Hey guys,

Today I am looking at the company Aspen Aerogels Inc ($ASPN). This company is a sleeping giant in the exploding electric vehicle market because $ASPN seeks to solve one major issue that plagues all of the EV manufacturers…thermal battery load. Let me show you how you can profit from this.

Update: 6 Months Later

It’s been 6 months since I published this article. Since then ASPN has rocketed up to $63 a share, that is a 44% increase in one year. Needless to say I am happy with the position, and I hope you guys got a chance to ride that wave as well.

Sincerely,

Chillznday

Business: What is $ASPN

Aspen Aerogels, Inc is an aerogel technology company that creates high performance aerogel insulation. This insulation is used in the energy infrastructure and building materials market. In 2019 ASPN decided to stop seeking outside research contracts with entities such as the U.S Federal Government. The reason behind this movement was to begin to focus ASPN’s effort on the emerging battery storage market.

ASPN has two major aerogel insulation product lines for the energy infrastructure market. These are the Pyrogel and Cryogel products and over the past thirteen years have grown from $17.2 million in 2008 to a massive $99.8 million in 2020. Since 2008 ASPN has shipped and sold over $1.1 billion U.S dollars worth of product globally.

Due to this massive success ASPN is positioned to become the major player in providing aerogel thermal reducing products. As such in 2019 ASPN decided to stop pursuing research contracts and instead fund their own research on applying their product line to battery storage technologies.

Investment Thesis: Longing the Battery with ASPN

ASPN is already dominating both the energy infrastructure and thermal building materials market. The untapped market here for ASPN is the rapidly expanding battery storage market.

The global lithium-ion battery market is expected to be larger than $45 billion by the end of 2021. These lithium-ion batteries produce an extreme amount of heat as they are used. This directly limits the life expectancy of the costly battery and further presents safety issues.

As the lithium-ion battery market continues to grow rapidly we will see an increasing demand for technologies that can limit thermal load on the sensitive batteries. ASPN stands to capitalize upon this by providing their proven thermal reducing aerogel products to emerging markets such as the electric vehicle market.

In order to get a head start on the EV market ASPN in September of 2020 entered into a contract with a major U.S EV equipment manufacturer to supply thermal barriers for their inhouse EV battery system. This contract expires in September of 2026 and is a major first step for ASPN into what will be a very lucrative market.

Since then ASPN has been in closed discussions with ten other major EV parts and car manufacturers across the globe. This is a major positive sign for ASPN who went out on a limb by entering into a new sector. We know that ASPN is already in the process of submitting corporate RFQ’s for EV vehicles and grid storage capacities. Evidently their September 2020 contract to provide aerogel thermal reduction products has paid off.

The title of this section is “longing the battery with ASPN” and ASPN is literally prolonging the life with their new battery technology while we are also going long on the asset.

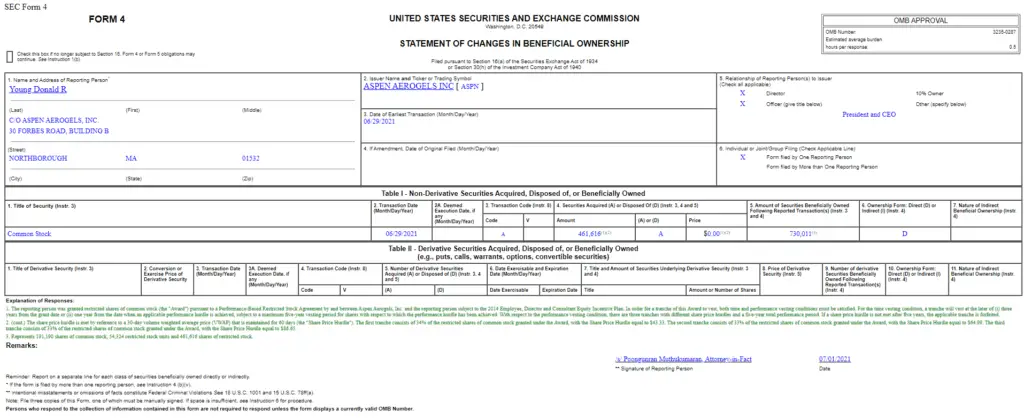

Insider Trading

On 06/29/2021 Donald R Young, the president and CEO, acquired 730,000 class A common shares in ASPN. This is an incredibly bullish as this happened after the major runup in their stock price. Essentially this means that Donald R Young is expecting a big upwards movement in his stock price.

The Trade: ASPN and you.

Ok, so how are we going to position the investment to capitalize on this emergent EV trend on ASPN?

Currently ASPN has broken out from its year to date highs on multiple bullish signs. The major event took place on 06/30/2021 when ASPN agreed to sell $75 million class A common shares to Koch Strategic Platforms.

Koch Strategic Platforms is an investment firm that specializes in investing in new and emergent companies with a proven product base to capitalize on new markets. What we are seeing here is an institutional investor taking a huge investment in the new EV market of ASPN.

As a result of this ASPN shot up 24% in one day and continued a further 5% into the next. Currently ASPN is trading at $34.82, which is more then its valuation.

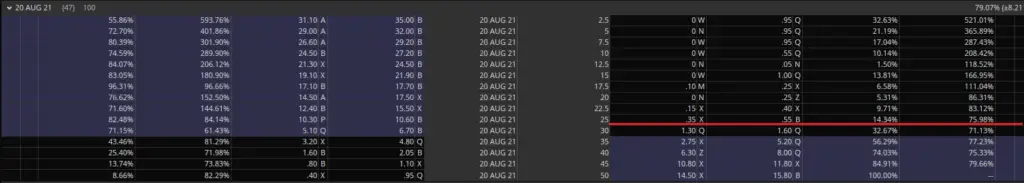

Right now I’m expecting ASPN to drop down in the low $30’s where I will take a position. Further, due to the volatility being high I plan on selling a naked put at or around the high $20’s so that I can gain a bit of premium out of the recent IV move.

Selling the option will net you around $35 which you can put back into the market. If the price of ASPN comes back down to below $25 you will have to buy 100 shares but that’s ok as the valuation of ASPN is in the low $30’s currently. You will just be entering at a good place.

If you don’t want to hold the risk in your portfolio you can wait for IV to settle down and then buy shares. I am expecting ASPN to begin to settle down in the high $20’s before rocketing up to the low $40’s in late 2022.

If played properly you can expect to get around a 25-35% return on this investment conservatively. If ASPN enters the EV market in 2022 publicly then you can expect to see a price in the high $60’s!

Risks to investment

Like any investment there are risks present. For going long on ASPN right now it is the fact that perhaps the companies 10-k is lying or that ASPN will leave the EV market defeated. If that is the case then the price of ASPN will drop to its valuation in the high $10’s or mid $20’s.

How do we protect against this type of risk then? Well for starters we will define our holding time. For this investment I wouldn’t hold for longer than 1 year without ASPN clearly laying out their game plan.

Further, I would leg into this trade. Don’t buy at market all at one moment but rather buy in 10-15% increments slowly. The idea is to average down over time on your position.

Finally, Once IV has settled down on the option chain I would buy an OTM put on the $30 strike price. This would guarantee your downside and transfer your risk to the seller of the put. Essentially this would be cutting into your profits but you can rest easy at night knowing that someone is taking on the risk.

Conclusion:

ASPN is up to something. We know that they have been cooking up some new technology surrounding limiting thermal load on energy storage systems. The market was expecting that ASPN would just become another major name in the EV market but apparently ASPN is on track to become something much, much, larger.

With the EV market poised to continue expanding for the foreseeable future ASPN might eventually become one of those household names. As such it might be a good idea to get in on this rumor and stock before it’s to late.

As always if you like content like this you should share this post on social media, like, comment, follow, and subscribe to our newsletter! Every share on social media helps me help others, so it’s much appreciated!

-

How Long Does a Short Squeeze Last? (3 Answers)

What is the time frame for you short squeeze? Well here is everything you will ever need to know to determine how long it will last.

-

Why You Still Own a Stock After It’s Delisted and How to Sell It

Do you still own a stock after its delisted? How do you sell it? Don’t worry the stock is still worth money and here is how to sell.

-

Can You Make 1% A Day in the Stock Market? (3 Steps)

Making 1% a day in the stock market is hard but defiantly doable. Here are 3 simple steps to helping you achieve this return.

Until next time, best of luck in your trading!

Sincerely,

Comments are closed.