3 Steps for Making Consistent Money in the Stock Market with Pictures.

OTC stocks, or Over The Counter, are a weird type of asset that is not traded on any major exchange.

These OTC stocks are often risky investments but since the spread is so high on them you can make a ton of money if played right. Traditionally OTC stocks should only be bought by people who have special information about the company or sector.

OTC stocks often times are traded through broker dealer arraignments. In this case the broker is the market maker for the OTC security in question. This means that sometimes there is a premium that needs to be paid to the broker in order to conduct the transaction. Always check with your broker before engaging in anything.

This means that liquidity is dependent upon the security in question. If there are plenty of potential buyers for the asset then the answer is yes. More often then not however there is very few potential buyers on the market. Gauging this liquidity is a vital skill to investing in the OTC market.

Let me show you how you can gauge just how liquid an OTC stock so you don’t waste money entering into a position you cant get out of.

Why OTC liquidity matters

Simply put if nobody wants to buy the stock then whomever wants to sell it cant close their position. You do not want this to be you.

For example if you buy $1,000 worth of an OTC stock and then their is no volume then chances are you will never be able to close out of the position. This will cause you to lose your entire investment unless volume (liquidity) in the OTC position returns.

Most novice investors fall for this trap at least once in their investing career. By educating yourself against this pitfall you can help prevent costly mistakes from happening in the future.

Without further ado, let’s jump right into how you can find out the liquidity in any OTC stock for yourself.

The 10% rule

Remember this one rule to find OTC liquidity; “Don’t ever buy or sell more then 10% of the daily trading volume on an OTC asset.”

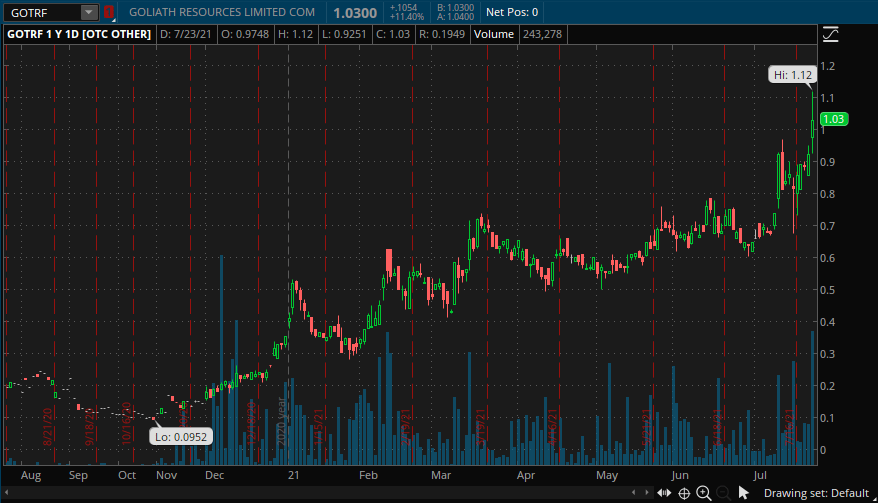

For example lets look at the following OTC stock; GOTRF.

Above we have the 1 year chart for GOTRF. This stock is traded on the Over The Counter Market (OTC). Over the past year GOTRF has steadily increased from $0.09 to $1.12.

To find the liquidity of this GOTRF you simply need to take the average daily volume over the past year. Currently it is around 100,000 shares traded daily. Now we take 10% of that number.

This leaves us with 10,000 shares able to be bought and sold at max by us. If we were to take more then this then chances are we could not exit the position fast enough.

Currently 10,000 shares would cost us about $10,300. If you put in say $50,000 then you might as well throw that money away as if you sold it then you would sell at a considerable loss.

Always remember the 10% rule on OTC stocks.

Risks

If we took the above OTC stock (GOTRF) and invested anything larger then 10,000 shares then you more then likely would not be able to exit the position fast enough should it start to move against you.

That or if you sold the position at market value it would sink the price as you would be a whale dropping a ton of shares at one moment.

While buying and holding more then 10% of the daily volume is risky its not the largest risk you could encounter by engaging in OTC stocks.

The largest risk by far is when liquidity drops to zero and you are still holding the shares. This would mean that you cant sell your position even if you wanted to.

Think of it like a house, if you bought a house and wanted to flip it but there were no buyers to be found you could never “liquidate” your property into cash. Now you been left bag holding an asset that you can never sell even if you wanted to.

Lets look at when this happened to investors.

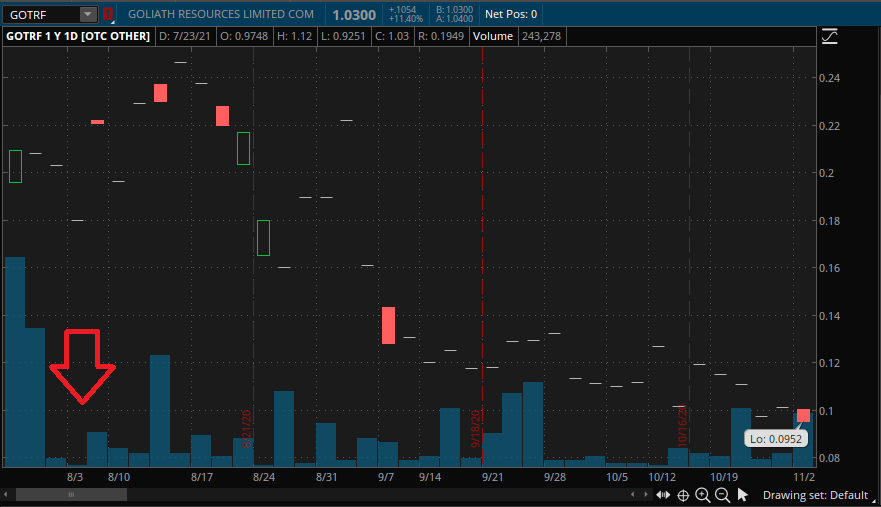

Here we again have GOTRF but this time in August of 2020.

On the left hand side we have the daily volume of 10,000 shares. The red arrow indicates that overnight the volume plummets down to close to 500 shares a day.

Now imagine you bought 10,000 shares and were left holding them. You couldn’t sell them even though the price was going up. Your position is essentially worthless.

This is the major risk to investing in OTC stocks. You need to always account for a liquidity drop in the markets. That is why I never hold OTC stocks for more then 1 day, and only when there is massive volume over daily average.

Conclusion

OTC stocks are always a gamble. Often times these companies are incredibly risky and lie in their financial statements to attract investors. These investors are left holding the bags after the stock’s liquidity plummets. This is called a pump and dump.

As always if you like content like this then you should share on social media and subscribe to the newsletter! Every share helps me help others so its much appreciated!

-

How Long Does a Short Squeeze Last? (3 Answers)

What is the time frame for you short squeeze? Well here is everything you will ever need to know to determine how long it will last.

-

Why You Still Own a Stock After It’s Delisted and How to Sell It

Do you still own a stock after its delisted? How do you sell it? Don’t worry the stock is still worth money and here is how to sell.

-

Can You Make 1% A Day in the Stock Market? (3 Steps)

Making 1% a day in the stock market is hard but defiantly doable. Here are 3 simple steps to helping you achieve this return.

Until next time, I wish you the best of luck in your investments.