Today we are looking at the stock EQT or the EQT Corporation. It is headquartered in Pittsburg, Pennsylvania. I am going to cover the fundamentals of the company, the technicals of the stock, and present an investment thesis on why you should add EQT to your portfolio.

As usual if you like content like this then you should share on social media along with subscribing to the newsletter!

Let’s jump right in!

Update

When I published this article EQT was worth $18. That was a great value play for the time and if you got in now you have a good priced energy asset.

Fundamentals

This section outlines the business model, finances, risks, and growth strategy. Each one of these sub sections has a summary at the end so you can skim through and get all the major details.

Business Model

EQT is the largest producer of natural gas in the United States. This has proved incredibly lucrative over the past five years as the United States becomes more and more reliant upon natural gas for energy generation.

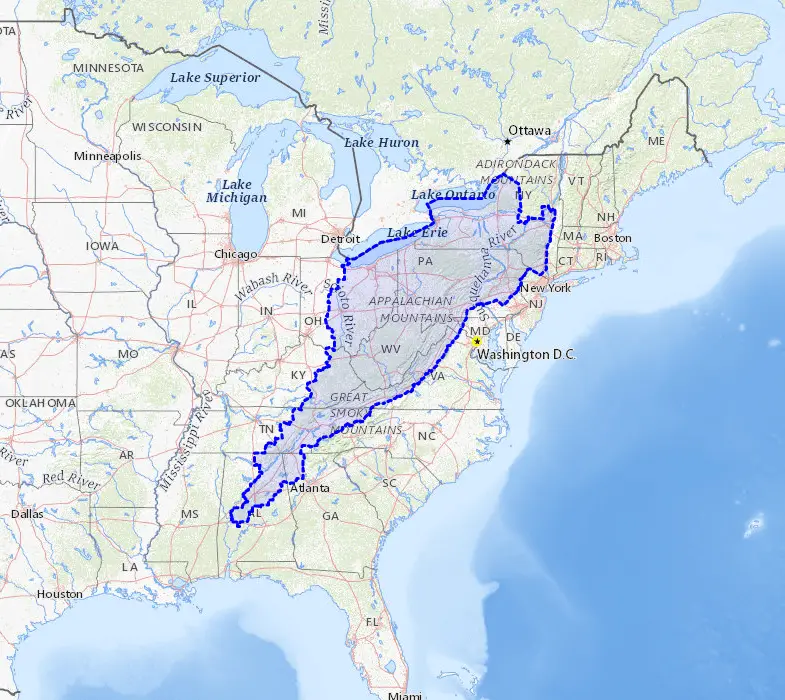

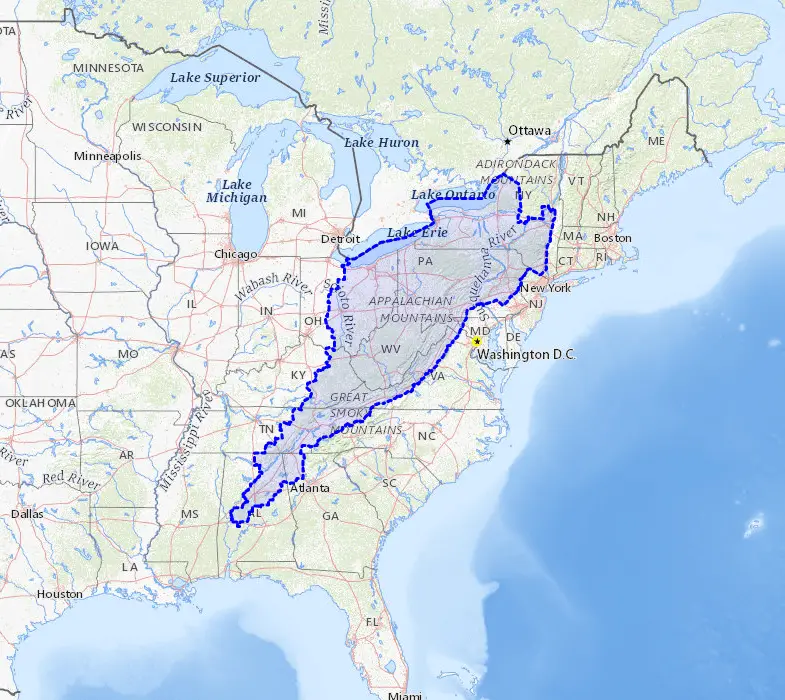

Operations for EQT is primarily focused in the Appalachian Basin where EQT retains deep drilling rights.

As we can see from the above image, the Appalachian Basin on the east coast of the United States is a hot spot for natural gas extraction. EQT is positioned in the middle of this basin and seeks to drill, extract, and sell natural gas to the energy generation market.

The Buisnes model of “Combo-development” of wells.

EQT beats out its competition by undercutting their overhead. Instead of investing in one well at a time EQT instead builds several at once. This eliminates capital inefficiencies and is called Combo-Development.”

By setting up several wells in tandem they can move skilled labor between them and cut down on the installation time. The down side to this is the risk inherent in the task. If one thing goes wrong logistically or on administration the entire project could come to a standstill.

EQT’s business model gets around this by moving very slowly in the planning stages. The age of saying of measure twice, cut once, holds true to this company. They play the long game and as such have seen a steady stream of revenue go from a trickle to a raging river.

EQT engages in this planning stage by utilizing proprietary digital planning and connection software. This way at any point during the building, drilling, and extraction phase EQT will instantly know if something goes wrong. Saving themselves potentially from a catastrophic loss of capital.

Summary of Buisness Model

The Business Model of EQT is centered around stable long term growth. The company primarily extracts natural gas within the Appalachian Basin of the United States.

The company centers their business model around lowering overhead expenditure by engaging in “combo-development” of their wells. This drastically lowers capital expenditure and allows safe expansion.

Finances

EQT in 2020 was heavily affected by the pandemic. They saw revenue decline while operating expenses increased.

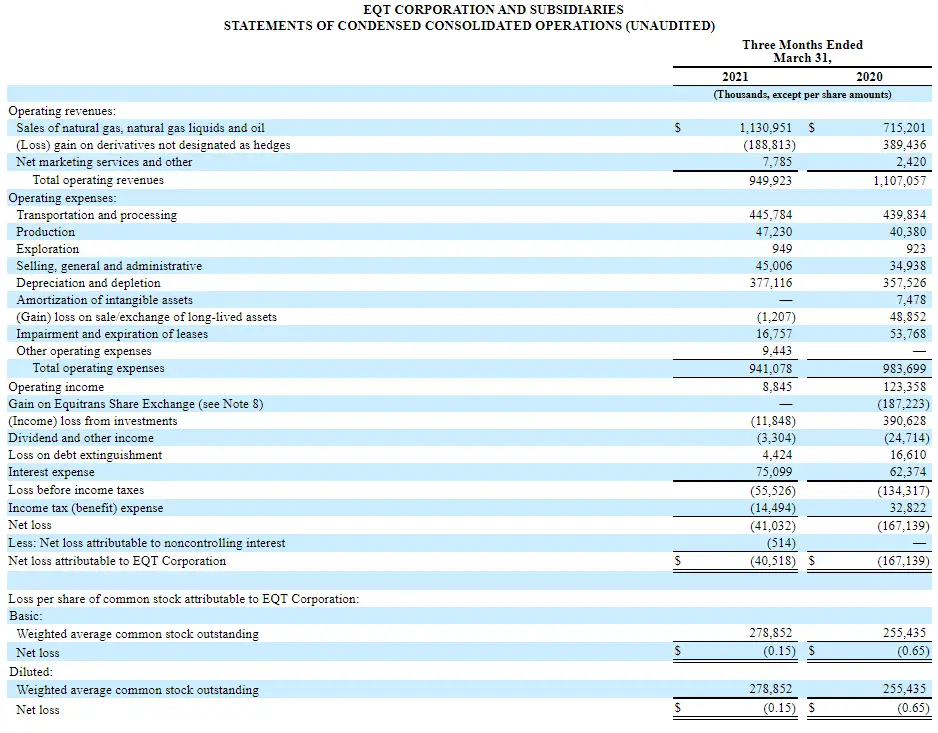

Thankfully, their recent 10-q report proves that this was just a phase for the company. Compared to this sector last year we have seen a 37% increase in sales of natural gas, liquids, and oil.

Their total operating revenue declined because they lost value on their derivates. That’s ok since the underlying business model is increasing in profitability.

EQT’s operating expenses dropped over the same time period by a nice 4.4%. This leads me to believe that EQT was heavily focused on cutting overhead over the course of late 2020-2021.

The interesting thing here is the net loss attributed to EQT. From 2020 to 2021 we have seen a net loss decline by an astounding 77%. This is a nice bonus to an already decent financial form. Further, EBITDA is a solid 8 which is in the healthy range and makes sense for EQT’s corporate profile.

Overall EQT has nothing truly surprising in their financial reports. They are a financial healthy company that makes a consistent and predictable profit.

Summary of Financials

EQT is a solid company and nothing to crazy stands out in their financial reports. This is a good sing as any expansion undertaking by EQT will have a steady and predictable revenue stream.

Further from 2020-2021 EQT has demonstrated the resilience of their business model. They rebounded quickly from the pandemic and are back to making money.

Risks

While there are several risks associated with investing in EQT, they can all be summed up into two major categories.

- First, is the overall risk to investing in a business engaged in drilling operations.

- Second, is the administration, logistic, and market risk inherent in a company engaged in the selling of natural gas.

Both are spread out across the entire industry but need to be covered before you take a position.

Risk 1: Investing in an extraction company engaged in drillion operations

Any ‘mining’ company is going to have the same risks. These are the risks of operations coming to a halt, equipment breaking, drilled wells running dry, or even ‘exploration’ or R&D not yielding any results.

Further, because of EQT’s method of ‘combo-development’ the investment is always at risk of failing. This is because if during this ‘combo-development’ EQT fails to properly foresee or plan for hurdles in installation there will be significant capital loss.

Overall I would be worried if this was a start up company without the proven track record of this type of well development. EQT has been around for well over 100 years.

Risk 2: Administration, Logistic, and Market risk.

This category covers everything that would be a normal risk for a company engaged in the extraction and selling of natural gas.

For administration there is the risk of misallocation of funds or wasteful spending on new acquisitions. EQT is no stranger to spending a premium to acquire new land, wells, or businesses.

Logistically there are several risks that could impair the flow of natural gas to the end consumer. This risk can manifest itself as a broken pipeline or ongoing legal struggles over land.

Market risk is by far the largest. The market for natural gas has exploded over the past 10 years with the advent of the shale revolution. The shale revolution finally made it cost effective to extract natural gas in large enough quantities.

At any point this market could begin to shift away from natural gas into another energy sector. This is a huge risk to not only EQT but the entire industry who have come to depend on this revenue source.

Summary of risks

The risks present in EQT are industry wide. There is nothing crazy to report here, and that’s a good thing.

The largest risk to EQT is in the form of the United States beginning to shift away from natural gas as its primary power generation source. Even though renewables are taking off it will be several years before we see the end of the shale boom.

Growth Strategy

EQT over the past three years has started to take some of those insane profits they received and reinvest it into two categories.

- Renewable trash energy generation

- More natural gas reserves.

Both of these growth plans fit perfectly into the business model of EQT.

First Growth plan: Renewable energy from trash

This is the most exciting thing EQT has done in over a century. In July of 2021 EQT announced that it had finished a deal to buy Covanta Holding Corporation and take it private.

Covanta specializes in burning trash to generate electricity across the United States. They take the trash in waste dumps and burn it to release energy.

This announcement surprised analysts on the market. They were used to EQT buying up competitors in natural gas but not a renewable company.

I think this acquisition is an amazing play. It gives EQT a baseline that is not in natural gas. They can build up this company, which already returns a sizable profit, into a safety net should the market for natural gas disappear.

This could mean that EQT is now diversifying into a more renewable revenue portfolio.

Second Growth Plan: buying up competators natural gas reserves

Natural gas is not a renewable energy source. Eventually EQT will run out of natural gas reserves on its drillable land. They will then either have to invest in acquiring new land or spending more money to drill deeper to hit more gas.

EQT buys out competitors to get access to their reserves and prevent the company from ‘running dry.’

In July 2021 EQT announced it had entered into a preliminary agreement to buy Alta Resources natural gas reserves for $2.9 billion. This type of growth strategy will allow EQT to continue operating and even reduce overhead further in the coming years.

Its a good growth strategy to buy out your competitors. EQT stands to dominate their geological proximity by buying out other competitors wells.

Summary of Fundamentals

EQT is a solid company whos revenue is consistent. Further the market for natural gas is continuing to expand at a record pace and does not show any signs of slowing down.

The business model for EQT is reliable and stable. They undercut their competitors by “combo-developing” wells in tandem so that they utilize minimal capital investments. This is lead to EQT saving up a considerable stockpile of both natural gas and wealth.

The finances for EQT is about as predictable as they come. Even during the height of the pandemic EQT saw only a modest decline in revenue. Once the pandemic started declining and the market opened back up EQT shot back up to normal revenue again.

The growth strategy for EQT is two part. First, they buy up companies that have a reliable and conservative revenue basis. Their recent acquisition was buying and taking private Covanta, who make their money off burning of emissions from landfills.

The second part of this growth strategy is buying more and more natural gas reserves to exploit. This will give EQT both ample space to expand and a stockpile of natural gas to extract in the future.

Technicals

What is the average volume, float, P/E, and current options statistics.

As we can see from the above chart EQT has steadily increased in value over the year. Currently the stock is downtrading on supply concerns in oil, but this should only last about a week or so.

The reason the stock trended up was because of EQT getting back to normal revenue in their recent 10q (May). This confirmed many analysts suspicions that EQT was going to begin to engage in rapid expansion.

Average daily volume.

The average daily volume for EQT is in the range of 4 million shares. This means that there is high liquidity for a larger investment.

This is because as a stock increases in volume we can safely enter and exit the position when more shares or money is being traded it in. If EQT only had 10,000 shares being sold a day ($230,000 daily amount) then we couldn’t enter with a large position.

Float on EQT

The float for EQT is 277 million.

The current short percentage is close to around 7%. This is high for an energy generation company. More then likely the reason is because of funds hedging against other positions.

We don’t run the risk of a short squeeze here. There simply is not enough volume to drive the price up. I don’t foresee this changing unless EQT announces a massive change to their business model.

P/E

The current P/E on EQT is around -5.89.

This is because of the recent 10-q that shows a negative financial situation. This P/E is to be expected for a large company with high overhead coming out of a pandemic.

Normally I would say this is an issue but since EQT’s market is a defensive sector we can expect for this to only be temporary. For a full rundown on what a defense sector is check out this post!

What is a Defense Sector: 5 sectors that will save your portfolio.

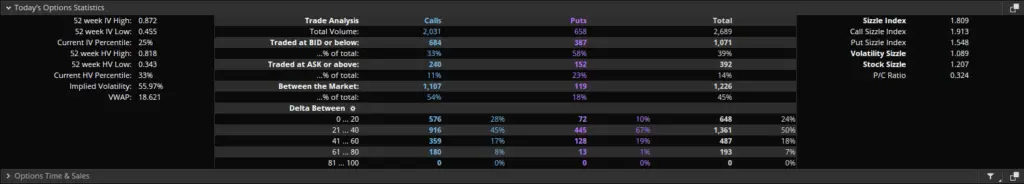

Current Options Statistics

Currently there is about double the amount of calls to puts. This is a bullish sign that the market is expecting something to happen to EQT.

Further, the volatility has increased to around 55% which is rather high for such an established company. This leads me to believe that the market is expecting that EQT will do something soon.

So we have calls to the upside with the market expecting that something is going to happen soon.

Summary of Technicals

The technicals of the company is normal. The stock is currently up trending and is expected to do so by the market for a bit.

The P/E is negative, but that’s expected for the company based off the current economic situation.

Stock volume is great and consistent. We have plenty of liquidity for a position.

The options statistics hints at the market pricing in some sort of increase in volatility.

Finally the float makes the company not prone to rapid swings or a short squeeze. This could change if massive volume enters for a random reason, but I don’t see that happening in a natural gas extraction company.

Investment Thesis: Why EQT will go Up

This thesis has two parts; First is the massive potential of the Marcellus shale basin. Second is the new business that EQT just bought.

Part 1: Marcellus Shale Basin Exploration!

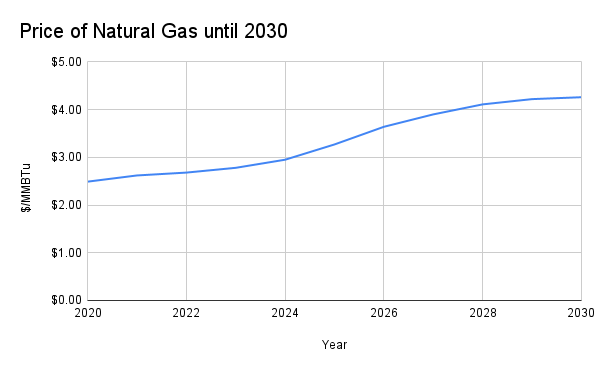

The price of natural gas is expected to rise by over 100% as more and more countries switch from coal/oil burning turbines to natural gas turbines over the next decade. (Citation:https://knoema.com)

This will result in massive profit for the major exporters of natural gas. Russia, Norway, and the United States. Within the U.S.A EQT has potentially the largest reserve of natural gas.

This is because before 2008 the Marcellus Shale wasn’t properly explored by natural gas extractors. In 2011 that changed however when a team of U.S geographic surveyors found that it has the largest reserves in the entire United States!

(citation: https://pubs.usgs.gov/fs/2011/3092/)

EQT dominates the Marcellus Shale Basin. It is highly probable that EQT is sitting on several billion dollars worth of undiscovered natural gas. This will give EQT two revenue streams.

First, they could sell their wells to other competitors for much more then they bought them.

Second, they could extract the natural gas and sell the gas.

We could see EQT jump in price by close to 24% just off future movements of the world demand for natural gas along with EQT’s low overhead to extract it.

Part 2: Covanta Holdings Aquisition

This one is exciting for EQT. They bought a new sub-business called Covanta Holdings.

This company has a unique power generation method of burning the excess gas coming off landfills along with recyclable trash. They have huge power generation capacity and are considered a safe investment for EQT.

EQT is now diversifying into the renewable sector to compete with other industry giants such as NextEra Energy. This diversification is great and it sets EQT on a 20 year growth plan. For a full rundown on how effective this is in the energy extraction and generation sector see the following post on NextEra Energy.

$NEE: Why Nextera Energy is going to explode in 2022 and beyond!

What Covanta brings to EQT is economic potential. For the longest time EQT suffered from its own success. It was in a stable market with little outside growth.

EQT can now expand into power generation through a renewable approach, trash generation. Covanta’s trash burning generators fits perfectly into EQT’s business model by also having the capacity to burn the byproducts of landfills, natural gas.

This gas called Landfill Natural Gas (LFG for short) is a huge byproduct of organic decomposition in landfills. Generating electricity from this is cutting edge and Covanta did it best.

Now EQT can benefit from this LFG generation. They will be able to run their own natural gas pipelines to the LFG generation spots to begin to provide energy to local consumers.

This is huge. Before EQT was beholden to their customers who had so much buying power they could negotiate the rates for natural gas. Now EQT is going out on their own to generate electricity and compete with the big power utility companies.

Price and ROI expectation.

EQT will have a price runup in 2022-2030. There is no way around it.

Further because of their business diversification into energy generation through LFG landfills we can see a huge jump in price around 2028.

Because of this I expect EQT to be in the $35-$50 range by 2028. If invested today we can expect to see a return on investment in the range of 230%-320% over the next six years.

Conclusion

EQT presents a great investment opportunity. Its a solid company, with solid finances and an achievable growth strategy.

Further its economic potential now is just to good to pass up. Your downside is around 4-5% but if held you could achieve amazing returns.

As always if you like content like this then you should share on social media and subscribe to our newsletter!

-

How Long Does a Short Squeeze Last? (3 Answers)

What is the time frame for you short squeeze? Well here is everything you will ever need to know to determine how long it will last.

-

Why You Still Own a Stock After It’s Delisted and How to Sell It

Do you still own a stock after its delisted? How do you sell it? Don’t worry the stock is still worth money and here is how to sell.

-

Can You Make 1% A Day in the Stock Market? (3 Steps)

Making 1% a day in the stock market is hard but defiantly doable. Here are 3 simple steps to helping you achieve this return.

Until next time, I wish you the best of luck in your investments.

Sincerely,