A REIT stands for Real Estate Investment Trust. These companies generate all of their revenue from leasing out real estate in a chosen market.

So are U.S REIT stocks a conservative choice for your portfolio? The answer is generally a no outside of a few select REITS who have either positioned themselves in a great sector or have such a widespread portfolio of real estate holdings.

Generally speaking you are better off investing in a large index tracking ETF such as the SPY or VTI. By investing in REITS you are going to get lower returns over the lifetime of your investment with the same amount or higher risk.

This is because the value of the real estate market in the United States follows the larger economy as a whole (outside select portions). If the U.S economy is down then your investment in a REIT will either not grow or worse begin to fall.

Let me explain in more detail.

Overall U.S REIT market vs. the SPY

Profitability

We are going to compare the largest ETF that tracks the U.S REIT market to the SPY. The goal of this is to show you that generally investing in REIT’s is not a conservative bet. There are times to do it but generally its better to buy and hold major ETF’s.

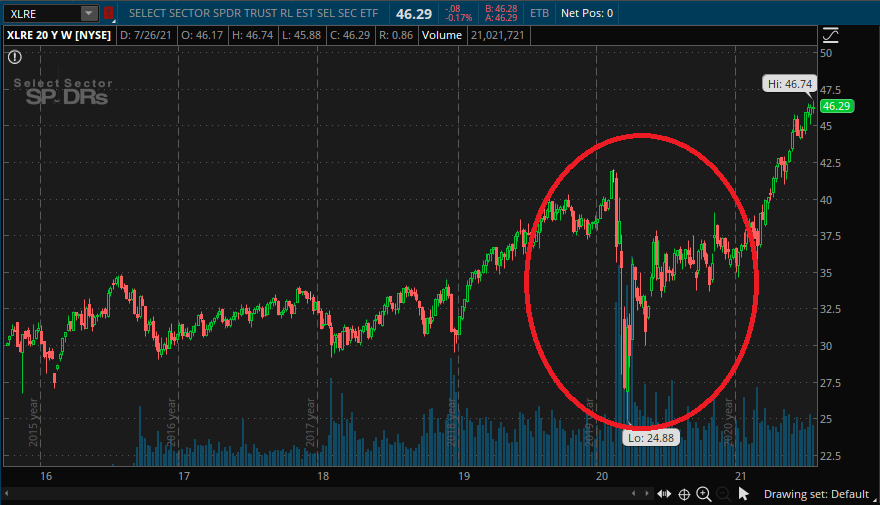

Here is image of one of the best performing ETF’s that seeks to track the top performing U.S REITS.

The above image is of SPDR’s Select Sector U.S REIT tracking fund, XLRE. XLRE seeks to track the most profitable REITS in the U.S sector.

XLRE holds positions in REITS that invest in commercial property, rental property, and storage sites. Because of this its a good gauge of the overall health of the U.S REIT economy.

If you invested $1000 in 2016 in XLRE you would now have $1,426. This represents a 42% growth over 5 years, or 8.4% per year.

Now lets look at the SPY, the largest ETF that tracks the overall U.S economy, over the same time period.

The above image is of the SPY over the past 7 years. 5 years ago you could have bought 1 share of SPY for $190.

With the same investment of $1000 in 2016 your investment would now be worth $2205. This represents a growth of 120.5% over 5 years, or 24.1% per year.

So the SPY is a better investment, but REITS are a more conservative pick right?

Still the answer is no.

Risk

During the height of the pandemic market crash XLRE (The ETF that tracks U.S REITS) dropped a grand total of 38% while the SPY dropped a total of 32% during the same time.

The reason behind this is that REITS have to pay out 90% of their net profit to their investors to retain their REIT status. This means that the company itself makes very little cash to protect itself against downturns in the market.

To drive this point home REITS had more risk to a market crash then the overall U.S market sector. By investing in U.S REITS you are exposing your portfolio to increased risk for less reward.

Its better for you to invest in the SPY or any other ETF that tracks the U.S market. You have less risk then REITS while at the same time having a much higher profit potential.

So why do people invest in REITS?

Well for two reasons.

First, they are lured in by the dividend amount.

Some REITS offer up to a 9% dividend per year. That’s insane.

For example if your chosen REIT gives out a dividend of 9% then off $10,000 you can make $900 a year or $75 a month. These dividends are straight cash so you don’t need to sell your shares to gain income off dividends.

Second, they think that REITS are a stable asset.

Its possible for a REIT to be a stable stock that has little volatility and grows at a steady pace.

These are rare however.

Most U.S REITS simply don’t beat the market in returns and they have more risk. Most new investors don’t know how to calculate risk in an asset and as such they try to build a portfolio around these REITS.

They will more then likely end up losing money over time, both in economic potential and in capital appreciation.

So What REITS are a good investment?

A good REIT is built around real estate that will generate revenue, have low overhead, and grow in land appreciation over time.

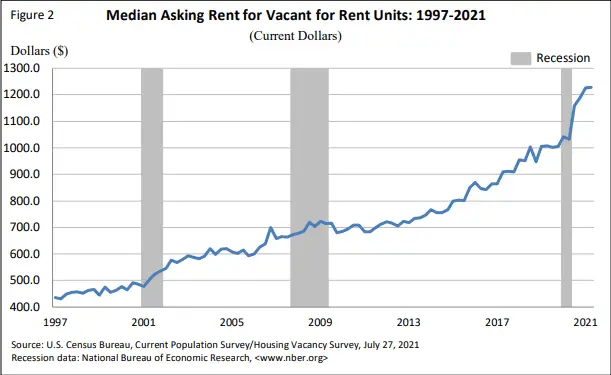

For example even though apartment rental rates are increasing at a record pace across the United States REITS that own rental apartments are a bad investment. This is because of the overhead, lifetime, competition, and repairs present in this type of real estate.

Here are two examples of great REIT investment companies where your initial investment will grow along with getting a great dividend payment monthly!

Great REIT pick 1: LAND

Gladstone Land Corporation is an amazing pick for a REIT. This is because LAND owns and leases out farmland where farmable acreage price is constantly increasing.

This means that the investors will generate a revenue from LAND renting out the land to farmers. This will take the form of a dividend going straight into your account.

More importantly the actual land that LAND buys and holds will appreciate in value over time. Which will increase the valuation stock price of LAND. This means that your investment will increase over time as well.

Talk about double dipping!

For a full run down on LAND and why its a good pick check out the following post!

LAND stock analysis: Going long on LAND

Great REIT pick 2: STAG

STAG industries is an amazing REIT. This is because STAG invests in warehouses that cater to the ever growing industry of e-commerce.

By investing in STAG you are going to generate a revenue from all things e-commerce. This is because e-commerce needs to house their products before shipping them to their end consumer.

STAG holds the warehouses for these e-commerce businesses.

By investing in STAG you will get a nice dividend return every month. More importantly your initial investment will be increasing in value as land these warehouses are on increase in value.

Because warehouses require almost no overhead STAG operates a multimillion dollar enterprise with only 78 employees. This means that the overhead for the entire company is close to zero.

Overall its a great REIT pick. For a full rundown check out this post before you invest.

Stag Industrial Inc (STAG) analysis: Why you need to buy STAG.

Conclusion

Generally U.S REITS are not a conservative investment. You really have to know what you are doing before you jump into investing in REITS. If you don’t want to spend the time to research the potential REIT then you should just by the SPY as you will have less risk and higher return.

As always if you like content like this then you should share this on social media as well as subscribe to the newsletter! Every share helps me help others generate wealth in the market, so its much appreciated.

-

How Long Does a Short Squeeze Last? (3 Answers)

What is the time frame for you short squeeze? Well here is everything you will ever need to know to determine how long it will last.

-

Why You Still Own a Stock After It’s Delisted and How to Sell It

Do you still own a stock after its delisted? How do you sell it? Don’t worry the stock is still worth money and here is how to sell.

-

Can You Make 1% A Day in the Stock Market? (3 Steps)

Making 1% a day in the stock market is hard but defiantly doable. Here are 3 simple steps to helping you achieve this return.

Until next time, I wish you the best of luck in your investments.

Sincerely,