Hey guys,

The following are three steps that every investor needs to take before investing in any stock. They are look at the fundamentals of the company, look at the technicals of the stock, and finally find an investment thesis. If you take these steps then you will notice a dramatic difference in your win/lose ratio.

Summary:

The three steps. First, look into the companies financial reports to see what they do and how well they do it (Fundamental Analysis). Second, Look at the statistics of the companies stock (Technical Analysis). Third, By combining both of these build an investment thesis.

Let me show you how to do this.

1.) Fundamentals

Before we even look at a chart we need to know the companies business plan, the companies financial situation, and executive team. Learning about each of these sections will allow you to form a complete picture of exactly what the company is.

Many people don’t do this part and only invest in a stock or asset off recommendations. By doing this basic fundamental analysis you will separate yourself from a majority of other retail investors.

The best place to find this type of information is from the companies annual investor publication. For U.S public companies this document is called the 10-k form. The Securities Exchange Commission (SEC) forces every publicly listed U.S company to publish a 10-k form that is available to the public.

We don’t need to read the entirety of the 10-k only focus on select portions I have outlined below.

Let me show you how to find this document.

How to find a companies 10-k

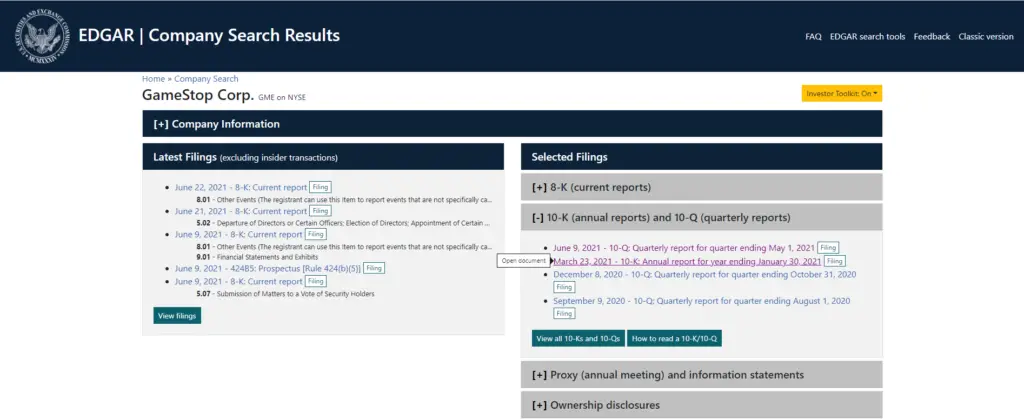

The first step to finding a companies 10-k is to go to https://www.sec.gov/

Once there you should be able to enter a companies stock ticker in the search field. For todays example we are going to be looking at the company GameStop.

Once you find GameStop’s 10-k go ahead and open the file. You should be greeted with the following image.

The above image is GameStop’s 10-k. This file is free to the public so that potential investors can see what there getting into before pulling the trigger.

Learning the companies business plan

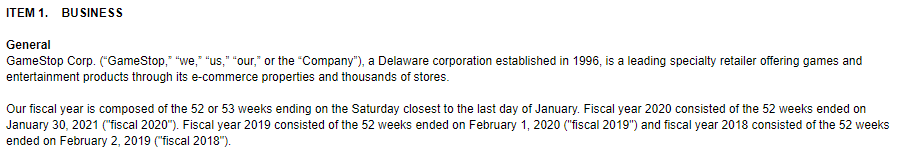

The 10-k file will have a table of contents that will go over the entire document. For this first section we will only be looking at the business and risk factors section of GameStop’s 10-k.

Go ahead and click on the business section of the 10-k. This section is going to outline the business model for GameStop and will allow you to understand what they do.

As we can see GameStop describes themselves as a “retailer offering games and entertainment products through its e-commerce properties and thousands of stores.”

Now you accurately know what the companies business plan is. All publicly listed companies 10-k file will have this section. I know that GameStop is pretty self explanatory but when looking into more niche companies such as bio-tech the 10-k’s business section is perfect.

As we scroll down through GameStop’s business plan the company outlines their main product lines that generate revenue. Next is the physical store location for GameStop. Finally, is the growth strategy. This is the forward looking statement that will help with your research on the company.

This growth strategy is important because we can see where the executive team of GameStop is trying to take the company. Often times I will simply close the 10-k at this point if the growth strategy is not achievable or if the company does not have any forward looking vision.

After this growth strategy you will make your way through logistics of the company. For GameStop this is vendors, distribution, and competition. The logistics section is important because you can see if the company is set up to achieve their business strategy.

The most important thing about reading this business section is to find out if the executive management is lying to themselves about their corporate ambitions. Larger companies such as Apple, Microsoft, Google have an absolutely phenomenal executive team that is both forward thinking and also aware of their corporate resources and logistics.

For example. Any bio-tech company can claim that they are going to cure cancer but without the proper leadership, resources, and logistics its a pipedream.

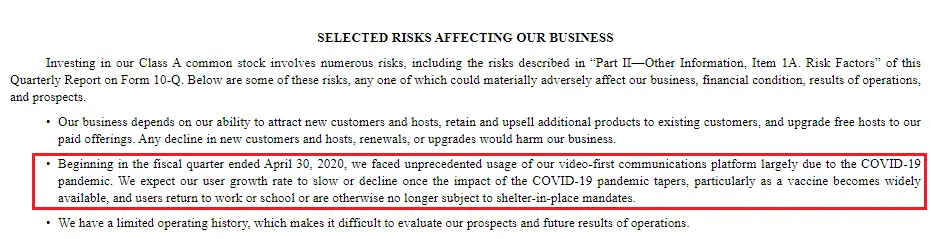

Risks

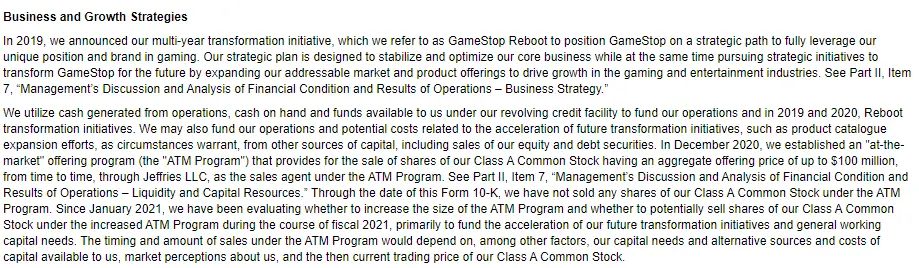

The next section we will move on to is the risks section.

This section is just as important as the business section. This is because the risks section is what the executive management team identifies as the biggest risk to their company, and as a result your investment.

Typically these risks are listed in the 10-k from the biggest to the smallest. For example in the GameStop 10-k the first risk listed is the major one of shifting game retailer market.

This risk is so large to GameStop that it changed market sentiment towards the company. Over the past 10 years GameStop has gone from a great investment to a failing one strictly from the changing game retailer market shifting from game retailers (GameStop) to direct e-commerce sales from Microsoft, Sony, Steam, and Amazon. For a full run down of GameStop’s current situation and how to make money off it see my following research post.

Should you buy GME stock? How to profit from volatility.

Make your way carefully through the risks section of the 10-k. Each risk should be read in its entirety. These risks are what the executive management teams sees as the largest threats to GameStop’s continuing operation.

Often you can figure out what you think will happen to a company in the next six months from this risk section alone. For example if a company that manufacturers Covid-19 masks for consumers is reliant upon the pandemic continuing to maintain profit then chances are that its price will go down in the future.

A good example of just this scenario can be seen with the company Zoom who exploded in price as everyone went to remote working for the pandemic.

Had you read through Zoom’s 10-k filing for 2020 then you might have noticed this risk statement.

If you were going to invest in Zoom in 2020 then this statement might have deterred you. That is if you thought the pandemic would eventually end.

This is why the risk statements are so important. It can give you a glimpse into the future as to how the company will fare.

Companies Financial Situation

As good as a great business plan is it is nothing without the capital to back it up. This is why we need to examine the selected financial reports published in the 10-k.

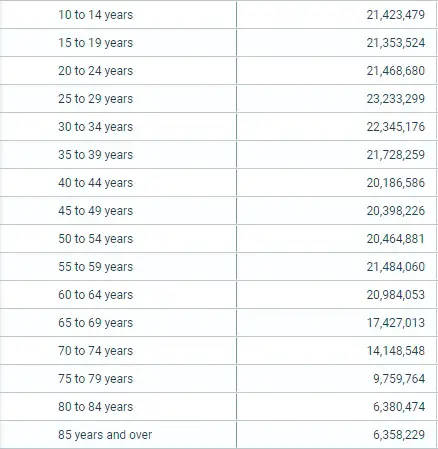

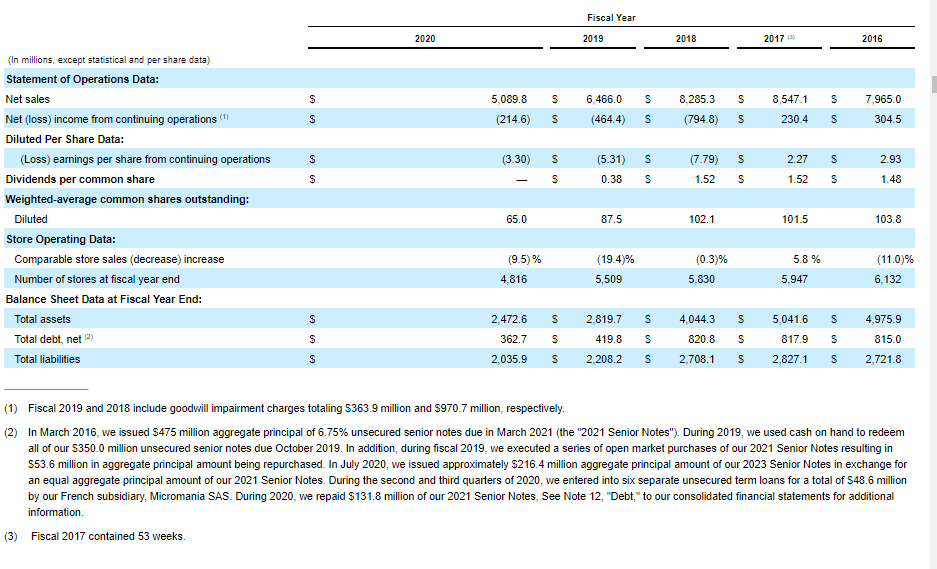

The above image is GameStop’s selected financial data from their 10-k filing. This data is important because it will give you a brief overlook on how successful the company is with their business plan.

As we can see from GameStop 2018-2020 has been a hard time for the company. GameStop’s net sales declined by around 40% over two years. This is massive for a company that operates a brick and mortar (physical location) business.

If you couple this financial data with the companies business plan it start to become apparent how the company is doing financially. Further, you can go through other data such as the liabilities and debts. Companies that have little to no debt often times have massive amounts of growth potential.

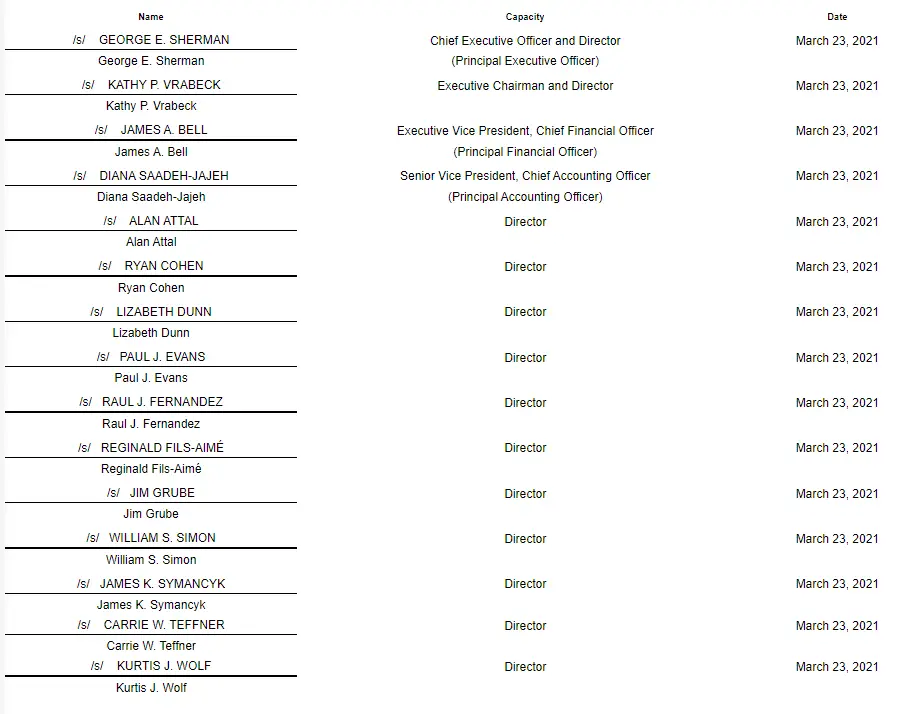

Executive Team

Without the proper captain no ship can sail. This holds true for all companies.

Without the a good executive team that has several years worth of industry experience and connections then a company will fail, no matter how much money or how great its business plan is.

When evaluating the executive team you need to look for two attributes in the companies executive team.

- Years worth of professional executive connections

- Years worth of industry experience

First, Professional executive connections. An executive needs to come to the table with a whole portfolio of people they can rely upon to get money, contracts, and resources from.

Second, Years worth of industry experience. A good executive needs to have ‘been in the trenches’ of the industry they are apart of. The more time spent honing their sales, lower-mid tier management, and public image the better. This is why you often see executives being groomed from an early age to become a director of a company.

As we can see GameStop executive team has more then enough connections and industry experience between them. You should always look up a couple of these executives to see if they have what it takes to grow the company.

2.) Technical Analysis

First, Technical analysis is not drawing pictures on graphs, that is charting. Technical analysis is when you look at how the stock IPO’d to the market along with market trading statistics such as volume, price, and movement.

When a stock goes IPO, or initial public offering, the company has to decide how it wants to set up its stock. Questions such as “do they want to have more retail investors or institutional investors?” causes the company to set up their stock in a certain way.

Technical analysis is looking at how the company set up their stock to be traded on a public exchange along with market trading statistics such as volume, price, and movement. It is an invaluable tool but it is worthless if you did not perform a fundamental analysis of the company. Likewise fundamental analysis without understanding the technicals can cause you to miss out on gains, or worse, suffer massive losses.

Fundamental analysis and technical analysis are two sides of the same coin called investing. You need to understand both before you take a position.

The ‘rabbit-hole’ of technical analysis goes way to deep for me to cover it accurately in one post. It deserves an entire section of posts dedicated towards it. I will give the basics to get you started in this section.

Stock Volume

The stock volume is the amount of shares traded during the trading period. The trading period is the time segment you are looking at. For example if you are looking at a one year chart on GameStop where each section is broken down in 1 day (365 sections to make up the one year chart) then each day would be the daily volume on the stock.

In essence just remember that stock volume is the amount of shares traded on that stock during a set trading period.

Stock volume is absolutely pivotal to understand. Stocks with low volume wont move, are hard to enter and exit, and more then likely will eventually die (greylisted).

Stock Float

The stock float is the amount of shares that a company has issued to the public. If for example a company only issued 10 million shares, or has a 10 million float, then there are only 10 million shares to ‘float’ between the investing public.

The float is important to understand because it dictates how fast the stock can move normally. If a stock only has a float of 10 million shares and the daily volume is currently 20 million then the entire stock float is trading hands in theory twice a day.

This means that the stock is highly volatile. By understanding this you can expect your potential investment to either move in price fast or slow.

Essentially all you need to understand is that a low float stock (under 100 million) could move either up or down at an incredibly fast rate.

The best resource I have found for finding out the stock float is Yahoo Finance.

Type in the name of the ticker and go to statistics to find it.

Stock float will help you determine your risk in the trade. A high float stock wont move as much as a low float stock. If you want fast movement in price look for low float stocks.

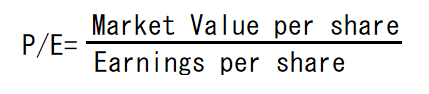

Price to earnings or P/E

P/E or PE is a term that you will hear thrown around a lot. Simplified it means Price to Earnings and it is an old way of quickly valuing stocks/assets.

Essentially the P/E is the price of the stock relative to its per-share earnings. When a company announces an earnings report you can take the market value of each share (its price) and divide it by its earnings per share (EPS). You get the EPS by taking the companies profit and dividing it by its shares. Below is the formula for P/E.

For a first timer this equation might seem daunting but practice it. By knowing the P/E and how it impacts the markets you can understand one of the basic building blocks of stock valuation. A stock with a high P/E might be overvalued, likewise a stock with a low P/E might be undervalued.

Short percentage of float

I made a whole post on what shorting is. I highly recommend that if you don’t fully understand it you check it out.

Shorting a Stock Explained: Making Money When the Stock Goes Down.

There are in theory only so many shares that you can short on a stock. All of these shares have to be rebought at some point in the future. This can be thought of as a giant buyback push on the stock.

Most stocks have around a 5%-10% short percentage. When you start to see short percentages in the 15% or above you should look into why. A high short percentage typically indicates a failing business model where people are willing to take on huge risks to make money if the company’s stock value goes down.

If for some reason the ‘shorts’ have to cover their position they will buy back and cause the price to inflate. This is what often times is caused a short squeeze and if you are on the right side of the trade you will make amazing returns.

The short percentage is a great tool to see what the market is expecting the stock will do in the near term. It also presents opportunity to the investor to position an investment to capitalize on a short squeeze.

A quick word on charting

Often times when you speak with someone who invests of technical, or is a technical analyst, they are referring to drawing on charts. There are several patterns such as the head and shoulders, ascending and descending triangles, flags, bars and many others.

Presenting most of these will get you kicked out of a fund interview.

That being said, there is a growing field of psychological trading that plays off retailers ability to think they can predict stock movements through charting. You can make money off this as well by knowing the most popular patterns and employ a trading algorithm that scalps 1%-2% movements as retailers clamor to buy a ‘double top.’

By knowing the charts you can make predictions off how retailers will act. When will they buy and when they will sell. If you know how others trade you can return a profit by getting in right before them.

3.) Building an Investment Thesis

Ok so now you know the fundamentals of the company along with the technicals of the stock. Now its time to have some fun.

We are still going to be looking at GameStop for this example. I will be presenting a very brief thesis that my GameStop research post goes into high detail over.

Should you buy GME stock? How to profit from volatility.

The Investment Thesis

We know that GameStop is throwing everything they got at building out a successful e-commerce site with next day shipping.

To do this they have brought on another executive Jenna Ownes to manage this endeavor. Jenna previously served at the e-commerce giant Amazon building out their distribution portfolio. You ever order from Amazon and get next day shipping? Thank Jenna.

After brining Jenna onboard GameStop pivoted their logistical distribution channels. GameStop invested heavily into renting out two new distribution centers in York, Pennsylvania and Reno, Nevada.

The reason for this is to have GameStop compete with Amazon for game distribution sales on shipping time and costs. The Reno center will handle the west coast of the U.S while the York center will handle the east coast.

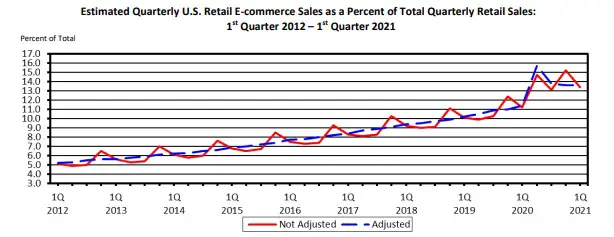

Further, the gaming demographic of the United States currently makes up 19% of the overall gaming market (video games, toys, streaming, etc.). This number is expected to grow tremendously with the U.S population growth.

GameStop further has several other products that have been growing in popularity over the years. Their pop-culture toy line has increased to cover a total 11.4% of GameStop’s revenue. This is a massive increase from a meager 8.5% three years ago.

The e-commerce market is positioned to explode over the next several years. GameStop’s shift to focusing on e-commerce will eliminate overhead while also driving excess sales.

Finally in 2021 GameStop sold off $1 billion worth of common stock to retail investors. This excess capital will fund all of this.

GameStop has positioned itself to explode in 2022 and beyond. If properly navigated we could see GameStop actually hold its share price and even grow.

Importance of Thesis

Having an investment thesis is pivotal. Its what differs you from the market.

You have to think differently then other people to make money off investments. I have to think that this stock will go up or down because of whatever reason.

Without a thesis you are just throwing money at the screen and hoping. Investing off hope is gambling and were here to make money not lose it.

Conclusion

Following these three simple steps will allow you to make money consistently in the stock market. It takes a little bit of effort but you will get good at this if you practice. Think of the three step process as a whole package, fundamentals….the box, technicals…the wrapping paper, and the investment thesis is the bow.

As always if you like content like this then you should share on social media, like, follow, and subscribe to our newsletter! Every share helps me help others so its greatly appreciated.

-

How Long Does a Short Squeeze Last? (3 Answers)

What is the time frame for you short squeeze? Well here is everything you will ever need to know to determine how long it will last.

-

Why You Still Own a Stock After It’s Delisted and How to Sell It

Do you still own a stock after its delisted? How do you sell it? Don’t worry the stock is still worth money and here is how to sell.

-

Can You Make 1% A Day in the Stock Market? (3 Steps)

Making 1% a day in the stock market is hard but defiantly doable. Here are 3 simple steps to helping you achieve this return.

Until next time, I wish you the best of luck in your investments.

Sincerely,

Comments are closed.