The goal of an index fund is to track an “index” of stocks that in some way are correlated. This can be the top 500 companies in the U.S or small cap stocks located in the biotech sector.

Index funds give investors a way of investing directly in a sector instead of a stock. Essentially by investing in an index fund you are spreading out the risk while also securing your upside potential.

This is why index funds are so amazing. If you are a passive investor who just wants to have a steady return with little risk then you should invest in index funds.

The best way to do this is by buying and holding ETF’s or Electronically Traded Funds. These ETF’s track an index and by investing in them you are opening up your portfolio to large growth potential.

So without further ado, let’s jump right into the 5 best index funds for investment growth!

SPY: The S&P 500 Index

Ok, so no list would be complete without mentioning the SPY.

The SPY seeks to track the S&P 500 Index. The S&P 500 tracks the top 500 companies by market cap in the U.S. The largest holdings of the SPY are as follows.

- AAPL (5.95%)

- Microsoft Corp. (5.4%)

- Amazon Inc. (4.05%)

- Alphabet Inc. (3.69%)

- Tesla Inc. (1.57%)

- Berkshire Hathaway Inc (1.44%)

- JPMorgan Chase (1.38%)

When you buy a share of SPY you are buying a little bit of the top companies in the United States. This spreads out your risk evenly, according to marketcap, so that your investment is never in jeopardy.

This is why the SPY routinely ranks as one of the best investments you can make. Year over year it has returned 10% at a compounded rate. This is huge and a $10,000 investment in 1980 would be worth over $500,000 right now.

The SPY rebalances its portfolio every quarter (4 times a year). This means that if AAPL drops down from 5.95% to 5% then the SPY will sell AAPL to match its market cap drop.

Really, everyone should have a position in the SPY. Professional investors have a hard time beating its returns and the risk is almost non existent. Its almost a financial cheat code to grow wealth.

VTWO: The Russell 2000

VTWO is the Vanguard Russell 2000 ETF.

The VTWO tracks the Russell 2000 index. This index tracks the top 2000 companies in the small-cap and mid-cap U.S market who have high growth potential.

Because these companies are small-cap and mid-cap they can move at a much faster pace then the larger companies that comprise the SPY. This means that the upside is much, much, higher then the more established companies like AAPL or MSFT.

At the same time you are exposing yourself to more risk. Small-cap companies routinely have to re-innovate themselves and hire outside talent to keep the lights on, while mid-cap companies struggle to cement their place in the market.

By investing in VTWO you are spreading out the risk across 2000 investments in this space. If 10 companies fail it wont hurt your portfolio, further if only one small-cap company starts to run it will open your investment up to a lot of growth.

When there is disturbances in the U.S market typically this gives small-cap companies room to run. Because of this during the 2019-2020 pandemic VTWO outperformed the SPY on the U.S economy recovering.

If you time your investment right into VTWO you can make a fortune.

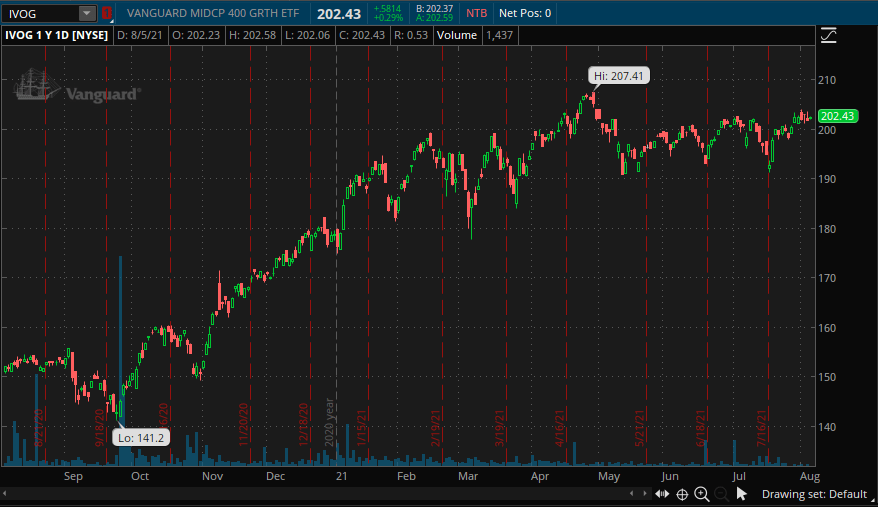

IVOG: Vanguard S&P 400 Mid-Cap Growth ETF.

IVOG is an interesting monster. It tracks the S&P 400 index and seeks to position investors to achieve higher then normal returns by investing in high growth ETF’s.

For many professional investors the ‘sweet spot’ for growth investing is in mid-cap companies. This is because mid-cap companies often have the cash flow to experiment with new products or different marketing without having the insanely high overhead of large-cap companies.

Innovation in this sector is high. Due to this we often see mid-cap companies getting bought up by large-cap companies who want to enter a new sector or need a new type of product.

IVOG positions your investment ahead of the curve to exploit this. As such we have seen IVOG spike out of nowhere like it did in November of 2020 (chart above).

Not only are in you investing in a stable asset with low risk but you also open yourself up to large growth opportunities.

ARKK: The Ark Innovation ETF

Unless you have been living under a rock chances are you have heard of the ARKK innovation ETF. This is because in the 2020 year the return for the year was 300%….

This is a unique ETF. ARKK seeks to identify and track companies with the largest growth potential due to their ability to either capitalize upon a new sector or disturb an already established sector.

In essence Ark creates their own internal index fund and then builds ETF’s on top of it.

The largest holding of ARKK in 2020 was TSLA. This caused ARKK to rocket upwards with the massive growth of TSLA.

Since then ARKK has started to level out as TSLA and other holdings began to consolidate. Due to this ARKK has been going at a discount as investors leave to position their returns in more established ETF’s, like the ones mentioned above.

ARKK does carry risk, but if you can hedge against a little risk in your portfolio then chances are you will reap massive rewards.

Currently ARKK has been investing heavily into the cryptocurrency market maker company, Coinbase (COIN). I already did a full report on Coinbase and why its a great buy, check it out below.

Coinbase (COIN) stock analysis: Why you need to buy Coinbase Global.

On top of this ARKK owns several other companies whose growth potential theoretically could cause massive stock price increases.

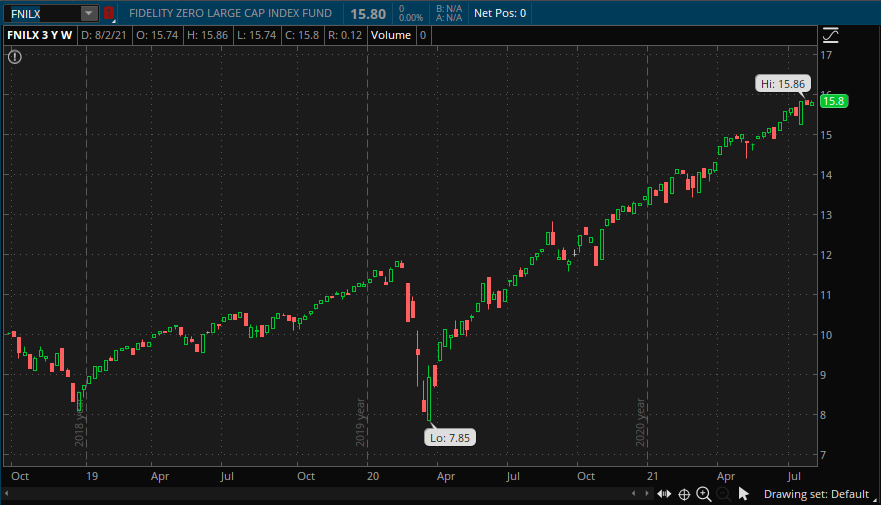

FNILX: Fidelity Zero Large Cap Index Fund

Ok, so this is an interesting fund.

FNILX seeks to track the S&P 500 along with the SPY. The difference here is that there is currently zero management fees…

Typically when you buy into an index fund you have to pay yearly to be an investor. This fee is negligible, like $5 for every $1,000. Over time however this will eat into your compounding return on the fund.

Having a zero fee fund that mimics the SPY is a game changer. You will return above market return simply by investing your money in the FNILX and just letting it sit.

So what’s the downside then? Well currently there is very little liquidity on the FNILX. This means that it will take a long time to get your investment out of the fund, so there is inherently more risk involved in this investment.

That being said sprinkling this ETF into the mixture with your other positions is a good idea. Without the fee you could see huge returns, well above market average down the road.

As such its a solid investment.

Conclusion

Index Funds are an amazing way for investors to increase their growth potential while minimizing their risk. Further, index funds provide the added benefit of having done all the research for the investor.

A novice investor might lose several thousands of dollars before hitting a good investment. With index funds you know you are getting a solid investment.

As always if you like content like this then you should share with your friends and subscribe to the newsletter! Every share helps me help others grow wealth in the market.

Further, check out some of my latest posts here.

-

How Long Does a Short Squeeze Last? (3 Answers)

What is the time frame for you short squeeze? Well here is everything you will ever need to know to determine how long it will last.

-

Why You Still Own a Stock After It’s Delisted and How to Sell It

Do you still own a stock after its delisted? How do you sell it? Don’t worry the stock is still worth money and here is how to sell.

-

Can You Make 1% A Day in the Stock Market? (3 Steps)

Making 1% a day in the stock market is hard but defiantly doable. Here are 3 simple steps to helping you achieve this return.

Until next time, I wish you the best of luck in your investments!

Sincerely,