Ok, you more then likely have either never heard of this Green Prairie or have just now been introduced. GPRE is a goliath in the North American Ethanol production industry and is poised to become a great investment.

Recently this stock came across my desk because of its latest earnings report. The analysts on the street predicted a -$.198 per share and instead GPRE released a +$0.2 per share. After diving through GPRE I found some very interesting things.

To demonstrate why GPRE is a great investment this article is broken down into three distinct sections; First is the fundamentals section. Here I highlight what GPRE does. Second, GPRE’s stock technicals. Here is how the stock performs and what you can expect. Third, I give you an investment thesis on why GPRE is a great investment.

For those who are short on time at the end of each of these sections there is a summary. Skip ahead to that if you want to get the basics without all the reading.

As usual if you like content like this you should share around the web with your friends as well as subscribe to the newsletter! I wont spam you and the newsletter allows you to get the latest stock reports.

Without further ado, let’s jump right in.

Update

Since I published this post GPRE shot up in price to close to $44. If you got in on time then you made some nice profit.

Fundamentals

This section is broken down into four sub-sections; Business Plan, Growth Strategy, Finances, and Risks.

The goal here is to give you a rundown on what exactly Green Prairie as a company is, their “world domination strategy”, how much money they make, and how exposed your investment is.

For those strapped on time jump to the end. I give a summary.

Business Plan

Green Prairie (GPRE) specializes is a North American super company that specializes in two distinct economies; first is creating high margin feedstock for the U.S/Canadian proteins market. Second is specialty alcohols for the massively growing North American Ethanol Market.

Essentially you can think of GPRE as a company that has a solid business foundation in providing hay, and other livestock feed, at a cost effective price. While also expanding into the huge Ethanol market production market.

Simply put, GPRE grows ‘hay’ and ‘corn’ to be used commercially across North America.

GPRE’s products can be broken down into three categories.

- Ethanol Production

- Agribusiness

- Commercial Food Consumption Products.

Ethenol Production

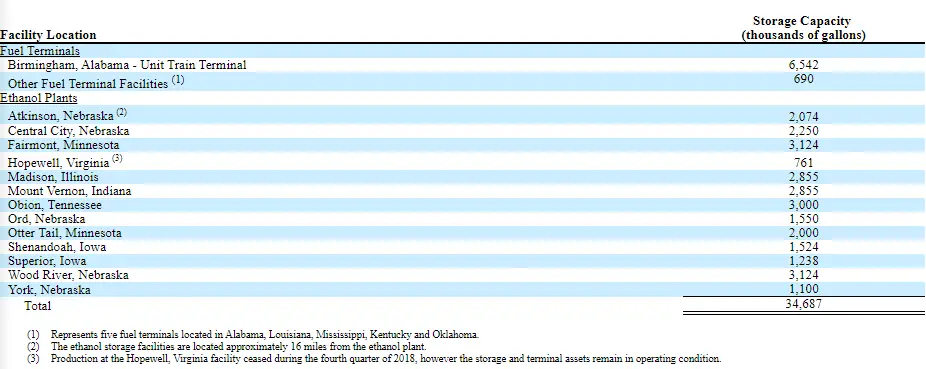

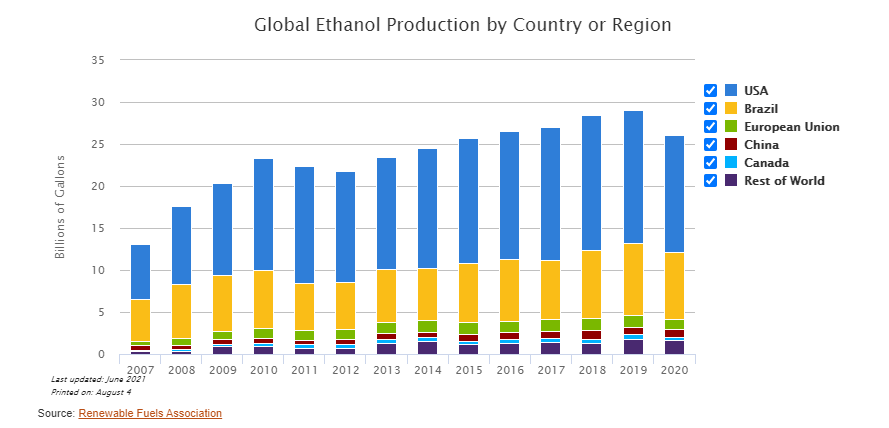

GPRE owns and operates 12 ethanol plants spread out across the U.S in Tennessee, Illinois, Indiana, Nebraska, and Minnesota. Together these plants produce over 1 billion gallons of ethanol per year.

Agribusiness and Energy distribution

All that hay and corn needs to be sold to make a profit.

In steps the business segment of GPRE. This category operates a chain that stores, packages, and sells up to 38.1 million bushels of grain. Further this section also operates and sells the 1 billion gallons of ethanol produced by GPRE every year.

Comercial Food Consumption Products

To add another revenue source to their list GPRE started to create vinegar from excess products. As a result Flischmann’s Vinegar, one of the largest vinegar manufacturers was born.

This is was a smart decision by GPRE. They essentially utilize spare corn ethanol to create, market, and sell another product.

Growth Strategy

As the human population grows, so will the demand for ethanol and animal protein. GPRE has positioned itself to pursue aggressive growth in both of these sectors with one business model.

Over the next decade GPRE will continue to amp up its corn production and storage to be able to capitalize on the worlds growing population. This excess corn will be able to be used as animal feed and ethanol.

The animal feed market is only going to expand as demand for protein continues to grow. Everyone loves a good steak, and chances are that cow was fed with GPRE corn.

Further, as environmental emissions become more of an issue ethanol demand will go up. This is because ethanol is both nontoxic and biodegradable. Further ethanol production is considered to be carbon neutral as growing the corn for ethanol consumes greenhouse gases. (source)

GPRE will be here to capitalize upon both of these sectors going forward. From 2021-2023 we can expect GPRE to expand ethanol production into the east cost of the United States by opening plants in York, Pennsylvania and Shenandoah, Tennessee.

Here is a list of the ethanol storage plants and their capacity for GPRE.

Finances

During the pandemic GPRE was hit hard. Less people were traveling on the roads, which lead to a lower demand for autogas and thus ethanol.

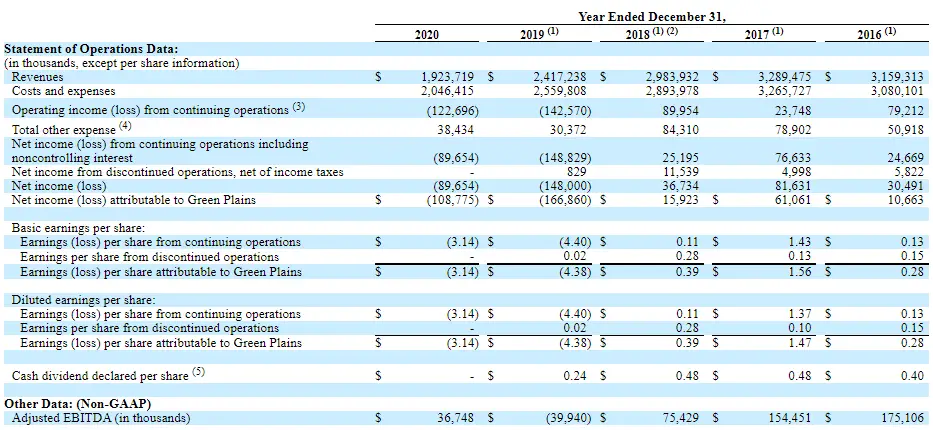

As we can see from the above 10-k, GPRE lost over 21% of its revenue due to the pandemic. This was a huge blow to GPRE and their share price tumbled from $17 down to $6 over the course of the 2019-2020 year.

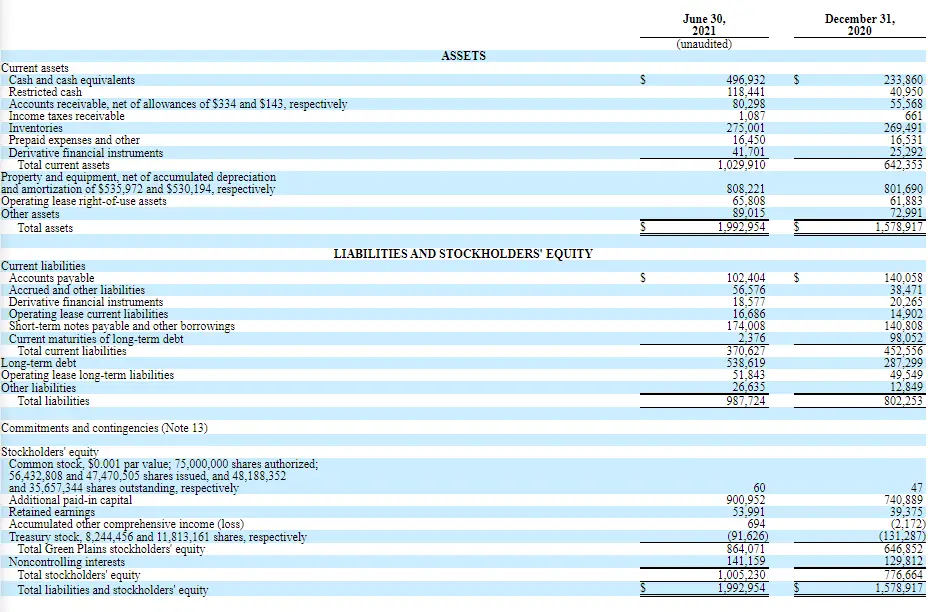

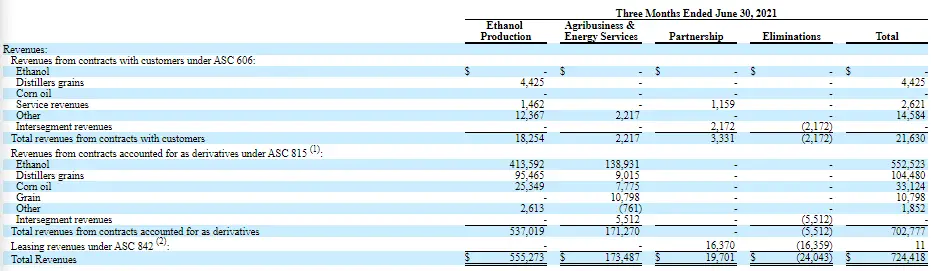

Since then however we have seen a massive increase in revenue. Here is their recent 10-q report. (07/31/2021)

From December 31st 2020 to June 30th 2021 GPRE saw a revenue growth of 54%. This was the massive boost in revenue that GPRE needed, a boost largely due to the reopening of the global economy and thus the demand for ethanol.

Here is a breakdown of how they achieved that impressive revenue growth.

As we can see a majority of the revenue generated came from ethanol sales. This trend will continue as we see a larger portion of the worlds global economy open back up.

Risks

The risks to investing in GPRE are centered around the ethanol industry at large and the companies debt.

Right now the primary driver for the ethanol sector is the automotive industry. This is rapidly changing as more and more EV’s (electric vehicles) are brought on to the market.

However going forward more and more studies are being done on ethanol and it is becoming more and more likely that ethanol will be used as a ‘green’ fuel source.

Over the past decade power companies such as GE have been experimenting with using ethanol as a way to power turbine generators instead of natural gas. This would prove to be a game changer for the U.S energy industry as this would mean that the U.S could become carbon neutral for the first time.

The University of Minnesota did an absolutely amazing study on the feasibility of using ethanol to power generators. (source)

Ethanol is not going anywhere anytime soon. GPRE knows this and as such they have doubled their efforts on ethanol production and storage.

Regarding the corporate debt, GPRE has racked up a large amount due to the pandemic along with funding its aggressive expansion. This however is manageable and GPRE is expected to start to eliminate its debt over the next 3 years.

Summary of Fundamentals

Overall GPRE has a solid foundation. Its business model is built around selling animal protein feedstock and ethanol (corn), the growth strategy is poised to capitalize upon the growing ethanol market, the finances in 2021 have been great, and the risks to GPRE are largely controllable.

Essentially GPRE is just a giant corn production company that is damn good at what it does. It grows and sells corn as a livestock feed and turns the excess corn into ethanol.

Technicals

The technicals section outlines how the stock itself behaves. I will go over the chart, average volume, and float/short percentage.

As usual at the end of this section I provide a summary that outlines everything so that you can skim through it.

Chart

As we can see GPRE has gone up and down over the past 14 years. In 2014 GPRE peaked around $48 and then steadily began to go down. This was because of the increasing debt due to their aggressive expansion.

This is starting to pay off and in 2021 we began to see a steady rise in revenue and GPRE start to payback its debt.

This is a bullish sign.

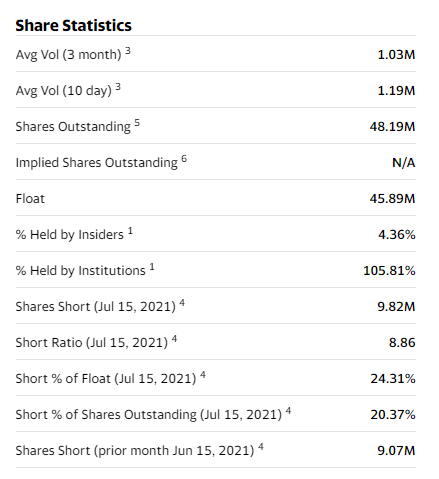

Average 3 Month Daily Volume

The average 3 month daily volume on GPRE is around 1 million shares traded daily.

Following the 10% rule this means that you can at most (due to liquidity reasons) invest $3.7 million dollars into GPRE. I doubt many of us have that type of discretionary capital sitting around but that’s the max you can throw in.

Further, this indicates that GPRE is open for retail investors to trade it freely. “Smart Capital” will have a hard time entering and exiting the stock.

Float/Short Percentage

As we can see the float on GPRE is an extremely small 50 million. This indicates that the stock is inherently volatile.

Because of the revenue growth in the most recent quarter we can expect a huge explosion in price once the average retail investor gets ahold of GPRE.

Further, the short percentage on GPRE is currently 24%. I am sure that a sizable portion of this bought back when GPRE announced their recent earnings. As such I would guess that the most recent short percentage is near the 14% mark.

This is high for a company and as such we could see a short squeeze in the future on GPRE.

Summary of Technicals

GPRE has a couple bullish flags indicating that investors in the short term thing the stock will go up.

Further, GPRE could be the target of a short squeeze if enough retail investors start to pile in. This means that your investment could double in price overnight.

Investment Thesis

So why is GPRE going to go up? Well the answer lies in ethanol as a viable alternative fuel source for power generation across the globe.

Over the past 20 years the United States has exported insane amounts of ethanol to other countries. Currently the United States is the largest exporter of ethanol by far across the world.

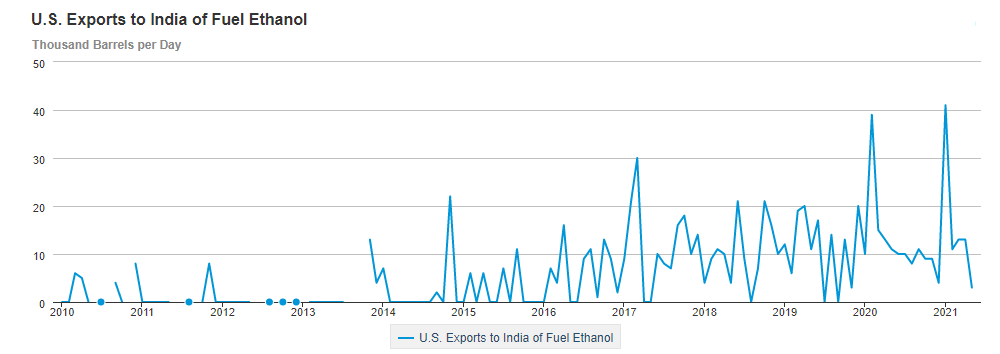

There is one country in particular that the US exports to that is interesting, the country of India. Currently India makes up 14% of the U.S global ethanol export growing at an alarming 9.1% year over year. (Source)

The reason behind this is because India wants to have all auto fuel within their country be comprised of 25% ethanol by 2025. This is huge as currently India has only 8% mixture. (source)

Further, India is experiencing an economic explosion in the middle class. This middle class is starting to buy cars and as such they will need to provide fuel for them. This means more ethanol being shipped from the largest ethanol manufacture, the United States.

GPRE is one of the top 5 ethanol producing companies in the United States. Further, they have aggressively been expanding at the cost of racking up debt. Starting in 2025 they will notice a huge upswing in ethanol demand.

What does this mean. Well simply put, starting in 2025 we will see GPRE start to pay off its debt in huge amounts. By 2030 they will become nearly debt free and as such their stock price will skyrocket.

In the near term they have demonstrated their capacity to fulfill the domestic ethanol market and started to return increasing amounts of revenue. An investment placed now will benefit from this.

Investment Thesis Conclusion

Overall we are going to see GPRE start to pay down its debt over the next couple years as more and more revenue from ethanol continues to come it. This will allow GPRE to further expand into more ethanol generation and storage across the United States.

What is going to drive this revenue source is India’s exploding middle class and India’s push to become more environmentally friendly and consume more ethanol in their automotive gas.

By 2030 we could see GPRE closer to the range of $70-$90 if they play their cards right, pay off their debt, and continue to stay their course. This would indicate a grow of 189%-243% over the next 8 years. This is well above normal market return of 10% per year, or 80% growth over the next 8 years (ignoring compounding).

Conclusion

Overall GPRE is a good investment now that it has demonstrated it can actually make money. The growth of the ethanol industry is going to cause GPRE to explode overnight and will lead to year over year growth for the company.

Its finally time for the corn kings, Green Prairie, to come out of their husks.

As always if you like content like this then you should share around the web and subscribe to the newsletter!

-

How Long Does a Short Squeeze Last? (3 Answers)

What is the time frame for you short squeeze? Well here is everything you will ever need to know to determine how long it will last.

-

Why You Still Own a Stock After It’s Delisted and How to Sell It

Do you still own a stock after its delisted? How do you sell it? Don’t worry the stock is still worth money and here is how to sell.

-

Can You Make 1% A Day in the Stock Market? (3 Steps)

Making 1% a day in the stock market is hard but defiantly doable. Here are 3 simple steps to helping you achieve this return.

Until next time, I wish you the best of luck on your investing journey.

Sincerely,