Volume is the key that will open up all investing opportunities.

Volume is important to potential investments because a higher amount of volume on a stock means more liquidity. This will allow you to place a larger investment and more importantly get out in case things go against you.

Simply put, without volume you’re investment is worthless because you can’t sell it.

Let me explain in more detail.

Volume = Liquidity

I am sure you have heard of the investing term liquidity. In the most basic sense liquidity is how liquid an investment is. A stock with high liquidity means that you can liquidate you’re investment fast.

Likewise a stock with low liquidity indicates that no matter how much money you’re investment is worth you won’t be able to liquidate it back into cash. This is a major problem.

For example, let’s say that you invested $100,000 into a biotech company listed on the stock market. A month later the biotech company announced that they had successfully cured cancer and the stock shot up 1,000% overnight.

You wake up amazed…the day before your investment was worth $100,000 and now your a millionaire. You rush to your portfolio to sell the stock and suddenly you realize you can’t.

There is no volume on the stock. There are no buyers who want to buy your stock.

Because of this your stock is worthless even though in theory your investment is worth $1,000,000. You are a millionaire who has 100% of their capital tied up in a company with no way of ‘liquidating’ your asset into cash.

In theory your liquid net worth is now less than it was previously. Unless volume increases on the stock you will never be able to reclaim your investment.

This is why volume on a stock is so important.

How to Find Volume on a Stock

Before you even invest you need to look at the volume on the stock to see if it even has the liquidity to invest.

Most novice investors will be attracted to penny stocks because of their ability to double or even tipple their investment in a day. That being said, without liquidity on the penny stock you will never be able to sell the stock since nobody wants to buy it.

Let’s look at how you can find the volume or liquidity of the stock.

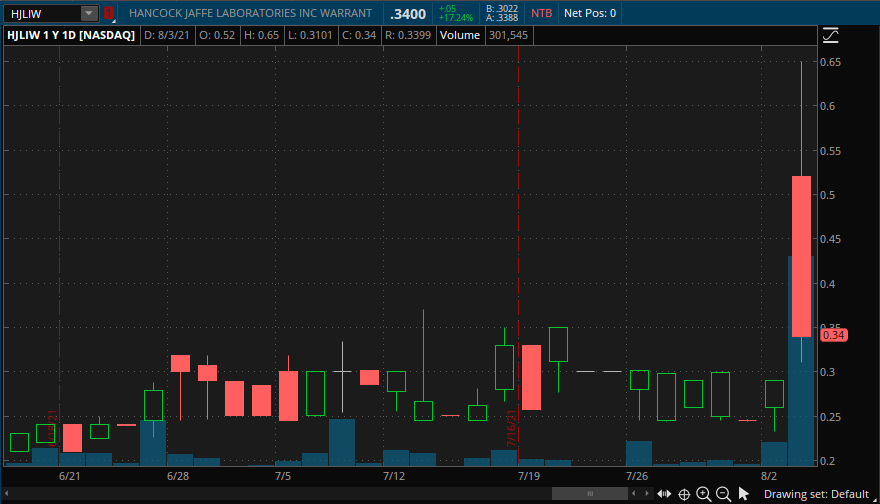

For this example we are going to be looking at the penny stock HJLIW.

The above chart is of the company Hancock Jaffe Laboratories Inc.

Over the past two months the average volume on HJLIW was around 5,000 shares traded daily at an average price of $0.25 per share.

This means that the average amount of money traded per day on this stock is $1,250 per day….

So lets say you invested $10,000 into this stock off a recent rumor they were going to release a new product. That means you would have to wait 10 days to sell the stock, therefore there is no liquidity in this stock.

Always follow the 10% rule on stocks. This rule is when you take the average daily volume for the past 2-3 months and only buy 10% of it. For example on HJLIW since the average daily volume is 5,000 shares you would only buy 500 shares.

This means you should have only invested $125 at max into this company regardless of news.

Had you known this ahead of time you could have saved thousands of dollars. This is why following the 10% rule for liquidity’s sake is vital to investing. Normally you don’t even have to worry about liquidity in the market if you stick to well known names such as AAPL, GOOG, MSFT, SPY, or others.

What to do if you Invested in a Low Volume Stock.

Ok, so you should have found this article earlier. Now you own a stock with low liquidity and are way over your head.

Let’s see if we can scavenge your investment. You are going to lose money, but maybe we can get back a decent portion of it.

The trick here is to place limit orders for your investment in small enough increments to get you out while also not tanking the stock price. For example let’s say you owned 10,000 shares of a penny stock who’s daily volume was only 1,000 shares.

Then you would follow the 10% rule and calculate 10% of the average daily volume on the stock for the past 2-3 months.

We already know the average daily volume in this scenario is 1,000 shares. That means you would sell at max 100 shares a day to prevent tanking the price.

You will need to be diligent in order to get out but in theory you could sell all 10,000 shares in 100 increments. This means that it would take you 100 days to fully get out of your investment.

It’s going to take you a long time but if volume ever picks up then you can exit sooner. (this is because daily volume will increase)

Conclusion

Volume is the most important thing that you can watch out for in the stock market. Without a sizable amount of volume then you should never enter into an investment as you may never be able to ‘liquidate’ your stock back into cash.

So long as you follow the 10% rule on the average daily volume then you will be ok and not fall into a liquidity trap.

As always if you like content like this then you should share on social media and subscribe to the newsletter. Every share helps me help others generate wealth in the market.

Further, check out our research posts on what stocks are the best idea for growing your wealth over time.

-

How Long Does a Short Squeeze Last? (3 Answers)

What is the time frame for you short squeeze? Well here is everything you will ever need to know to determine how long it will last.

-

Why You Still Own a Stock After It’s Delisted and How to Sell It

Do you still own a stock after its delisted? How do you sell it? Don’t worry the stock is still worth money and here is how to sell.

-

Can You Make 1% A Day in the Stock Market? (3 Steps)

Making 1% a day in the stock market is hard but defiantly doable. Here are 3 simple steps to helping you achieve this return.

Until next time, I wish you the best of luck in your investments.

Sincerely,