Most new traders/investors blur the line between investing and trading. Trading offers a quick hit of adrenaline and can reap massive one time profits. Investing, on the other hand, positions you to constantly return a profit for an extended period of time.

Investing is better than Trading for two main reasons; first, is the reliability of investing. Second, is the ability to consistently grow and compound your returns.

Most people shy away from investing because it’s a slow process that takes several months to years to come to fruition. Further, most retail traders don’t want to spend the time learning how to invest.

I promise you, once you learn some of the basic building blocks of investing you will never go back to trading.

Let’s jump right in.

What is Trading

Trading is actively looking for a mispriced stock on the stock market with the goal of flipping the stock in a quick time frame and profit from the spread.

For example if you think that Coinbase is going to shoot up from $280 to $300 tomorrow then you would buy the stock with the idea of selling it around $300 and making $20 a share profit.

Traders will spend countless hours drawing on charts and finding resistance points. These charts become self-fulfilling prophecies when every other trader thinks that a certain point is a ‘break-out’ point.

As such the traders will buy around a select point in a chart. This will artificially create volume and can reward patient traders who seek to exploit this momentarily bump in volume and price.

The goal of trading is to hold a stock for only a short period of time. This timeframe is often in the range of 10 minutes to 1 month. Further, traders don’t really do research on the stocks they are trading. If it has volume then there is money to be made.

Trading can make you a huge amount of money if done right. For example those who got in successfully on GME in January 2021 made a fortune off right timed trades.

As we can see from the above image GME shot up from $21 to $500 in about a week! If you were trading GME then you would have made a huge amount of money. As such it’s possible to make a lot of money in the market by trading.

The secret to becoming a good trader is to have a repeatable method of finding stocks before they start to move. This is incredibly hard to do, and many professional traders get lucky more often than they lose.

What is Investing

Investing is when you invest in the company itself. While traders will find misplaced stocks an investor will find a company that has solid growth potential and invest.

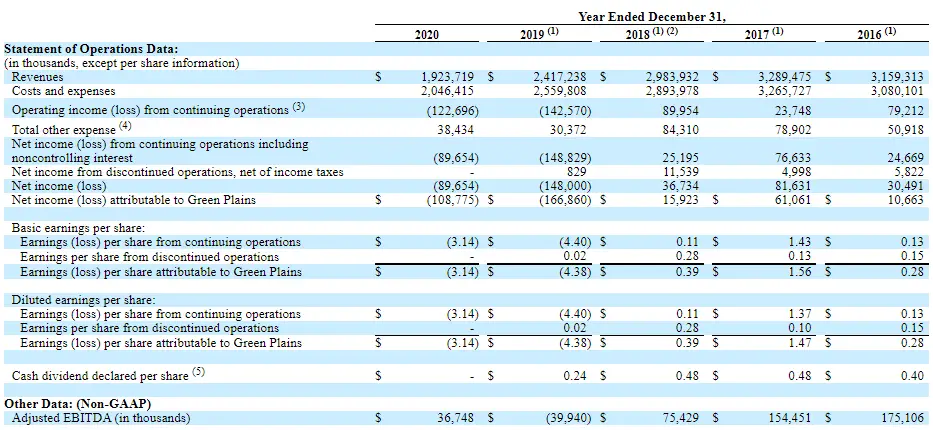

Both traders and investors buy stocks. The difference is the time window and research method the investor/trader undergoes before buying into the stock. The investor will look over financial reports of the company and its competition, the trader will look at the volume and statistics of the stock itself.

Investors will pay little attention to the chart of the stock. Instead they focus their time on the sector, company, and management of the stock. Because of this they start to build up their knowledge of a sector and its major players.

For example I have been investing in the energy sector for close to ten years professionally. From scouring over financial reports and attending industry conferences I know where the sector is going to be in 5,10, and 20 years.

When I look at potential energy company investments I look at companies who can fit this future outlook of the sector they are in. I figure out if they stand a good chance to innovate upon the sector changes, innovate better than their competition.

Why Investing is Better than Trading

Investing is better than trading because simply put the investor can routinely return profits that compound in net worth over time. The trader has to try harder and harder to keep up and as a result increase the amount of risk in their portfolio.

Where the investor compounds their economic potential year over year the trader compounds their risk.

There is an entire investment industry set up around convincing people they can be the next Warren Buffet by trading 10 times a week. Unless you know something the market doesn’t do not be a trader.

By all means if you attend industry conferences and know insider information trade the stock. Most people however think that charts and graphs will carry them to success, it will not and people are getting paid to convince you that charting on graphs will help you.

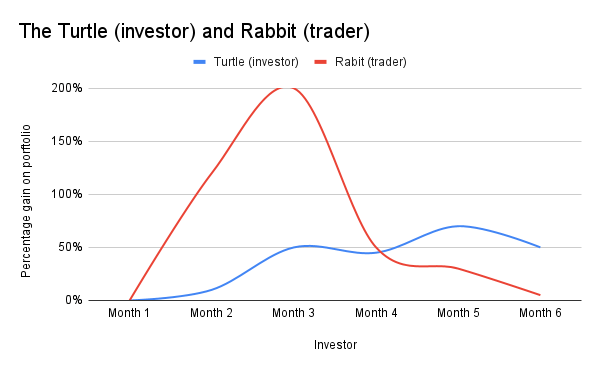

To better illustrate this, I am going to be using the story of the turtle and the rabbit.

Turtle and Rabbit

Let’s talk about an investing story. It’s the story of the rabbit and the turtle.

The rabbit (trader) is fast off the line and makes two 100% gains in a matter of a couple weeks. The trader (rabbit) is flying high planning their Forbes interview when they hit their first major loss, a -130% overnight on a failed earnings report.

Dismayed, the trader tries again and bets 50% of their portfolio on a random biotech company who is expected to announce a new product at an industry conference. Instead the company announces they are looking for excess investments to meet capital expenditure, they are fundraising and are in dire need of money.

The biotech stock plummets…the trader is down by 60% on their entire portfolio. Their previous wins have been knocked out and they are back to square one.

Now the entire time this has been happening the turtle (investor) has been researching stocks, reading 10-k/10-q documents, reading sector reports, and calling investor relations of potential investment companies. The turtle places 4 investments spread evenly across the finance sector.

The turtle in 6 months is up 50% on his portfolio, the Rabbit is at 0%. The reason behind this is because every month the Rabbit takes on more and more risk into his portfolio, while the turtle actually reduces it in his.

This is the secret weapon that investing has. Risk reduction over time….

Why the story matters

The turtle in a year is up 50% and the rabbit is maybe up 10% if they even have money left. The next year, the turtle is up 120% while the rabbit is up 15%. In the third year the turtle retires and the Rabbit goes back to work.

Simply put, every year the trader has to increase his risk to maintain his returns while the investor simply has to let his money work for him. Being a trader is easy, listening to other people and losing money. Being an investor takes time but will actually make you a millionaire.

Does this sound familiar? Investors such as Warren Buffet routinely return positive growth in a portfolio and snowball their wealth out of control.

Ok…Ok. Let’s Make Money Investing Then.

Alright, if you have come this far in the article then chances are you want to make money. That’s good, let’s get you on the right track to be rich.

Here is a list of the following skills you are going to need to become an investor.

- Basic math skills

- Reading skills

- Phone calling skills

- Research skills

- Patience and Time

That’s it. If you have the patience to read through the financial documents of 100 companies you will find 1 or 2 companies that will net you a good return.

The best thing to do is spread out an investment across a couple amazing companies that return stable revenue and have solid growth potential. Below is a great post to learn exactly how to evaluate a company to see if it’s a good investment.

3 Steps for Making Consistent Money in the Stock Market with Pictures.

Here at Chronohistoria I train investors for free. I am an investor, my brother is an investor, my dad and mom are investors, and hopefully you will be an investor too.

Conclusion

Learning to become an investor and not a trader is a long and hard task. Like anything worthwhile it takes time to learn the skill set and how to evaluate a company properly.

Luckily for you this website, Chronohistoria, is the perfect place to start your investing journey. I grow wealth passively in the market and have little risk in my portfolios, it’s my goal to get you guys to that point.

Surprisingly it does not take that much time. A couple months of learning (3-5 hours a week) is all it takes. Before you know it you will be looking at your portfolio and seeing that you made $10,000 today.

Hopefully at that point you give a shoutout to lowly Chronohistoria, I’ll still be here doing what I do best; looking at and evaluating stocks. 😉

As always if you like content like this then you should share with your friends and subscribe to the newsletter. Every share helps me help others, so it’s much appreciated.

Further, check out some of our other posts as well. Who knows what might help you on your financial journey.

-

How Long Does a Short Squeeze Last? (3 Answers)

What is the time frame for you short squeeze? Well here is everything you will ever need to know to determine how long it will last.

-

Why You Still Own a Stock After It’s Delisted and How to Sell It

Do you still own a stock after its delisted? How do you sell it? Don’t worry the stock is still worth money and here is how to sell.

-

Can You Make 1% A Day in the Stock Market? (3 Steps)

Making 1% a day in the stock market is hard but defiantly doable. Here are 3 simple steps to helping you achieve this return.

Sincerely,