Investor Sentiment, or ‘hype’, surrounding a stock can drive prices through the roof. Understanding how to predict this hype will allow you to place an investment and make absolutely massive returns.

The above chart is of Gamestop (GME). As we can see hype for the stock sent GME’s price from the low $40’s soaring up to close to $500! If you had gotten in before the investor hype on the stock shot up then you could have turned an investment of $10,000 to $110,000 within a week.

As always, if you like content like this then you should share on social media as well as subscribe to the newsletter! Every share helps me help others, so its much appreciated.

Let’s jump right in on how to predict these movements.

Step 1: Tracking the Volume

Typically months before a stock is about to explode off investor sentiment you will notice a gradual uptick in volume.

This is because more and more people are ‘buying in’ to the stock for whatever reason. Sometimes this reason can be because a ‘guru’ online said so, or the retail investor noticed a post on a popular investment board online.

Regardless of the reason as more and more retail investors notice the stock they will start to buy into the company. This will steadily increase the ‘hype’ surrounding the stock, which will take the form of steadily increasing volume.

Let’s look again at the Gamestop explosion.

Notice the blue and red bars I put on the bottom of the chart. If you look closely you will notice the blue bar is for the months of July and August of 2020, while the red bar is of September 2020 through early January 2021.

During the blue bar the average volume for GME was around 2 million shares daily. During the red bar the average volume for GME increased to a huge 35 million shares daily!

That represents an increase of 1,750% in daily volume. GameStop had not announced anything new during this period, so there was no justification for the sudden investor intrigue in GME.

This increase in volume was generated from investor hype surrounding the stock.

It is important to track the volume on these stocks and to figure out why it increased. If there is a logical reason, say GME cured cancer, then I could see why suddenly every retail investor was interested in the stock. Since there was nothing then we can move onto the next step.

Step 2: Figure out Stocks Float

This is the next vital step. We need to figure out how fast the stock can move.

To do this you need to figure out how many shares are available for the public to trade. This number is called the public float of a stock, more commonly referred to as the ‘float.’

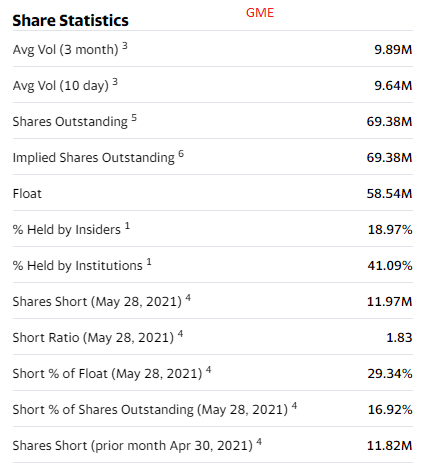

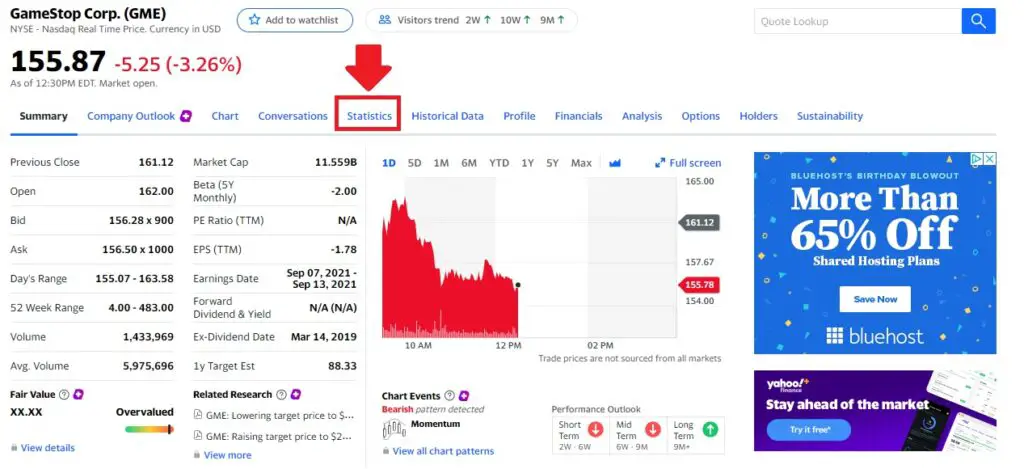

There are many ways to do this but the method that I chose is to go to Yahoo.Finance.com. On the homepage you can enter in your stock’s ticker in the search bar.

The next step is to then navigate to the statistics section of your stocks main page.

When you click on this statistics section you will then be greeted with a bunch of data that wont make any sense to you unless you have been doing this for a while. We are going to find the float section in the GME share statistics tab.

This is a zoomed in section of what you are looking for… the Share Statistics.

As we can see the Float of GME is 58.54 million. This means that there are 54 millions shares available to buy or sell on GME.

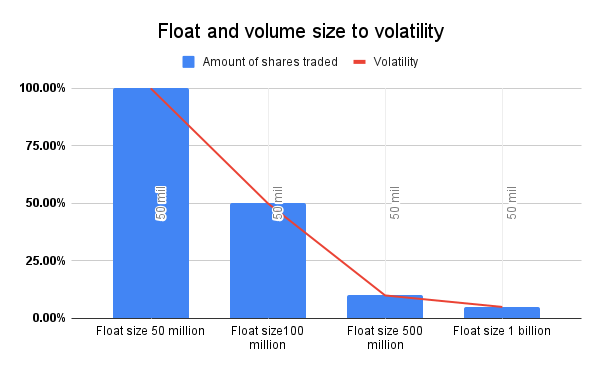

Below is a chart representing how float size affects the volatility on hyped up stocks.

The above chart has a consistent volume of 50 million shares traded. As we can see as the float size gets larger the blue bar gets smaller. This because there are more shares available to buy in relation to the consistent volume of 50 million.

Since we already know that in the days leading up to GME explosion the volume increased to 35 million daily we can reasonably assume that GME had a huge explosion in potential volatility as well.

This is why understand the float as well as the volatility is so important. If the daily volume on a stock is near the maximum float then the law of supply and demand goes into affect. This will drastically increase the stock’s price so long as buying demand (volume) stays high.

Step 3: Figure out Investor Sentiment.

Your goal here is to figure out what the average retail investor who is looking at the stock thinks. Fortunately this is a fairly easy task and does not have to be perfect.

To do this you must go to where the investors congregate to discuss their ideas. The best spots for this are website forums such as WallStreet Bets, Twitter, or Stocktwits.

By simply asking questions of what people think you can gauge the average investing knowledge of these traders and what their position will be in the future. Sometimes they might even tell you when they will take a position, which often revolves around a fixed number.

By listening to enough of these retail investors you will be able to figure out if they are bullish or bearish on the stock. This will help tremendously as these retail investors are the people who drive the stock price up.

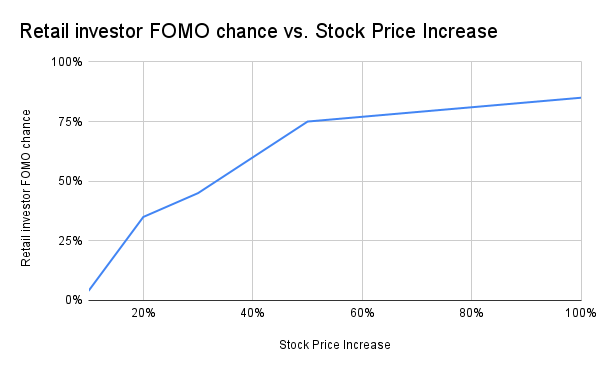

This is because the average retail investor experiences FOMO (Fear of Missing Out) when a stock price they were looking at begins to increase in price.

Because of this FOMO the average retail investor will chase the stock price as it continues to climb. This will further increase the stock price and will lead to a runaway snowball of price increases.

Its my goal here to position your investment before this happens to maximize your potential returns while minimizing your risk.

Let’s begin to place our investment.

Step 4: Calculating Liquidity.

Before you buy shares in anticipation of an explosion in share price you absolutely need to calculate liquidity in the stock.

This is because if you buy to many shares there is a chance you wont be able to sell those shares back to the market without tanking the price and selling at a considerable loss.

The easiest way to do this is to simply follow the 10% rule. The 10% rule is where you take the average daily volume of the stock in the past 5 months and only buy 10% of it.

For GME the average daily volume before the explosion was close to around 7 million. This means that at max you could of taken a position of 700,000 shares. This would of allowed you to sell the position whenever you wanted without tanking the price.

Assuming an average share price of $20 before the explosion. You could of at max invested $14,000,000 into Gamestop and be safe from a drop in liquidity.

If the explosion does not work out and you took to large of a position you might be left bag holding. This is because you would not have been able to sell your position had you not looked at liquidity before buying.

Take it from me, this is a rookie mistake that hurts a lot when you mess up. I know I have done this numerous times, so please, look at liquidity on any asset before you invest.

Step 5: Invest and Wait.

The biggest reason people lose money in the market is that they are not patient. You are going to have to wait for the explosion to happen, so grab a drink/coffee and chill.

Set an alarm on your position to notify you as to when the stock price explodes. Contact your broker as each trading platform is different. They are paid to help you do this.

While you wait you need to track volume, remember its what is going to drive the stock price up. If volume is consistent and large in relation to the float size then you are still good.

As soon as the volume starts to drop day over day its time to get out. Fortunately for you if you followed the 10% rule on liquidity then you can liquidate your position for near what you bought in for.

The secret to this style of investing is to continuously look for opportunities in the market and position an investment (following the above steps) and wait. If volume starts to decrease then get out and wait for it to increase again.

Eventually you will hit a stock that will explode and your investment will triple in worth overnight. The next step is to short at the peak which in theory will double your profits.

But that’s a topic for another day…..

Conclusion

Learning how to identify, gauge, and safely position an investment to explode with a stock is key to making money in the market. Before you invest remember the 5 step process; Volume, Float, Sentiment, Liquidity, Patience.

If you do this then you will be fine.

As always if you like content like this then you should share and subscribe to the newsletter! Every share around the internet helps me help others so its much appreciated!

-

How Long Does a Short Squeeze Last? (3 Answers)

What is the time frame for you short squeeze? Well here is everything you will ever need to know to determine how long it will last.

-

Why You Still Own a Stock After It’s Delisted and How to Sell It

Do you still own a stock after its delisted? How do you sell it? Don’t worry the stock is still worth money and here is how to sell.

-

Can You Make 1% A Day in the Stock Market? (3 Steps)

Making 1% a day in the stock market is hard but defiantly doable. Here are 3 simple steps to helping you achieve this return.

Until next time, I wish you the best of luck in your investments!

Sincerely,