When is the best time to invest in the stock market? The easy answer is to invest when the market is going up, or a bull market. The long answer is much more complicated and if you understand it you can make money whenever.

Let’s jump right in to how you can find out the best time to invest in the stock market.

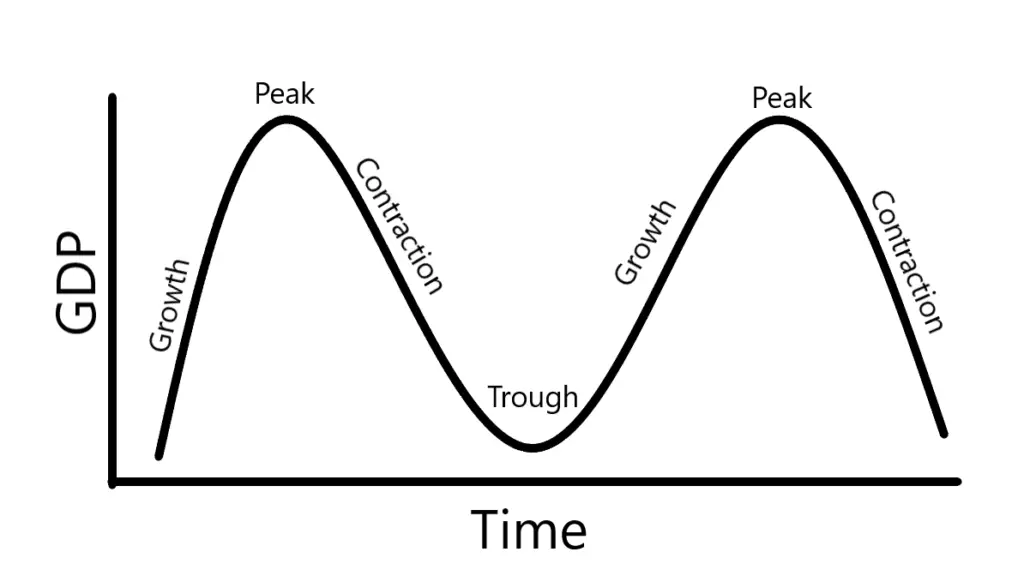

Understanding the Economic Cycles of the Market

In order to predict the right time to enter the stock market you need to look at the overall economic condition of your country. This is because a majority of your assets will be tied to your current home economic situation.

Generally these economic cycles are predictable and repetitive. Several professional investors start their investing journey here, understanding the cycles. These cycles are as follows.

- Growth

- Peak

- Contraction

- Trough

Growth

The economic cycle of growth. This growth cycle is marked as increasing GDP in the host country you are investing in. For America this is any of the major U.S ETFs that chart the overall market.

By investing in ETFs such as SPY, VTI, or IVOG during an economic growth period you will see your investment compound over time. This is an amazing phase for people who buy and hold stocks. They can expect huge returns around 10-17% return per year.

The growth economic cycle will eventually begin to level off into the next phase…peak.

Peak

The economic cycle of peak. This is when stocks are valued the highest and inflation is low. This is also when the people who buy and hold will see the largest profit during the cycle.

Eventually inflation will start to catch up to growth and the economy as a whole will begin to falter. People will start to pull money out of the market. This will be slow at first but eventually it will start to increase as more and more people scramble to get their funds.

If governments are not careful this will lead to an economic collapse. This has happened before with the great depression. During the great depression people were pulling money out so fast that banks did not have enough cash on hand and just closed down destroying the financial lives of those who gave them money.

Once the peak face is over we will start to see a decline in the overall market. This leads to the next phase of the economic cycle…contraction.

Contraction

This is when the market seems to be in freefall. Across the board stocks are in the red week over week. Everyone is losing money if they didn’t get out in time.

Normally countries at this point will begin to ‘bail-out’ big companies who employ millions of citizens. This in theory is temporarily good for the country but will result in increasing inflation as more and more companies begin to rely upon bailouts.

As more and more companies and firms declare bankruptcy a void in the market forms. This void is an opportunity for small and mid tier business’s to claim what professional investors call market cap. This market cap, or market capitalization, is a companies ability to capitalize and dominate their current market.

Disney dominates their market, entertainment, therefore they are a large cap.

When enough companies have shifted around then the market will eventually begin to rise again as innovation takes over. People and technology will adapt to the new market environment and once again we will be in a period of economic growth.

When is the best time to invest in the stock market.

For new investors, the best time to invest is during a period of market growth. For this watch GDP of the host countries market.

The United States has a steady GDP growth of 4-6.5% year over year. It is one of the most reliable markets in the world. Further since 1945 it has been in a steady growth cycle with only small corrections.

For the last 20 years there have only been two major shifts in this growth cycle. The first was the 2008 housing crisis when a huge portion of U.S mortgage market fell through on misplaced credit. The second time was in early 2020 when the U.S was struck with the global pandemic.

To demonstrate this the above image is of the SPY. The SPY is the largest ETF that seeks to track the top 500 companies by market cap in the United States. The SPY is an amazing tool to visualize the 4 economic cycles.

As we can see in 2008 and in 2020 there were two major corrections to the SPY. These were brief changes from economic peak to contraction in the market. They only lasted for a brief period of time.

The answer to when is the best time to invest in the market is during the bottom, or trough, of the economic cycle. Had you invested during the height of the pandemic for example you would of made close to a 47% return in one year!

Waiting for these economic pull backs is a great time to enter into the stock market. You will know when the pullback happens as everyone will be talking about it and it will impact your life.

During the 2008 crisis houses were being sold left and right for cheap as homeowners tried desperately to recoup some of their investment. During the 2020 pandemic every business was shut down as a country wide quarantine went into affect.

Best way to predict the market

Remember this saying.

“Time in the market always beats time in the market.”

A very smart investor

These wise words are a great way to simplify this whole process.

Even the most seasoned professional investors get investing wrong every now and then. The best way to increase your odds of making money year over year is to simply invest in a good stock and walk away.

The economic cycle will always continue. By walking away you free yourself from the constant stress of looking at your portfolio time and time again. The purpose of this website, ChronoHistoria.com, is to teach you how to invest and generate consistent wealth while also sleeping well at night.

Absolutely the best way to do this properly is to learn how to pick the best stocks for future growth and just…..let it ride. You cant influence the market by constantly being plugged in. If you form a proper investment thesis and do your own research then you will be ok, even if the stock goes down.

This is because you already know the stock/etf will go up in the future. For large ETF’s like the SPY you can pretty much bet that it will constantly hit new highs. This is because the U.S market has consistently grown year over year.

If your looking to learn how to pick winners in the market then check out this helpful post. It will show you the blueprint for successfully growing wealth in the market!

3 Steps for Making Consistent Money in the Stock Market with Pictures.

Conclusion

Don’t sweat the overall market. There are four major cycles that always repeat themselves. Investing in ETF’s that track the overall market will protect you from major losses because it will rise in price again.

As always if you like content like this then you should share on social media and subscribe to our newsletter!

-

How Long Does a Short Squeeze Last? (3 Answers)

What is the time frame for you short squeeze? Well here is everything you will ever need to know to determine how long it will last.

-

Why You Still Own a Stock After It’s Delisted and How to Sell It

Do you still own a stock after its delisted? How do you sell it? Don’t worry the stock is still worth money and here is how to sell.

-

Can You Make 1% A Day in the Stock Market? (3 Steps)

Making 1% a day in the stock market is hard but defiantly doable. Here are 3 simple steps to helping you achieve this return.

Until next time, I wish you the best of luck in your investments.

Sincerely,