The fall months of October and September mean a lot of things to different people. To some, fall means candy, pumpkin spice, and cold weather. To investors however fall means increased volatility in the market.

In steps the aptly named “October Effect.” An event where retail investors panic and begin to sell their positions in droves, thus driving down the overall value of the markets. To savvy investors there are ways to profit from this increased volatility. A good investor can gain an extra 5-10% on their total yearly return simply by utilizing these 3 tricks to profit from the “October Effect.”

The 3 tricks to profit from the “October Effect ” are to buy market ETFs after a drop, buy ETF puts in September, and to sell ETF put’s during the rebound. By carefully performing these tips you can easily milk another 5-10% out of the market and really set yourself up for an amazing yearly ROI.

Here at ChronoHistoria I teach people how to generate above normal market returns. I publish articles on stock research and tips/tricks of the investing trade. If you want to stay updated on everything that is going on feel free to sign up to the free newsletter.

So, let’s jump right into the 3 tricks to profit from the “October Effect” in the stock market.

First, What is the “October Effect?”

For those who are unaware, in the fall months of September/October typically the stock market sees a sharp decline in prices. There is typically no reason for this decline other than fear that the market will crash.

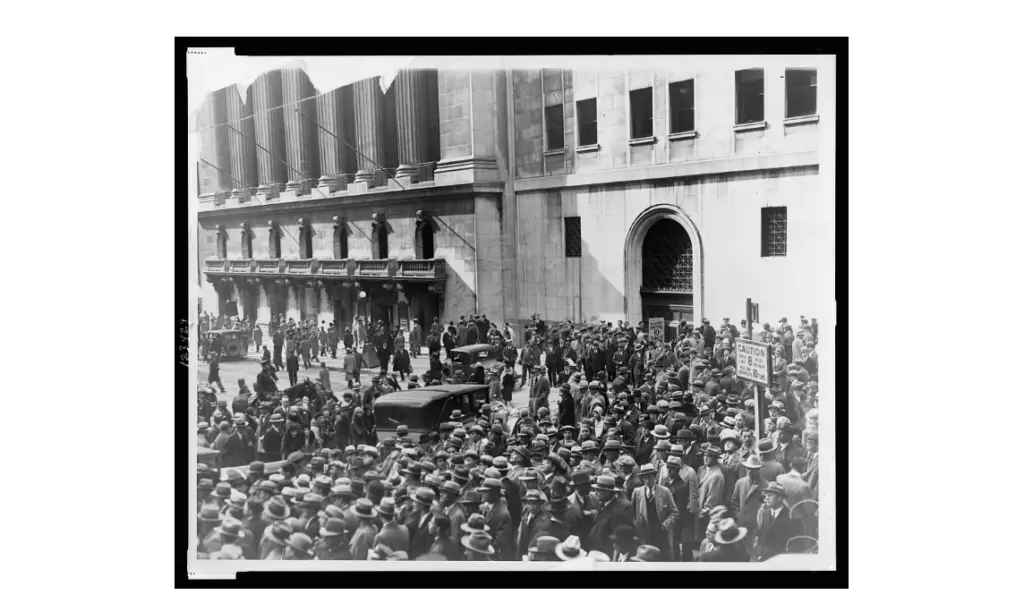

This fear stems from the fact that over the past 100 years October has seen some of the worst falls in stock prices in the United States. Some of the most notable stock market crashes have happened in October.

- Panic of 1907: mid October, 50% crash in the market (Source)

- October 24th, 1929 The Great Market Collapse/Black Tuesday: Start of the great depression, U.S stocks lost 50% of their value overnight. (Source)

- Black Monday Crash of October 19th, 1987: Global markets lost 11-47% overnight. (Source)

Imagine losing half of your portfolio overnight. Because of this retail investors have become incredibly weary of the months of September and October. As such typically in late September up through mid October stock markets across the world see a massive sell off.

Whenever there’s panic in the markets there is room for good investors to profit. Let’s jump right into how you can do this easily using a couple tricks of the trade.

Trick 1: Buy Large Market ETFs After A Drop And Hold.

Trick number 1 is simply to buy large ETFs that track the overall market and hold. In the above image we have SPY, the largest ETF on the U.S market. Here we simply buy and hold the ETF and wait for the rebound.

The SPY will eventually rebound back to where it was. This is because the SPY tracks the 500 largest companies in the U.S by market cap. Essentially if you are betting that the SPY will fall, you are betting that the U.S market will collapse.

If you take a macro economic look at the U.S market over the past 200 years you will notice that the United States never truly has a market collapse. Even during the great depression and 2008 recession the market recovered and eventually went above its highs.

With this trick we are simply going to wait out the “October effect” and sell the ETF once it recovers above its normal price. It’s the least risky way to profit from the “October effect” and this trick is a very hands off strategy. Simply buy and hold.

Depending on the year you can expect to get another 2-6% gain out of this trick on the “October effect.”

Trick 2: Buy ETF Puts In September

In the above image we strategically bought a put contract on a large ETF in September. As a result, as the ETF’s value declined in October we began to make money.

This type of strategy works if you get in ahead of time in early September and hold until late October. I typically buy large LEAP option contracts so that I have lots of theta left in the contract. This lowers my overall risk in the position and also provides a practical hedge on my overall portfolio.

Once the ETF has dropped to its peak we sell this option put contract for a nice 20-25% return. Buying option put contracts is one of the best ways to gain a nice yearly ROI on your total portfolio. Further if you are holding ETFs in your portfolio (which you should) then this also hedges you against any mass sell off because of the “October Effect.”

I wrote an entire article on how to properly hedge your portfolio to maximize your profit. If you’re interested you can check it out by clicking here.

From this trick you can expect to get around 6-15% return over the course of the “October effect.” However, once you start messing with options your total risk starts to skyrocket so I would only recommend that experienced investors perform this trick.

Trick 3: Sell ETF Puts On The Rebound

In the above image not only did we buy the underlying large market ETF during the bottom of the “October effect” we also sold a put on the same ETF. Because of this we are essentially betting that the ETF will not go down any further, if it does we will buy the ETF at the strike price ($285 in above image).

Because of this when the ETF rises at the end of the “October effect” we will rake in a huge amount of profit. In the above scenario off a capital investment of around $2,000 we made a total profit of $780 or about 61%!

Making a 61% profit in just about two months is huge. That means that if you put in $10,000 you would have made close to about $6,100 in cash. There is a catch however.

If the large ETF went below the strike price of $285 at any point then you would have to buy more shares of the ETF at the strike price of $285. So in the worst case scenario you would have to buy more shares of a large index ETF such as the SPY. So, not that big of a deal.

I personally use this strategy all the time and make a yearly return closer to around 20%. This is nearly double the average return of 9.25% that you can expect from the market. (Source)

If you’re interested I wrote an entire article on how to go about doing this during any pullback on the SPY. It goes over the step by step process to profit from this type of strategy. (click here for article)

Conclusion

There you have it, the 3 tricks to profit from the “October effect” in the stock market. Just by knowing how to perform these 3 tricks you will instantly open up a world of possibilities for your portfolio to profit tremendously.

As always if you like content like this then feel free to subscribe to the newsletter. It helps me help others passively generate wealth in the stock market. Who knows, maybe it will help you become the next millionaire. Then you can give a shootout to little-ole ChronoHistoria. I will still be here doing what I do best, making money in the stock market.

Further, you can check out some of the other posts below.

-

How Long Does a Short Squeeze Last? (3 Answers)

What is the time frame for you short squeeze? Well here is everything you will ever need to know to determine how long it will last.

-

Why You Still Own a Stock After It’s Delisted and How to Sell It

Do you still own a stock after its delisted? How do you sell it? Don’t worry the stock is still worth money and here is how to sell.

-

Can You Make 1% A Day in the Stock Market? (3 Steps)

Making 1% a day in the stock market is hard but defiantly doable. Here are 3 simple steps to helping you achieve this return.

Until next time, I wish you the best of luck in your investment journey.

Sincerely,