An individual investor alone is nothing…however a million of them, that forms a stock market. Oftentimes professional investors, academic researchers, and hedge funds/investment banks forgot about the building block of all stock markets, investors.

The exact purpose of an investor in the stock market is to efficiently allocate capital from failing businesses to succeeding ones. In doing so the stock market becomes extremely fluid and smart investors can profit from this transfer of capital.

This article is going to show you precisely how to profit from the slow allocation of capital by investors from failing business to succeeding businesses. To do this we will be discussing the following definitions; stock market, alpha decay, and liquidity. If I do my job properly you will leave this article armed with the knowledge on how to constantly profit in any stock market.

As usual if you like content like this then feel free to subscribe to the free newsletter. I never spam, and the whole point is to keep you updated on the latest stock research/tips and tricks of the trade.

Without wasting any more time, let’s jump right into how to profit from the exact purpose of investors in the stock market.

Understanding Why the Investor is Important

Every single investor in any market in the world follows one simple law. That is the law of capital preservation and appreciation.

Essentially, every single investor interacting with the stock market only wants to grow and preserve their capital, nothing else matters. Because of this we can safely assume that investors will always sell what they think is a bad investment and instead invest in a good investment.

Now instead of talking about an individual investor spread this law out across an entire nation’s population. Suddenly, you can visualize how fluid and seamless the stock market truly is. Capital is constantly flowing in and out of investments as investors speculate if their chosen investment is a good choice.

Remember, no matter if the investor is an amateur or a professional they will always seek to increase and preserve their wealth. That’s the law of the stock market.

Definitions of Key Terms to Profit Investor Capital Allocation

There are three key terms that we will need to learn to profit from the concept of investor capital allocation. The goal here is to have you position an investment before the other investors start to get in. This is the secret behind the professional investors or ‘smart money’ (thus the name).

Here are the key terms that we will need to define.

- Stock Market

- Alpha Decay

- Liquidity

Definition 1: Stock Market

The stock market is simply defined as a market where investors can speculate on future values of individual shares of companies.

What we need to understand however is that we currently live in the age of global capitalism/globalism. Below is a link to an absolutely phonemical article written titled “Globalization at a Critical Conjuncture?” Written in the Cambridge Journal of Regions, Economy and Society.

https://academic.oup.com/cjres/article/11/1/3/4877030

For our purposes it’s important to understand that since all capital markets are now intertwined. If an elderly hospital patient in Cambodia sneezes then an investment banker in New York will buy 10,000 shares of a tissue company.

The basic building block of the stock market is the individual retail investor. For the first time in history there is a global capital stock market that is becoming more and more efficient every year. This means that the concept of capital flowing from failing business to succeeding business is becoming faster.

So what does this mean for us and this article? It’s rather simple, because all markets are interlinked we have more investors. More investors means a faster flow of capital from failing businesses to succeeding ones. This means that globally the potential returns on our portfolios have increased.

Basically professional investors who are armed with the right methodologies and knowledge see high returns while amateur investors see higher losses. Let’s put ourselves on the winning end of that trade.

Definition 2: Alpha Decay

The term alpha decay comes from particle physics. In physics the term describes the radioactive decay that happens to a primary particle over time where a tiny amount of the primary particle dissipates over time. (Source)

Obviously we are not physicists here, so why does this term matter to investing?

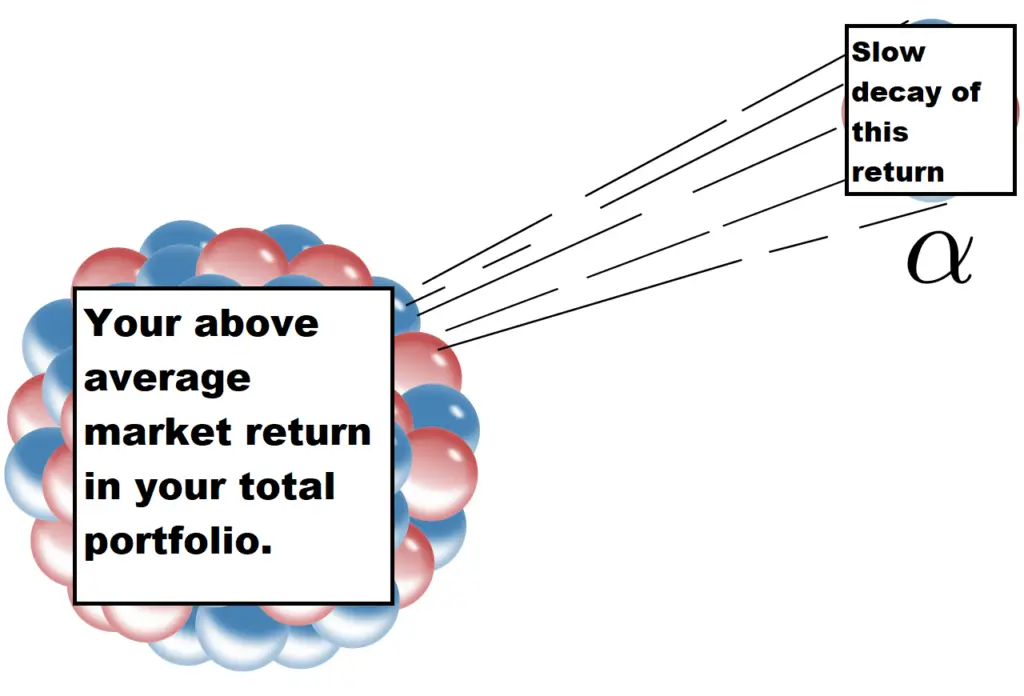

Alpha in a portfolio is the amount of return you get that is above market average. It is the secret positions that you put in your portfolio that return above normal market return (10%). If you put a midcap that you expect to return 30% over the next year then you have 20% alpha on that position, assuming you’re correct.

Now this 20% will slowly decay over time until it reaches 0% or normal market return. This is because eventually investors will start to catch on to your good investment and slowly start to allocate capital from their investments to yours. This will increase the average return in the market and thus decrease your ‘above average return’ or alpha.

To stick with the above image analogy; here is Alpha Decay visualized for your total portfolio.

So why does alpha decay matter? Well since all investors seek to gain more and more over time eventually your great investment will become the new norm. You will have to seek other places to return above normal returns, and eventually that will decay down to the average return.

We can make money from this decay as investors allocate capital to chase higher returns. The trick is to get into a position before the general market and to wait for the decay to take effect.

As we can see from the above image, if you got into a position with high alpha in month 1 then you would be able to extract almost the entirety of the position’s total value. Conversely if you got in around month 11 then you would only be able to get around 50% of the total alpha.

Finding Alpha is the plight of professional investors. Luckily for you, you found Chronohistoria.com here. I help people generate alpha in their portfolios for free…because I love what I do (and I make money from ads).

Definition 3: Liquidity

Liquidity is simply how easily you can liquidate an investment from a position back into cash. The lower the liquidity the less implied volatility and less alpha present within a stock.

For example, let’s say you invest in a stock when it’s worth $1 and has a daily trading volume of 100,000 shares. That means that in total the daily amount of cash flowing in and out of that stock is $100,000. If you take a position in the sizing of $50,000 then you bought 50% of the total daily volume. That means that you would have to wait several days to sell the entire position back to the market because there is almost no liquidity.

Stocks with high alpha have lower liquidity then they should have. If you remember high alpha positions are not commonly traded on the market yet because the average investor has not found out about it. As alpha decay takes effect you will notice liquidity in a position increase as more and more investors take a position.

One of the best studies done on liquidity increasing as alpha decay happens comes out of the University of Pennsylvania. Robert Stambaugh’s “Liquidity Risk and Expected Stock Returns” indicates that as liquidity increases so does potential returns. (source)

So why does this matter? Simply put if you place a good investment that is expected to gain you should notice liquidity going up as more investors enter into the position.

So How Do We Profit From This Investment Strategy/Methodology?

Here is the short and simple answer. If we position ourselves in stocks that are expected to return higher than normal market returns that have the capability to attract large amounts of retail investors then you will profit off hidden alpha present in liquidity increasing.

Right now it’s hidden because the relation to liquidity increase (volume increase) and alpha decay/generation is relatively new. Since the 90’s retail investors have been pouring into the stock market in droves, this has highly destabilized the nature of investing.

What has not been destabilized is the law that investors always look for higher returns and lower risk. To profit from the exact purpose of investors in the stock market we must open positions in assets that can explode in liquidity as more investors start to jump in.

If we position ourselves before the liquidity ‘jump’ we will be able to exit a position at a much higher value, thus increasing our total return. We need to look at assets that retail investors will think will increase in value, in the future. Opening a position in these assets will allow us to profit immensely as investors allocate capital from failing companies to succeeding ones.

This hidden effect of liquidity increasing total returns will only continue into the future as more and more retail investors clamor into the market. If done properly we can see huge alpha gains in portfolios.

Conclusion

There you have it, how to profit from the exact purpose of investors in the stock market. Its new methodology that has only just started making its rounds in the professional investment space. Who knows what the future holds and eventually this investment methodology will alpha decay back to normal market return, but for now its ripe for you to use in your portfolios.

As always if you like content like this then feel free to subscribe to the free newsletter. I publish stock research and tips/tricks of the trade.

Further, you can check out some of the other articles below.

-

How Long Does a Short Squeeze Last? (3 Answers)

What is the time frame for you short squeeze? Well here is everything you will ever need to know to determine how long it will last.

-

Why You Still Own a Stock After It’s Delisted and How to Sell It

Do you still own a stock after its delisted? How do you sell it? Don’t worry the stock is still worth money and here is how to sell.

-

Can You Make 1% A Day in the Stock Market? (3 Steps)

Making 1% a day in the stock market is hard but defiantly doable. Here are 3 simple steps to helping you achieve this return.

Until we meet again, I wish you the best of luck in your investment journey.

Sincerely,