Hey everyone,

The Iron Condor is an amazing tool to have in your investing toolbox. Understanding this trading strategy will allow you to take money out of the market on a consistent basis so long as you have the capital to support the trade.

As always if you like content like this then you should share on social media, like, follow, and subscribe to our newsletter!

Let’s jump right in.

Definition of the Iron Condor

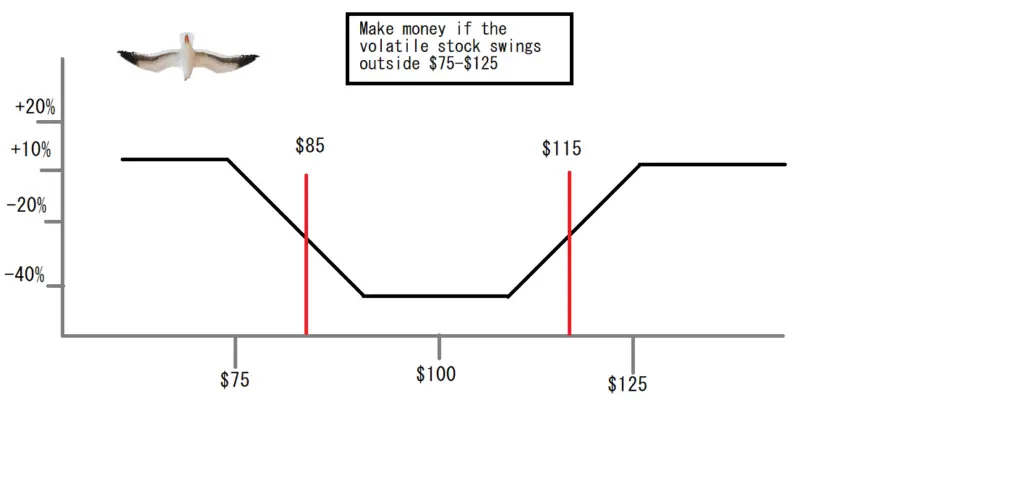

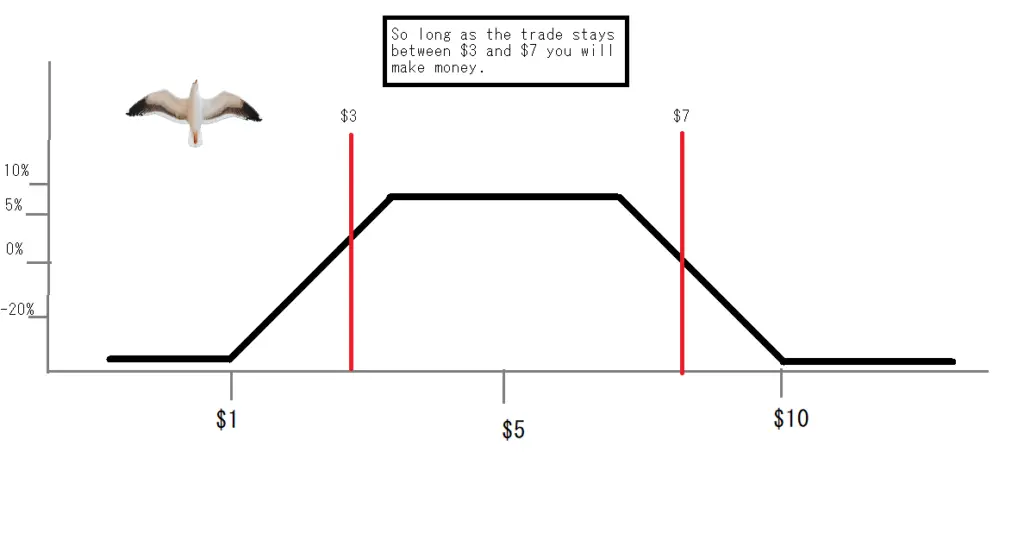

The Iron Condor is a trading strategy that relies upon both buying and selling options. These options are bought and sold as vertical spreads. If done properly then you can position a directionless trade where you will either make money if stock goes outside a range (long Iron Condor) or stays within a range (short Iron Condor).

The Iron Condor strategy gets its name from how the trade looks in an analysis chart.

Iron Condors used to be an advanced trading strategy reserved for high end funds to capitalize. With the advent of retail traders and online trading platforms we are begging to see a more democratization of these trading strategies.

Value of an Iron Condor

Playing Iron Condors are great when you want to do one of two things.

- You are not sure which way the price of an asset is going to move. (Sell/Short)

- You are sure the price of an asset is not going to move that much. (Buy/Long)

Not sure what way the price is going to move.

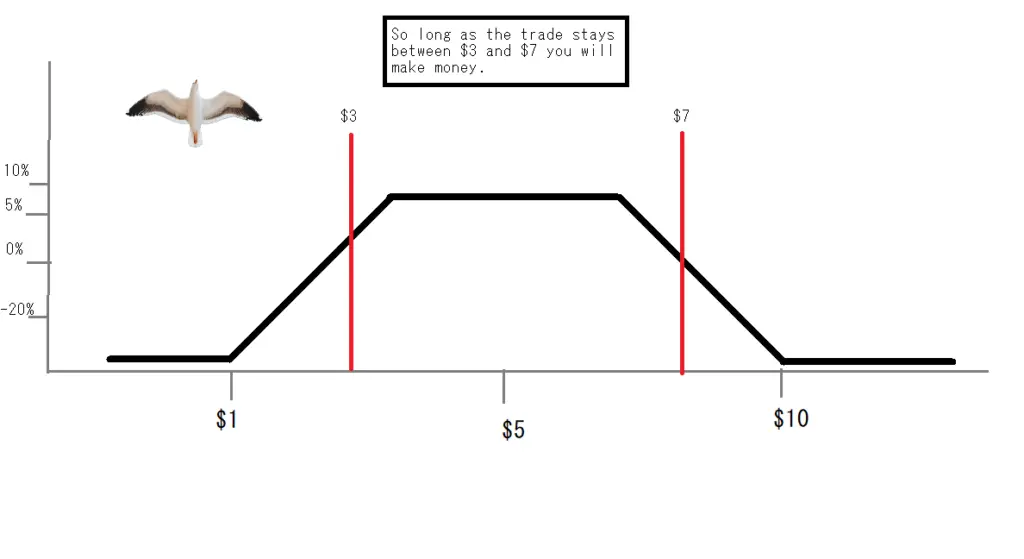

So you are looking at an incredibly volatile stock such as AMC or GME. These meme stocks are incredibly volatile and you would like to enter into the stock to make some money.

The only problem is you are not sure what way the stock is going to move. These stocks will be +15% one day and -15% the next. You don’t want to be caught on the wrong end of one of those swings.

In that case you can buy an Iron Condor to make money if the stock swings either up or down. This is called the long (buy) Iron Condor.

If we take out this trade we are betting that at some point over the contracts time frame the stock’s price will swing outside of the body of the Iron Condor and onto the wings. This will result in us making a profit.

An example of a situation where this might be a good idea is with any of the large meme stocks that have steady volatility. These stocks swing rapidly and you in theory can trade these Iron Condors repeatedly to make a quick buck with a high likelihood of making money.

If we bought an Iron Condor on GME then we can be pretty sure that at some point it would swing out onto the wings to make us money.

Generally you can expect to get around a 10% return on investment from this type of Iron Condor. It wont make you rich but it can net you some pretty decent returns if done over time and strategically.

You are sure the price of an asset is not going to move that much.

Sometimes you get a hunch that the market either overreacted or that a stock/asset will start to lose volume/traction and trend at its current price for a bit.

Normally you couldn’t make much money from this type of stock. It simply wont move anywhere so your money will just sit.

Well if you inverse the above Iron Condor by selling an Iron Condor to the market you will start to make money so long as an asset/stock stays within a range.

This type of trade is great for ETF’s and large cap stocks whos growth is typically predictable. If for example you see SPY shoot up 10% in one day then maybe you start to think “The SPY is so large, I doubt anything huge could happen to move it 10% in one day.”

If that’s the case then you could look at selling an Iron Condor to the market on SPY. This is a common strategy and is one way trades make a consistent return on daily.

For example you could sell an Iron Condor in the range of $390-$480 that expires at the end of this month. Chances are pretty high that SPY wont hit these prices within the month.

Every day you hold the Iron Condor you would make a percentage return. If you held for the full 30 days on SPY then at the end all contracts would expire worthless and you would keep 100% of the capital as you would not have to buy back the contracts to close the position.

How to take out an Iron Condor

So the Iron Condor is comprised of two vertical spreads; First, the put vertical spread and second the call vertical spread. Both of these need to be taken OTM, or out of the money at a strike point you feel the underlying stock/asset wont hit.

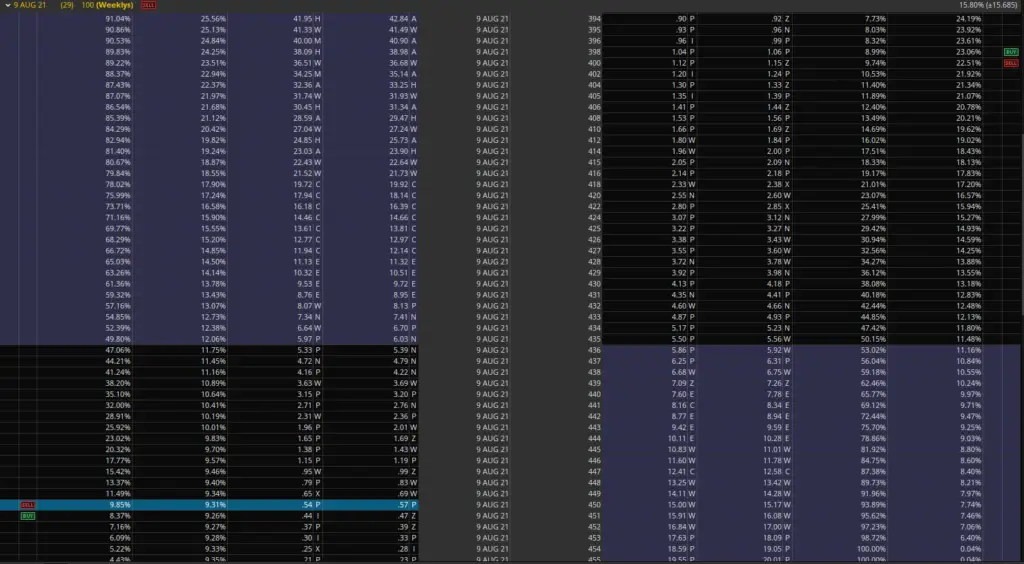

The below image is an example of a short Iron Condor on the SPY. The image is the options chain on SPY for 07/09/2021

As you can see I have placed an order for two vertical puts. One call, and one put.

This trade will expire on August 9th, 2021. So long as SPY does not swing outside of the range of $400-$450 then I will make 10% on capital invested. For example if I put $10,000 into the trade then I would get $1,000 within the month. Or about $33.3 a day for the next 29 days.

That’s pretty good for a trade that profits from SPY just staying within its range and behaving as it would normally.

If you thought SPY was going to shoot up or down then you could simply inverse the trade and buy instead of sell an Iron Condor. This would give you about a 10% return over 30 days if SPY traded outside of a set range. I do not recommend buying Iron Condors on SPY unless you have information the market does not.

Risks on Iron Condor

Every trade comes with risks. The Iron Condor is right around 90% of the time. The one time its wrong however and you don’t monitor its progress it will take 100% of your investment.

This is because you have to put up capital to buy or secure the sold contracts. This requires a degree of margin to engage with but so long as you stay on top of events that might impact the trade you will be fine.

That is the secret to Iron Condors, maintenance. So many people just place the order and think they will generate income passively for the contracts period. While that answer is a resounding yes, you will need to keep up with the trade as you would any other one.

So long as you strategically place the trade and monitor any changes in the underlying asset/stock then you will be fine. I sell Iron Condors habitually on large ETF’s and monitor the underlying stocks held by the ETF. This has allowed me to generate above average market returns for the past 5 years with only a little bit of reading a week.

Tips for the Iron Condor.

Here a couple helpful tips to keep in mind when you take out an Iron Condor position.

- Make sure you set up the contract correctly. Measure twice, cut once applies here. Don’t make the rookie mistake of accidently buying the wrong contract. It will ruin your trade before you begin.

- Typically the first couple days of the Iron Condor are the hardest. This is because you pay a premium to engage in the contract so you will see a -% at first. Don’t pay this any attention.

- Research the underlying ETF or stock you are trading the Iron Condor on. So many people fail to do this and as such cant predict a rapid swing. Does your ETF only do Pharmaceutical companies? Find the biggest holdings and look into them. A little bit of elbow grease goes along way here.

Conclusion

That’s it. The Iron Condor is an amazing tool where you can make money off playing it safe.

If you think the stock is not going to move, sell and Iron Condor. You will milk theta everyday that you hold the negative Iron Condor in your account.

Think the stock is going to shoot up or down but don’t know which way? Buy and Iron Condor and laugh to the bank as you make money off a crazy swing in price that you couldn’t predict. These are great with “meme” stocks as retailers drive the price all over the place.

As always if you like content like this then you should share on social media, like, follow, and subscribe to our newsletter below! Every share helps me help people generate wealth so its much appreciated!

-

How Long Does a Short Squeeze Last? (3 Answers)

What is the time frame for you short squeeze? Well here is everything you will ever need to know to determine how long it will last.

-

Why You Still Own a Stock After It’s Delisted and How to Sell It

Do you still own a stock after its delisted? How do you sell it? Don’t worry the stock is still worth money and here is how to sell.

-

Can You Make 1% A Day in the Stock Market? (3 Steps)

Making 1% a day in the stock market is hard but defiantly doable. Here are 3 simple steps to helping you achieve this return.

Until next time, I wish you the best of luck in your investments.

Sincerely,