Pump and dumps are when a company or investor buys class A common shares and then artificially pumps up the share price to sell it higher then they bought in.

The problem with this is the fact that if you cant spot these pump and dumps you could be caught as a victim and be unable to sell your position.

These pump and dumps are incredibly profitable for companies and investors how are willing to illegally pump up the share price by releasing false information. This false information will in turn hype up the retailer investors who will start to funnel into a stock and artificially pump up the price.

What happens is that the average retail investor is left holding the stocks in their portfolio with no hope of ever making their money back.

To protect yourself from this I will show you how to predict and stay away from these pump and dump schemes.

A pump and dump can be broken down into four parts.

- Insiders start buying up shares.

- Insiders then start hyping up the stock.

- Retail investors pour in to make a quick buck.

- Insiders sell their shares and the hype dies down.

Let’s look at each of these steps.

Step 1: Insiders buying up the shares.

Before a pump can even start the investors will start buying up shares of the company.

These insiders are the masterminds behind the pump and dump. What you will see is a couple days of high volume out of nowhere. This volume will then die down around a week after the investors start buying in.

This takes some time to notice but anytime a stock starts to gain volume while the share price remains stable something is off. In order to identify this you need to look at the company and see why the volume was increasing.

If you cant identify any reason behind the volume rising while share price remains stable then chances are there is no reason. This is because the insiders have agreed to take their positions over several days.

Once they have taken their positions the insiders will then start the next phase of the pump and dump.

Step 2: The Pump.

This is when things start to get obvious. The insiders who previously bought up the shares cant artificially inflate the price on their own, so they will need help.

The best form of help they can get is from retail investors. In order to attract these retail investors the insiders will start to hire marketing companies to release false information to the public.

These “press releases” often have no sources or citation and are put out by shadowy PR firms. When your reading a company publication you should always see where they got their information from. If no information was provided then chances are there is nothing credible.

Often the fresh news surrounding the stock to be pumped will be attention grabbing like ” X company just cured cancer.” When you see attention grabbing headlines from a no name PR firm along with no citations you can readily expect the company to be engaging in a pump and dump.

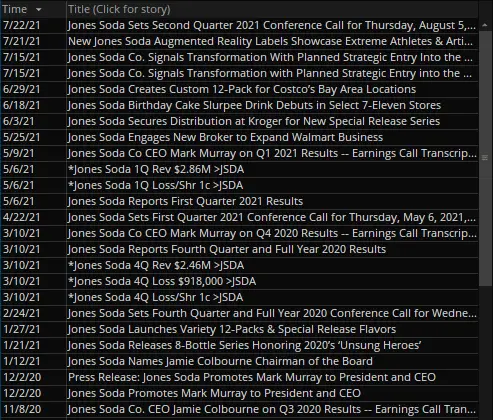

The above image is from a company called Jones Soda (JSDA). In late June of 2021 JDSA started pushing out news release after news release. These news releases had nothing to do with the underlying value of the stock. This is a huge red sign.

Unfortunately not everyone can see through this charade and as such we progress on to the third step.

Step 3: Retail Investors Pour In.

Retail investors start pouring into the stock causing the price to shoot up through the roof.

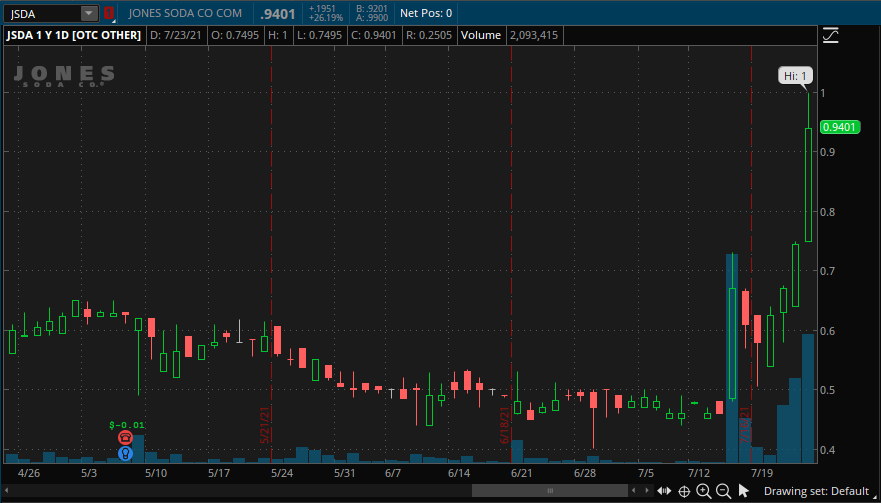

Remember our example of Jones Soda that was pushing out headline after headline? Well lets look at their stock price now since those publications.

As we can see those publications drove massive retail investor interest into the stock. The result of this is the massive pump up of the share price from $0.4 to close to $1 overnight.

Nothing JSDA released in the form of news could of resulted in a proper valuation at this price. This is a pump and dump.

Without the retail investor pumping their lifetime earnings into the stock then massive explosions like this would not be possible. Now its time for the insiders to sell their positions into this retail hype and take their hard earned cash.

Step 4: Insiders Sell their Shares and the Hype Dies down.

Since the retail investors have bought in its time for the insiders to sell their shares and stop paying for the marketing agencies to pump the stock.

What happens next is that retail investors will start to flee the stock and the price will plummet back down to where it was before.

For those investors lucky enough to get out before the volume drops to near zero. Congratulations you got a portion of your investment back.

However a lot of retail investors will be left holding the bags of the now dumped company. They will never be able to recoup even a small portion of their investment because the volume will never creep back up to allow for it.

This is the main reason you should always avoid a pump and dump scheme. Sure you might make out like a bandit and earn a decent return but the worse thing is losing 100% of your investment because you fell for a pump and dump.

Conclusion

There are so many pump and dumps in the stock market because they are incredibly profitable for the people who get in before the retailers. These insiders often times are company officials who want an easy way to become rich.

They will engage in unethical and illegal practices to extract as much wealth from their investors as possible before disappearing. This is why you should learn to spot a pump and dump before it even happens.

As always if you like content like this then you should share on social media and subscribe to the newsletter! Its always beneficial.

-

How Long Does a Short Squeeze Last? (3 Answers)

What is the time frame for you short squeeze? Well here is everything you will ever need to know to determine how long it will last.

-

Why You Still Own a Stock After It’s Delisted and How to Sell It

Do you still own a stock after its delisted? How do you sell it? Don’t worry the stock is still worth money and here is how to sell.

-

Can You Make 1% A Day in the Stock Market? (3 Steps)

Making 1% a day in the stock market is hard but defiantly doable. Here are 3 simple steps to helping you achieve this return.

Until next time, best of luck in your investments!

Sincerely,