Today’s post is going to outline the maritime bulk shipping company Eagle Bulk Shipping (EGLE). I will be going over the fundamentals, technicals, and give an investment thesis on why you should short EGLE.

As always if you like content like this then you should share on social media, like, follow, and subscribe to our newsletter!

Let’s jump right in.

Summary

You should short EGLE because the company is currently overvalued and does not have the financial capacity to stay afloat in the completely changed sector of 2020-2030 ocean freight companies. Right now you can get around a 40% profit on a short investment so long as you watch it. EGLE could shoot up due to the low float and high short interest.

Update

I published this post when EGLE was around $54 a share. It has since shot down to around $37 a share. This would have netted you a 32% profit.

1.) Fundamentals Section

Within the fundamentals section I will be outlining the business model, risks, and finances. At the end of this section is a summary so you can skim through if you like.

Business model

Eagle Bulk Shipping is based out of Samford, Connecticut and operates/sustains a fleet of around 45 bulk shipping vessels. The average age of these vessels is 8.8 years and together their deadweight tonnage is about 2,686,570 tons.

These ships require constant upkeep and upgrade. Since 2016 EGLE has engaged in continual fleet renewal and growth. Starting in 2016 Eagle Bulk Shipping has begun to diversify into newer and larger ships

As a business model EGLE provides shipping for commercial freight. Their business model can be separated into three different types of commercial “charters.”

- Voyage Charter

- Time Charter

- Index Charter

Over the past three years EGLE has started to diversify away from index and time charters in favor of voyage charters. This is because they are shifting away from dedicated cargo freight lines in favor of a pay-per charter model.

This change allows EGLE to have bidders for their ships. If a customer needs to have their freight and they are willing to pay a premium then they can bid for one of EGLE’s super or ultramax ships.

This change in business model has proven incredibly effective during the pandemic when overseas shipping came crawling to halt. Shipments were backed up and shipping companies could start to charge a premium for their services.

Since then however shipping has started to return to normal. Eagle Bulk Shipping’s business model might be in need of an updating or they could risk losing customers.

EGLE’s customer basis

EGLE’s customer basis is mainly comprised of large agricultural, mining, manufacturing, and trading companies.

Before EGLE takes on a new customer they perform an in house evaluation of their financial condition. They don’t want a customer that cant pay the shipping costs. Further, they don’t want to have to large a customer come in an utilize their buying power to drive profit margin down for EGLE.

Because of this there is no one customer that represents over 10% of EGLE’s revenue. This is a defensive position and prevents huge customers from directing EGLE’s profit margin.

This minimizes a large risk that plagues a majority of other shipping companies.

Two part operations

EGLE has to central parts to their business model; Commercial operations, and Technical operations.

First, commercial operations. This is the money maker and is the chartering of vessels between two ports or for a set amount of time to deliver freight shipping.

Second, technical operations. EGLE maintains, outfits, and crews their own vessels. Because of this they can control their own overhead to a degree. Another aspect which separates them from other shipping companies.

All of technical operations takes place on the Marshal Islands through an EGLE owned subsidy company, Eagle Bulk Management LLC.

Risks

Right now there are two major risks in across the shipping industry as a whole.

- The rising environmental regulations on pollution emission.

- The overabundance of old ships and tankers.

- The ongoing pandemic.

As you might have guessed the shipping industry is susceptible to other geo-political macro trends such as terrorism or escalating national hostilities. Naturally these are near impossible to predict and are best left to be reacted against.

Rising enviromental regulations

Shipping produces a lot of climate pollutant emissions. According to an October 17th report by The International Council of Clean Transportation ocean going shipping was responsible for 2.6% of the global emissions.

This massive amount of greenhouse gas has caused several regulating bodies to look into the shipping industry as an effort to reduce or eliminate this 2.6%.

For the past 5 years the EU and other countries have taken steps to curb this rise in shipping emissions. Starting in 2018 the EU agreed to a greenhouse gas emissions reduction strategy for the shipping sector. This reduction strategy calls for emissions from shipping to be reduced by at least 50% by 2050.

Citation: https://ec.europa.eu/clima/policies/transport/shipping_en

The overabundance of old ships and tankers.

The sector for shipping is expanding at a rapid pace. According to “The Maritime Analytics Market Forecast to 2027” written by ResearchANDMarkets.com we can expect the shipping sector to grow from $824 million to an astounding $1,833 million by 2027.

This massive growth of the market will mean that older ships will quickly become obsolete and need to either be scrapped or retrofitted to keep up with the sector.

The ongoing pandemic

The pandemic has caused turmoil for the shipping industry. While they are making record profits they also need to abide by new regulations and laws. Further, these are rapidly changing at any moment the entire sector could change leaving shipping companies in the dust.

Finances

How does EGLE’s finances stack up. Well there is a reason I chose this company over others. Its because they have the best chance to capitalize upon the changing industry trends.

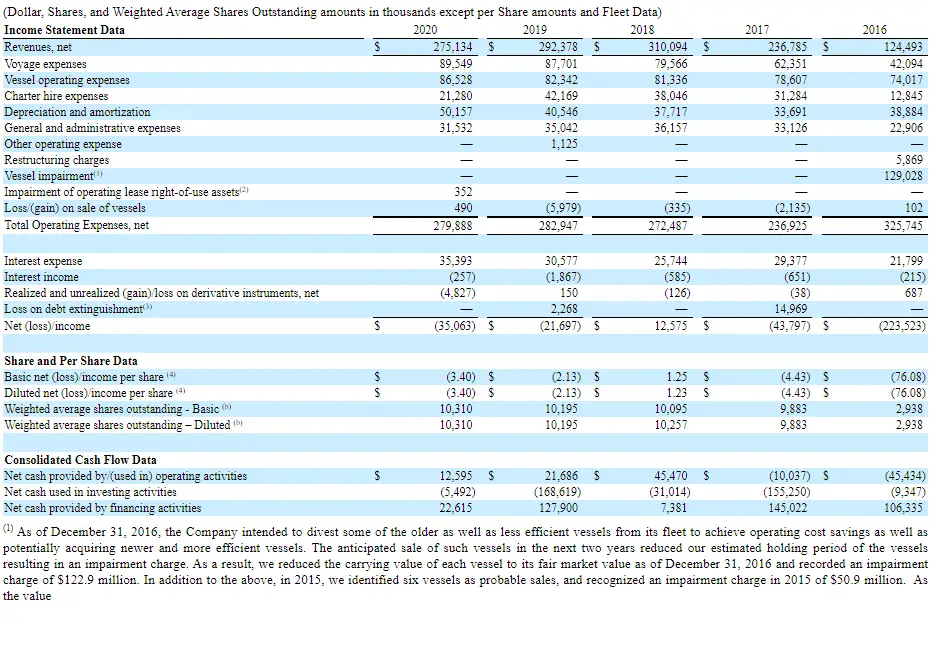

What we see in this financial sheet is a company taking a defense approach to their industry. We can see this in the net gain on vessels of $490,000 along with the depreciation and amortization of $50,157,000. This is forcing EGLE in 2021-2022 to start the re-fitting of their vessels.

What is concerning is the net revenue decreasing but operating expenses continuing to go up. This is one of the main reasons why EGLE in June of 2021 offered a sale of 1.5 million class A common shares to raise money.

This is always a red flag for a company, especially when you look into their finances and see that for the past two years they have been bleeding money.

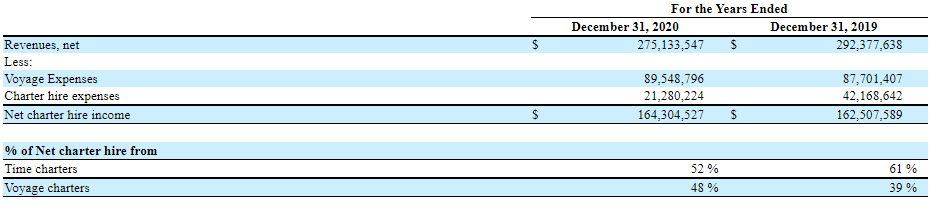

As we can see from this total revenue actually dropped over the 2020 year. This is a worrying sign when investing in a company who should see growth in a sector that is expected to double over the next decade.

Summary of Fundamentals

The sector of ocean shipping is exploding, however EGLE is not. EGLE in fact is barely treading water when it should be easily floating.

The business plan is solid, the sector is growing, but EGLE just cant seem to get its finances in order and is prolonging retrofitting its entire fleet.

This is a worrying sign.

2.) Technicals

The technical of EGLE look solid from the surface level. When we dive in deeper we begin to see something happening, something we can profit from.

P/E

Current P/E on EGLE is -18. This means that for the current stock price EGLE is actually overvalued from a earnings standpoint.

P/E is not always accurate but it does give a snapshot of how a company is doing financially. We already know that EGLE is hurting for cash.

Float

EGLE’s float is an astounding 11.31 million. Further the short percentage of the stock is around 17.76% which is insanely high for a traditional stock. This stock is a candidate for a short squeeze. As such are needs to be taken in regards to shorting.

Volume

Volume is a consistent 100,000-200,000 shares traded per day. Upon announcing they were selling more class A common shares volume shot up to 1.5 million.

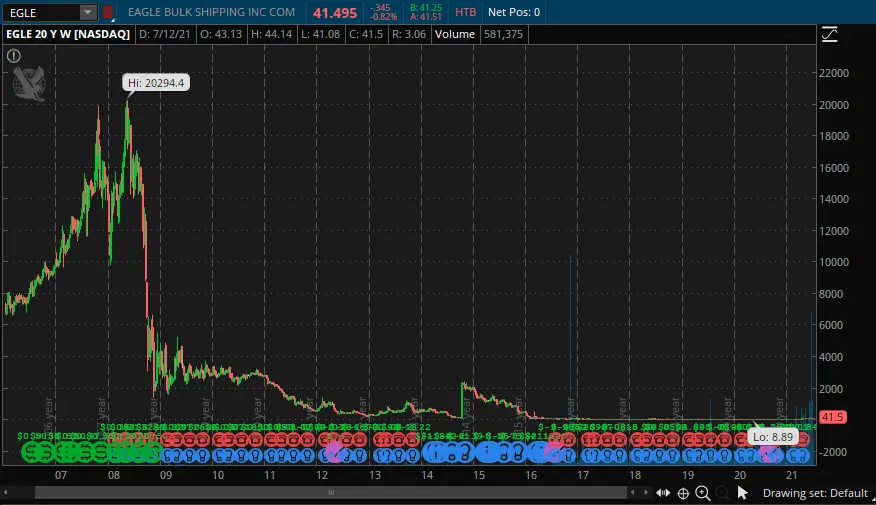

20 year chart.

EGLE is prone to shooting up randomly but since 2015 has stayed in place in the price range of $10-$50. Right now it is trending at the high end of that spectrum.

Summary of Techincals

The technicals of EGLE are exactly in line with what to expect for the fundamentals. The stock is currently overvalued on EPS, P/E, and has the capacity to either rise or fall rapidly.

3.) Investment Thesis

You should strategically short EGLE for 2021-2025. This is because of 2 main reasons.

- Changing sector

- Financial troubles

Changing Sector

The bulk shipping sector as a whole is going to be changing in the upcoming years. More then it has in the past 20.

We will start to see increasing environmental regulations taking place that will force shipping companies to upgrade, scrap, or retrofit their existing fleet. EGLE’s current stance on this is kick the can down the road. They keep on buying newer ultramax vessels that only seek to lower emissions.

This is no fault of EGLE its a rather large industry trend. That being said EGLE does not have the EBITDA to engage in this behavior and should start scrapping or selling a majority of its vessels. The larger shipping carriers will start to retrofit a larger percentage of their vessels and leave EGLE behind.

Financial troubles

EGLE has run into financial troubles and its stock price is currently overvalued to its earnings. For this we can make a quick short investment, so long as we hedge properly and watch investment.

The overall sector of EGLE is growing but EGLE just does not have the discretionary capital to maintain with their competition. This will result in EGLE starting to lose market cap over time to the competition.

Summary of Investment Thesis

Because of this we can start to build out our investment thesis.

EGLE is poised to fall in stock price because in the short term the stock is overvalued due to the company’s financial problems and lack of growing revenue. Further, the sector as a whole is going to require a massive capital expenditure to upgrade and retrofit ships to comply with new emission standards set to roll out in the mid 2020’s.

As a result of this we can see several prominent shipping companies start to fall in market cap as they slowly lose revenue to the larger for financial sound companies.

If I was in charge of EGLE I would reduce the shipping side of the company and start focusing more on repairing, outfitting, and logistically operating other companies ships. This would be a great business model for 2030-2040.

Conclusion

Investing in EGLE in the form of a short position is a great way to make a decent return on your portfolio for 2022-2023. If done properly you could see a return in the range of 40% with risk around 4-5%.

Naturally since we are shorting you need to monitor the position at all times and adjust for exposure. If done properly then we can see EGLE be at the price range of $25-$32.

As always if you like content like this then you should share on social media, like, follow, and subscribe to our newsletter!

-

How Long Does a Short Squeeze Last? (3 Answers)

What is the time frame for you short squeeze? Well here is everything you will ever need to know to determine how long it will last.

-

Why You Still Own a Stock After It’s Delisted and How to Sell It

Do you still own a stock after its delisted? How do you sell it? Don’t worry the stock is still worth money and here is how to sell.

-

Can You Make 1% A Day in the Stock Market? (3 Steps)

Making 1% a day in the stock market is hard but defiantly doable. Here are 3 simple steps to helping you achieve this return.

Sincerely,