Cardano is poised to be the largest gainer in crypto over the next decade.

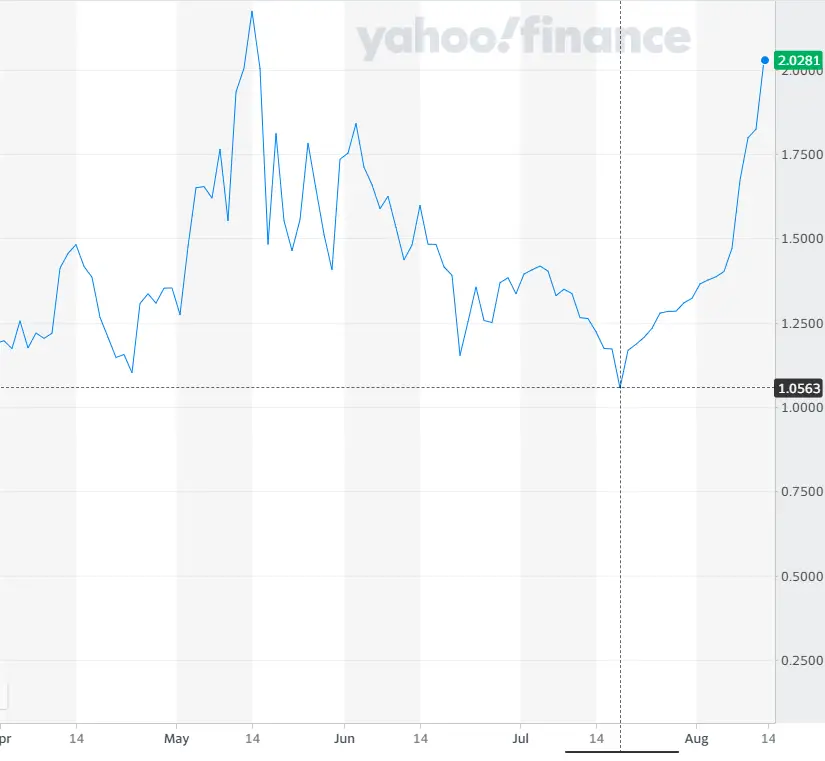

As we speak Cardano has exploded in price from $1.1 up to $2 in a matter of days. This explosion is only the beginning as more and more institutional investors buy into the Cardano project.

This article is going to go over the fundamentals, technicals, and give an investment thesis on why Cardano is going to explode above $10!

Let’s jump right into it.

Fundamentals

The Cardano project has designed and developed a cryptocurrency that is currently the most advanced cryptocurrency with market liquidity. ADA is Cardano’s stable coin and the cryptocurrency associated with the project. ADA is built upon a smart blockchain technology.

This smart blockchain technology has allowed Cardano to adapt to the rapidly changing sector that is cryptocurrency. Because of this adaptability ADA is considered to be a 3rd generation crypto currency. These generations are outlined below.

Generations of Crypto

- Bitcoin

- Ethereium

- Cardano

Understanding how each of the preceding generations innovated upon the previous is vital to understand exactly why Cardano is so different.

Generation 1: Bitcoin

Bitcoin was released in 2009. Bitcoin created the blockchain technology.

The goal of blockchain technology is to provide validation for transactions without the need for an intermediary to validate. For example, in 2005 if you wanted to send money to another country you would have to wire money.

This wired money would have to go through your bank and sent electronically to a validator to verify that both accounts (yours and the recipients) were valid. This validator would take a portion of the transaction as a fee and validate the wire transfer.

Bitcoin innovated on this transaction validation service by providing two major changes. First, Bitcoin removed the need for a validator service by automating the transaction validation. Second, because the validation step was automated the speed of the transfer in theory could be near instantaneous.

This was a huge innovation made possible by blockchain technology. Blockchain technology can be thought of like a chain link.

Each link of the above chain is a transaction. So long as the transaction is valid it secures the next chain link. As such the blockchain would steadily increase over time.

Validation companies were replaced by validation nodes or ‘miners’ who would process the transactions and get rewarded a percentage fee. As such we had the birth of bitcoin mining, or simply bitcoin validation machines.

Generation 2: Ethereum

Ethereum was created in 2013 by Vitalik Buterin and a team of novice programmers. Eth is revolutionary and paved the way for Crypto for the next 10 years.

This is because Ethereum made one huge improvement to Bitcoin. They introduced a programing language onto the blockchain!

The introduction of the ability to program on top of a validation service completely changed how transactions were processed. Now for the first time we could take blockchain technology outside of financial services and apply it to any sector that needed verification technology.

Think about that. Now blockchain technology, which streamlines the process of validation, can now be applied to any sector. Nations could employ Ethereum technology to validate voting booths. Banks could adopt blockchain to automate their hiring process. The possibilities overnight were endless.

However, this rapid explosion of blockchain adoption came at a cost. Computers still needed to validate every transaction and there were not enough validators.

With every single transaction the blockchain increases. This results in an ever increasing file size, which means more powerful computers are needed to process the transactions.

Essentially Ethereum made itself obsolete from its own success. There is a bottleneck in decentralized blockchain validation.

In steps Cardano….

Generation 3: Cardano

Cardano was released in 2018 by one of the founders of Ethereum, Charles Hoskinson.

Cardano was built from the beginning to take the best of Ethereum and build upon it by adding scalability from the start. Remember that bottleneck that plagues Ethereum? Cardano does not have that.

Simply put this is because Cardano has the ability to breakdown each of its transactions into smaller pieces to allow for more computers to validate. What this means is that Cardano does not have one computer, that has to hold the huge blockchain, validating one transaction. It segments each blockchain into smaller amounts to make it easier for each computer to handle.

Because of this the major setback of Ethereum has been improved upon. Cardano is fully scalable and can grow organically as the total market cap for cryptocurrency increases.

If this is not impressive enough Cardano was released with Proof of Stake technology instead of Proof of Work. Both Ethereum and Bitcoin use Proof of Work, where each computer competes with others to process the current transaction the fastest.

Proof of Stake on the other hand is all about each computer delegating its power to ‘vote’ upon which computer should mine the next transaction. This means that rewards are more consistent for miners as well as overall energy expenditure is significantly less.

Further, Proof of Stake is easier to grow organically and inherently allows more decentralization to take place across the entire network.

As a result of all of this Cardano is the most advanced cryptocurrency with liquidity on the market.

Technicals of ADA

There is three technicals of ADA that need to be discussed; total market cap, volume, and total supply of coins.

Understanding how all three of these variables impact each other will give us the ability to properly predict a price.

Let’s jump right in.

Total Market Cap

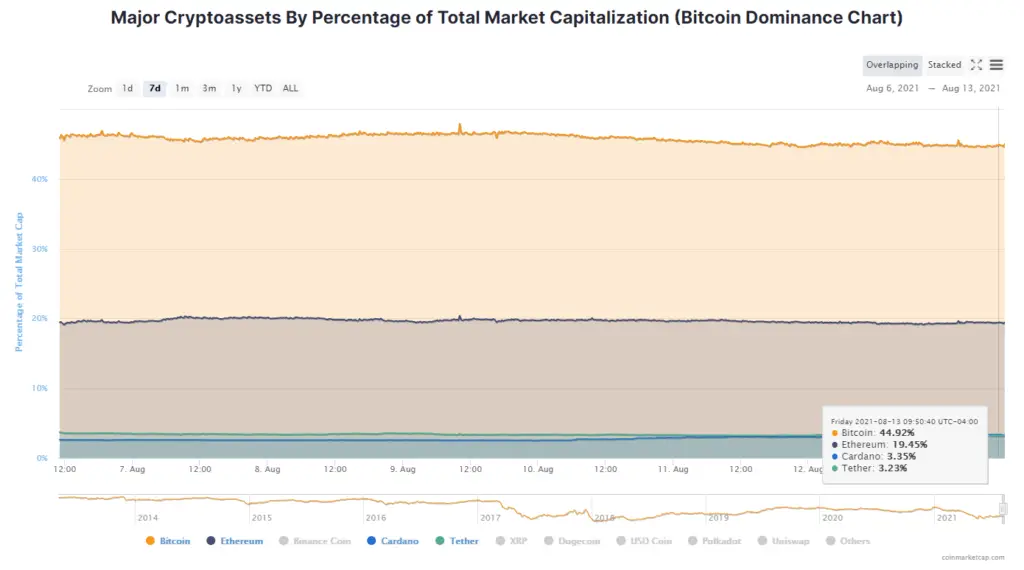

As we can see from the above image Cardano currently is the number 4 coin by total crypto market cap.

Cardano will fluctuate between 2.5%-3.3%. Recently however it has started to trend upwards gaining market cap even during bear crypto markets.

The reason behind this is because Cardano is expected to release its latest major update to their blockchain which will fully implement smart contracts onto their ecosystem.

By 2030 Cardano is expected to have a market cap of around 20%, which will put its price alone at $13.

Volume

The average daily volume on Cardano is $7 billion.

This is amazing as this high volume means high liquidity. High liquidity allows institutional investors such as hedge funds and ETF’s to invest safely.

This in turn will increase the price on Cardano over the next couple months.

Total Supply of Ada

ADA has a total supply of 32,112,337,286 ADA.

This means that Cardano is a relatively stable coin as it would take a huge amount of volume to move this coin.

Total supply can be thought of as similar to float on a stock. If the float is low, then the volatility is high.

Investment Thesis

The total market cap for crypto currency is expected to increase drastically over the next 5 years.

Essentially more money will be held in Crypto currency then ever before. The best time to invest was yesterday, the next best time is today.

Cardano sits as the best choice for growth investing. Further because of Caradno’s total market supply of coins and stable volume Cardano has to most liquidity of any growth asset in the crypto sector.

Ethereum will continue to be a major player in the market but we will see Bitcoin’s total market dominance go from 60% to around 35% by 2030. A majority of that market cap, I suspect, will go to Cardano as more and more projects are built upon the fully scalable block chain.

What will happen is that as more and more people engage in Crypto they will start to buy lower priced assets with stable growth. This is because retail traders think that lower priced stocks/crypto have more room for growth; its easier to make $1 turn into $2, then it would be to make $1000 turn into $2000.

While this isn’t necessarily true, it does mean that a high amount of traders will start to buy into Cardano, thus increasing volume and buying power. This will drive the coin’s price up through the roof in 2022.

From 2022-2030 Cardano will increase in market cap to around 20%. Currently this increase in market cap would put Cardano around $13 a coin. Remember however that with overall market cap increasing so will that percentage increase.

As such we could see Cardano coming close to $100 by 2030. Nearly a 5,000% increase from current prices.

Cardano is also easier to hold in wallets. Simply ‘staking’ the coin will net you a 5% increase in your Cardano per year. This return will compound and if invested now you can see your total net worth snowball out of control.

To be clear I own both Ethereum and Cardano but a majority of my holdings are in ADA.

Conclusion

Cardano is going to be one of the best investments of this generation. Worse case scenario you only double your money while in the best case scenario an investment now can change your life (financially).

That is why I hold Cardano. It pays out 5% per year in ‘dividends’ and has more growth potential then any other asset I have found. Around 10% of my overall portfolio is in Cardano, and I expect that number to increase as more platforms adopt the coin.

As usual if you like content like this then you should share on social media and subscribe to the newsletter! Every share helps me help others.

Further, check out some of our other posts here!

-

How Long Does a Short Squeeze Last? (3 Answers)

What is the time frame for you short squeeze? Well here is everything you will ever need to know to determine how long it will last.

-

Why You Still Own a Stock After It’s Delisted and How to Sell It

Do you still own a stock after its delisted? How do you sell it? Don’t worry the stock is still worth money and here is how to sell.

-

Can You Make 1% A Day in the Stock Market? (3 Steps)

Making 1% a day in the stock market is hard but defiantly doable. Here are 3 simple steps to helping you achieve this return.

Until next time, I wish you the best of luck in your investments!

Sincerely,