It’s the dream of many but only accomplished by the few. Those who have become millionaires through investing in the stock market are no different from you. They simply learned how to pick winning stocks in an easily repeatable manner.

The trick to making millions in the stock market involves three key concepts.

- Picking good investments

- Investment Timeline

- Risk your willing to take on to hit your financial goal

Learning how to manage all three of these key concepts when picking out a potential investment will instantly start rewarding you, which will set you well on your way to becoming a millionaire in the stock market. This is because before you even click buy on a stock you will have the entire investment timeline mapped out. As such you will be confident that an investment will return what you expect by a certain time.

If that sounded complex, don’t worry. I am here to show you exactly how you can make millions in the stock market in a repeatable manner. We are going to go through each of the above key concepts so that you know exactly what to do before you start to buy a stock.

Before we begin, if you like content like this then you should subscribe to the newsletter and share on social media. I am here to share my knowledge of market mechanics with others so that we all can generate wealth in the market.

Without further ado, let’s jump right into the simple guide on how to make millions in the stock market.

About the Author

Any article should include a small introduction so you know my experience and background. Or as I like to call it, “I’m not blowing hot air” section.

I am a professional investor/trader who has over a decade of industry experience working at buy side funds as a research analyst. My sole purpose is to generate Alpha, or above normal market returns, for clients.

I write anonymously here because I run a consulting business for several funds in the U.S and if savvy investors could figure out my name they could link the investment methodologies I discuss to the funds, thus jeopardizing returns through Alpha decay.

I started ChornoHistoria as a way to help the average investor generate higher returns in the market, well above the average of 10% per year. If you’re interested in more accomplishments, check out the about me section.

Also I am known to occasionally cause problems in the market from time to time. I guess you can say I have been ‘featured’ on CNBC.

Picking Good Investments

Ok, so this is the hardest thing about investing right? Well actually, once you know what you’re doing it’s actually going to be the easiest of the three key concepts.

This is because just like riding a bike or playing a sport, learning how to pick winning investments is like a skill. Just like any other skill you will learn in your life you will need to practice this one and before you know it you will be a pro.

Picking good investments involves a three part process. Simply practice these three steps and you will be fine.

Step 1: Look Through Investing Reports

First, you will look at a company’s investment reports. These investment reports can either be found on the companies website or a better source would be at your countries regulating exchange. For U.S residents this would be the Securities Exchange Commission. (Source)

Here you are going to be looking at the company’s business model, the risks they recognize to that business model, the company’s leadership, and finally the company’s current financial situation.

The goal here is to get a ‘whole picture’ approach to how a company is currently doing and whether or not they have what it takes to grow in their industry over time.

One of the biggest red flags you need to look out for is their current financial situation and their executive leadership. Simply put if a company does not have good finances, then chances are they are a failing company. This is because a business has one goal, to generate profit. If the potential investment is not generating increasing profit, then chances are it’s not a good investment.

If it does not make dollars it does not make cents to invest.

Regarding executive leadership. You need to see if the major positions (CEO, CFO, CLO, Head of Engineering) in the company have what it takes to grow the company. A good executive will come to the table with connections, both financial and professional. These connections will allow the company to get contracts, deals, and low rate financial loans through personal connections.

If the executive leadership has these then they’re golden.

Step 2: Look at the Technicals of the Stock Itself

Simply put you are going to be looking at things like dividends, average volume, float, and P/E to gauge how the market is reacting to the stock.

Let’s be clear a company can be doing great but the stock can be stagnant or doing awful. This happens with niche companies who don’t get the recognition they deserve. Don’t invest if the stock does not have the right technicals.

While there is a million statistics the three major ones you need to pay attention to are; average volume, float, and P/E

Average Volume

This is easy, what is the average daily volume on the stock?

Volume is the amount of shares that trade during a time period on a stock.

The reason you need to look at this is for liquidity concerns. The goal of any investor is to invest in a company and eventually sell or liquidate their investment for a higher profit.

If the potential investment does not have high enough average volume DO NOT INVEST. You will run the risk of losing your entire investment.

This is because if you own 1000 shares of a company and the average trading volume goes down to 50 shares and you want to liquidate your investment guess what? It’s going to take you 20 days to sell everything off. During this time if the stock’s price drops 50% you will lose 50% of your investment no matter what.

Float

The float is the amount of shares that are available for the common investor to trade on a given day; or ‘float’ between investors.

If a potential investment has a low float in the range of 20-50 million and an average volume of at least 30% the average float then your potential investment has a naturally high implied volatility. This means that the stock can swing fast either up or down in price.

You might be going for a stock like this or you might not. Regardless it’s important to know how fast a stock can ‘move’ on any given day.

P/E

P/E stands for Price to Earnings. It’s a very easy way to gauge current market sentiment on a stock.

The way to calculate P/E is to take the current price of the stock and then divide it by the current earnings per share.

P/E = share price / current earnings per share

This will show you how much the average retail trader is willing to pay for a share of that company. Companies with a high P/E number indicate that investors are willing to pay a premium for the stock, while companies with a low P/E indicate that investors are not willing to pay a premium and even perhaps think the company is overvalued.

Regardless, P/E is a good and quick way to gauge market sentiment. A common interview question for professional investors is “explain to me why tech stocks have a high P/E.” To which the answer is a combination of investors are bullish and willing to pay a premium and because the tech stock has a low overhead to earnings potential. (investors can see the economic potential)

Step 3: Find an Investment Thesis

Ok, so you got your company info and the stock’s technicals are good for your investing horizon. Now why do you think the stock’s price is going to move in the direction you think?

This is called an investment thesis.

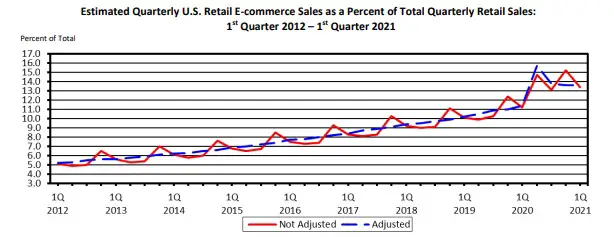

For example, I think that Amazon will continue to go up in price. This is because the overall e-commerce sector is going to grow overtime with both population increase in first world countries as well as second world countries getting access to Amazon’s e-commerce platform.

Here’s a nice little graph from the U.S department of commerce indicating the growth of the U.S e-commerce sector.

There are hundreds if not thousands of potentially great investments! You won’t figure them out however if you don’t have a good investment thesis.

You can’t simply bet, hope, and wait for an investment to increase in price. Investing off hope is the worst investment thesis ever.

It takes a little bit of time but eventually you will know what to look for to nail down a proper investment thesis on a stock. For example I always look for sector reports on a potential investments sector. It gives a starting point and allows me to fine tune my approach.

More Info on Picking the Right Investments

If you’re interested in more info and steps to pick the right investments check out this article. It goes into more detail and might help fill in the gaps for you.

3 Steps for Making Consistent Money in the Stock Market with Pictures.

Investment timeline

Ok, so here you should be asking yourself “how long do I want to be in the market to hit my goal of making millions?”

This will drastically impact what you invest in. For example if you have $500,000 and want to become a millionaire in 10 years. Well just buy the SPY and wait.

This is because the SPY will return around a 10% return per year. If you simply just put that $500,000 into the SPY and awaited a decade you will have doubled your return.

Now naturally it’s hard to find people with $500,000 worth of liquid capital who just want to let their investment sit in the SPY for 10 years.

We are here to make real returns, well above market average of 10% per year. You can either go find your own investments or you can simply go to the top of this page and click on the ‘research’ tab where I outline potentially amazing investments.

I’m here to save you the time, but also give you the tools to perform good research on your own.

Here are some good picks for a smaller timeline(1-5 years).

Coinbase (COIN)

Coinbase (COIN) stock analysis: Why you need to buy Coinbase Global.

Coin has amazing growth potential over the next 5-10 years. Well above normal market returns. This is because their business model is perfect for their current sector. COIN calls it the ‘flywheel’ business model and it requires very little capital to keep running.

Check out the above article for a full rundown on the company.

NextEra Energy (NEE)

$NEE: Why Nextera Energy is going to explode in 2022 and beyond!

NextEra Energy is a rare company that provides both power generation and distribution across the United States. They invest heavily into renewable energy generation, a sector that is expected to explode over the next 20 years.

Check out the above article to get a full run down on a potential investment in the company.

Aspen Aerogels (ASPN)

ASPN Stock Analysis: The Sleeping Giant of the EV market.

Aspen Aerogels makes thermal reduction products. In 2020 they decided to stop going after U.S federal contracts and start adapting their product line to the exploding electric vehicle sector (EV). Right now it’s rumored that they have successfully done this and have signed multiple contracts with EV manufacturers across the world.

As usual, for a full rundown on the company and as a possible investment check out the above article.

Risk Your Willing to Take on to Hit Your Financial Goal

Risk is the stealthily killer of investment portfolios. The magic word right now in the world of investment management is “risk adjusted returns.”

This is because most investors only care about dollar signs. The entire market is set up to promote this higher return, this is why we see stock ‘gurus’ who say stuff like ‘read my timeline’ to entice investors to subscribe to their premium services.

They won’t ever teach you how to manage risk in your portfolio. Remember this, it’s better to make a 1% return per year and risk 0% of your portfolio then it is to make a 1,000,000% return and risk 100% of your portfolio, or worse go in debt to your broker….

If you’re going to hit your goal of becoming a millionaire in the stock market then you need to understand how to manage and take on a responsible amount of risk in your investments.

How to Manage Risk

One of the easiest ways to manage risk to become a millionaire is to learn how to hedge your investment properly.

Hedging is simply designed to keep you in the market if your investment starts to go against you. There are three ways you can do this; keeping cash on hand, buying put contracts, investing in an inversely correlated stock.

First, keeping cash on hand. If you can keep a portion of cash on hand then you are betting that your native currency will either stay at or increase in value over time. For example, if the USD increases in value over other currencies at a 2% per year average then you can assume that your cash will increase in value as well.

Second, buying options. If you buy an option put on the stock you own then you are guaranteeing your downside. If the stock drops suddenly in value then no matter what you can exercise the contract to sell 100 shares of the stock to someone at a set price. This will guarantee a set sell price.

For example if your investment was $100 when you bought in and it drops to $1 overnight but you bought a put at $50. Well some unlucky soul is going to buy your 100 shares at a strike price of $50 and you only lose 50% instead of the 100%.

Third, investing in inversely correlated stocks. This is an advanced way to manage risk. Essentially you are going to find a stock that will go up as your investment goes down.

For example, the USD is not based on the average price of gold or the ‘gold standard.’ As such if USD goes down then the price of gold will rise. If you invest heavily in the U.S market then buying GLD or any other gold asset will hedge you against a decline.

Conclusion

In order to become a millionaire in the stock market you will need to learn a few key skills. Once you learn how to invest properly, how to gauge your investment timeline, and how to manage risk then you will be investing with the best of them.

Most retail investors/traders don’t understand how to perform these steps but when done properly you will be making huge returns year over year. The best part…all of this is done passively over time. You spend the effort upfront and then start to reap the rewards every day.

As always if you like content like this then you should consider subscribing to the newsletter and sharing on social media. Every share helps me help others so its much appreciated!

Further, you can check out some of the other articles below.

-

How Long Does a Short Squeeze Last? (3 Answers)

What is the time frame for you short squeeze? Well here is everything you will ever need to know to determine how long it will last.

-

Why You Still Own a Stock After It’s Delisted and How to Sell It

Do you still own a stock after its delisted? How do you sell it? Don’t worry the stock is still worth money and here is how to sell.

-

Can You Make 1% A Day in the Stock Market? (3 Steps)

Making 1% a day in the stock market is hard but defiantly doable. Here are 3 simple steps to helping you achieve this return.

Until next time, I wish you the best of luck on your investing journey.

Sincerely,