| Also Check Out | Here Is How Short Selling Drives a Stocks Price Lower |

A normal short squeeze can cause the stock to run by 30-300%! Investors and traders who capture a portion of this runup can drastically increase their yearly returns. However, a key part of ‘playing’ these short squeezes is to know how long they last so you can get out. In this article, I am going to give you 3 answers to how long a typical short squeeze will last so you can time your exit strategy.

Typically short squeezes will have 3-time windows for how long they last depending on the volume of the stock.

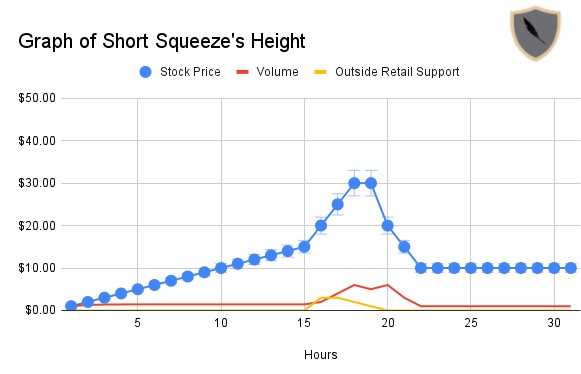

- If the stock has only a small increase in volume that is not sustained then the squeeze will be over in a couple of minutes.

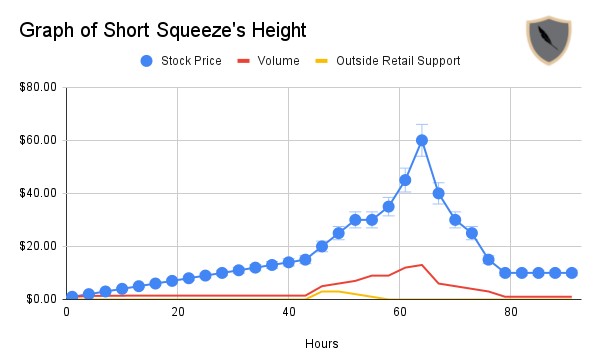

- If the stock has sustained volume but no outside retail trader support then the squeeze will be over in about a day or two.

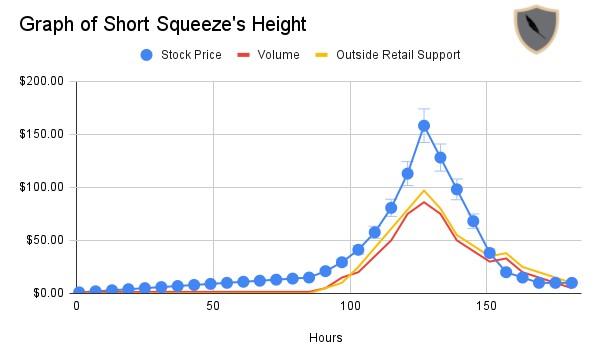

- If the stock has both sustained volume and outside retail trader support then the short squeeze will last a week or more so long as outside support remains strong.

Of course, each of these time frames varies but this is generally what you can expect for how long a short squeeze will last. In reality when judging if a short squeeze will continue or not you need to gauge outside retail trader interest. If people keep on pumping money into the short squeeze then it will continue to grow.

Let me show you how you do this.

Remember if at the end you liked this article subscribe to the free newsletter and share around the internet. Every share helps me help others. Here at ChronoHistoria, I aim to teach people how to trade and invest properly while minimizing their risk.

Let’s jump right into it. Here are the 3 answers to how long a short squeeze will last.

What is a Short Squeeze: Clearly Defined

Before we give any time windows for what a short squeeze is we need to clearly define it. When I ask retail traders to define a short squeeze most of them give the wrong answer; this will directly hurt their chances of making a profit from a squeeze.

Short Squeezer Definition: A Short Squeeze is when investors short a low-float stock thinking the stock will continue to trend downwards. After a large percentage of the float is out short traders will begin to pump up the price which causes the short sellers to either cover or get margin called. This drastically increases the stock’s price thus causing the traders to ‘squeeze’ the shorts to cover their position.

It is important that we remember that what causes a short squeeze is 3 main things.

First, a short squeeze is caused by investors shorting a large percentage of a stock’s float. The float of a stock is how many shares are available to be publically traded. If over 30% of the stock’s float is being loaned out on short then the stock is ripe for a short squeeze.

Second, the stock will have to see a large percentage of traders start buying the stock. This will increase the volume of the stock and cause the stock to slowly begin rising in price. Since a vast majority of the float is out on loan it is easier to increase the total price of the stock. Simply put, if there is a small number of shares available to trade then it won’t take much buying power to increase it.

Third, what causes the stock’s price to rise drastically are the shorts that are going to be forced to cover their position. The Financial Industries Regulatory Agency (FINRA) specifies that any investor who is using margin to short a position must maintain 25% of the investment total value or be forced to close their position. If the stock continues to rise in price on a shorted position eventually the short seller will be forced to buy back the stock to close their position, thus increasing the price.

This is why we call a short squeeze a short squeeze: during a short squeeze we are squeezing the short seller between the choice of a margin call on their account and closing their position by buying back the shares. Both of these actions will force the short seller to buy the stock and increase its price

This is why it is vital to understand exactly how a short squeeze works and its definition. Without understanding this it is impossible to accurately judge how long the short squeeze will last.

However, now that we have a firm understanding of what is a short squeeze now it is time to see the 3-time windows for how long a short squeeze will last.

Time Window 1: If There is Only a Small Increase in Volume That Is Not Sustained Then the Squeeze Will Be Over in a Couple of Minutes.

The first time window for how long a short squeeze will last is when there is only a small increase in volume. Because this volume is not sustained and there is not outside retail trader to support the stock’s ‘time window’ for a short squeeze is only a couple of minutes.

This is because only small accounts of short sellers will be forced to close.

If the short squeeze only has a small increase in volume and no outside retail trader support then most large short sellers can afford to wait out the short squeeze. This is because of the margin requirements needed to remain in a short position.

If I have a portfolio of $1 billion dollars and only $20 million of it is shorting a stock then I have more than enough capital to maintain the short position until it returns back to its normal price. Remember, in order to prevent a margin call I have to have greater than 25% of the value of the short position in my account.

What this means is that if my short position value was initially only 10% of my total portfolio value then the shorted stocks value would have to increase by 250% in order to force a margin call on my account. As you might imagine the big funds that are shorting the stock will not have to close their position unless it is a large short squeeze.

This is why a small short squeeze that only sees a small increase in volume will be over within a couple of minutes. There simply is not enough volume to make the stock’s price increase enough to cause the big short sellers to close their position. They can simply wait it out.

However, the small investors who shorted the stock will be forced into a margin call. This however, will only add a tiny amount of buying volume to the stock. As such the squeeze part of the short squeeze will never be large enough to drastically increase the price.

How to Tell if Your Short Squeeze Will Last Only a Couple of Minutes

The trick to seeing if this is a time window for your short squeeze is to gauge the percentage increase in volume along with retail trader support.

Essentially, what you need to look for is how much volume is coming into the stock leading up to the short squeeze and how many people online are looking at the stock.

So those are the two variables; volume and retail trader attention.

First, to gauge volume you should be looking at the stock’s total public float. If the float of a stock is less than 100 million shares then it is considered a low-float stock.

Once you have the float number look at the total volume leading up to the stock’s short squeeze. If you are seeing a sustained volume of between 20-40% of the stock’s total float in the minutes leading up to the short squeeze then you fall into the first time window. The short squeeze will only last a couple of minutes.

Second, here you need to look at retail trader support. If people online are not talking about the stock’s short-squeeze potential then it will only last a couple of minutes. This is because there is no retail trader support to keep the volume of the stock growing.

The easiest way to gauge retail trader support is to go over to either a popular subreddit for investing/trading and search for mentions of the stock in the past couple of hours. Repeat the same thing for other social media platforms such as Twitter.

If you see lots of people talking about it then the stock’s short squeeze might run for longer. However, if you don’t see anybody then chances are it will not increase that far.

Time Window 2: If You See Sustained Volume but No Outside Retail Trader Support Then the Squeeze Will Be Over in About a Day or Two

In this second time window for how long a short squeeze will last we see a squeeze lasting a couple of days. This is because the volume continues to increase while the stock’s short squeeze continues.

This type of short squeeze will last for a couple of days because now medium-sized funds are going to be forced to close their short position. This will cause the funds to be forced to buy millions of shares pumping the stock’s price higher.

This is the most common type of short squeeze you will find. They happen about once or twice a year and are usually caused by other hedge funds hunting medium-sized funds. If you know what to look for you can ‘piggyback’ off these funds to make a nice return.

However, if you find yourself in this type of short squeeze time window you will notice that most retail traders are not aware of the short squeeze. It simply has not gained enough social traction online to cause retail traders to funnel into the stock.

When you see a short squeeze lasting for a couple of days and not getting any social traction online then you are watching two funds battle it out! This is because another fund has found out what fund has shorted the stock and can guess its position size.

For example, let’s say you have a portfolio of $100 million and had a short position in a stock worth $10 million. Imagine that a larger fund knew about this and started to mass buy the stock to push your position size on your short to $26 million. Now your total portfolio will be forced to close the position at market value. That means you will be forced to buy $26 million dollars worth of the stock at market value! The other fund will sell into this massive pump to essentially take your position.

The reason this type of short squeeze lasts for about a day is that you are seeing two funds battling it out over a position size. If you notice the stock’s volume is constantly increasing during the short squeeze and there is no retail trader support then the short squeeze will last about a day.

If you are in this type of short squeeze then you can ‘piggyback’ off this action by playing a volatility options play. You have to be fast but if you catch the squeeze in the early parts you can run an Iron Condor play to make money regardless of which direction the stock moves.

How to Tell if Your Short Squeeze Will Last a Couple of Days

This is actually pretty easy once you know what variables to look for.

Here we need to watch the volume growth on the stock leading up to the short squeeze along with retail trader interest online. These two metrics are going to tell us if the squeeze will last for a day or more.

If the short squeeze’s volume leading up to a rapid price increase is constantly increasing by 5-15% every hour in even of 100 (100,1,000,10,000) and nobody is talking about the stock in retail trade hangouts then your short squeeze will last for a couple of days.

This is because you are watching a fund attempting to squeeze another fund. Traders at these funds are taught to buy the stock in allotments of 100 because it is easier to run quality control on an algorithm with even increments. Further, these funds will spread out their buying actions every hour to hide their actions from the other fund in the market.

If you check online and nobody is talking about the short squeeze then your squeeze will last a day or two. These types of squeezes are great for making a quick buck. I normally play volatility strategies if I am early but if I am late I will simply buy the stock to make a quick 2-5%. However, my position size is below 1% of the total portfolio.

Time Window 3: If the Stock Has Both Sustained Volume and Outside Retail Trader Support Then the Short Squeeze Will Last a Week or More

This is the biggest short squeeze of them all, also it lasts for a week or more. This type of short squeeze is the rarest of them all and it only happens once a decade or so.

This type of short squeeze is so rare that when it happens people end up getting sued for attempting to manipulate the market. The last short squeeze that was in this category was the famous GameStop short squeeze of January 2021.

The reason that this type of short squeeze lasts for a week or more is because volume remains consistent and retail traders are flocking to trade the stock. This will cause the stock’s volume to rise drastically and continues to rise even after a day or two.

This type of short squeeze is often caused by a semi-organized group of investors that manage to manipulate retail traders into buying the stock en mass. This volume will continue to rise as the stock becomes more known in retail trading communities. As a result of this, every retail trader thinks they are missing out and starts to pour money into the stock. This becomes a sustaining short squeeze that will last for a week or more.

Often this type of short squeeze will turn into a gamma squeeze. A gamma squeeze is when even the broker can’t cover the margin of the calls of the funds that are being margin called. As a result, the broker ends up writing further out-of-the-money option calls. This pulls more shares off the market. However, as retail traders begin to buy more shares the broker must write more contracts. As more call options become in the money then the short squeeze rises faster and faster.

As you might imagine this could go on nearly forever so long as retail investors continue pumping up the stock. If left unchecked a gamma squeeze will crash the market unless it is artificially stopped.

This is what happened to the GameStop short squeeze in January 2021. It turned from a normal short squeeze into a gamma squeeze as all options contracts were being bought up and retail traders were pushing the stock’s price higher and higher. This caused a runaway effect with the stock that was only stopped once several brokers agreed to halt trading on the stock.

If you see yourself in this type of short squeeze then hold on. Things will become crazy and volatility will shoot through the roof. You will see the stock’s price grow between 100-200% every day leading up to the climax of the squeeze. GME in 2021 resulted in a brief gamma squeeze where at its peak GME was %18,650 above its price from only 4 months before.

How to Tell if Your Short Squeeze Will Last for a Week or More

I am going to tell you right now chances are this is not the case for your short squeeze. A short squeeze that lasts for a week or more is a once-in-a-decade opportunity.

There are two variables you will need to look for to see if this is a time window for your short squeeze. First, you will need to look at the volume of the stock. Second, you need to gauge retail trading interest.

First, look at the volume of the stock. Do you see the stock’s volume increasing by 20-30% for the weeks leading up to the short squeeze? This type of short squeeze needs prolonged volume increases to even have a chance of happening. This is because these types of short squeezes are caused by retail traders slowly investing in the stock at first.

Second, you need to look online in retail trader hangouts. Do you see people talking about this stock constantly? With GME there were retail traders talking about it for months before it started to explode. If your stock has tons of retail traders talking about it for a prolonged period of time and they are actually buying the stock then you might have something.

Both of these variables being true is exceptionally difficult. Essentially people will need to be willing to throw their money away for several months. On top of this more people will have to jump into this stock and this trend will have to grow over a period of months. If this is the case then your short squeeze might last a couple of weeks.

Summary

There you have it; everything you will ever need to know about how long does a short squeeze last.

I hope this article helped you out. Many people fall for tricks online when investing in a short squeeze and I hope this article helps people make good decisions. Short squeezes are an amazing way to some nice returns but they have to be fully understood to make them work for you.

Remember if you liked this article then subscribe to the free newsletter and share it around the internet. Here at ChronoHistoria, I aim to teach people to how to invest properly while minimizing their risk.

Further, check out some of the other articles below.

-

How Long Does a Short Squeeze Last? (3 Answers)

What is the time frame for you short squeeze? Well here is everything you will ever need to know to determine how long it will last.