Hey guys,

This post explains one of the basic types of orders for the stock market; buying a share. This is starting building block of a portfolio and should be one of the first order types that you learn. This post is another in a series on introductory posts to learn how to invest in the stock market. This is how you buy a stock.

Our previous post went over how to get started investing in the market.

How to get started investing in the U.S stock market: Simple and easy answer with pictures.

Let’s get started.

Buying a stock simple answer

Buying a stock, or going long, is when you buy a portion of an asset that is publicly traded on an exchange.

In the business we call the term ‘buying a stock’ going long in a position. The reason behind this is because when you go long you are expecting the asset’s (or stock’s) value to rise over time. As such you take a long position, since well you are expecting to hold the stock for a long time.

That’s the super simple explanation for buying a stock. Now let me show you how you do it and how you make money.

How to profit from going ‘long’ or buying a stock

For this example we are going to be buying the SPY. The SPY is a fund that seeks the track the largest 500 companies in the United States. It has served as a benchmark to measure the U.S economy against and generally goes up year over year.

As you can see the SPY has steadily gone up (outside recessions) for the past 20 years. You would be wise to buy the SPY and hold it for several years based off the history of the ETF alone. Right now one share of the SPY sells for $434.10 so lets go ahead and buy one.

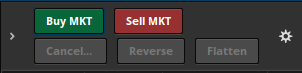

What you are going to be looking for is the ability to buy a share at market value. This means that you will put an order in to buy 1 share of the SPY at the current market value of SPY, or $434.10. Most trading platforms have simple buttons to execute this. If you can’t find it on your platform you should call your broker, they will help you.

So lets buy at market value by clicking the green button. You just spent $434.10 to buy one share of the SPY, congratulations! You are now an investor.

How to profit from your buy order

We are all here to make money. Let’s look at how your ‘buy’ or long order will make you some money passively.

Since you bought your one share at $434.10 and the price is now $430.36 what do you want to do. The answer is not sell as you will be out $4 (industry term is ‘down’ $4). Since we know the SPY will trend up eventually you simply need to hold onto the SPY and wait. Eventually your one share of the SPY will be valued higher than your ‘entry’ price of $434.10.

If the SPY jumps up to $450 and you sell then you will have successfully made $15.9 on your trade. This represents a meager 4% gain on investment, but you did it without any effort. This is why investing can make you a millionaire if you invest wisely and in the right assets!

What to do now with your extra cash.

So you sold your share of SPY at $450 and made a nice $15.90 as a result. What do you do with this extra money?

Well you an either pull it out of your brokerage account and spend it on whatever you like. Or you can reinvest those earnings into another ‘buy’ or ‘long’ order. This is what most people do and it’s called compounding returns. If done properly your ‘buy’ orders will compound and return massive profits!

Conclusion

Going ‘long’ on a stock (or buying) is a great way to generate a passive return over time. Depending on what trading platform you are using it is a relatively easy process. If you are stuck and can’t find the buy button then you should reach out to your broker, they are paid to help you.

As always if you like content like this then you should share on social media, like, follow, and subscribe to our newsletter!

-

How Long Does a Short Squeeze Last? (3 Answers)

What is the time frame for you short squeeze? Well here is everything you will ever need to know to determine how long it will last.

-

Why You Still Own a Stock After It’s Delisted and How to Sell It

Do you still own a stock after its delisted? How do you sell it? Don’t worry the stock is still worth money and here is how to sell.

-

Can You Make 1% A Day in the Stock Market? (3 Steps)

Making 1% a day in the stock market is hard but defiantly doable. Here are 3 simple steps to helping you achieve this return.

As always, I wish you the best of luck in your investments.

Sincerely,

Comments are closed.