Hey guys,

It’s a rainy Saturday where I am located. As such today is the perfect day to talk about one of the biggest plays in renewable energy that will add value to your portfolio. Today I am talking about NextEra Energy, and how this energy giant is going to bring massive returns over the next 2-10 years.

Business Model: What is NextEra Energy?

Basically $NEE is a two tiered business centered around both generation and distribution of energy to its consumer basis. Both of these businesses together allow for NextEra energy to have a vertical monopoly on the supply chain for energy generation and distribution. This type of corporate structure is a long term investment that allows complete control over the logistical growth of the company. As such $NEE can plan out several decades ahead of time and control its risks internally.

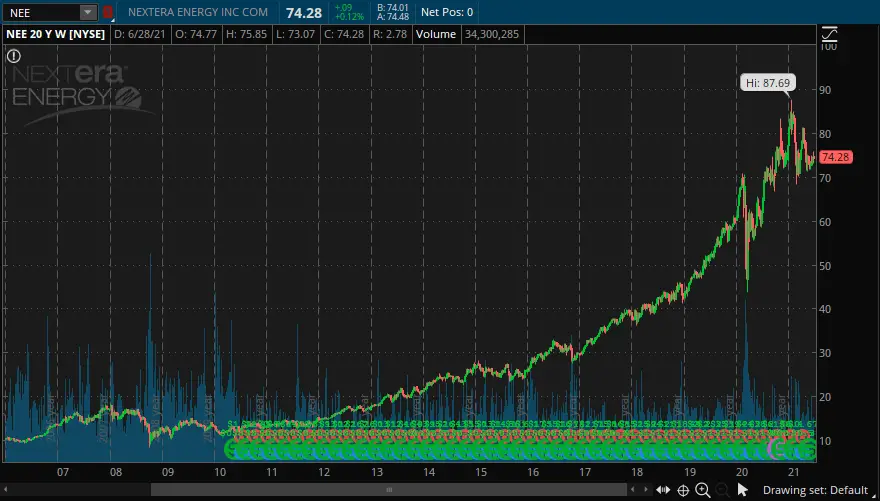

This planning decades ahead is the key to $NEE’s success. From the beginning $NEE has been set up to minimize growing risks while allowing for the “smart” allocation of investment capital. Investment’s that focus around low maintenance renewable energy generation. This has allowed $NEE to explode over the past 20 years with a steadily growing revenue stream.

Further, $NEE has for the past 20 years been steadily growing its dividend payout to investors. Currently the dividend sits at a meager 2% which is not that exciting. However the alpha present in a long term position with $NEE is insane due to both the ability of the stock to appreciate in value and the nice dividend.

Below is the two tiered business model that comprises $NEE.

First: Florida Power and Light.

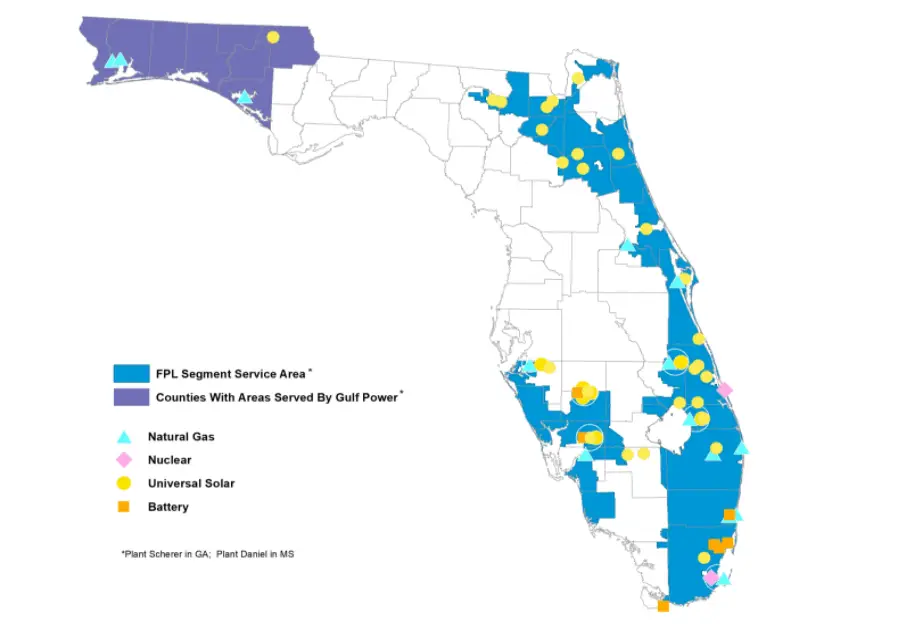

Florida Power and Light (FPL) is primary energy generator and distributor in the state of Florida. Due to this FPL accounts for nearly 80-87% of $NEE’s revenue every year and is growing at a rapid pace.

FPL’s power generation portfolio consists of several different types of generation methodologies. The largest by revenue size is the natural gas generators (marked by triangles in the above image) with solar coming in second (marked by yellow circles).

Over the past two years FPL has been heavily investing in solar energy generation and battery storage capacity. This is has proved to be a huge investment that will start to allow FPL to shift its power generation portfolio from natural gas to solar over the next 5 years.

Recently, $NEE bought out a competitor to FPL in Florida, Gulf Power. Both FPL and Gulf Power merged in January of 2021, an action which is going to allow FPL to dominate Florida.

Second: NextEra Energy Partners.

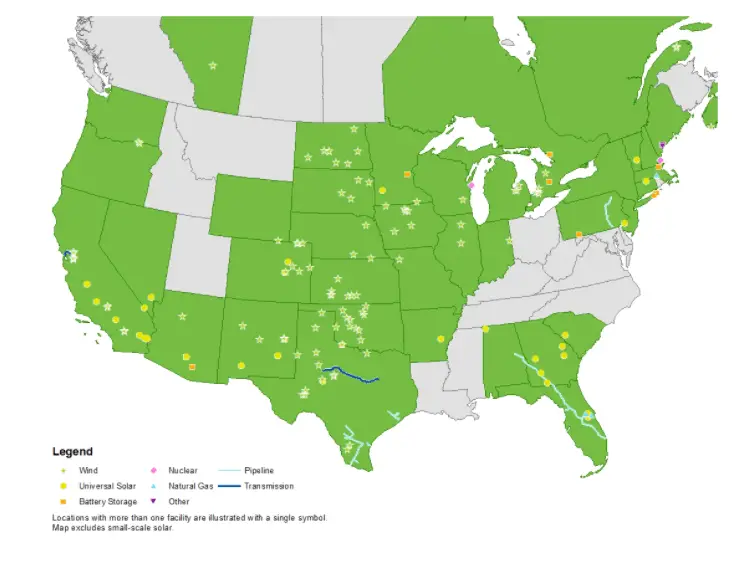

NextEra Energy Partners (NEP), much like FPL, is a subside of $NEE. NEP manages, acquires, and owns clean energy projects with stable, predicable, long-term cash flows. These energy projects are comprised of wind, solar, nuclear, and battery storage. Geographically, these investments are located across the United States and as such sell their energy directly to other energy distribution companies.

NEP’s is growing at a substantial rate and remains one of $NEE’s primary investment expenditures. Currently NEP generates 12-15% of $NEE’s revenue per year but it is expected to grow to around 20-30% by 2030 due to favorable economic conditions surrounding renewable energy generation.

Investment Thesis: Going long on growth

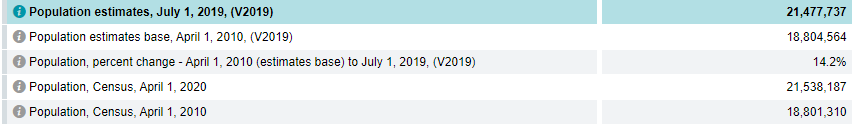

First, a rhetorical question. What is the underlying market for an energy generation and distribution company? Who are the consumers? The answer to this question is simple, it’s the average person who is going to profit from $NEE’s energy generation. As such, the underlying question of growth for $NEE is tied to the growth of populations in locations where $NEE is servicing.

First: Milking Florida’s population boom.

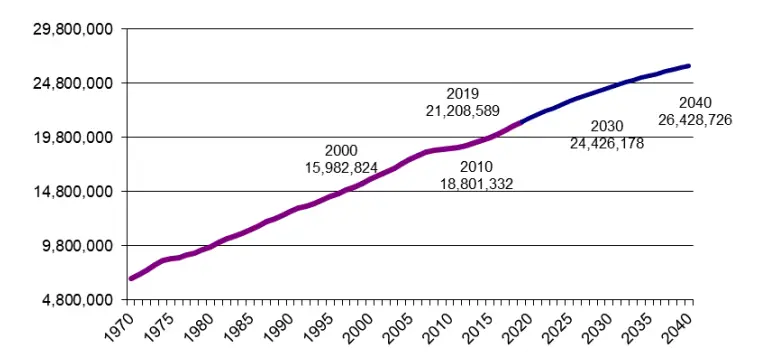

Florida is on track to become one of the largest states within the United States by 2030. Since 2008 every year Florida has seen record population growth caused by a mass-migration from more populated regions to the low-cost of living sunshine state. From 2010 to 2020 Florida saw a population explosion of close to 15% and this trend is expected to continue for the foreseeable future.

This explosion in population will result in increased revenue from FPL in the state of Florida. A state that $NEE dominates in both energy generation and energy distribution. Further, the fact that FPL has been strategically buying up other distributors along with installing renewable low cost energy generation systems (solar) means that FPL is positing itself to offer extremely competitive pricing that will box out the other distributors in the Florida market.

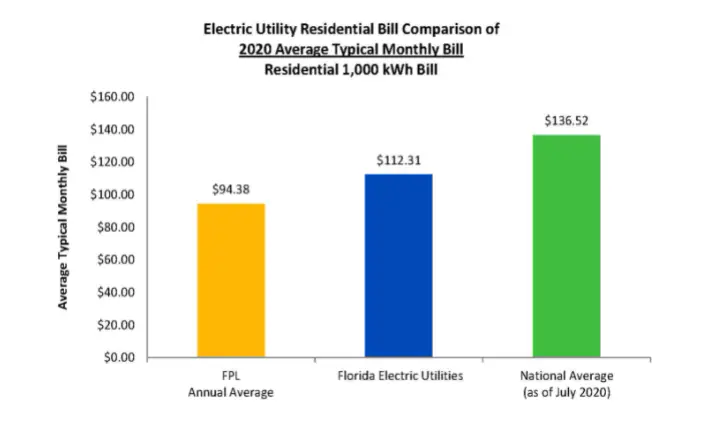

Competitors won’t be able to compete with FPL on price. Above is the current price per 1,000 kWh bill in the state of Florida. Already FPL is boxing out competition, and this will only increase as more and more solar generation installations come online across the state.

Second: NEP’s steps to world domination.

NextEra Energy Partners is slotted to continue expanding at a rapid pace. In April of 2021 NEP announced that it had decided to buy several wind farms in California, a deal valued at around $400 million.

This constant investment in the renewable energy sector is smart especially when paired with a vertical monopoly structure where $NEE can start to bully out competitors in the regions they enter. If FPL is $NEE’s shield then you can think of NEP as $NEE’s sword. What we are seeing is economic expansion into untapped regions of the United States by NextEra.

In June of 2021 $NEE doubled down on their renewable expansion plans by raising $500 million in the form of senior convertible notes. These senior convertible notes can be exercised by the contract holder to acquire underlying shares of a company. What this means is that $NEE was a sleeping giant, that has finally started to rise from its sleep.

NEP is now the expansion predatory subside of the NextEra Energy, the largest utility and energy generation company in North America. The overhead on NEP is completely covered by FPL’s revenue basis; a basis that is expected to grow year over year due “smart” investments in renewables along with massive population growth in Florida.

What this means for our investment thesis is that we have a two tiered company. The first tier (FPL) provides for the second (NEP) while the second paves the way for the first to expand into and lock down new territories. As such $NEE is positioned to capitalize heavily upon the energy market in the U.S. An energy market that is going to become more renewable friendly every year.

The Trade: Long Term Capital Appreciation

In 2021 NEP did not return the expected earnings and as a result $NEE saw a downtrend of around 14% as institutional investors pulled out of $NEE in droves. This downtrend is temporary as $NEE has positioned itself for massive expansion in the next 20 years. As a result of this downtrend you can buy $NEE at a discount right now when compared to its economic potential.

The pullback is only temporary due to the concept of NEP. NEP is a smart investment vehicle for $NEE to expand into other sectors. It also sells generated renewable energy to local distributors throughout the U.S and Canada. Right now it is only 10-15% of $NEE’s revenue portfolio but with every year the economic potential of NEP climbs. Eventually it will hit critical mass as NEP generates energy at a significant discount compared to the rest of the U.S market.

Further, while this is also going on $FPL is going to continue to generate 80-85% of $NEE’s revenue. FPL is growing at an alarming rate and as such so will NEP. The below chart demonstrates good entry points for $NEE.

Getting shares of $NEE in the low $70’s is a steal and should be acquired at any available moment. Right now $NEE is trading in the mid $70’s so buying has a moderate amount of risk in the near term.

Between 2022 and 2026 I can see $NEE climbing from the mid $70’s up to well over $100 and into the $110 range. This represents a 42-55% growth over the next four years. Well above market returns along with a growing quarterly dividend.

Conclusion

$NEE is a great opportunity and buy to hold over the next 2-4 years. It is a chance for a person who wants to expose themselves to a defensive industry (energy utility and generation) while also pursuing massive gains (for the sector).

I hold $NEE both leaps (ITM) and stock. It is a defensive part of my portfolio that I consistently add to.

As always if you like content like this you should share on social media, like, comment, and subscribe to our newsletter!

-

How Long Does a Short Squeeze Last? (3 Answers)

What is the time frame for you short squeeze? Well here is everything you will ever need to know to determine how long it will last.

-

Why You Still Own a Stock After It’s Delisted and How to Sell It

Do you still own a stock after its delisted? How do you sell it? Don’t worry the stock is still worth money and here is how to sell.

-

Can You Make 1% A Day in the Stock Market? (3 Steps)

Making 1% a day in the stock market is hard but defiantly doable. Here are 3 simple steps to helping you achieve this return.

Until next time, best of luck in your trading.

Sincerely,

Comments are closed.