Real Estates Investment Trusts are an investment vehicle designed to pool investor capital and go buy high value real-estate normally not available to an average investor.

REITS are a great way to diversify your portfolio away from stocks and bonds. Further, REITS are given a tax break status so long as they pay out 90% of their income to the shareholders.

The trick however is finding a great REIT to invest in. If you manage to grab a good one you can rest easy knowing that you will be passively earning income/dividends from holding the REIT in your portfolio.

I am going to show you the top 3 best REITS to own for capital growth in 2022-2030.

Let’s jump right in.

On Dividend Rate and Risk

Before we even jump into the REITS we need to talk about dividend rate and the risks associated with pursuing to high of a dividend pay out percentage.

So many new investors chase dividend pay out rates in the 8-14% payout range. They think that they will make millions of dollars passively by investing $100,000 into a high dividend REIT.

While the math checks out for them what these novice investors don’t realize is that with such a high dividend payout the REIT company has little cash left over to reinvest in their business model.

The ‘golden-range’ of dividend percentage on a REIT is between 2.5%-5%. This is because in this range the REIT company still has money left over to pay for new investments, put into savings, and generally operate better on.

If you pursue dividend payout rates higher then this then there is a solid chance that your initial investment will decrease in value faster then your dividend payout will make you money.

In essence, a higher dividend payout will cause you to lose money in the long run. So stay away from it.

Now let’s get to the top 3 REITS for 2022-2030.

STAG: Stag Industrial

Current Stock Price: $41.24

Dividend Rate: 3.52%

Company Website: https://www.stagindustrial.com/

Sector: e-commerce shipping (consumer).

Stag is one of if not the best REIT in the e-commerce sector. When you invest in STAG you are investing in a network of shipping and receiving warehouses that power the e-commerce industry.

Because STAG has positioned its business model around e-commerce it has exploded time and time gain over the past 5 years. Further, during this entire time STAG has paid its investors at a steady 3.52% every month.

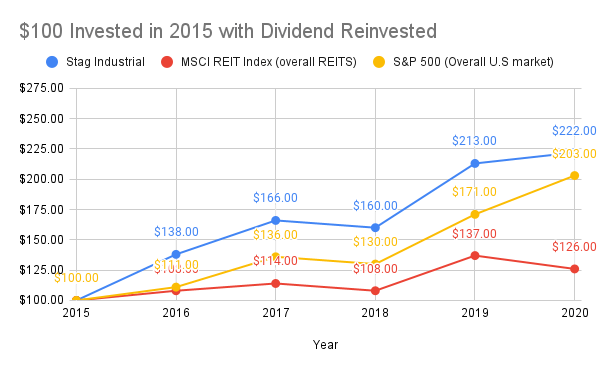

Because of this STAG has consistently beat the average return on the U.S market.

This is huge coming from a REIT. As you can see the MSCI REIT index, which tracks the entire REIT market, has lagged considerably behind STAG. This trend is expected to continue into the future as e-commerce continues to explode.

As such there really is no reason to not have a position in Stag industries. Here at ChronoHistoria I did a full research article on STAG. Check it out if your still on the fence.

Stag Industrial Inc (STAG) analysis: Why you need to buy STAG.

LAND: Gladstone Land Corporation

Current stock price: $22.81

Dividend Rate: 2.37%

Company website: https://www.gladstonefarms.com/

Sector: Consumer durables (food)

Gladstone Land Corporation is a REIT that buys and holds…..land. This land is then rented out to farmers who in turn farm and sell cash crops. LAND gets paid based off rent and a portion of the overall revenue of the farmer.

Further, LAND only rents their farmland to mid-tier commercial farming companies that specialize in one or two crops. Because of this the individual tenant farmer does not have enough renting power to force LAND to lower their renting rates.

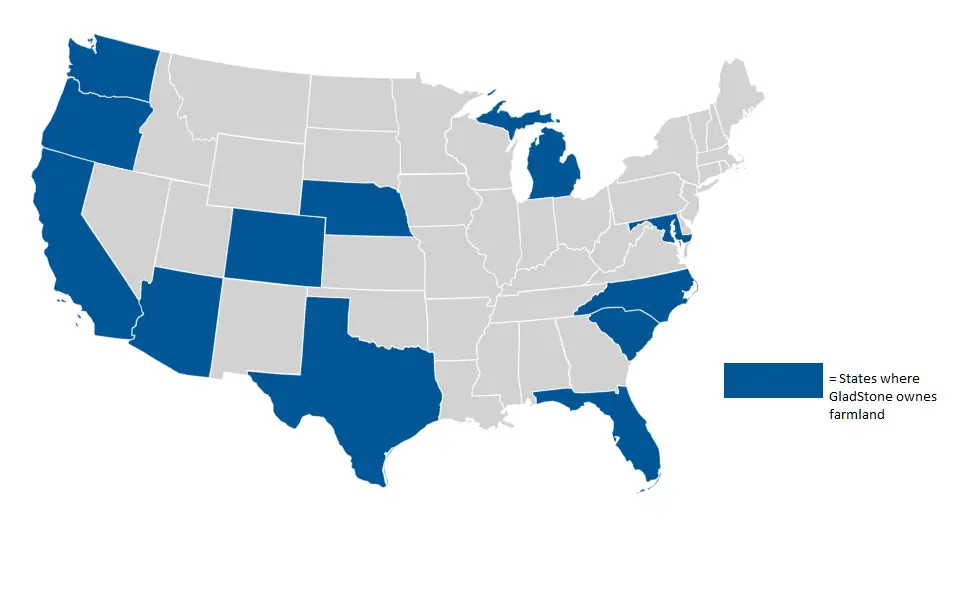

The above image is of all the U.S states where Gladstone owns their farmland. This is important because not do these states offer prime farmland with nearby major markets they also are increasing in overall farmland value.

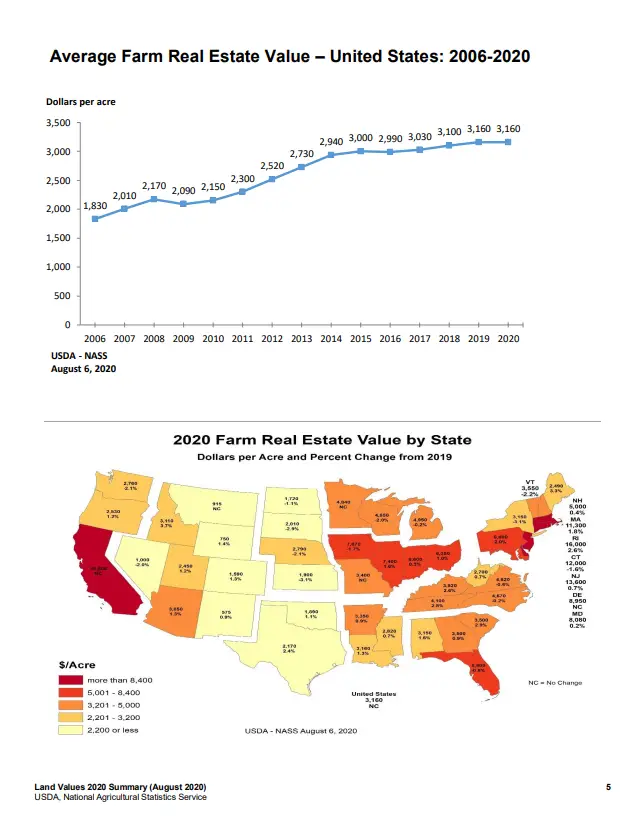

As LAND buys, manages, and sells farmland in states where the price of land is containing to increase then so will the overall REIT’s value increase. This is the secret weapon of LAND.

Over the past 10 years LAND has steadily been increasing in value as their farmland has been increasing in value. As a result investors have their initial investment increase in value as well as return a monthly dividend.

Everyone should own a position in LAND. For a full rundown on LAND I did a research article on the stock. Check it out if you got time.

LAND stock analysis: Going long on LAND

ELS: EQY Lifestyle

Current Stock Price: $61.76

Dividend Rate: 2.3%

Company Website: https://www.equitylifestyleproperties.com/

Sector: Healthcare and entertainment.

EQY lifestyle owns, operates, and manages properties that cater to retirees across the United States. These properties are RV resorts, manufactured home communities, and marinas for public boats.

Because of this EQY has exploded after the 2020 pandemic began to subside. During the 2020 pandemic people sold their boats and their RVs. As such EQY saw a drastic drop in their price that mimicked the market as a whole.

Since then however EQY has started to rocket back well above its highs. Still EQY is a stable bet because of one key reason. The overhead on their properties.

EQY invests in locations and properties where the overhead is incredibly small to maintain. These are RV campgrounds, which is just land with a power plug hookup. For marinas EQY only needs to maintain the dock, little else. On manufactured homes the owner maintains the house, EQY just sits on the land.

Because of this EQY has been seen by many professional analysts on the street as a stable rebound investment to buy now and hold for several years. The U.S retiree population is expected to grow at a substantial rate over the next couple years, and with that comes a need to cater to this generation of people in their golden years.

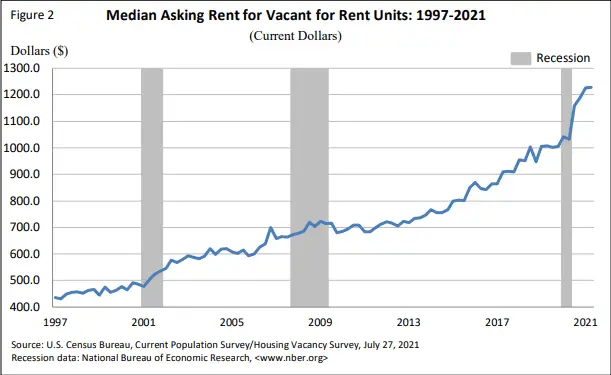

EQY will make their money off a cost of living increase. When rental price of vacant units across the United States increases so will RV rentals along with manufactured homes.

Because of this EQY sits in a good spot for 2022-2030 and should be added to everyone’s portfolio.

Conclusion

By investing in STAG, LAND, and EQY you will be exposing your portfolio to not only get a monthly dividend check but also gain from capital growth. We are only going after REITS that have a solid business model that will grow your initial investment in the long run while also returning capital.

The reason behind this is because the longer you hold these REITs the lower your overall risk becomes in the investment. For example, if you held STAG for 5 years then you would of returned close to 100% on your initial investment.

STAG at this point would have to fall from $41 all the way down to $22-$23 for you to even go negative on the stock. As such your risk on this investment is nearly 0%!

As always if you like content like this you should share on social media and subscribe to the newsletter! Every share helps me help others, so its much appreciated.

Further, check out some of our other blog posts below. A little reading could save or make you $10,000!

-

How Long Does a Short Squeeze Last? (3 Answers)

What is the time frame for you short squeeze? Well here is everything you will ever need to know to determine how long it will last.

-

Why You Still Own a Stock After It’s Delisted and How to Sell It

Do you still own a stock after its delisted? How do you sell it? Don’t worry the stock is still worth money and here is how to sell.

-

Can You Make 1% A Day in the Stock Market? (3 Steps)

Making 1% a day in the stock market is hard but defiantly doable. Here are 3 simple steps to helping you achieve this return.

Until next time, I wish you the best of luck in your investments.

Sincerely,