On the 29th of July, 2021, Exponent Inc released their quarterly earnings report. The market expected that the report would indicate around $.042 per share but instead EXPO delivered a massive $0.48 a share instead.

The next day EXPO shot up 7%!

1 year chart on EXPO

Since then everyone has been asking if this was just a rare occurrence or if EXPO is a good investment. Well I’m here to show you why EXPO deserves to have at the very least your attention, at the best a well deserved spot in your portfolio.

This research post is broken down into three sections; Fundamentals, Technicals, and Investment Thesis. I encourage you to read through all of it but if you are strapped for time at the end of each section I give a summary.

As always if you like content like this then you should share and subscribe to the newsletter. Every share helps me help others grow and compound wealth!

Without further ado, let’s jump right in.

Fundamentals

The fundamentals section of EXPO is broken down into the business plan, growth strategy, finances, and risks.

By studying fundamentals of a stock you will learn exactly what the business does, how well it does it, and how well it can capitalize upon its success and grow.

Let’s get started.

Business Plan

Exponent Inc. provides engineering and scientific expertise on a consulting basis to solve some of the worlds most advanced problems.

To do this EXPO recruits and retains employees with graduate degrees that can provide expertise within their field. EXPO has over 300 of these highly educated employees spread out across 90 different technical disciplines.

Normally this type of pay for consulting business model is not as successful. EXPO breaks this mold by having a huge customer basis with a solid history of success. Since 1967 EXPO has been helping large companies with their R&D research, design, and implementation.

As the business world increasingly becomes more complex EXPO has seen the demand for their services skyrocket. Over the past decade EXPO has seen the demand for “failure prevention and technology evaluation” services explode across developed economies.

Companies are willing to pay EXPO up to $825 an hour for an expert to evaluate, localize, implement, and solve an issue that would normally take hundreds of salaried manhours to do. EXPO and their target customers engage in contracts to provide the expertise for months on end.

Here are the major sectors where EXPO provides consulting.

SEctors for consulting

- Buildings and Structures

- Data and Computer Science

- Biomedical Engineering and Science

- Electrical engineering

- Human Factors

- Polymer Science and Materials Chemistry

- Biomechanics

- Civil Engineering

- Large scale construction consulting

- Materials and Corrosion Engineering

- Thermal Sciences

- Vehicle Engineering

- Ecological and Biological Sciences

- Environmental and Earth Sciences

- Health Sciences

- Chemical and Food Government Regulation.

Quite a large list of services provided. Normally a company with such a diverse portfolio would be ‘spread to thin’ but in this case its fine. This is because EXPO retains 930 expert employees spread across all of these sectors. 642 of these employees have obtained an education level of Ph.D, Sc.D, or M.D.

These 930 experts are spread across the globe and sit upon over 250 scientific and engineering committees and advisory boards. This not only gives EXPO prestige but serves as a way to box out competition.

This is because customers are willing to pay a premium to have an expert, who is active in their field and has connections, help them with their issues. Other companies cant compete with this and as such EXPO can offer a premium for their services.

Growth Strategy

EXPO aims to grow into further sectors in the coming years. In order to do that they have to keep and retain new expert personal.

Thankfully EXPO has not had any issues with personal retainment or recruitment. This is because EXPO takes extremely good care of their personal with ample work/life balance and pay. Further EXPO provides all the necessary materials for their experts to provide the best service as possible.

This means that EXPO pays a huge premium for aids, labs, materials, research, and publications. The expert could not get this anywhere else and as such stays where they are treated the best, with EXPO.

Because of this EXPO stands to dominate emerging markets across the globe by providing superior localized service. As we speak EXPO is hiring for over 200 positions with 140 of those open for professional consultants.

Further, EXPO has a long track record of serving large cap clients successfully. Because of this they have seen a snowball affect of mid cap clients requesting service and this trend is expected to continue.

Simply put, there is plenty of room for EXPO to grow by staying their course and not deviating from what’s working.

Finances

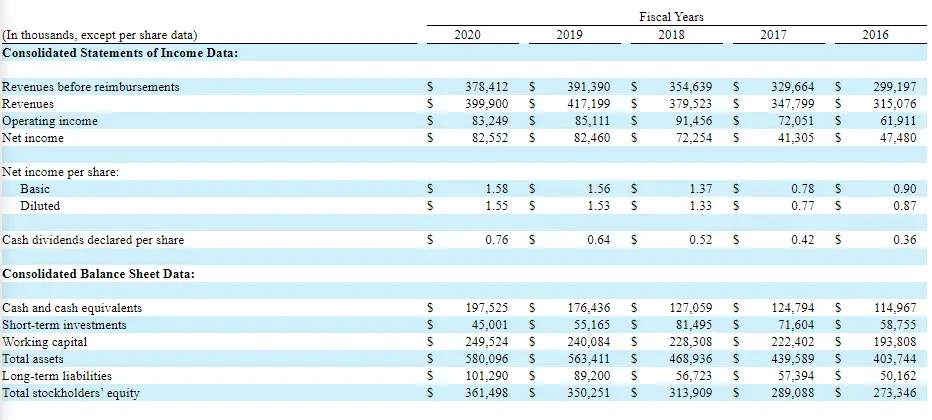

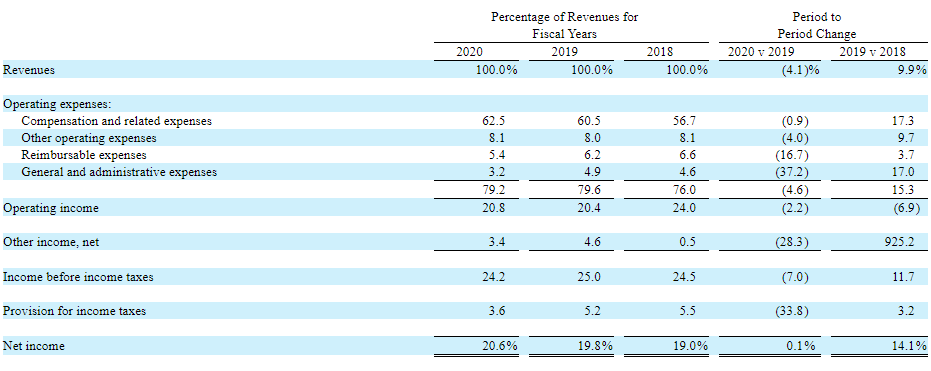

As we can see every year except for 2020 has seen increasing revenue growth. The reason for revenue declines in 2020 was due to the pandemic and select companies cutting consulting hours prematurely.

Even with this decline in revenue we see a higher net income during 2020. This was because EXPO manages internal investments, which did well in 2020. This helped to offset the loss of revenue.

The above image is of EXPO’s operating expenses. In 2020 EXPO saw a net income of 20.6%, which was still higher then the previous year. This is amazing as 2020 was the worse year for EXPO but they still managed to increase net income over operation expenses.

On the 29th of July, 2021, EXPO announced their 2nd quarter financial results. With the easing of pandemic restrictions EXPO saw a revenue gain of 30% over last year ($119 million vs. $92 million)! As a result, EBITDA increased from 26% of net revenue to a huge 36% of net revenue (WOW). Citation

This from a profitable company regardless of economic situations. My hat is off to the CEO Dr. Catherine Corrigan who ran a tight ship during the pandemic and is now profiting from the results.

This type of financial success and clever management is reflective in their 20 year chart.

If you would of invested $10,000 in 2013 in EXPO your investment would now be worth $109,000…. talk about growth. That is a 1,090% gain in just over a decade. This more then beats average market return of 10% per year.

Risks

Ok, so what are the risks to such a profitable company?

Well the risks revolve around two major variables; customers hiring their own talent, pricing, and global macro risks.

let’s jump right into them.

Customers hiring their own talent

It is possible that a large enough customer of EXPO could hire their own talent or steal EXPO’s professional. One of the many expert consultants could decide that the customer they have been working with for the past year is better then EXPO.

This is certainly a risk but I think that its blown out of proportion. This is because EXPO gives the experts everything they could ever want. The pay their staff incredibly well with the entry level associate positions (grad students still in school) making well over $100,000 a year. Citation

Further, EXPO gives the expert any resources they might need to get the job done. For academics this is perfect because they can have an army of graduate students doing the menial labor as well as staff to handle the paperwork.

Because of this the retention rate of EXPO consultants is near 100%.

Further, if a customer hires their own talent they would miss out on the other experts that EXPO can throw at their situation. The customer would have to hire an entire team of expert’s and that simply would take to long and be way to costly.

Its easier for a customer/client to pay EXPO.

Pricing

This is a real risk to EXPO.

The pricing model of EXPO is high. The average range for consultant pay from EXPO is $500 an hour. At 40 hours a week for a whole month that is $80,000 a month the customer has to pay to EXPO to retain the consultant.

While this is pricy, for many of EXPO’s larger clients its actually cheaper then hiring and retaining the right talent for the job.

However, its very possible that a competitor could come in and offer a cheaper price. This however would cut into the consultants pay and push the experts to go to where they are paid the best, with EXPO.

It could happen if EXPO ever became bloated with overhead. I don’t see this becoming a thing anytime soon. Maybe in 20 years.

Global Macro risks

The pandemic demonstrated how much EXPO is at the whim of their clients sectors.

Since EXPO is spread out across so many sectors any major event that would affect the global economy would heavily impact EXPO.

This event could be a pandemic, a world war, or a natural disaster. This risk cant really be hedged against by any company in the world. I mention it because I think that EXPO is slightly more exposed then a normal company.

Summary of Fundamentals Section

EXPO is a great company at the fundamental level. They specialize in providing extremely high level consultants who are recognized as experts in their field.

EXPO’s growth strategy is amazing and has primed them for aggressive expansion from 2022-2030.

EXPO’s finances are the best part about the company. They have a huge EBITDA and have beat market expectations for earnings time and time again. Exponent Inc really is in a good spot financially.

Regarding EXPO’s risks. They are negligible for the time being. I don’t see EXPO having any major pitfalls for the foreseeable future unless a competitor comes in and can pay their consultants more while also reducing overhead. This does not seem likely for the time being.

Technicals Section

In the technicals section I am going to outline the chart, average volume, P/E, EPS, and Float/short. The goal here is to present how accurate the chart reflects the growth value of EXPO, the volatility of the stock, and what size position you can take.

Let’s jump right in.

1 year and 20 year chart on EXPO

As we can see the above image is the 1 year and 20 year chart on Exponent Inc. EXPO has trended upwards since 2012.

The charts seem to have a form of resistance in the low $80’s. This is good as this indicates the ‘floor’ for the share price has risen over the course of the year.

Right now we are in a breakout on the stock with the news of EXPO’s recent amazing earnings.

Average Volume

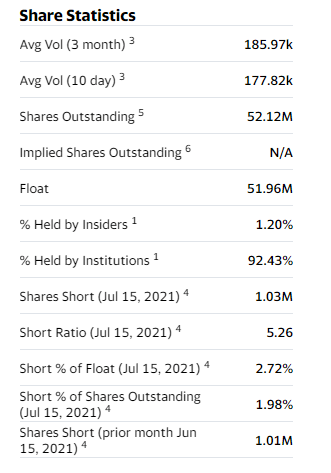

The average 3 month volume on EXPO is 185. 97 K while the average 10 day volume is 177.82K. Citation

The reason for this decline in volume was the increase in share price from the low $90’s up to the high $100’s.

Further, this indicates that the maximum position you can take for liquidities sake is just shy of $17.7 million. (following the 10% rule).

This size volume is to be expected for a stock this size. I foresee the volume on EXPO increasing to be closer to 300k average volume over the next year as more and more people buy in.

P/E

The current Price to Earnings (P/E) ratio of EXPO is 65.3. Citation

This high P/E ratio indicates that the market is very bullish on EXPO and that it should consolidate in share price around $104 before pushing back up.

P/E is a good way to indicate market sentiment on a stock.

EPS

Earnings Per Share or EPS on EXPO is currently 1.64. Citation

This EPS indicates that EXPO is overvalued in relation to its share price floor. A good place for the EPS to equal out at is in the mid $90’s or low $100’s.

This is nothing to be afraid of just further indicates that the market is bullish on EXPO.

Float/Short

As we can see the float on EXPO is 51.96 million while the short percentage is only 2.72%.

Both of these indicate that should EXPO get any volume it will shoot up. This is because the float is only 50 million. Further, since the short percentage is only 2% the market is bullish on the stock.

Summary of Technicals

Overall everything on the technicals of EXPO indicate that the market is expecting the stock to first pull back in to the low $100’s and then start to shoot up.

Its a bullish sign for Exponent Inc.’s stock ticker EXPO.

Investment Thesis

So why exactly is EXPO a good investment and what is going to increase its stock price?

Well the answer lies in the growth of high skilled jobs across the developed world. EXPO serves to capitalize tremendously on this growth by offering large cap employers a way to reduce their overhead while also filling temporarily vacant employment spots without taking on excess employees.

Every year that goes by EXPO stands to increase further in value simply because they can provide the talent to solve, build, identify, and implement solutions for some of the hardest corporate problems.

Growth and Demand for High Skilled Labor

EXPO makes its money off providing highly skilled expert labor at a fraction of the price that it would take to hire them fulltime.

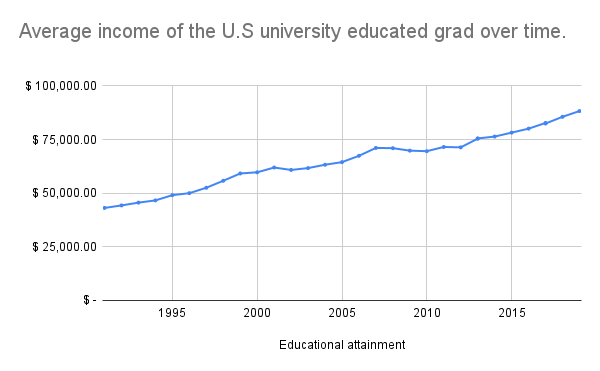

As the world becomes increasingly more and more specialized this type of labor is going to be going at a premium and Exponent Inc can fill the necessary labor spots. For a demonstration of how fast this labor pool is growing here is a chart demonstrating the average salary for a university level graduate over time in the United States

Over the past three decades we have seen the average salary for a new hire in the United States skyrocket. This is because of the ever increasing complexity of the working world.

As this trend continues then so will the demand for expert consultants within the workforce. This is the reason that we have seen Exponent Inc. increase in value over the past decade by 1,000% year over year!

If this trend continues I don’t see any reason why we cant see EXPO at a share price of just under $200 within 3 years.

Summary of Investment Thesis

The demand for expert consultants is increasing across the board. This is because as time goes on the larger successful business need to hire the right talent to compete successfully.

Further, new university graduates are getting paid more for their skillsets even though they are entry level. This further indicates that there is an ongoing demand for the right talent in the field.

Finally, Exponent Inc has all the financial capability in the world to position themselves to capitalize upon this trend going forward. They can attend hiring events, offer sign on bonuses, acquire the right talent to ‘lend’ to their clients and continue to make the massive revenue they have been.

I only see EXPO increasing in value over the next 5 years. Within 3 years we could see a share price between $180-$195. Which would represent a year over year growth of 14.3% per year. That is around 4% higher then normal market returns!

Conclusion

Buying EXPO seems to be a good idea currently. It has everything needed to explode in value over the next decade and is a good investment.

The risks are minable and the company is posting record profits. Further, they have successfully positioned themselves in a sector that is rapidly expanding where they can offer their services at a premium.

Exponent Inc is a good investment.

As always if you like content like this then you should share on social media and subscribe to the newsletter! Every share helps me help others!

-

How Long Does a Short Squeeze Last? (3 Answers)

What is the time frame for you short squeeze? Well here is everything you will ever need to know to determine how long it will last.

-

Why You Still Own a Stock After It’s Delisted and How to Sell It

Do you still own a stock after its delisted? How do you sell it? Don’t worry the stock is still worth money and here is how to sell.

-

Can You Make 1% A Day in the Stock Market? (3 Steps)

Making 1% a day in the stock market is hard but defiantly doable. Here are 3 simple steps to helping you achieve this return.

Until next time, I wish you the best of luck in your investments!

Sincerely,