Hey guys,

Happy Sunday. This post goes into detail how you can go about finding the next “meme” stock and how to play it! Lets dive in.

1:) The Anatomy of the “meme”

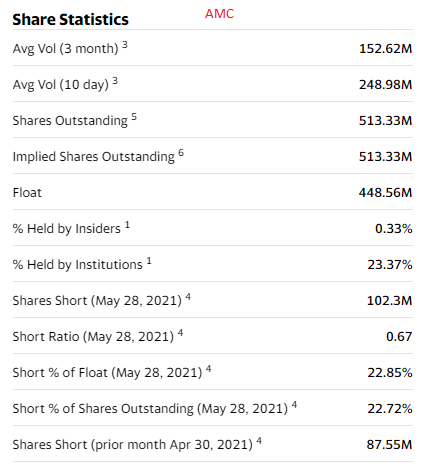

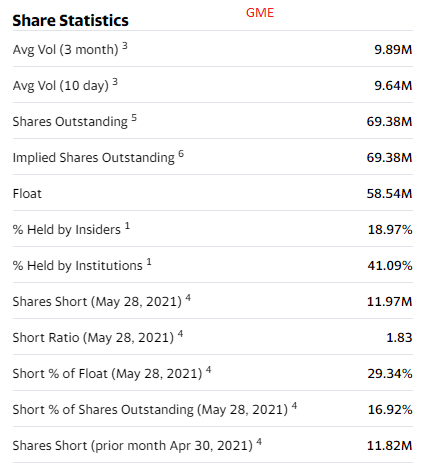

Before we even begin to invest we need to find out what all of these “meme” stocks have in common. Currently, the biggest names within the “meme” stock community are $GME and $AMC. Both of these stocks share similar statistics on their publicly traded shares.

As we can see its going to be the short % of the float and the relatively small publicly traded float. In essence this means that the company is susceptible to strong swings when large enough volume begins to funnel into the asset. This will make the stock’s price shoot up if enough retailers are attracted to the stock.

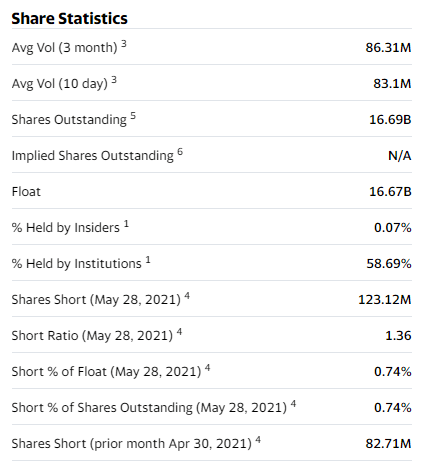

Now look at the the float and short percentage of a major stock such as $AAPL.

As we can see, since the float is so high then the chances of $AAPL running in massive swings is highly unlikely. We need to focus on stocks with a high short percentage and a low float.

2:) Retailer’s chart wizardry.

The concept that you can draw a pattern on a chart and divine the price point of the stock in the future is ludicrous. Patterns need to line up with fundamental analysis in order for a pattern to be self-fulfilling. Normally this is the case…unless we are looking at “meme” stocks.

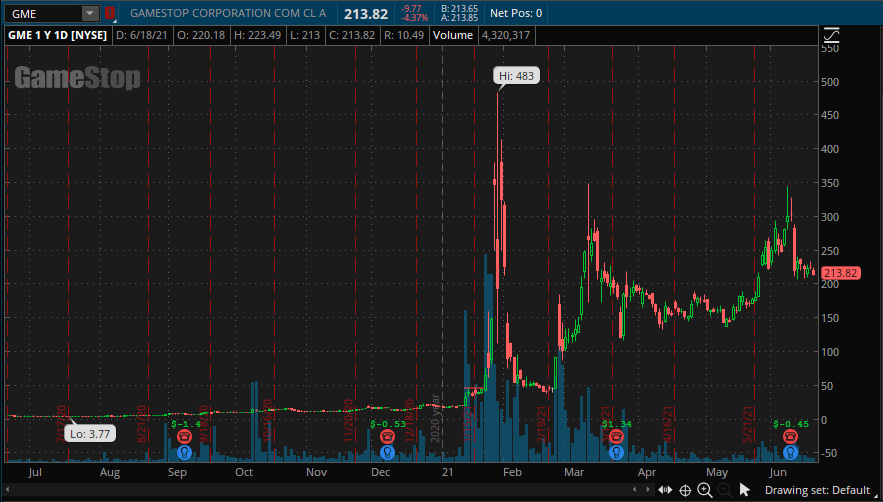

Above we see a 1 day chart for AMC and GME. We know that the market bets heavily against these stocks by going short and buying puts on both AMC and GME. Normally this is a good investment because there is no way that GME nor AMC is valued at its current price.

What we need to understand is that since the potential “meme” stock has a low float and a high short interest it can run hard as more and more retailers funnel into the stock. This begins to create a parabolic affect that will cause more and more people to panic buy into the stock in an effort to secure some profits.

Our potential “meme” stock must then have the ability to “break-out” and run. We can determine this by looking at increasing volume, and thus interest, in the underlying stock. I must be clear increasing volume here is key. Look at the early part of 2021 for both $AMC and $GME for evidence of this. (Volume is the blue bar in the chart)

3:) The “Meme-ability” of the asset.

What does GameStop and AMC movies have in common? Retailers are heavily influenced by these brands marketing and products. More and more retailers are coming of age from the generation that played video games. Therefore $GME is an iconic company that most U.S and EU retailers are familiar with.

$AMC on the other hand is a major movie chain that retailers interacted with to watch new and emerging movies. Every person who entered and left and AMC with a positive experience subconsciously is aware of the company. As such when they hear news regarding the price movement of the stock they gravitate towards it.

What we are looking for then is a company that has the ability to make a ripple-like affect across a community. For example recently I posted about Wendy’s stock within the WallStreetBets sub-reddit that caused the stock to shoot up by 30% overnight. Cramer ended up covering the stock in his Mad Money show and it further shot up.

For a link to my analysis of Wendy’s that I posted in the WSB sub-reddit see the following:

My research on Wendy’s that cause the stock to shoot up 25% on 06/08/2021. (Funny)

Finding the next “meme”

Our list of potential “meme” stocks must contain the following three things.

- A low-float and a high short intrest. This will allow the stock to have a high run up.

- A good looking chart that retailers will draw all over. They will divine that the stock is going to shoot up and mass poor in.

- The Stock must have a positive “social-score” with the retailer crowd. Both GME and AMC are commonly known names for most of the retail population within the United States.

A good example of a stock that has all three of these common characteristics is TootsiRoll. It has a low float, a decent looking chart that will attract retailers, and is a readily known name. For my analysis of $TR see the following post, I’m still in it as 06/20/2021.

Why I invested with Tootsie Roll ($TR).-Chillznday

Conclusion:

Finding the next “meme” stock can lead to massive upwards gains. I tend to play LEAP options on the asset so that I have a ton of time until my thesis comes true. Buying shares are a safe method where you have unlimited time to wait.

If this article helps then you should consider subscribing, following, and sharing on social media. It really helps me help the most people possible.

Until next time and best of luck!

Sincerely,

Comments are closed.