Hey guys,

This research post is about the company Coinbase Global. Coinbase (COIN) went public in April of 2021 at a share price of mid $300. Since then it has skyrocketed up to $429 and down to $208 as the stock searched for a consolidation point.

Today’s post is going to go over why this company is a buy in my books. I will talk about the fundamentals, technicals, risks, and give a thesis on why its a buy.

If you don’t want to read everything check out the 300 word summary at the bottom.

As always if you like content like this then you should share on social media, like, follow, and subscribe to our newsletter!

Let’s jump right in.

Update

Since I have published this post COIN shot up through the roof from $253 to $353. That’s a potential profit of around 29%.

1.) Fundamentals of COIN

Overview of Business model

On the surface level Coinbase global is a broker/dealer platform for potential investors to easily engage with to invest in the cryptocurrency economy. Coinbase seeks to become the main broker of choice for people to invest into the cryptocurrency market.

To accomplish this Coinbase has become a market maker for the crypto market. A market maker is an entity (firm or individual) who provides the bid and ask spread for a commodity/asset and allows people to trade with guaranteed liquidity in the commodity/asset.

Investors (customers) pay the market maker in the form of commissions and flat rate fees for access to these markets. If there is no market maker then the investor would have to seek out the buyers and sellers of a product, effectively creating their own market.

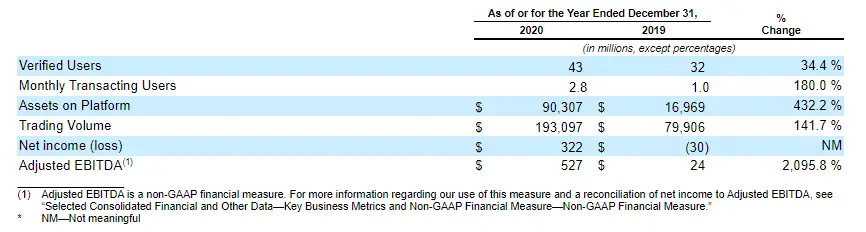

Coinbase has created this crypto market for potential investors (customers) to buy and sell their assets in. As we speak Coinbase has over 43 million retail users and 7,000 institutional investors spread over 100 countries.

The Coinbase “flywheel” and marketing

Coinbase’s user retention and marketing is based around what COIN calls its “Flywheel.”

This “flywheel” is described as pulling in customers to COIN’s easily approachable trading platform. First, These customers (retail and institutions) store assets and drive liquidity in Coinbase’s market. Second, Coinbase can use the stored assets along with commissions/transaction fees to invest in further building out their platform to attract new customers. Third, these new customers then deposit more assets into the ecosystem.

This self developing ecosystem is an incredibly effective way to grow and develop a business model. It requires low overhead and relies upon user satisfaction. Both of which Coinbase has in excess.

Further, this flywheel is such an effective business model that Coinbase gets over 90% of its customers through word of mouth advertising. This is a massive bonus of the flywheel model as COIN still has plenty of room to grow through paid marketing.

Conclusion to business model

COIN’s business model is near perfect.

The ability to attract consumers, put them in the COIN ‘flywheel’, and keep them satisfied while taking transaction fees, which guarantees income for COIN, has little risk within the model itself.

A successful company all starts with a good business plan/model. COIN has demonstrated a great model here that is easily scalable and has little overhead in the form of marketing.

The only risk to the model itself is if customers started not liking COIN’s products. I don’t see this happening unless a large activist fund got into the market and sought to disrupt COIN’s ‘flywheel’ by pissing off its consumers.

That being said, I see no issues with COIN’s business model and I expect it to grow as the company goes forward.

Finances.

As of 2021 Coinbase has generated over $3.5 billion in total revenue from transaction fees. These commissions/transaction fees represented over 95% of Coinbase’s revenue.

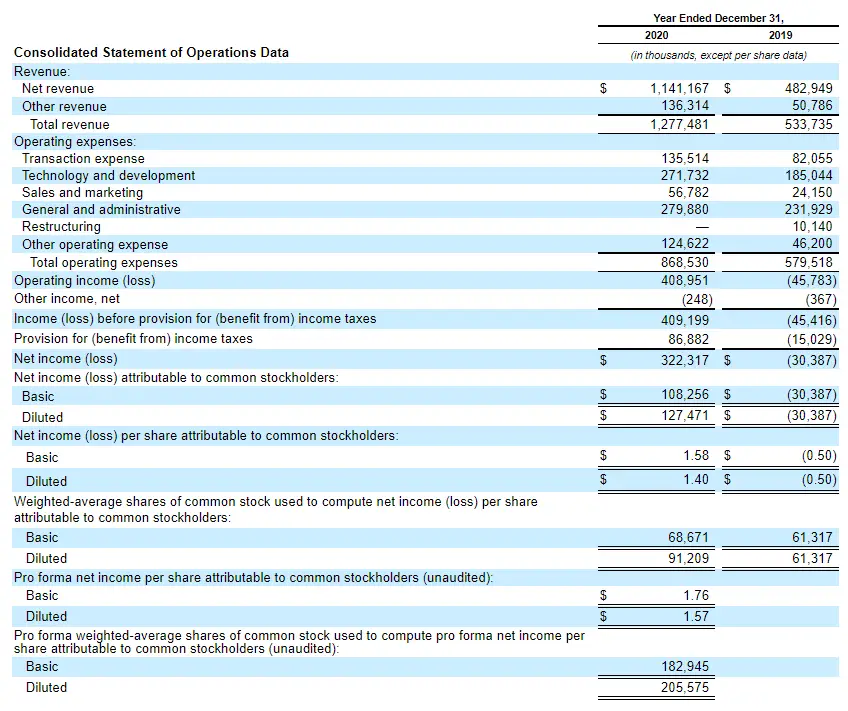

From 2019 to 2020 Coinbase saw a revenue growth of close to 60% while operating expenses increased by only 34%. Further, we see that the net income on shares increased by near 200% from -$0.5 to $1.4 per share.

What all this data means is that Coinbase in 2020 saw an explosion in revenue driven largely by the massive uptrend in market cap of the Crypto market.

This uptrend is reflective in the amount of new users on Coinbase.

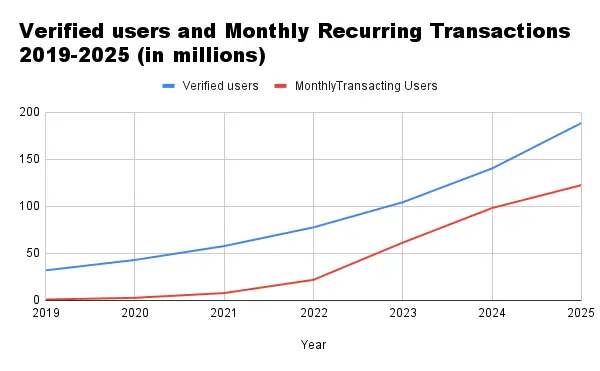

From 2019 to 2020 Coinbase saw a 26% increase in verified independent users. Further, Over the same time period Coinbase saw a massive increase in monthly transacting users with an increase of 180%!

This is important because as previously stated Coinbase generates close to 95% of its revenue from user transactions. Having not only a growing customer base but having those customers come back month after month will continuously drive revenue. This is called customer retention, and obviously Coinbase does it incredibly well.

Conclusion to finance section

COIN has nothing to worry about in regards to finances. It has demonstrated that its corporate financial profile is extremely profitable.

Further, the fact that COIN has seen such a large growth in monthly transaction users is amazing. This means that customer satisfaction is increasing more than customer acquisition rate. This is indicative of the fact that COIN’s investments into applications that seek to retain customer attention (and cash) is working better than intended.

Currently COIN has no problems financially.

Business Growth Strategy

Every business plan needs to be able to grow with the market. Coinbase clearly outlines their growth strategy and their business model allows for scalability.

Since Coinbase has a consistent revenue base we will look at this growth strategy to see if it’s achievable and clearly laid out.

The growth strategy for COIN is a three tiered approach.

- Adding more customers.

- Expanding from transactions to other income generating assets.

- Helping developers build a ‘crypto ecosystem’ surrounding Coinbase.

1.) Adding more customers

This won’t be a problem for COIN and is easily achievable. This is evident from two things; their customer retention rate (see finances section) and COIN’s marketing (see “Flywheel section). Coinbase’s business model dominates in this category.

2.) Expanding income generating sources

This is important for COIN as right now over 90% of their revenue comes from one income source, customer transactions. If for whatever reason COIN sees a decline in these transactions then their income will suffer.

That being said COIN has more than enough capital to invest into other income generating assets such as Proof of Stake crypto currencies or investing directly into the stock market to become a hedge. Either one of these will fit within COIN’s scalable business model.

I see no issue with this second point and I expect to see very soon how Coinbase will diversify their income portfolio.

3.) Helping developers build a Coinbase ‘crypto-ecosystem.’

This involves having software developers build out programs that will expand the ability for users to invest in the crypto market. If done properly this will give COIN a bleeding edge in customer retention and acquisition. A method that will box out the company’s competition due to a high barrier of entry.

By giving developers the reins to create apps and platforms to attract more and more consumers COIN will start to become a larger and larger company by market cap. This will further increase the ‘flywheel’ effect that the company has perfected (see ‘Flywheel’ section).

There is no problem with this growth strategy.

Conclusion to growth section

Coinbase has nothing to fear with its growth plan. The strategy fits perfectly into its business model of providing a ‘flywheel’ for customers and institutions to engage with.

Further, the fact that COIN sees over 90% of its new customers come to the platform through word of mouth advertising means that this strategy is working just as intended.

I see no problem at all with this growth strategy and expect COIN to expand rapidly in 2022-2023 and continue to skyrocket into 2030 with the expansion of the crypto market.

Risk Factors

Investing in COIN does carry a small degree of risk. The primary risks are outlined in the following list; I will elaborate on all of these.

- The crypto market is volatile.

- Over 90% of COIN’s income is from transaction fees.

- Two major coins dominate the market for Coinbase. Ethereum and Bitcoin.

- COIN’s value is derived from digital assets. As such cyber attacks are a huge threat.

- There is little regulation of the industry. This is both a good thing and a bad thing.

1.)Volatility of Crypto Market

The crypto market is incredibly volatile. There are rapid swings and declines in prices.

While COIN is hedged against this to a degree due to them making money off transaction fees (they make money regardless). If too many customers begin to lose money then they will leave the platform and the market as a whole.

To combat this COIN has started to run campaigns that seek to inform their customers more about risk and how to prevent it. Further, COIN advocates for a buy and hold strategy (HODL) over trading. This is evident by COIN’s new vault feature, a feature where it will ‘lock’ up currency in a vault so you can’t be tempted to sell it.

2.)Over 90% of COIN’s income is from transaction fees.

COIN is completely dependent upon its customer base being happy and continuing to conduct transactions. If customers start pulling out their money and leaving, either for another platform or the market as a whole, then COIN will start to see a decline in revenue.

As previously stated COIN has started advocating for a long hold strategy (HODL) by allowing customers to lock up their currency and not panic sell. This guarantees that at some point the customer will have to pull out of the market, which gives COIN a predictable future income.

3.)The dominance of Bitcoin and Etherium

Currently Bitcoin has a market dominance of 45% while Etherium is 18%. Should demand for these two coins decline over time, and a new coin does not replace them, then we could see the demand for COIN decrease.

This more than likely will not happen. While BTC (Bitcoin) will decline over time the demand for other coins will increase. We see this Etherium that holds around 18% of the market cap. Further other currencies such as Cardano and Binance Coin have risen to around 3-4% of total market cap.

To combat this COIN has been diversifying their market portfolio by adding all major coins to the exchange. This has started to eliminate this risk while also exposing COIN’s customer basis to other potential investments.

I see this risk slowly fading away altogether.

4.) Coinbase could come under a cyber attack

The problem with storing and housing digital assets is the intangible nature of them. It’s much harder to steal gold, a car, or a phone than it is to steal crypto currency.

The reason why COIN has become so successful is because of the trust that the retail crypto investor has with COIN’s ability to safeguard their assets. If there was a cyber attack on COIN and the customers assets disappeared then the credibility of COIN would disappear overnight. A result of which would be customers leaving the platform in mass.

COIN is acutely aware of this and has invested tremendously into safeguard measures. While this threat will always be a looming presence it is generally accepted that customers who invest in the crypto market are aware of the potential for a 100% loss of capital. Further, Coinbase has a reputation of being one of the safest digital exchanges to house your assets in.

5.) There is little regulation in the industry

This is both a good thing and a bad thing. History has shown that an industry with little regulation can expand and innovate at an alarming rate. That’s good for the sector as a whole but bad for businesses that can’t keep up.

For example crypto might start transitioning to decentralized exchanges where transaction fees are minimal. If one of these exchanges could partner with a major financial provider such as Visa then we would see a decline in COIN. This is because COIN would have to shift their business model to compete with the now industry lower transaction fees. If COIN failed to do this then we would see a shift in the industry market cap.

I don’t see this becoming an issue for now as COIN is investing heavily into making its platform as approachable as possible. This will grab the attention of retail investors and bring them. That being said, if COIN’s executive team can’t keep up with evolving trends then we could see a decline in market cap.

Conclusion to risk section.

While COIN has its risks they are actively being hedged against by the company. This is a good sign as most companies who just went IPO tend to focus on revenue generation first and risks second.

This means that COIN is creating a floor for their company to grow from. A floor that I believe is already mostly complete.

Executive Team

Briefly looking at a company’s executive team is essential for a proper analysis of the company. If not done then you open yourself up to risk.

For example a good ship without a good captain will just go in circles. A good captain will direct the crew, boost morale, guide the ship, and plan for departure. Think of a company as a ship, and its executive team as the captain.

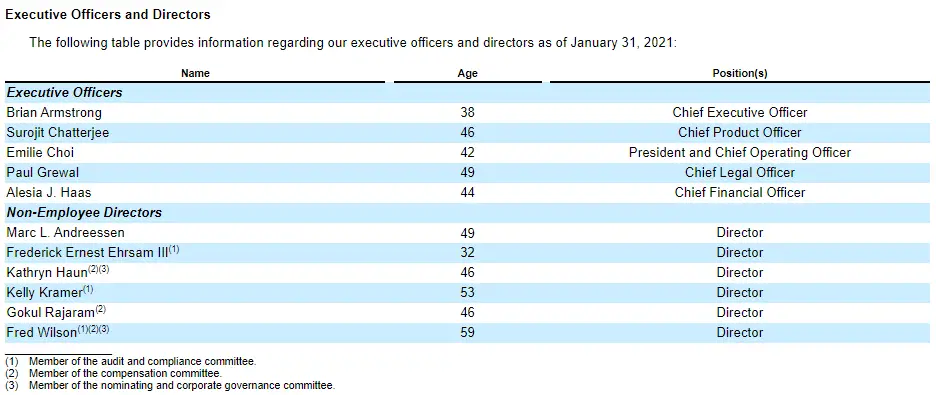

CEO: Brian Armstrong

In 2005 Armstrong graduated with a Bachelor’s Degree from Rice University in computer science and economics. Later in the next year Armstrong graduated with a Master’s Degree from Rice in Computer Science.

Further, Armstrong founded UniversityTutor.com an online tutor service that seeks to pair potential tutors with eager students. This appears to be where Armstrong pioneered his approach to the ‘flywheel’ business model.

In 2011 Armstrong became a Technical Product Manager for Airbnb.com and served in that position for a year.

In 2012 Armstrong would co-found Coinbase.

Other than this data, derived from his LinkedIn, I do not see any held board positions or prominent networking activity.

Chief Product Officer: Surojit Chatterjee

Ms. Chatterjee was hired in February 2020 to drive COIN’s emerging product line. Previously she served as Vice President for Google Shopping at Google. Further, she has several years of experience in executive management roles in e-commerce seeking to drive acquisition and retention of customers.

She holds a Bachelor’s Degree in Computer Science and Engineering from Indian Institute of Technology , a Masters in Science from the State University of New York, and a M.B.A from MIT.

Chief Operating Officer: Emilie Choi

From June 2019 to November 2020 Choi has served as both the COO and President of Coinbase. Previous to this she served as vice president and head of corporate development for LinkedIn, who in 2016 was bought out by Microsoft. As such M.s Choi comes with substantial business connections, which can be employed later by COIN.

Ms. Choi holds a B.A in Economics from Johns Hopkins University and an M.B.A from Wharton School at the University of Pennsylvania. This in combination with her successful sale of LinkedIn to Microsoft positions Ms. Choi as a prime candidate to develop the corporate profile of Coinbase going forward.

Chief Legal Officer: Paul Grewal

Paul Grewal has served as the Chief Legal Officer of COIN since August 2020. Previous to this Grewal served as Vice President and Deputy General Counsel of Facebook from 2016-2020. From 2010-2016 Grewal was a U.S Magistrate Judge for the U.S District Court of California. Grewal holds a S.B in Civil and Environmental Engineering from MIT and a J.D from the University of Chicago Law School.

The position of Chief Legal Officer (CLO) is vital to help COIN navigate the ongoing legality of the crypto market. Grewal’s experience with Facebook in the 2010’s demonstrates that he knows how to help a company in an emerging sector stay on top of an ever changing legal landscape.

Chief Financial Officer: Alesia Haas

Ms. Haas has served as the CFO for COIN since 2018. Before this she served as the CFO for Sculptor Capital Management along with various leadership positions at OneWestBank. She holds a B.S in Business Administration from California Polytechnic State University.

Ms. Haas’s experience and connections brings a wealth of potential capital investment to COIN. We typically see good CFO’s bring in potential institutional investors to help rapidly expand a company to help capitalize on an evolving market. Haas brings that experience and resources to the table.

Conclusion to Executive team section

While Armstrong (CEO) has little executive management experience he does have a great vision for the company. Further, he has surrounded himself with the right talent to get the job done.

This executive team makes a great captain for the Coinbase ship. I see no problems for the company going forward due to lack of experience or connections.

2.)Technicals of the COIN stock.

For the technicals of COIN I will go over the chart and volume, volatility, P/E and recent earnings.

Let’s dive right in.

Chart and Volume

As we can see COIN IPO’d in April of 2020 in the price range of the mid $300’s. Since then it has continued to downtrend into the low $200’s before coming to rest in the mid $200’s.

The volume has remained consistent throughout this period at the median range of 5-9 million shares per day. Since May of 2021 Coinbase has started trending upwards while volume remained consistent.

This is indicative of a short-term positive outlook in the market for COIN.

Volatility

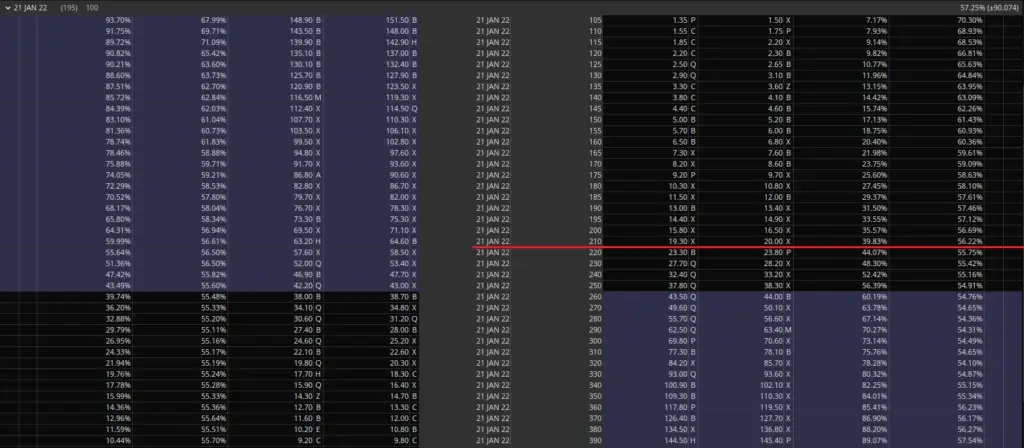

Options Chain

The volatility on the options chain is hovering around 64% which is to be expected for a newly IPO’d stock. We are noticing a small rise in volatility as the stock increases in value but it’s nothing too crazy.

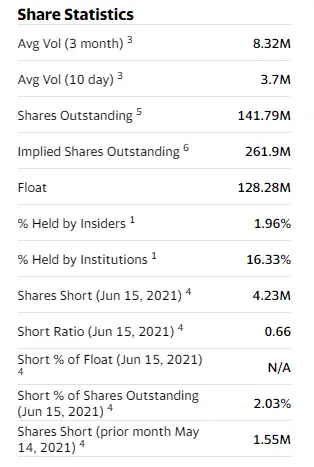

Float

The float on COIN is rather low for its market cap at a meager 128 million. Any increase in traffic could cause the price of the stock to rise or fall dramatically.

This is good for COIN as I believe that they are expecting a rise in their price so they can sell more stock to retailers.

P/E and earnings

P/E

Currently the P/E on Coinbase is 102.98, an abnormally high P/E for most stocks.

That being said COIN is considered a ‘tech’ stock and investors are willing to pay a premium because of the capital appreciation. Companies such as AAPL, MSFT, and FB have a P/E in the range of 28-40 which in many regards is still overvalued.

COIN having a P/E in the range of 102.98 is concerning but not a dismissible factor. The reason for the high P/E is the fact that Coinbase’s business model has a low overhead but is capable of rapidly and efficiently scaling.

Recent Earnings

COIN’s first earnings release slipped on analysts ratings by about 28%. This is nothing too crazy as it was the first earnings report and many analysts were shooting blind. It’s actually pretty impressive the analysts got as close as they did.

COIN continues to see their ‘flywheel’ business model work as more and more customers enter into the Coinbase crypto ecosystem. This continues to drive income and shows no signs of slowing down.

Conclusion to technicals

The technicals indicate that COIN is overvalued by market standards right now. That being said the market is wrong as Coinbase routinely adds more and more consumers to its portfolio and more importantly retains them.

Risk right now is present in COIN’s stock. This is indicative by the extremely high P/E but is manageable if approached correctly.

3.) Investment Thesis

This Coinbase investment thesis is broken down into three steps; First, The crypto market growth. Second, Coinbase’s business model/retail attraction. Third, the low overhead and limited enforcement within the United States.

Crypto Market Growth

In 2013 the overall crypto market cap was estimated to be around $1.1 billion USD. In 2021 the market cap is around $1.4 trillion. That is an astounding growth of 1,272% over a decade!

This trend is expected to continue over the next coming years. This is because the application of the blockchain technology is nearly endless and more importantly it is economically scalable where modern solutions are not.

We can expect the crypto currency market to continue to trend upwards over time as Bitcoin continues to prove its reliability as an inflationary hedge on the U.S dollar. Much in the same way that gold is currently.

Coinbase holds crypto assets within its platform. As the market increases and matures we will see Coinbase capitalize upon these assets to drive revenue generation.

2.) COIN’s business model and retention rate

The biggest secret to Coinbase’s success is the ease at which a retail investor can invest in the crypto market. We already established that the crypto market is going to continue to explode. Now let’s look at how Coinbase will explode with it.

According to a report issued by Goldman Sachs there are currently only 21.2 million owners of crypto in the United States. The United States is the largest consuming economy on the planet, where the average population has the largest discretionary income.

Citation for Goldman article, pg. 13: https://www.goldmansachs.com/insights/pages/crypto-a-new-asset-class-f/report.pdf

If Coinbase can position itself, which it does, to capitalize upon the largest economy in the world, the U.S.A, then we will see an explosion in price. This is why Coinbase is putting so much effort behind R&D to get and keep consumers.

COIN is already incredibly successful at this. Their retention rate and acquisition of new consumers is incredibly high. More importantly their entire marketing strategy is built around word of mouth advertising. Eventually we will see a near parabolic increase in customers on the Coinbase platform as this trend continues.

The above chart I put together is just past historic data coupled with expected U.S population growth data from U.S census.gov.

This chart is extremely conservative for COIN and I expect us to see much higher retention rates on verified users as we go forward. This is because COIN is investing heavily into bringing its platform to the untapped U.S population.

If Coinbase can capture even a fraction of mass retailer interest we could see a huge spike in growth, which will correlate to a huge spike in stock price.

3.) Low corporate overhead and limited U.S enforcement on sector.

Low corporate overhead

COIN’s business model has extremely low overhead. The reason for this is simple.

It is a market maker without having the liabilities of brick and mortar, insurance, brokers salaries, or anything else that would constitute a normal market maker. This is huge and is one of the reasons we saw adjusted EBITDA on COIN grow by a massive 2,095% from 2019 to 2020.

Granted a lot of this growth was caused by the explosion in Bitcoin’s price but COIN’s low overhead in such a volatile industry will allow the company to swiftly move to adapt to an ever evolving market. (see risks section)

This low overhead has allowed COIN to promote and implement a host of new services and products over the past two years. The executive team is doing an outstanding job of planning and thinking ahead so far, and I believe that this trend will continue with the aid of a low operation expenses.

Limited U.S enforcement on the Crypto sector

Currently in 2021 the Securities Exchange Commission remains relatively neutral in their stance towards the Crypto Market. Several prominent politicians on both sides of the aisle have brought forth regulation over the past half decade but it never went anywhere.

This is because of the concept of crypto currency itself. A stock is representative of a fractional percentage of a company, crypto is not representative of anything. Therefore the SEC is lost as to how to classify the crypto currency market.

So long as this is the case fast moving companies can capitalize upon this stagnant bureaucracy to lobby, regulate, and enforce laws in their favor. It remains to be seen if COIN will engage in this but with every passing day it becomes more and more likely.

This is a great thing for investors as companies that engage in lobbying practices tend to shift from a mid cap company to a large cap in a relatively short amount of time.

I believe that COIN can and will do this. They will utilize the stagnant enforcement standards on the SEC and begin the process of pushing through regulation that will both prevent new competition while also allowing them to operate freely.

The trade

Right now COIN is a buy with caution.

There are a couple risks (see risk section) but they are actively being lessened by management in the company.

Currently buying in the range of $230-$240 is a good price if it trends down there again. You will be locking your capital up for about a year if invested.

Further I recommend buying a put at $210 with an expiration of January 2022. Currently these are selling for $2000 and will secure your downside for the rest of the year.

This will allow you to invest $23,000-$24,000 and only lose about 9-12% on capital.

The upside is massive and we can see COIN hitting $375-$400 by the end of 2022. This will result in a staggering 43.75% gain on capital! Should COIN stay the course.

Summary

Coinbase (COIN) is a buy right now for three reasons; First, The crypto market growth. Second, Coinbase’s business model/retail attraction. Third, the low overhead and limited enforcement within the United States.

If invested right now and hedges properly you can see a maximum risk of 9% on capital for a potential gain of 43% or above by the end of 2022.

Conclusion

Coinbase presents an interesting opportunity right now for savvy investors to get into a great asset before the rest of the retail crowd. I recommend buying an OTM put to hedge against your downside risk. That being said, the upside is more than worth it currently.

As always if you like content like this you should share on social media, like, follow, and subscribe to the weekly newsletter!

-

How Long Does a Short Squeeze Last? (3 Answers)

What is the time frame for you short squeeze? Well here is everything you will ever need to know to determine how long it will last.

-

Why You Still Own a Stock After It’s Delisted and How to Sell It

Do you still own a stock after its delisted? How do you sell it? Don’t worry the stock is still worth money and here is how to sell.

-

Can You Make 1% A Day in the Stock Market? (3 Steps)

Making 1% a day in the stock market is hard but defiantly doable. Here are 3 simple steps to helping you achieve this return.

Until next time, I wish you the best of luck in your investments.

Sincerely,