your orders are being bought and sold into the retail traders market orders you are getting better prices then the average trader. You repeat this process over and over again, as seen by the zig zag on the above graph. Each time you do this you can scalp between 0.5-1% per trade on capital.

This means that with $10,000 you can make around $75 per trade. Now you can do this several times per day. If you just do this once per hour during the entire trading day then on that $10,000 you can make a return of 6% per day, or $600!

Now imagine you do this trade every 30 minutes. Now you’re pulling in 12% per day in a perfect trading environment!

This is called playing the spread and it can net you huge returns if done properly.

How to Find a Stock to Play the Spread On.

This is the hardest part of this trading strategy.

You need to scan for stocks that have consistently rising volume and have a lot of retail traders buying and selling each day. Good stocks to do this on are ‘meme’ stocks and mid-cap growth stocks that have a cult-like following.

It’s not hard to identify these stocks, a little bit of research in online chat forums will direct you to the right ones.

However you need to be diligent in this trading strategy. If the stock ever begins to fall out of favor with retail traders then you will be left holding shares that you can’t sell into retail trader hype. You will be left playing this strategy with everyone else in the market.

No trading/investing strategy is perfect. You will need to adjust your approach for each trade but if you’re diligent enough and willing to learn then you can make a killing in this market.

Conclusion

Learning what the spread is, the difference between the bid and ask, and how to make money off the spread will allow you to trade in any environment so long as the variables remain consistent.

I use this strategy with the aid of computer programming and algorithms. It’s nothing new and funds have been doing this strategy for the past 5 years now. That being said, funds move way too much capital to do these trading strategies on a lot of the smaller stocks, as such this strategy is open for you to employ.

As always if you like content like this then you should share on social media and subscribe to the newsletter! Every share helps me help others generate wealth in the market.

Further, check out our other posts below. A little research might make you thousands in the market!

-

How Long Does a Short Squeeze Last? (3 Answers)

What is the time frame for you short squeeze? Well here is everything you will ever need to know to determine how long it will last.

-

Why You Still Own a Stock After It’s Delisted and How to Sell It

Do you still own a stock after its delisted? How do you sell it? Don’t worry the stock is still worth money and here is how to sell.

-

Can You Make 1% A Day in the Stock Market? (3 Steps)

Making 1% a day in the stock market is hard but defiantly doable. Here are 3 simple steps to helping you achieve this return.

Until we meet again, I wish you the best of luck in your investments!

Sincerely,