Getting into a short squeeze before it explodes can earn you massive returns. Some short squeezes explode and those who bought in before it happened will see returns of 100-1,000% overnight.

Predicting these short squeezes is simpler then you might think. This article will break it down on how you go about doing this.

Before we begin, if you like content like this then you should share it on social media and subscribe to our newsletter! It helps me help others so its much appreciated.

Let’s jump right in.

What is a Short Squeeze

Before we can even begin to search for potential short squeezes we need to first look at exactly what a short squeeze is.

A short squeeze is when a stock has a high percentage of shares out on loan, or shorted, these loaned shares need to be recalled at some point. Due to FINRA regulations each account needs to have 25% capital to cover the short. As a stock price rises these shorts buy back the loaned shares because they have to.

This creates a runaway effect of everyone buying back shares at market value to repay the shares they received a loan for. I wrote an entire post on shorting and how it works. I put the link below for anyone who needs more detail.

Shorting a Stock Explained: Making Money When the Stock Goes Down.

Understanding how shorting works is vital to understanding, finding, and predicting a short squeeze. Think of it as the foundation that we will continue building our ‘short-squeeze’ house on.

The short squeeze in essence can be thought of as a runaway snowball where buyers are forcing shorts to cover by continuously buying the stock. This pushes the price up and forces the shorts to have to cover their positions to remain in FINRA regulations. If they fail to maintain the 25% capital requirement to cover the stock they will be margin called.

People and firms who short have the fear of being margin called. Think of it as declaring bankruptcy on your stock account. Your broker will liquify all positions and then smack you with an invoice on the remaining balance.

This is how we are going to make money. We are going to force shorts to cover or else be margin called. Each short that covers will buy back shares at market price which will further push the price up. Leading to the runaway snowball effect.

Requirements for a Short Squeeze

Ok, so in order to find the short squeeze target we need to look for a set of variables in the market. This is the winning combination and always needs to be followed to find these targets.

Don’t forget these terms.

- Daily Volume

- Float

- Short Percentage

- Catalyst

By knowing these terms we can begin to scan the market for potential short squeezes.

Daily Volume

Easy enough. Volume is the amount of shares being bought or sold on a ticker. The ticker is the stock we are looking at.

For example AAPL has a massive daily volume of between 200-800 million shares!

Daily volume is important because if the stock already has a high volume then you missed the potential short squeeze. Remember you are trying to get in before the action, not after. Look for low but consistent volume in relation to the next term, float.

Float

The stock float is the amount of publicly traded shares that are able to ‘float’ between accounts on the market. This is important because stocks that have a high amount of publicly traded shares, or float, wont move that much.

If the stock cant move fast, then there is not really a good chance of a short squeeze. Remember you want fast explosive upwards action that forces shorts to cover.

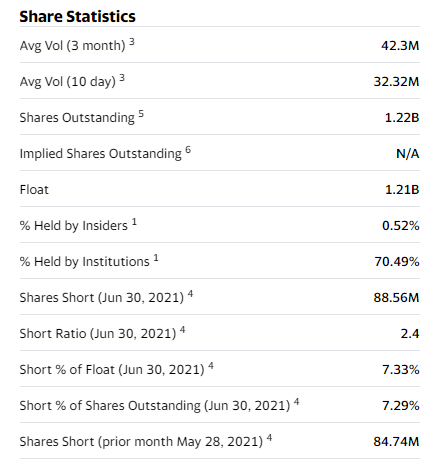

Here is the public float of GameStop along with AMD.

A stock with a high float wont have the explosive upwards action. AMD has a float of over a billion shares. As such it wont move that fast.

Gamestop on the other hand has a public float of around 58 million shares. This is significantly less then AMD. Logic would then dictate that since the float of GME is less then it is at a better chance of exploding? The answer is yes.

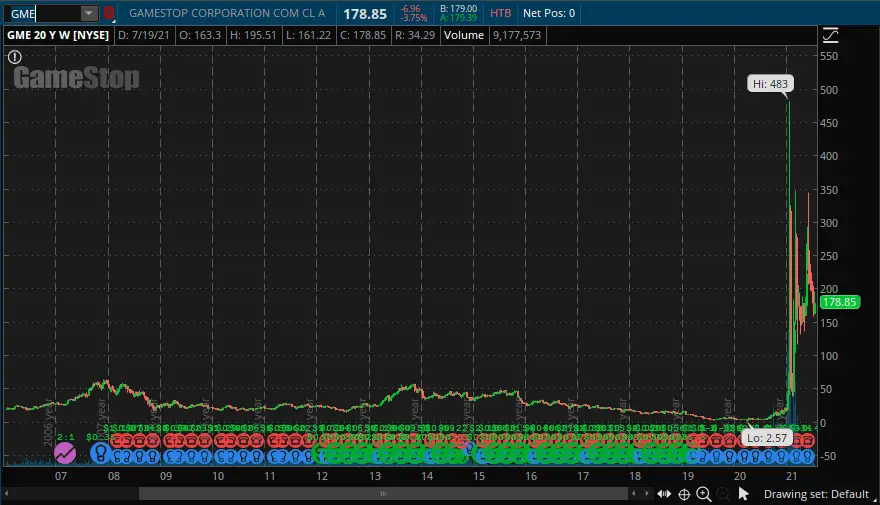

GME exploded on a short squeeze in January of 2021. It had consistent volume, a low float, and most importantly the next term; a high short percentage.

Short Percentage

This is vital to understanding the potential of a stock to turn into a short squeeze.

The short percentage is the amount of the float that has been taken out on loan to be shorted. GME in the above scenario had close to a 100% short percentage. This meant that of the 54 million shares on the public float close to 100% of them had to be bought back at a future date.

If you look at AMD the short percentage is around 7%. Any percentage above 20% is a prime target for a short squeeze. The larger this percentage gets the better the potential squeeze will be.

This is because a higher short percentage indicates that more people will need to buy back shares at some point in the future. If the price of the stock starts to increase then shorts will start buying. This will lead to the runaway snowball effect if the other two variables are met as well.

Catalyst

The catalyst is what you think is going to cause buying volume to soar in the stock. This could be good earnings, a corporate announcement, a buyout, or sometimes just retail investor support.

To find this you need to do a bit of digging. I typically look at retail investor hype as this can cause a runaway effect as more and more people FOMO into the stock.

To gauge this retail investor interest I look at places they are expected to hang out. This is either Twitter, Facebook, Discord, Reddit, or other websites. By simply asking questions of these retailers you can learn why they decided to invest in a stock.

If enough people gather around research then they can pour into the stock and drive the price through the roof as shorts attempt to cover.

Further, you can always look into websites built to track the most talked about stocks on these sites. Some good examples are the following.

These are just two that I tend to use to get a snapshot of retail investor interest. You will still need to do your own research and ask the appropriate questions to gauge interest. If done properly you are good to go and start investing.

Finding the Next Short Squeeze

Let’s start scanning the market for these variables. If you have a stock trading program such as Think or Swim you can pump in these into the scanner section. If you don’t a good free website to use is Finnviz’s free screener tool.

https://finviz.com/screener.ashx

When you open up the site you can play around with the different variables to find a stock that fits the short squeeze definition.

One such stock that stood out to me was Tootsie Roll. I did an entire research post on why TR is a ticking time bomb due to short squeeze potential. Check it out if you want an example of a short squeeze before it happens.

Why I invested with Tootsie Roll ($TR).-Chillznday

How to Invest Before the Explosion.

So now we found the stock that has a good shot of exploding on a short squeeze. How should we play it?

Well you can always just buy shares and let it ride. This will give you unlimited time to wait until the explosion happens. This is what I recommend doing if you are new to this type of investing as you can always sell your shares for near the same value or more at any point.

If you really want to ride the lightning however you need to buy call options. If you buy call options and the short squeeze happens before your options expire worthless you could see absolutely massive gains of close to 200% on a small explosion.

This is how people make real money from the market. Its a gamble because eventually those options will expire. If your options expire even one day before the short squeeze you will make nothing and worse you will lose everything.

But if you wait for volume to start rising, find a catalyst, look for a small float, and position yourself properly then you to turn $1000 into $25,000 overnight.

Conclusion

There you have it. A super simple and well defined way on how to spot short squeezes before they happen.

Playing short squeezes are going to continue to become one of the quickest ways to make considerable returns on your portfolio. That being said it is not investing, you are gambling plain and simple.

But if your willing to bet it all and win then this might be the strategy for you. Its a pretty fun way of making massive returns on capital and it could be a way for you to retire early if played right.

As always if you like content like this then you should share on social media along with subscribing to the newsletter! Every share helps me help others!

Until next time, best of luck in your investments.

Sincerely,