You found a great stock with amazing value. You invested and now your down money. Before you sell to recoup a portion of your investment and let’s go over averaging down.

Averaging down on an investment will lower your cost per share and could result in you making huge returns if timed properly. In this article I will show you how and when the professionals average down on an investment.

As always if you like content like this you should share with your friends and subscribe to the newsletter. It’s really appreciated.

Without further ado, let’s jump right into averaging down.

What is Averaging Down

Averaging down on an investment is when you already hold a position and you buy shares as the stock goes down. This will reduce your price per share and result in your owning more shares at a cheaper price then before.

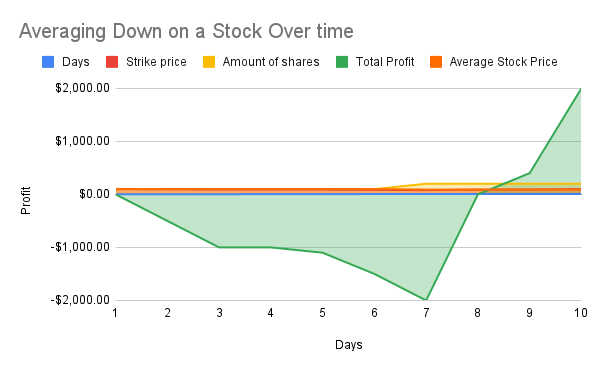

For example let’s say you bought 100 shares of a random company at $100. Your initial investment would be $10,000 (100 x $100= $10,000). Now let’s say that this company dropped in price down to $80 from the initial $100.

Your investment now is worth $8,000 instead of the initial $10,000. This sucks, you lost $2000 on your investment. You still believe that the company will be worth more in the future however so you decide to “average down.”

In order to average down in this position you would buy more shares of the company at the $80 stock price. Let’s say you decided to buy another $100 shares at $80. Now you have spent $18,000 in total and your investment is worth $16,000.

Your first price on the stock was $100 while the second buy price is $80. You now own 200 shares at an average price of $90 per share.

Now the company goes back up to where it was before at $100. You now made profit a profit of $10 a share, or about +$2,000! If the stock continues to go up you will continue to make more money.

This is why averaging down is so important. If your investment thesis is correct then chances are you can make a huge return.

As we can see from the above image buy doubling down on your investment on day 8 (buying another 100 shares) then your potential for profit skyrockets. This is because you average down on the stock price to double your potential gains.

How to Average Down

So you hold a stock and want to average down.

You need to make sure that you think that your stock will continue to increase in price over time. The best way to do this is to find a stock that you really believe will increase in price over time.

To learn how to do this check out this post on the three steps to pick out winning stocks.

3 Steps for Making Consistent Money in the Stock Market with Pictures.

In order to show you how to average down we need to pick out a stock that we believe will increase in price in the future. For this example I am going to use the famous SPY, as it tracks the U.S top 500 companies. This indicates that it will continue to go up over time.

We are going to buy the stock as it dips below an average amount. Let me show you how.

Averaging Down Example

Ok so lets say you bought 100 shares of the SPY in 2019 when it was priced at $300 exactly. You had no idea that in 2020 the Covid-19 pandemic would strike the U.S economy and as such your position tanked 17% over the next couple months to around $250.

Your choice here is to either sell your position in SPY and lock in your loss or to ‘double down’ and average down on your shares.

So you already owned 100 shares of the SPY at $300 and now you want to buy 100 more shares at a price of $250. This means that you will have in total spent around $55,000 on the SPY.

Further, your price per share after buying the 100 shares at $250 will have dropped from $300 down to $275 in total.

So your all in on the the U.S economy recovering. As a result of your faith in the resilience of the U.S market you are rewarded and in 2021 the price of the SPY rockets up to $400 a share.

Now your 200 shares of the SPY is worth a grand total of $80,000! This means that in one year you turned $55,000 into $80,000 by averaging down on your investment.

Had you simply waited with your initial 100 shares of SPY, bought at $300, you would have only made $10,000 when the SPY hit $400.

This is why the strategy of averaging down your price per share is so important. You need to identify if the potential investment will either rebound or go further up then your initial price.

Conclusion

Learning how to average down is an amazing entry level strategy to maximizing returns on good stocks. The secret of course is to identify great investments that have potential to grow in the future.

If you double down on a failing investment then you will lose more money then you initially put in. Strong investments that have a track record of returning increasing revenue while eliminating liabilities/overhead are great for growth opportunities.

Further, finding good value investments are a great place to practice this strategy. Practice makes perfect with this type of strategy.

As always if you like content like this then you should share on social media and subscribe to the newsletter!

Check out the other posts below!

-

How Long Does a Short Squeeze Last? (3 Answers)

What is the time frame for you short squeeze? Well here is everything you will ever need to know to determine how long it will last.

-

Why You Still Own a Stock After It’s Delisted and How to Sell It

Do you still own a stock after its delisted? How do you sell it? Don’t worry the stock is still worth money and here is how to sell.

-

Can You Make 1% A Day in the Stock Market? (3 Steps)

Making 1% a day in the stock market is hard but defiantly doable. Here are 3 simple steps to helping you achieve this return.

Until next time, best of luck in your investments!