| Read This After | Here Is What Happens to a Stocks Price After a Short Squeeze |

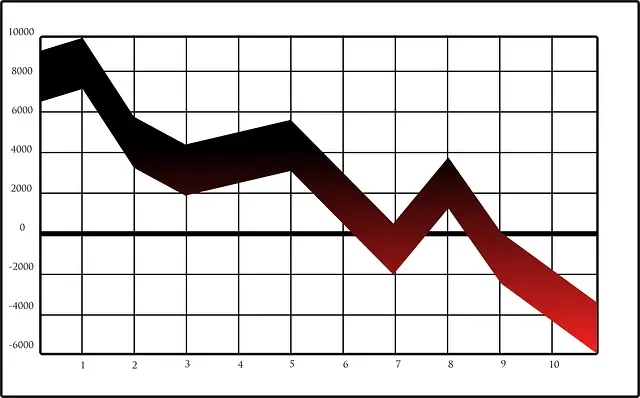

Short-selling a stock can cause the price to drop lower. This often causes people who are long on a stock to be upset but don’t worry in the end it all evens out. Here is an entire article going over why the stock drops lower if someone short-sells it.

Shorting a stock causes the price to drop lower because of the effects of investing in a negative position. When someone shorts a company they take out a negative balance which means they sell the stock before they even own it. In the future, they will have to rebuy the stock to zero out their position. This causes the stock to drop momentarily.

Many retail traders do not know the mechanics behind short selling. Many think that the practice of short selling is unethical but in reality, the practice is needed to help balance out the true value of the stock. Once an investor or trader understands the mechanics behind short selling they can use a shorted position to their favor to make larger-than-average returns on a position.

Here at ChronoHistoria, I aim to teach people how to make above-normal returns while also managing their risk. Feel free to subscribe to the free newsletter and share the site around the web!

Let’s dive right into the article; here is everything you will ever need to know about how short selling drives a stock’s price lower.

Short Selling Is Taking Out a Negative Position?

Remember this statement: short selling is a trader taking out a negative position on a stock. The trader takes out debt in the form of shares and will have to repay it back at a certain point. This is done by buying back the shares in the market.

This concept is a bit hard to grasp for newer traders. Whenever someone shorts a company they will first sell shares they don’t have and then have to buy back the same amount of shares at a later date. If the trader buys back the shares when they are worth less to zero out their debt then they will make money.

For example, let’s say I short 100 shares of the $SPY when it is worth $400. To do this I will need to sell 100 shares of the $SPY when it is worth $400 which causes me to go to owe the market $40,000 (100 x $400 = $40,000).

Now 5 months later I rebuy back the shares when the $SPY is worth $350. I bought back all 100 shares of $SPY that I owed to the market. However, since the value of a single $SPY share dropped from $400 to $350 it only costs me $35,000 to rebuy the shares. This means that I make $5,000 from the entire trade.

However, notice that I had to buy back the shares to close the position. This is very important because that means the stock’s total price movement from me is 0%. I sold 100 shares and then bought back 100 shares at a later date.

It is very important that we understand that short selling is taking out a negative position on a stock that we will have to rebuy in the future. We will drive down the stock’s price when we short the company but we will also increase the stock’s price when we rebuy the shares. In the end, it is a negative price movement.

Understanding How People Shorting the Stock Moves the Price

Ok, so now that we know the basics of short selling here is how shorting the stock will actually move the price downwards.

When a short seller sells a stock they have to sell the stock to create a negative balance. This means the short seller must sell the stock to a prospective buyer. What retail traders see on their end is a red number that indicates somebody sold the stock.

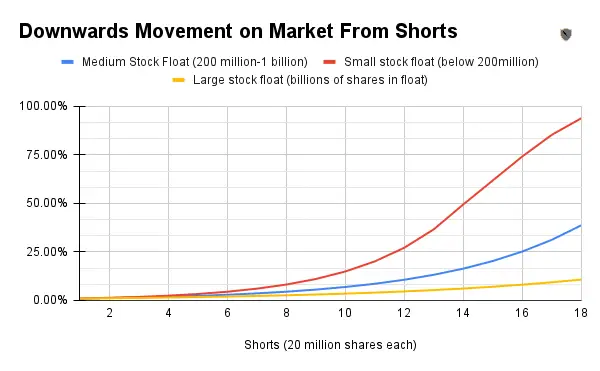

This creates downwards pressure on the stock’s price. If there are enough of these short sellers then the downwards pressure will cause the stock to go down. However, depending on the volume and size of a stock this downward pressure is different.

For large stocks with a ton of shares on the market (float), you will see almost no movement from shorting. These are stocks such as large ETFs or blue-chip stocks. There simply are too many shares in the stock’s float to have shorters move the stock.

However, are the total float of the company decreases so does the power of the shorts to affect the company’s stock price. Mid-cap companies with a float of 200 million shares to 1 billion will start to notice their price decreasing as more people short their company. However, even a mid-cap company will hardly see much of a decrease outside of extreme circumstances.

Where shorts impact the float the most is with small-cap companies. These are companies where the float is under 200 million shares. Often a large group of short sellers can drive down these companies by 15-20% over a couple of days by shorting the company. This will only take place however if the buyers of the stock remain normal.

It is important to understand how short selling impacts the company’s stock price. For small-cap companies, short sellers actually can lower the total price of the stock. However, this really only happens to small-cap companies. Mid-cap and large-cap companies will have a large enough float on their stock to prevent any amount of shorting from significantly impacting their company.

Simply put, if you short-sell a stock you will instantly sell the stock for a set price. This will cause the price to go down slightly. However, you will have to buy it back in the future so the overall investment is net neutral.

Is It Bad That People Can Move the Stock by Short Selling?

So here is the golden question that people will ask after learning how short selling can impact a stock’s price; is it bad that people can move the stock price down by short selling?

The answer to this depends on the person but generally speaking no, it is not bad that short selling moves the stock’s price down. This is because the short seller must at some point also buy back the shares to zero out their total position.

On top of this every day the short seller holds the loan on their shorted shares they will have to pay a fee. You can think of this as interest paid on a car or home loan. The odds are stacked against the short seller when you compare the benefits of buying and holding shares.

So why do people short-sell then? Well, the answer to this is that it is by far easier to find failing companies than it is to find good and succeeding ones. This is because a good company has thousands of variables that it needs to control in order to grow and scale. A failing one simply needs to exist.

Several of the most profitable traders in the world have made their money from shorting companies that are failing. Millions of dollars were made on the decline of BlockBuster, Gamestop, and Sears. You can also invest the same way and make similar returns that hedge funds and the pros do.

Conclusion

There you have it; an entire article going over how short sellers drive a stock’s price lower. While some people might think short selling is unethical it is actually a vital part of the stock market. This is because short sellers help correct a stock’s price when it is overvalued.

You can mimic the investing strategies of hedge funds and other professional investors. That is why I created the website ChronoHistoria; I am to help people learn how to professionally invest and trade in today’s crazy markets. If you liked this article then feel free to subscribe to the free newsletter and share around the web.

Further, you can check out some of the other articles below.

-

How Long Does a Short Squeeze Last? (3 Answers)

What is the time frame for you short squeeze? Well here is everything you will ever need to know to determine how long it will last.

-

Why You Still Own a Stock After It’s Delisted and How to Sell It

Do you still own a stock after its delisted? How do you sell it? Don’t worry the stock is still worth money and here is how to sell.

-

Can You Make 1% A Day in the Stock Market? (3 Steps)

Making 1% a day in the stock market is hard but defiantly doable. Here are 3 simple steps to helping you achieve this return.