The SPY is the largest ETF that tracks the overall U.S market. Since the U.S market has consistently gone up over the past 100 years history indicates that selling puts on the SPY is a great strategy.

We can clearly see that over the past 20 years SPY has consistently increased in value year over year.

Because of this trend, we can make a ‘bet’ that this will continue for the foreseeable future. This article is going to show you how to sell puts on the SPY to make a huge profit by leveraging this ongoing trend.

Let’s jump right in.

What is a Put?

Before we can even begin we must define what a put is.

A put is a contract that forces somebody else to buy 100 shares of a stock at a set price in the future. When you buy, or sell, a put contract on the stock market somebody is indebted to buying 100 shares of the contracted stock in the future.

Understanding options contracts, and in particular puts, is a great tool to help you consistently return money in the markets. I highly recommend learning options contracts because if you fully understand them then you can return consistent monthly profits so long as you manage risk.

How Does Selling a Put Work?

If we sell a put we tell the market that if a stock hits a certain price we are wiling to be contractually obligated to buy 100 shares of the stock. Somebody else in the market will buy our contract for a set price, essentially saying “Ok, I am willing to pay you for the right to sell you 100 shares.”

Because that other person had to pay us for the contract, we will be getting a lump sum of cash for selling the put. Eventually this contract will expire, and if the stock is still above your buy strike price then you will keep the money the other guy gave you.

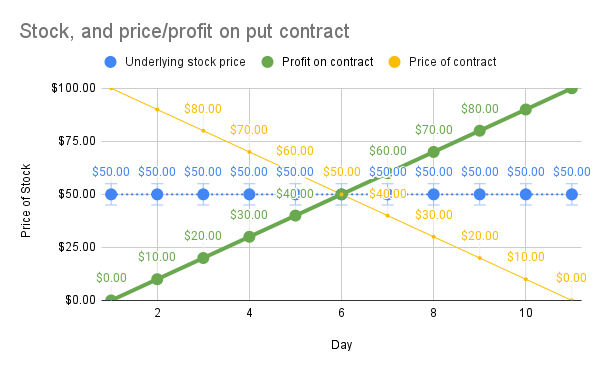

This is how we are going to make money. Bear with me here, the below image will help.

In the above image lets say that we sell a put on a random stock worth $50 (blue line). This put contracts states that we have to buy 100 shares of this stock if the price ever hits $45, essentially putting your portfolio at a $4,500 risk.

The buyer of this contract is willing to pay you $100 for this contract. You agree to sell the put and instantly collect the $100 into your account. Every day you hold that contract the chance of the stock swinging to hit the $45 strike price gets lower and lower.

Because of this the the price of the contract starts to get lower as well. After one day of holding this contract you can buy it back from the market (closing out your position) for $90. This means that in one day you made $10 from something called theta decay.

This means that for every day you hold the contract in your portfolio you will earn $10, assuming the stock does not move. You decide to continue holding the contract and after 11 days it expires worthless.

If a sold contract expires worthless then you keep 100% of the premium of the contract. This means you made $100 from thin air. Congratulations.

So Why Sell Puts on the Spy?

Remember our underlying thesis on the SPY? That it seems to always increase year over year?

Well by understanding the mechanics of selling puts you can not only make a return from theta decay but also make a return because the SPY increases in value steadily over time.

This is the secret weapon of the SPY. It steadily increases over time and as such we can make an educated bet that this trend will continue.

Further, the reason we target the SPY for selling puts is the liquidity present in the largest ETF on the U.S market. There is always someone buying or selling contracts on SPY so it wont be a problem to liquidate a position in case it starts going against you.

Finally, the SPY has the most inherent volatility present in its holdings. This is because the SPY has the most volume and retail traders actively trading it. Further, its weighted heavily towards the big tech companies. These companies can post huge earnings reports that drastically swing the price of the SPY.

Since the volatility is so large for the SPY that means that the premium for selling options is great on the SPY. This means more money per trade for your portfolio.

Because the SPY consistently increases and has such a large liquidity pool on every contract strike price its the absolutely perfect investment vehicle for doing this trading strategy.

Let’s figure out how to place the trade.

Placing the Trade on the SPY

There is one trick to starting this before we even open up the trade. You need to wait for a pullback on the SPY.

Typically this happens once every two months or so. Let me show you what you need to look for.

As we can see the secret is to wait for one of these pullbacks. Typically the SPY will pull back in the range of around 2% in one day on the first day of the pullback.

Wait for one of these entrance points. The reason is because the SPY will bounce back and will make money from both the theta decay and stock price increase on the SPY.

Once you have identified a good pullback on the SPY its time to take a position.

Selling the Put

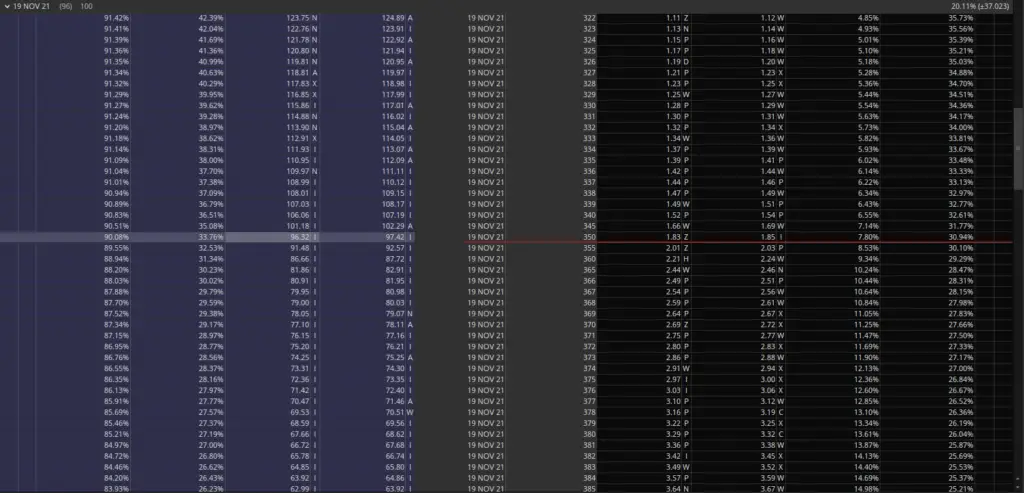

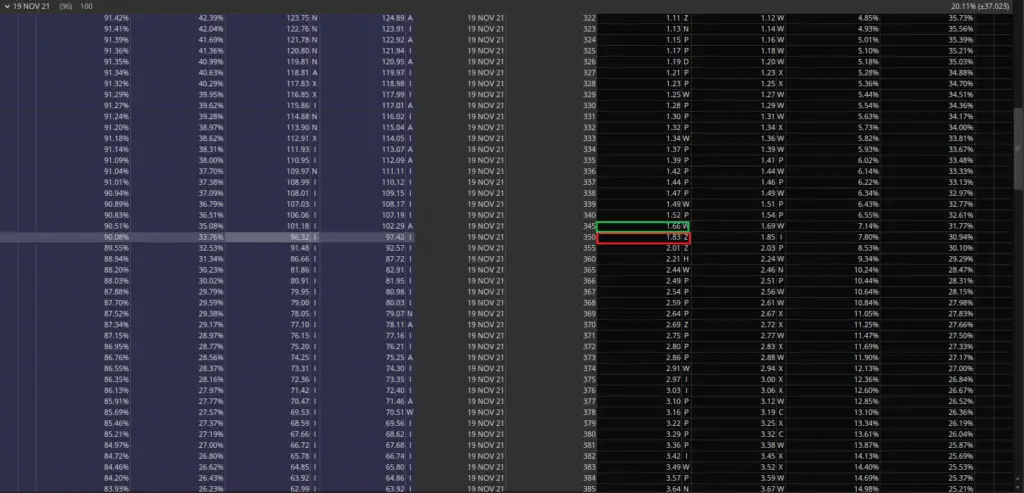

Here we are going to sell a put that expires in 96 days for around $200 at a strike price of $350.

This means that you will make about $2.08 every day that you hold the contract so long as the SPY does not increase in price. Which we know is going to happen because you waited until a pullback.

Over the course of your contract the SPY will increase in price and your risk will decrease due to theta decay. Because of this your set to gain a constant return on your sold put every day.

Its hard to calculate the total price in the future but I have noticed that from this strategy I can make around 10% on my portfolio every 4-5 months. This is huge as I am essentially doubling my portfolio alpha value so long as I wait until a pullback.

It really is a secret weapon for investing. Which is why I am sharing it with you.

Managing Risk

Ok, lets talk about the ugly of the trade.

You are going to be putting a lot of capital up at one time. Right now the price to engage in one of these contracts is between $35,000-$43,000. Not many people have this discretionary capital available.

If you have the capital then worse case scenario you buy 100 shares of the SPY. Which will increase in value over time, so its not that bad.

However if you don’t have the excess capital needed you can engage in selling a vertical put. This will reduce the capital needed from $35,000-$43,000 to around $300 per trade.

The down side of this is however is that if the position goes against you and you need to close out you will lose 100% of your investment. I sell naked puts on the SPY because I know the SPY will increase in value. I used to sell vertical puts but if you have the capital I recommend just selling naked puts.

What is a Vertical-Put?

The way to reduce capital needed for this trade is to engage in a vertical put.

For a vertical put you simply need to buy a put that is further out of the money then your sold put. This will provide a cover for you incase your sold put is exercised.

Now you can exercise your bought put and cancel out the shares you are indebted to. You just have to pay the difference in share price.

Notice how in the above image you sell the $350 strike price and at the same time you buy the $345? This means that if your sold put (at the $350 strike price) is exercised you can in turn exercise your bought put (at the $345) and cancel out the shares.

Worse case scenario you are going to be paying the difference between the share price. Further, by buying a put you are cutting into your profits.

That being said vert-puts are a great way to enter into this strategy. I used to run them before I had the capital needed. Now however I chose to just sell naked puts on the SPY.

How Long to Hold a Sold Put on SPY

This is an artform. How long should you hold a put on the SPY?

The answer for me is to constantly gauge the overall health of the U.S market. This means looking at earnings reports, national job reports, inflation, and GDP.

If the U.S market looks to be entering into a recession I will sell the position and take profit. Then I will wait for another pullback and repeat the process.

If you don’t want to spend the time to research all of these reports you can always follow Chronohistoria.com. We post everything you need to know and answer questions constantly. I would be happy to help you.

Or you can simply hold the position for around 30-50% of the total time on the contract. Other sites such as Edeltapro have performed studies that indicate that the most profitable time for holding contracts is between 30-50% of the total time on the contract. (source)

There are several studies done and a concreate decision still has to be made on how long to exactly hold the position. I just follow all of research statistics to help me gauge when to get out.

Here is a list of sties I use for research on the overall health of the U.S market.

- https://www.census.gov/

- https://www.eia.gov/

- https://www.huduser.gov/portal/ushmc/home.html

- https://www.congress.gov

These sites have been instrumental to helping me form investment decisions that routinely make money in the market.

Conclusion

Selling puts on the SPY is an amazing strategy for returning profit in the U.S market. Basically the U.S market is healthy and keeps on going up in valuation. As such the SPY increases as well.

Occasionally the market will correct and drop a bit. Sell a put at this point and wait until you make a nice sizable return. Repeat this process until you are filthy rich.

If you like content like this then you should share on social media and subscribe to the newsletter!

-

How Long Does a Short Squeeze Last? (3 Answers)

What is the time frame for you short squeeze? Well here is everything you will ever need to know to determine how long it will last.

-

Why You Still Own a Stock After It’s Delisted and How to Sell It

Do you still own a stock after its delisted? How do you sell it? Don’t worry the stock is still worth money and here is how to sell.

-

Can You Make 1% A Day in the Stock Market? (3 Steps)

Making 1% a day in the stock market is hard but defiantly doable. Here are 3 simple steps to helping you achieve this return.

Until next time, I wish you the best of luck in your investments!

Sincerely,