These are the 5 major reasons why you lose money in the market; bad position sizing, not reading SEC reports, not having an exit strategy, listening to the wrong people, not having an investment thesis/catalyst.

If after reading this post you want the blueprint for success when it comes to investing check out this post.

3 Steps for Making Consistent Money in the Stock Market with Pictures.

let’s jump right in.

1.) Bad Position Sizing

If you have ever invested in a stock without checking the daily volume then this is for you.

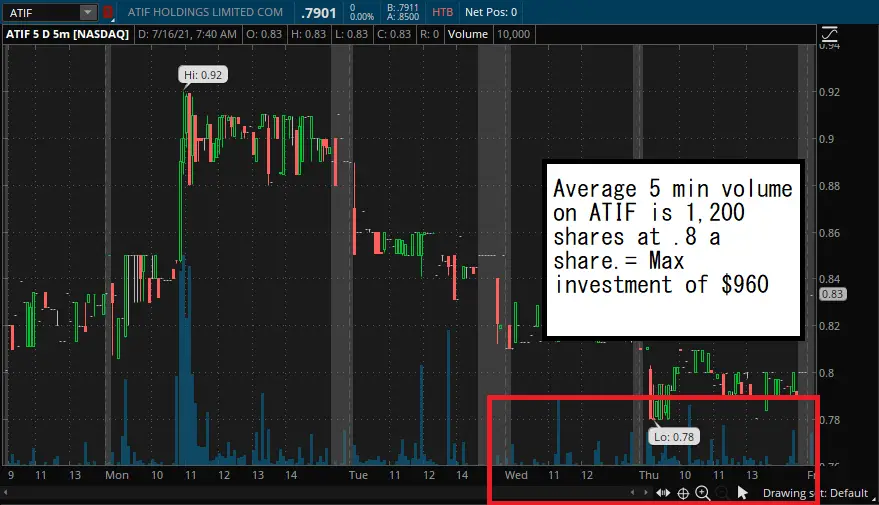

There is an unsaid rule never invest more then 10% of the 5 minute volume in a stock. This is because if you invest more then 10% then you cant liquidate the position in case things start going against you.

For us normal investors this wont be a problem until we get towards the smaller stocks. As the above image demonstrates we can only have a maximum investment of $960 in ATIF due to its volume size.

If we invested more then $960 in ATIF we would have to sell our stock over the entire day, instead of at once. Which could cost us a significant portion of the investment.

Following this rule will prevent you from being stuck in a stock due to liquidity reasons. Its an easy rule to follow and will prevent you from extremely costly mistakes.

Always follow the 10% volume rule! It guarantees you will have liquidity to get out if need be.

2.) Not Reading Public SEC Reports

There are available under SEC.gov for every stock traded on the open market. You should always read the basic reports (10-k) to understand what the company does, its financial situation, its risks to investing, and its leadership.

This will allow you to understand what will move the company’s stock price going forward. For example, if the company has bad financials an influx of cash or increased customers accounts will drive the price up.

If you get in the habit of checking out the business, finances, risk, and leadership of the 10-k before you even click buy it will save you a ton of time and money.

This is because often companies will selectively chose what to publish to paint a better picture of their current situation. If your investing for the long term, make sure you read the financial reports.

A little bit of time spent reading can save you hundreds or thousands of dollars.

3.) Not Having an Exit Strategy.

Believe it or not, most new investors don’t have a strategy for when their investment goes south.

In the professional investing world we call this hedging. In the basic sense this is simply defined as having a strategy for when feces hit the rotating oscillator or ‘SHTF’ (I’m sure you can figure it out).

YOU ABSOLUTLY NEED TO HAVE AN EXIT STRATEGY.

This is something you need to practice when investing. Some people use stop loss, trailing stops, or they hedge with either options or other investments.

Nobody can accurately predict the market. Professional analysts get predictions wrong all the time and what saves your capital is having an exit strategy, or hedging, your investment.

A good example of a proper exit strategy for example is buying gold to hedge against U.S inflation. As inflation increases the value of the dollar will decrease and the value of gold will increase. This is why most professional investors will have a 5% stake in GLD or another gold asset to hedge against inflation.

This works because the U.S dollar is not based off the gold standard. When the worlds largest currency (the U.S dollar) falls in value, then the rest of the worlds currencies will rise (most are based off gold standard). This will allow your investment to be saved.

4.) Listening to the wrong people.

Those people you see online who are professional traders…are largely paid actors. Hate to break it to you.

They are paid by the industry to promote certain stocks above others to their followers. These followers are considered retail traders and will pump money into a influenced stock. This pump will allow the stock influencer and their beneficiaries to get out at a higher price since the invested before the pump.

There is an entire industry centered around the most successful influencers. It does not take long to figure out a list of these people.

Wrong person to listen to: Stock Influencer/Guru

So how do you differentiate between good research and an influencer pumping up their shares. Well I have spent two decades trading and investing and I have seen influencers come and go. Here is a quick list on how to spot an influencer.

- They post about their lifestyle

- A majority of their trades are wins

- They state trading industry terms such as Risk vs. Reward

- They draw lines on charts and don’t talk about fundamentals

- You will find they promote premium products such as private chat rooms and merchandize

- They never give an investment thesis, timeline, or hedge

These influencers are helpful for following retail traders. Retail traders will increase liquidity in a stock which can help you get out before they get in. Further, retail traders also really only know how to buy which will inflate the stock price.

As such following influencers is a good way to make a quick buck so long as you understand how they impact the stock price but that’s where it ends. If you want to do this yourself and have a consistent return you need to learn the basics of investing.

Right person to listen to: Analyst Who Goes Over Fundamentals, Technicals, and Provides Investment Thesis/Catalyst.

Ok, so we spotted the professional influencer/guru. How do we now differentiate from these guys and the real analysts.

Here is a quick list on who you should listen to (if your going to listen to anybody). These guys exist and often times they are both wrong and right.

- They focus on a particular sector or sectors. Energy, Consumables, Tech, etc.

- Their research is broken down into three parts; Fundamental, Technical, and catalyst/thesis.

- They don’t use charts to predict future price.

- Professional analysts invest on a 6 month-5 year or more basis.

- They don’t post about their lifestyle or who they are. The research speaks for itself.

- They follow a predictable, repeatable, and time proven investment strategy. Buffet for example has been a value investor since the 1940’s focusing on defensive undervalued growth plays (see Coka-Cola).

These guys wont try to pump a stock. They don’t need to because by presenting an investment thesis/catalyst they already are expecting a stock to move in a direction; they don’t need retailer support to drive it.

If your listening to the guru, you will lose money. If your listening to the analyst you will make money.

The best person to listen to: Your gut.

As the title suggests, the absolute best person to listen to investing advice is…yourself.

Once you learn how to invest properly you learn how to generate wealth overtime. The secret is not to pursue rapid growth but to position an investment to grow, year over year, to hit your goals.

This is why I always recommend sitting down with a certified financial planner to asses your investment horizon. If you went to one and said “I need to make 100% tomorrow” they would point you to nearest casino. If however you said “I want to grow wealth at a modest pace to hit retirement” they would give you 4 stocks and five bonds to invest in to hit your goals.

Learning on your own however will save you thousands on fees over the course of your lifetime. That is the goal of this website, ChronoHistoria; to give you the tools and examples to help and guide you on the path to generate consistent returns in the market.

My goal is to have to eventually be able to pick out a stock, perform a valuation, figure out the investment timeline, and find a thesis/catalyst to invest off of. At the end of the day the objective is to have you investing your own money off your own research. Maybe give Mr. old site ChronoHistoria a shoutout when your the next Buffet ;).

5.) Not Having an Investment Thesis/Catalyst

This goes without saying…but why do you think your investment will make money?

This question is pivotal to making accurate judgments in the market. If you ask yourself the above question and your answer is because “I saw a post online” or “this guy said it will go up” or anything similar, chances are you will lose money.

If however your answer to this self imposed question is “because x will happen at x date, the sector is going to be there at x point, and x company is poised to capitalize upon it best” then you stand a much, much, much,…..much better chance at making an actual return on investment. Often times at a higher rate then the average investor.

Look at any one of our research posts and we give you the answer to this question. We wouldn’t be in business if we didn’t. A good place to start is an overall sector research. Our simple version for 2022-2023 for the highest expected performing sectors is below.

Top 5 Sectors to Invest in for Massive Growth (2022-2030).

Conclusion

If you listen to these five reasons why you keep losing money it will help you actually make money. A majority of retail investors throw money at their computer screens and expect a return, here at ChronoHistoria we believe in showing you the right way to invest.

As always if you like content like this then you should share on social media and subscribe to our newsletter for up to date investing stuff.

-

How Long Does a Short Squeeze Last? (3 Answers)

What is the time frame for you short squeeze? Well here is everything you will ever need to know to determine how long it will last.

-

Why You Still Own a Stock After It’s Delisted and How to Sell It

Do you still own a stock after its delisted? How do you sell it? Don’t worry the stock is still worth money and here is how to sell.

-

Can You Make 1% A Day in the Stock Market? (3 Steps)

Making 1% a day in the stock market is hard but defiantly doable. Here are 3 simple steps to helping you achieve this return.

Until next time, best of luck in your investments!

Sincerely,

Comments are closed.