Stock trading has been around for well over a century. Nowadays we can log into an online brokerage firm and place our stock orders online. This has led to an explosion in online day trading since the mid 90’s. However stock trading is not new and has been around for as long as the markets. So then how did people trade stocks before the internet?

Here is the short answer.

The answer: Stock trading was done by charting out graphs by hand and either phoning a broker to place a trade. Before phones you would have had to physically be at an exchange to place a trade. This means that prior to the 90’s in order to be a stock trader you would have had to know how to graph out a stock yourself and then place a trade.

However the long answer is much more involved and complex. Stock trading before the age of computers and the internet was a long drawn out process. This article is going to go over the whole process from start to finish. It all revolves around how fast data can be transmitted from the investor/trader to the market. Now in the age of computers data transmission is almost instant, before computers placing a stock trade would have taken a long time.

Here at Chronohistoria I teach people how to generate wealth above normal market returns (alpha). I routinely publish articles on investing research, methodologies, and tips/tricks of the trade. The whole point is to better arm the average retail trader so that they can make huge returns in the markets.

Feel free to sign up for the free newsletter to remain up to date on everything investing.

Let’s jump right into the article; Stock Trading Before Computers: How It Was Done.

Stock Trading Before Computers: Hand Drawn Graphs, Telephones, and Open Outcry Yelling.

If you wanted to be a professional stock trader before computers started dominating trading then you would have had to have 3 things. First, you would have had to have an office that could graph out charts for you. Second, your firm would have to have a phone link to the exchange. Third, your firm would have to have a person who was loud and aggressive enough to yell your orders out via the open outcry method.

The Hand Drawn Graphs and Stock Ticker Tape Era

Today we are used to computer drawn graphs. These graphs are automatically updated with the latest information and allow for rapid transmission of trades. Everything happens seamlessly and we take for granted the subtle art of hand drawn stock graphs.

Before the 1960’s you would have to document each price change that happens on an exchange. When a stock increased by a dollar you would have to write down the time and increase in price. Over time you would be able to create a stock chart by which you could trade off of.

From 1870 until 1960 all stock market data was transmitted over telegraph lines. A machine would then take this telegraph transmission and punch out the latest stock information on volume and price. This creation was called ticker tape and it was the basis that all professional traders would obtain their information from. (Source on history)

Professional trading firms would hire people who could draw accurate graphs from these ticker tapes. These people would spend the entire day graphing and presenting charts to management who would then order trades to be placed. One of the founders of technical analysis, William Peter Hamilton, published an entire book in 1897 on the concept and subtly of graph focused investing. (Source for book)

In the 1960’s primitive computers would come to replace stock tickers as a way of transmitting accurate financial data on stock exchanges. However these computers were extremely primitive and only displayed the volume and latest price. Professional stock graph drawers existed up until the late 70’s when firms started to automate their job with computers.

As you might imagine hand drawing graphs from stock ticker tape drastically slowed down the trading lifestyle. Today we can place trades instantaneously. Before the age of computer trading it would take you an hour to just draw out a graph and make a decision.

Telephones

Ok, so your professional trading firm has decided to place a trade. Now you would need to relay that information back to the exchange to have a person representing your firm place the stock trade.

Before 1878 your trading firm would have had to send a runner to relay the message to your representative at the exchange to trade a certain stock. This took valuable time and fast stock runners were paid very well. In fact the transmission of information amongst the public was the primary mover of stocks in the 19th century.(Source)

1878 marks an important year because that’s the year that the first telephone was installed on the New York Stock Exchange. The telephone revolutionized the stock market. Now firms could read the ticker tape, make a prediction, and then call the floor to place their trade. These telephones were so important that by 1920 there were over 88,000 telephones on Wall Street Alone. (Source)

The telephone revolution had begun. Now what took hours to do could be performed in a matter of minutes. This huge spike in information transmission speeds started interlinking all the sectors across the United States. This interlinking and subsequent volatility increase would be one of the causes of the great depression of 1929.(Source)

Telephones would continue to dominate trading right up until the 1990’s when online trading became readily available for retail investors. However up until 2009 all trades had to go through a face to fact interaction on a trading floor regardless of computer driven orders.

Open Outcry Method Of Placing Trades

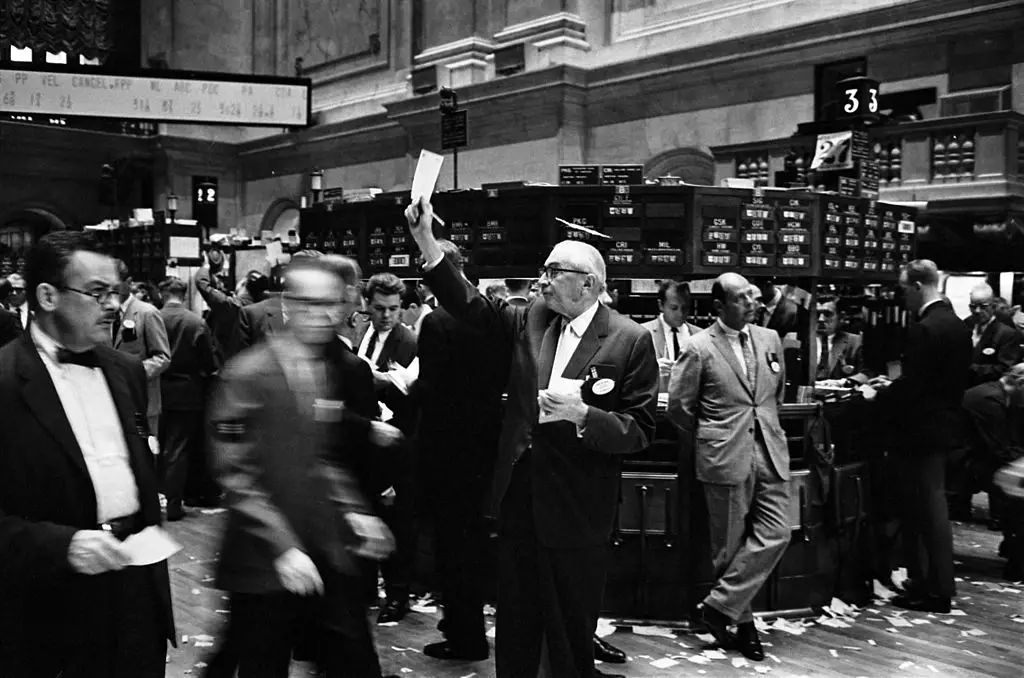

A relic of the past. Before computer trading started taking off in the 1990’s all traders had to be shouted at an exchange. A buyer would stand up and say “I am selling 10 shares of X company at $10.95” and everyone would write down that sell order in a personal notebook. Someone else would shout “I am buying 10 shares of company X at $10.30” and everyone would write down this number.

Now multiply this by 3000 companies on an exchange. This type of order buying and selling is called open outcry and up until the 1990’s it dominated the way stock trading was performed.

The above image is of the trading “pit” in the Chicago exchange on January 1st, 1993. As we can see the professional traders are standing in the middle of the “pit” yelling out their buy and sell orders.

This obviously would become incredibly hectic. On a single trading day thousands of orders would be shouted out every hour. These orders would fluctuate continuously as more and more telephone calls/texts would hit the brokers phones.

It was an artform to navigate the trading pit successfully. A stock trader had to get the best price for their client. As such a good stock trader would attempt to deceive other stock traders into settling on a trade in their favor.

One by one all of the major exchanges in the world started converting to electronic trading starting in the late 1980’s. From 1987 up until 2017 all major exchanges converted to electronic trading except one. To this day you can go to the Chicago Board of Trade’s exchange in Chicago to engage in open outcry trading.

Currently open outcry trading is only used to obtain good pricing on complex investing strategies surrounding futures contracts. Typically these strategies are reserved for institutional investors and hedge funds.

The art of the trading pit is fast dying. I have only ever found one resource that has successfully preserved the nature of pit open outcry investing. If you’re interested in the culture and art of open outcry investing I recommend you check out the website TradingPitHistory.com.

Summary

Before the age of computer trading stock trading was harder to get into. The art of reading ticker tapes, drawing graphs, and pit open outcry trading has long died out. However now with the use of computer aided trading we are seeing a surge in complex investing methodologies and faster capital transition.

It all comes down to this. The history of stock trading has revolved around how fast information (data) can be transmitted. A “fast” stock trade in 1887 would have taken an hour or two to complete. Today “fast” stock trades can be performed in a thousandth of a second.

Conclusion

There you have it, an entire article that goes over how stock trading before computers was performed. A lot of people glance over the history of capital markets, which is unfortunate because of how cool it all is.

Here at Chronohistoria I teach people how to generate above normal market returns (alpha) in their portfolios. I routinely publish articles on investing research, methodologies, and tips/tricks of the trade so that you can be better prepared. Feel free to sign up for the free newsletter to remain up to date on everything investing.

Further, you can check out the other articles below.

-

How Long Does a Short Squeeze Last? (3 Answers)

What is the time frame for you short squeeze? Well here is everything you will ever need to know to determine how long it will last.

-

Why You Still Own a Stock After It’s Delisted and How to Sell It

Do you still own a stock after its delisted? How do you sell it? Don’t worry the stock is still worth money and here is how to sell.

-

Can You Make 1% A Day in the Stock Market? (3 Steps)

Making 1% a day in the stock market is hard but defiantly doable. Here are 3 simple steps to helping you achieve this return.

Until we meet again, I wish you the best of luck on your investing journey.

Sincerely,