Having a mixture of growth and defensive stocks in your portfolio will allow you to gain on bull markets while also prevent loss/decay during bear markets. The question however is what is more important for an investor to focus on growth or defensive stocks.

The answer depends on the current state of the market you are investing in. During a bull market growth stocks should be focused on, while during a bear market defensive stocks should be focused on.

Right now growth stocks are a better investment then defensive stocks. This is because the current economic cycle favors growth stocks in the market.

I am going to show you how to position your portfolio to gain during both of these cycles by switching between growth and defensive stocks.

Let’s jump right in.

The Economic Cycle

Before we can even begin to look at investing in either a defensive or growth stock we need to understand the economic cycle.

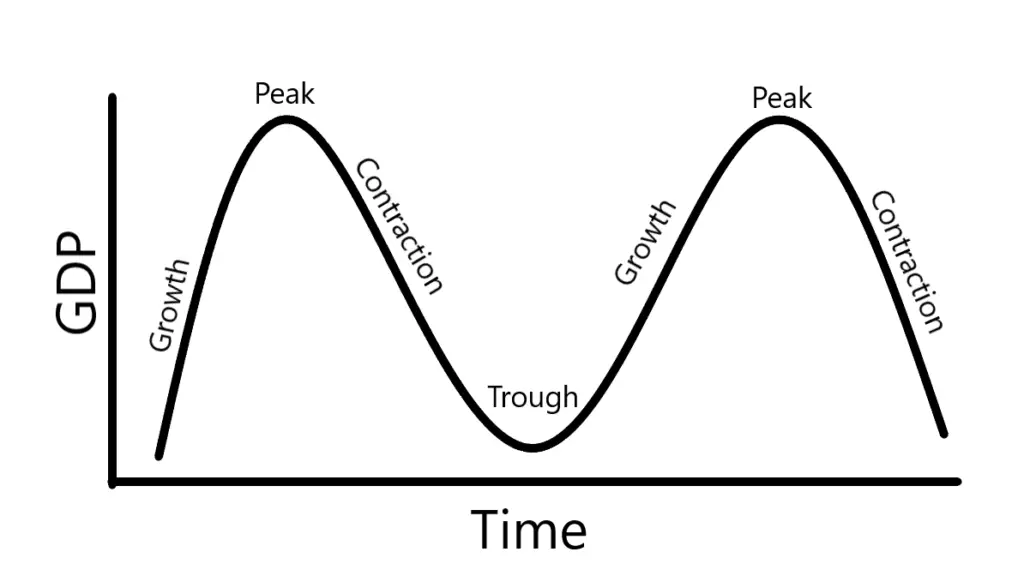

Pictured above is the economic cycle. During periods of high economic growth (GDP for nations) stocks in the economy’s market grow due to an increased overall wealth of the market.

The next phase in the economic cycle is peak. During the peak of the economic cycle the economy is at the highest point it will be at for a while. During this period you will see high growth rates on established stocks.

The third phase is contraction of the economy. During this time wealth will begin to leave the economy. Stocks will start to decrease during this time and if you don’t get out in time you will lose money.

The fourth and final phase of the economic cycle is trough. During this period innovation is at an all time high as companies have to diversify their product portfolio to generate additional income. This will also be the time that you see stocks at their lowest price during the economic cycle.

Why the Economic Cycle is Important

Its important to understand the economic cycle because it is the foundation that we will build our portfolio off of. We cant determine when to invest in growth stocks if you don’t know what phase of the economic cycle you are currently in.

For example, during the economic cycle phase of peak you need to be closing out of growth stocks and focusing on defensive stocks. Likewise during the economic phase of trough you should be looking at getting back into growth stocks.

This is why the economic cycle is so important to understand. If this is all a bit complex don’t worry, I am going to show you how to figure out what phase we are in.

What is the difference between Growth and Defensive Stocks

Ok so let’s talk about what the difference is between growth and defensive stocks.

Defensive Stocks

A defensive stock is a stock that will return consistent dividend returns and wont lose much of its value during an economic downturn.

You will find defensive stocks in sectors such as consumer durables (bars), Energy/utilities, and healthcare. For a full rundown on what sectors are defensive check out the following article.

What is a Defense Sector: 5 sectors that will save your portfolio.

Here is a quick list of stocks, along with their sectors, that are considered defensive plays.

- NextEra Energy ($NEE): sector is energy

- Gladstone Land ($LAND): sector is farming

- Johnson and Johnson ($JNJ): sector is healthcare

- Coca-Cola ($KO): sector is consumer durables.

The above list only a brief overview of four stocks that will save your portfolio during a recession. There are plenty more defensive stocks that you can invest in.

Growth Stocks

A growth stock is a stock that gain in price drastically under the right economic conditions. These stocks are great to invest in at the right time in the economic cycle as they can return massive returns in the range of 200-300%.

A good example of a growth stock currently is Coinbase ($COIN). Here is a full research article on why COIN is a good growth stock investment.

Coinbase (COIN) stock analysis: Why you need to buy Coinbase Global.

A good list of growth stock are as follows.

- Coinbase ($COIN): sector is cryptocurrency

- BlackBerry ($BB): sector is cybersecurity

- Aspen Aerogels ($ASPN): sector is energy

- Exponent Inc ($EXPO): sector is business services.

The trick to finding a growth based stock is to first identify a sector that is going to be growing at a fast pace during the economic growth phase. The next step is to identify a stock with high growth potential and EBITDA. Here is an article on the top 5 sectors that are expected to explode in 2022-2030.

Top 5 Sectors to Invest in for Massive Growth (2022-2030).

Which is Better, Growth or Defensive

Here is the one year chart on the SPY. The SPY is typically the best way to gauge the overall U.S market’s status. Right now you can see we are in a growth stage/peak stage of the SPY.

As such, right now growth stocks are better to invest in then defensive stocks. Let me show you how to do this properly.

As we can see we are either in a period of growth (bullish) or a the peak. As such now is a great time to invest in growth stocks.

Investing in Growth Stocks

During periods of economic growth you should be investing more in growth stocks with good financial resources.

For example when the economy is growing you should be putting around 60% of your investing resources into strategic growth investing. Invest in companies like Coinbase, BlackBerry, Aspen Aerogels, and Exponent Inc.

Will all of these companies explode in price, no. The trick is to watch for what companies are doing well and hold or buy more stocks in those companies. The companies that are not performing that well should be cut from the growth portfolio.

For example, here is the 1 year chart on Coinbase.

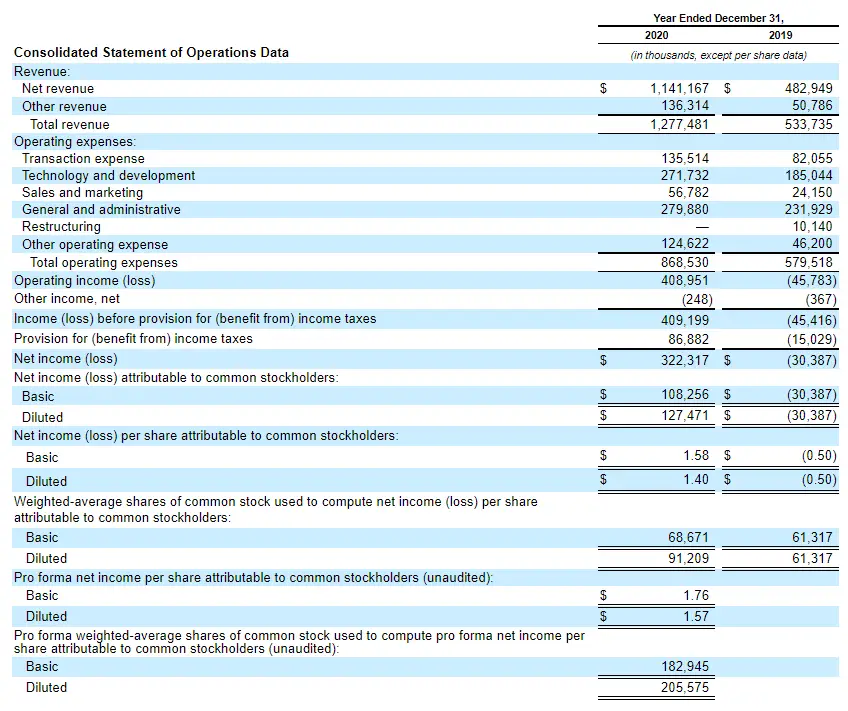

The reason that Coinbase is doing great as a growth pick is because of its EBITDA. The excess cash that Coinbase generates (EBITDA) is huge because the company has very little overhead.

I would watch COIN in a growth portfolio and start to cut my losses when COIN either does not return a growing revenue source (more money) or watch for an increasing overhead to revenue. This would indicate to me that COIN is not growing at a fast enough rate, thus it would lose its status as a growth investment in my portfolio.

The trick is to invest in several growth stocks with stable revenue growth and the possibility to explode in their growing sector. COIN currently is poised to do this over the next couple months (Q-4 2021 to Q-1 2022).

I will put up to 50 growth stocks across several portfolios and watch them like a hawk to generate a higher return then normal.

Investing in Defensive Stocks

Once we start entering into a period of economic contraction we need to look at defensive plays.

I currently hold a sizable position in the energy sector. The reason behind this is because even during an economic recession energy stocks will continue to grow and return dividends.

What I recommend is selling out of growth stocks slowly over several years and putting the earnings into defensive stocks. This will allow you to sleep at night knowing that your portfolio is protected.

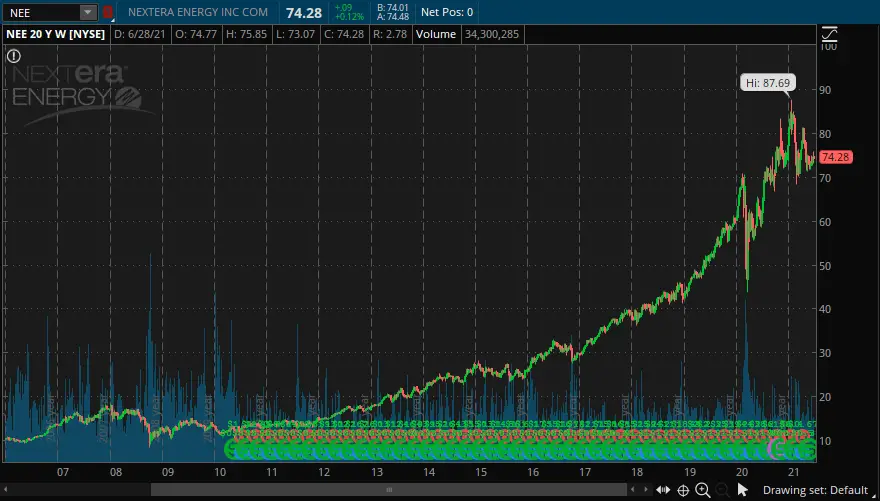

For energy I love to invest in Nextera Energy. This is because they are based around a defensive sector while also returning above average growth for the sector.

During the 2020 pandemic NEE lost 53% and then quickly rebounded above their previous highs. This was because they were based around a defensive sector.

By investing in NEE before the pandemic you could rest at night knowing that your portfolio would be safe in the long run.

I will take around 30-40% of my returns from growth stocks and pour them into NEE over time. This will allow me to ‘safeguard” my portfolio’s gains. Further because NEE has a dividend I know that my capital will be generating excess wealth for my portfolio over time.

This is one of the best things about investing in defensive plays. Even during market recessions your portfolio will be returning dividends. This will allow you to ‘survive the storm’ of the recession and still make a return on your investment while you wait for the economic cycle to return.

Conclusion

Learning how to switch between growth and defensive stocks will allow you to grow your portfolio even during major economic recessions. As such any serious investor needs to learn the economic cycle and how to position capital to grow regardless of current economic conditions.

Currently growth stocks are a better investment then defensive stocks. This is because of the current economic cycle we are in.

As always if you like content like this then you should share on social media and subscribe to the newsletter! Every share helps me help other people grow wealth in the market.

Further, check out some of our other posts.

-

How Long Does a Short Squeeze Last? (3 Answers)

What is the time frame for you short squeeze? Well here is everything you will ever need to know to determine how long it will last.

-

Why You Still Own a Stock After It’s Delisted and How to Sell It

Do you still own a stock after its delisted? How do you sell it? Don’t worry the stock is still worth money and here is how to sell.

-

Can You Make 1% A Day in the Stock Market? (3 Steps)

Making 1% a day in the stock market is hard but defiantly doable. Here are 3 simple steps to helping you achieve this return.

Until we meet again, I wish you the best of luck in your investing.

Sincerely,