| Read This For More Info | Shorting a Stock Explained: Making Money When the Stock Goes Down |

When it comes to amazing opportunities in the stock market few are as powerful as a short squeeze. Some short squeezes can shoot upwards of over 200% in as little as 2 or 3 minutes. The trick is to grab these short squeezes before they explode and how you do that is by building a good stock scanner. As such here are the 3 steps you need to follow to scan for one of these rockets for yourself.

Scanning for the next short squeeze is as simple as following these 3 steps. First, make sure you build a scanner to look for a stock with a low float. Second, after this, you need to scan these stocks for the highest short percentage. Third, finally, you need to add a variable to the scanner that can find increasing volume.

If you do this properly then you will end up with only a couple of stocks on the market. These stocks have the 3 qualifications to be a short squeeze; they have a low float, high short percentage, and increasing volume. After you find a stock that can be squeezed then it is just a matter of finding the right catalyst that will send it skyrocketing upwards.

Let’s jump right in. Here are the 3 steps to scanning for a short squeeze.

Step 1: Creating a Scanner To Look For A Low Float Stock

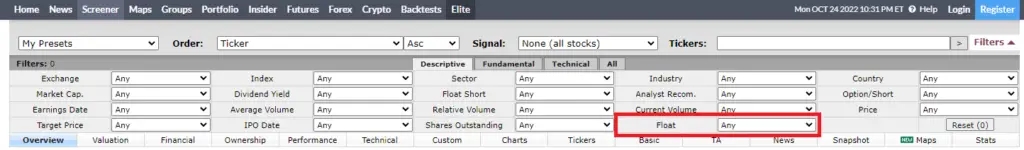

The first step to scanning for a short squeeze is to create a scanner that will scan the entire market for a low float stock.

The float of a stock is how many publically traded shares there are on the market. Larger companies will often have billions of shares out on the market for sale or buy. This means that there is a larger pool of shares which means the stock will move a lot slower.

Any company that has a float of under 100 million shares is a small float. If you can find a company that has a float of under 50 million shares then that is extremely volatile. It is a small float company that will allow for large explosive growth on a stock.

If anybody ever tells you that a company is going to see crazy growth then look at the float of a company. If that company has a float of under 100 million then chances are it won’t be the next short squeeze. Just knowing this will help you not lose money in the markets; a stock has to have a low float to be able to have a short squeeze.

As such the first thing we have to do in order to scan for a short squeeze is to look for the float of the company’s stock. A scanner will be able to filter through all of the stocks on the market and give you a list of low-float stocks.

Step 2: The Next Step Is to Scan for a High Short Percentage

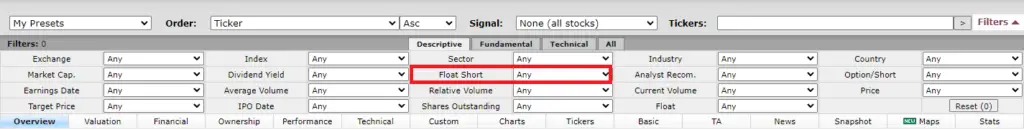

After you have narrowed down your list of stocks to only stocks with a low float the next part is to figure out which one of these will explode.

How we do that is by figuring out how many shares of this public float have been loaned out on short. When someone shorts a stock they basically borrow imaginary shares to pay back in the future. If they pay back the imaginary shares when the stock costs less then they make the spread as profit.

When a stock has a high short percentage that means that a lot of people expect the stock to go down. If too many people short the stock to try and make money then that’s when we can get a short squeeze.

In your scanner look for a stock where 30-50% of the float has been taken out on short. This means that if the stock starts moving upwards then people will have to quickly buy the stock back to cover their loss. As more and more short investors buy back their stock then the price will rise dramatically. This is a short squeeze.

Finding stocks with a high short percentage is vital to building a short squeeze scanner. Here I always put between 30-50% of the stock out on short as a variable in my scanner. Now I have taken my list of low-float stocks and narrowed it down to an even smaller list of stocks that are heavily shorted.

As such the second step to building out your short squeeze scanner is to scan for stocks with a high short percentage after scanning for stocks with a low float. Now, whatever stocks we have left in our scanners have a low float and a ton of shares that need to be bought back by investors.

Step 3: Add A Variable That Can Scan For Increasing Volume

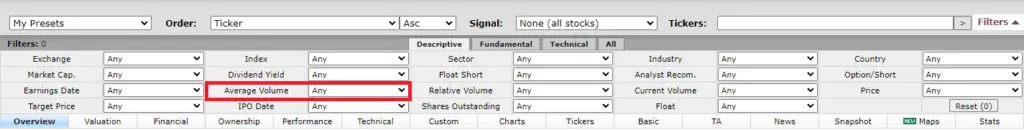

The last step to building out a stock scanner that can easily spot short squeezes is to add the last variable into our scanner. This is to search for stocks that have had a growing average volume over the past 30 days.

Now that we know how many shares there are out on loan/short along with how many shares there are available to trade we need to search for growing volume. This is because if the average volume is growing then so is the volatility present in the stock. If volume continues to grow then the likelihood of the stock exploding is high. This is what causes a short squeeze.

In the professional investing world we call this an investing catalyst. A catalyst is what will make the stock move. Here we have built a scanner that will scan the entire market to find a stock with a low float, high short percentage, and now increasing volume to push the shorts to buy back.

This growing volume can result in stocks rapidly exploding upwards as more and more people begin to buy back shares to cover their short position. Since we discovered the short squeeze early enough we will profit from people rapidly jumping in to chase the stock as it climbs upwards as well.

Conclusion

There you have it; the 3 steps to scanning for a short squeeze.

So long as you follow these three steps then you will start to uncover massive opportunities in the market. Several big investors got their start by chasing these short squeezes and finding them before they exploded upwards. This process can be easily replicated so long as you know what you are looking for; which is what this article goes over!

Check out some of our other articles below if you have time.

-

How Long Does a Short Squeeze Last? (3 Answers)

What is the time frame for you short squeeze? Well here is everything you will ever need to know to determine how long it will last.

-

Why You Still Own a Stock After It’s Delisted and How to Sell It

Do you still own a stock after its delisted? How do you sell it? Don’t worry the stock is still worth money and here is how to sell.

-

Can You Make 1% A Day in the Stock Market? (3 Steps)

Making 1% a day in the stock market is hard but defiantly doable. Here are 3 simple steps to helping you achieve this return.