Have you ever seen Skechers Shoe’s? There a lot more prevalent then you might think and the companies recent earnings report analyst expectations by 42%!

Today’s research post is going to be looking at the fundamentals, technicals, and present an investment thesis on why Skechers should be added to your portfolio.

If you don’t want to read everything then skip to the end. I put a summary for those who are strapped for time.

As always if you like content like this then you should share on social media as well as subscribing to the newsletter! Every share helps me help other people build and generate wealth.

Without further ado, let’s jump right in.

Fundamentals

Sketchers (SKX) is a shoe production company that specializes in providing a vast array of footwear for boys, girls, men, and women. They were incorporated in 1992 and started by producing sport utility footwear.

Since then SKX has invested heavily into marketing and brand recognition. In fact SKX has one of the largest marketing teams that seek to keep SKX shoes in the retailers mind.

The marketing department of SKX is the secret weapon behind Sketchers. During 2020 Sketchers aggressively marketed their entire lineup of products by using influencers, actors, sports stars, musicians, and non-profits.

Marketing of these products is essential to build brand loyalty. The shoe market is both incredibly lucrative and also ripe with competitors. Sketchers recognizes this and invests heavily into bombarding people with adds for their product lines.

The Sketchers Product Line

Sketchers has four main product lines. Each of these product lines is centered around the capability to market towards the audience.

- Lifestyle brands

- Performance Brands

- Skechers Kids

- Skechers Work

First, lifestyle brands. These shoes are created with a certain lifestyle in mind. For example anime or hiking. This allows Skechers to market the shoe directly to the end consumer and fine tune their approach.

Second, performance brands. These shoes are for the athlete who seeks to have both comfort and maximum performance. This product line competes with other major provider such as Nike but at a fraction of the cost without sacrificing performance. Athletes are the primary marketing factor here.

Third, Skechers kids. Remember the light up shoes, yeah thank Skechers. This entire product line is marketed towards children. SKX invests heavily into capturing what they call “takedowns” of adult sized shoes paired for children; that way the kids can wear the ‘adult’ shoes. Along with this Skechers invests into ‘fun’ shoes that seek to attract other kids through jealously.

Fourth, Skechers Work. These shoes are built for durability and reliability. In this product category we see slip resistant, steel-toe, and boots. This product line is created with affordability in mind.

Production Location

All of Skechers products are manufactured by independent factories in Asia. This considerably drops Skecher’s overhead and allows the company to remain flexible to adapt to consumer demands.

Relying upon cheap factory labor in Asia is something that every major shoe company has to engage with to remain competitive. This will only increase as labor becomes more cost effective across Asia.

Risks

The risks to Skechers as a company are centered around brand loyalty and logistics.

For brand loyalty. Should Skechers start to fall out of favor with their consumer basis then their revenue will fall drastically. To secure against this risk Skechers engages heavily in marketing and events that build a positive association between the consumer and the company.

Five major customers made up around 10% of the companies revenue. This is another risk to brand loyalty. Skechers hedges against this risk by further diversifying their product portfolio.

For logistics. Since all of their products are manufactured in Asia any change to international shipping maritime law or their supply chain could significantly hurt operations.

To combat against this Skechers has started to hold inventory in their primary markets. This has allowed Skechers to adapt to changing markets by having a ‘nest egg’ to pull from. Shoes don’t expire so in theory the overhead on the storage is minimal and allows Skechers to be adaptable.

Growth Strategy

Apparel companies have three growth strategies that they can utilize to upscale within their industry; better product, high value goods, or flooding the market.

Take Nike for example. They focus on creating a better product for their end consumer and marketing the product as the best choice. This is why you see massive product R&D expenditure on their balance sheet.

Skechers on the other hand focuses on flooding the market with decent goods and marketing the products as the best choice. This means that there are more nets in the water for Skechers to get a return.

This is the secret to Skechers success. Instead of focusing on one major product line they made four and advertised them differently. A growth strategy like this will eventually turn into a runaway snowball of revenue growth for the company so long as marketing is succeeding.

And it has.

Financial Data

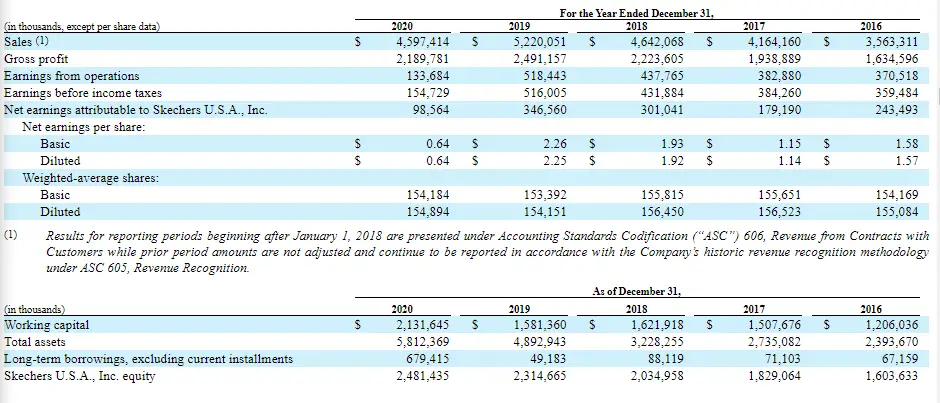

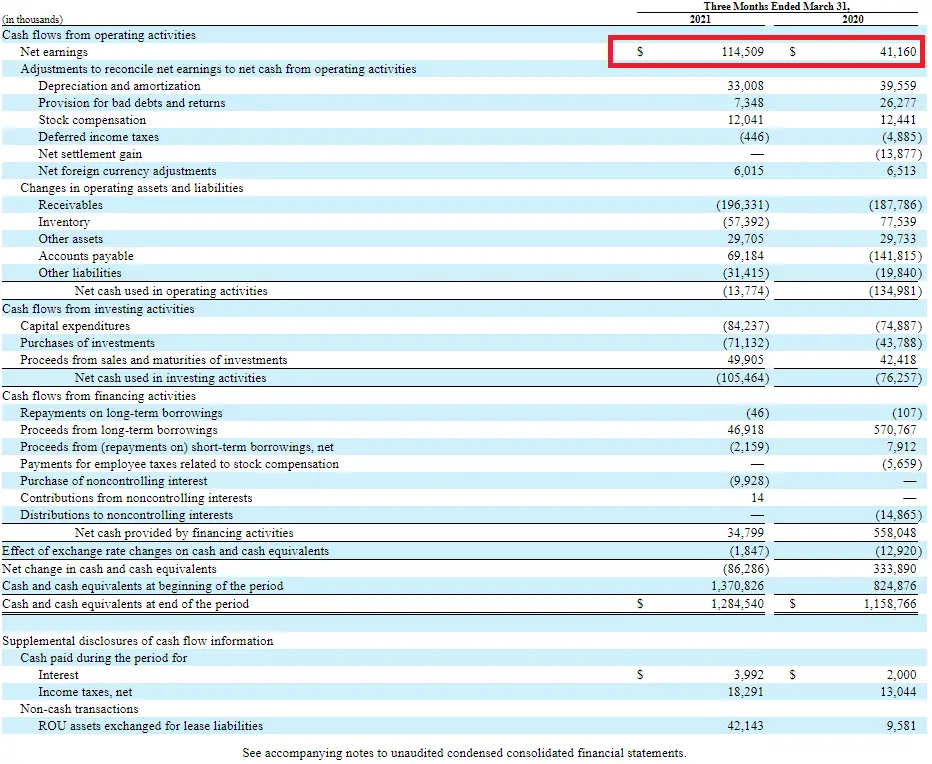

Skechers has seen year over year growth for their brands. This is a great sign of that runaway snowball starting to pick up steam.

As we can see up until the pandemic, which disturbed their logistics chain, SKX saw a year over year growth of around 8% per year.

This is a very good sign for a company whos main revenue driving source is shoes. This is indicative that the marketing strategy for SKX is starting to explode.

On 07/22/2021 the market was stunned when SKX published their recent 10-q (quarterly financial report). This earnings report beat market expectation by close to 42%!

Further, we diving into this report we see something insane.

Look at that change in net earnings from operating activities! That is an astounding 65% growth from last year.

SKX used this excess cash to begin to pay down some of its debts and begin to reinvest in marketing for their brands. This is an great sign for the company who now have plenty of finances on hand.

Summary of Fundamentals

The secret to Skechers is two fold. First is the huge product line of shoes for pretty much every activity. Second, is the marketing team behind Skechers who have advertised the brands successfully for the past 30 years.

Further, their financial data is great. The company is making money and paying down debts time and time gain. The insane net earnings growth in their 10-q of +65% is an amazing sign that SKX is here to explode.

Techincals

As we can see when that 10-q hit the market there was a huge jump in growth in SKX’s value. Almost overnight we saw a jump in 10% growth in SKX.

Having jumped into the financial data we can now see its because of the massive explosion in net earnings. People really want their shoes.

Now lets look at the technicals of SKX to see what’s going on and how to profit.

Average Daily Volume

The average daily volume on SKX is in the range of 600,000-1,000,000 shares. Following the golden rule of 10% we can see that there is plenty of liquidity for an average person to take a position.

For readers who are loaded with excess cash. The maximum position you should take in this asset currently due to liquidity concerns is $32 million. So hedge funds and accredited investors beware, no billion dollar positions available here unless you are pairs trading.

If your interested in pairs trading check out this post.

Pairs Trading Stocks: Everything You Need To Know To Start Making Money

P/E

The P/E for SKX right now is 55.

That is really high for an apparel company. This means that investors are willing to pay a premium to get into SKX before the large push. This is a bullish sign since they just announced their 10-q report that smashed analysts expectations.

I expect this P/E to fall into the high 30’s range over the next six months unless we see Accumulation/Distribution continue to climb.

Accumulation/Distribution

Accumulation/Distribution currently for SKX is 6.46. This has risen considerable over the past week.

This A/D is a good sign that more and more people are buying and holding the stock. Further it indicates that funds are also holding the stock as well. Both of these indicate a short term bullish trend evolving.

This A/D will slow down to around 2-3. We will see a pullback from this but its nothing to crazy. When you see this number its a good time to take a position.

Earnings Per Share (EPS)

This EPS for SKX is .85 which is to be expected. This indicates that the ‘floor’ for SKX has risen up to the low $50’s level.

This is further a bullish sign that the stock will rise in the next coming months. How high, don’t know. What we do know is that when you put everything together we can expect a pullback into the low $50’s and then upwards growth depending on if SKX can keep their finances rolling.

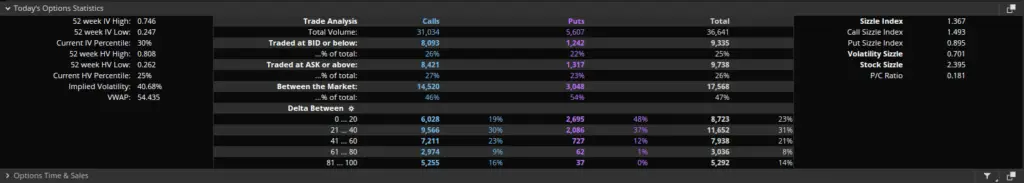

Daily Options Statistics

The Daily Option Statistics. On 07/25/2021 there were 35,000 calls to a meager 5000 puts. That is 86% call and 14% put ratio.

We are seeing a massive amount of calls being bought. This is a bullish sign when coupled with everything else. Further the volume of options bought and sold is 30% greater then normal which means that any investment now could benefit from ITM action on the option chains. Which further pumps up the price.

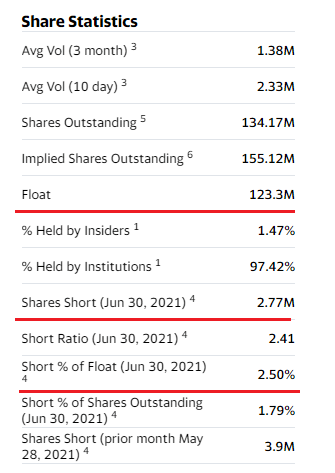

Float and Short Percentage

SKX is not a candidate for a short squeeze.

With a float of 123 million and only a short percentage of 2.5% buying calls here is not a good idea unless they are crazy far out LEAPS. This is because the chance of the stock exploding upwards is slim to non.

We are more then likely going to see a gradual uptrend. That being said however if the short percentage ever closed into the 20% or above range then SKX could be a good candidate for a meme stock short squeeze.

For a post on how to predict these ‘meme ‘stocks check this out.

Finding the next “meme” stock before the retailers-ChillznDay

Summary of Technicals

The technicals of SKX indicates we should see a gradual upwards trend.

Buying calls or puts is out of the question. Its better to go long currently then anything else because their just isn’t enough volatility to make money in options.

That being said if you want to make theta then you could sell a put below the $50 strike price. This is because the floor moved up on SKX. Somebody might bite.

Investment Thesis

Ok, so now we get to the good stuff. This is why SKX is going to explode in 2022-2030.

There are two reasons why; growing middle class population, and runaway snowball of shoes.

Allow me to explain.

Growing Middle Class Population of E-Commerce Customers.

The middle class is the main target for SKX. They market their shoes for the everyday child, man/women, and athlete. These people comprise the middle class.

This middle class is utilizing E-commerce more and more to buy their apparel and goods. SKX has already positioned themselves to dominate this market in the next two decades.

In December of 2020 Zacks Equity Research published an article on Nasdaq.com. This article goes into detail on how during the pandemic SKX began to shift away from brick and mortar stores to focus on their own e-commerce business.

This shift has resulted in drastically cut overhead while also causing SKX to explode online. As we speak SKX is close to about 4% over the entire shoe and retail apparel market due to this shift.

Now that we know that SKX has successfully shifted their business model online lets look at the overall state of the e-commerce sector.

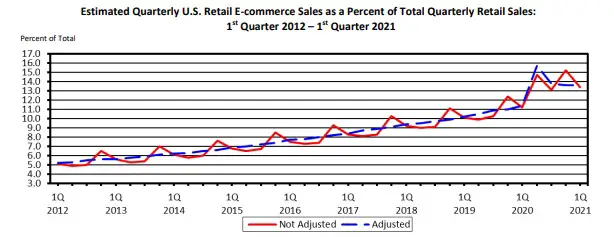

As we can see e-commerce has grown massively over the past decade. This trend is expected to continue as younger and younger people obtain excess discretionary wealth.

This growing middle class across the world will create a giant economic opportunity for retail apparel going forward. SKX has successfully positioned itself to capitalize upon this trend.

All of their products are catered towards the middle class. This is a situation of the perfect product line in right sector at the right time. As such we could see a gradual upwards trend in SKX over the next decade.

That would typically be good enough… but SKX has a secret weapon 30 years in the making. Lets talk about the runaway snowball of shoes.

Runaway Snowball of Shoes

Ok, so for the past 30 years SKX has slowly been expanding a product line that caters towards an expanding middle class.

SKX business growth plan is centered around flooding the market in both cost effective products as well as product marketing. Their product lines are centered around creating a compounding effect of cost effective shoes.

These shoes are decent, comfortable, and most importantly have massive brand recognition. As more and more families obtain wealth they will want to buy new shoes, and SKX is their to serve their needs.

Those families will in turn wear them outside and ‘advertise’ the brand to other people. This free advertising will take the form of either direct or indirect advertising.

Direct is when the customer directly refers SKX to a potential customer. Indirect is the subliminal message that a passerby will see when noticing the Skechers brand.

Where other brands such as NIKE focus on being the best shoe for their market SKX has decided to just flood the market with cost effective shoes. This is massive as with each shoe is the potential for more marketing.

SKX has started to snowball…the 10-q has demonstrated this. Now is a good time to get in before the market prices this in.

Conclusion to Investment Thesis

SKX is a great buy because of two major reasons. A growing middle class who is using e-commerce. SKX has pivoted to an online presence and is dominating it.

Further, SKX’s entire business model is centered around creating a runaway snowball effect that compounds off successful marketing. With every shoe sell they become stronger, their recent 10-q is a testament to this success.

Conclusion

SKX is a great buy. It recently dominated analysts by announcing a massive increase in net earnings in the 10-q. Their marketing team is secret weapon that has successfully created a snowball effect that will carry SKX into the next decade and will only increase revenue.

Because of this we can expect SKX to easily hit above $65 and continue on to $100 so long as their revenue is consistent and they stick to their current course.

As always if you like content like this then you should share on social media and subscribe to the newsletter! Every share helps me help others so its much appreciated.

-

How Long Does a Short Squeeze Last? (3 Answers)

What is the time frame for you short squeeze? Well here is everything you will ever need to know to determine how long it will last.

-

Why You Still Own a Stock After It’s Delisted and How to Sell It

Do you still own a stock after its delisted? How do you sell it? Don’t worry the stock is still worth money and here is how to sell.

-

Can You Make 1% A Day in the Stock Market? (3 Steps)

Making 1% a day in the stock market is hard but defiantly doable. Here are 3 simple steps to helping you achieve this return.

Until next time, best of luck in your investments.

Sincerely,