Good afternoon guys,

Market just closed. It came to my attention that a lot of people don’t know this strategy to double dip on some of the larger U.S ETF assets. For this example we will be using my personal favorite $SPY.

Thesis: Double Dipping

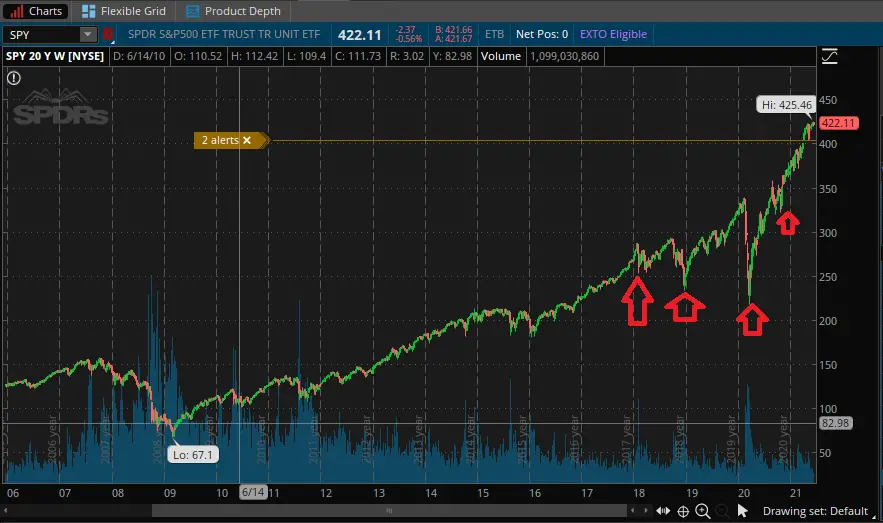

The underlying asset in this case ($SPY) is the U.S Market which has been steadily increasing for the past 200 years. In theory this trend will continue for the foreseeable future. As such we can think about how to profit from this trend.

So how exactly do we profit from this trend. Well the first way is buying and holding shares of the $SPY, but the other way is to strategically sell puts on the $SPY as well. The first part of setting up this trade is to put $42,000 capital on reserve (100 shares of SPY should your contract be called away). We can hold this capital in stable assets such as a bond ETF such as $BIT while the trade works its magic. Or you can simply hold a U.S index etf such as $VTI or $SPY as well.

The next step is to sell a put on the $SPY which will guarantee you an entry point at a certain strike price in the future. You will need to be able to buy 100 shares of the $SPY in worse case scenario, but since the U.S trends upwards eventually you will net positive even in the worse case scenario of you owning 100 shares of the $SPY ETF.

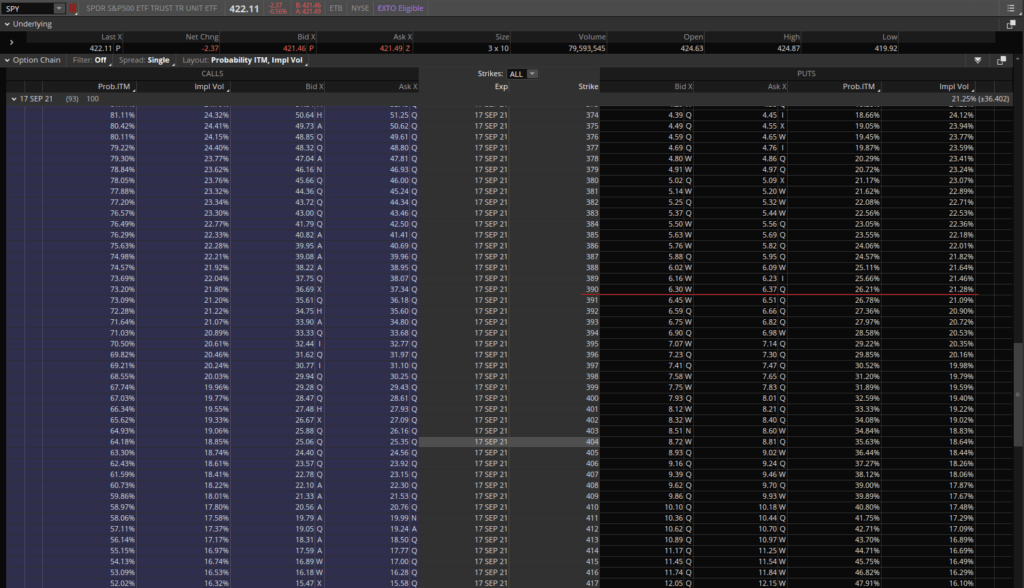

This trade serves two purposes, the first is to guarantee your downside and define your risk. If you sell a put for the $390 strike price currently you will net $638 of premium, but you run the risk of being exercised to buy 100 shares of $SPY. Which his not that bad of an idea since the $SPY just tracks the U.S Market.

Second, the premium you make for selling this put will be debited into your account which allows you to but more shares of the asset ($SPY). Currently on a $390 put with 93 days to expiration will net you $638 in juicy premium. If the asset does not drop below $390 then you will just get to keep the $638 which is an added benefit.

We will then be putting that premium generated capital into the $SPY. This will allow you to gain capital on a trend upwards. An action which gives you a “double-dip” opportunity on the $SPY. If your contract is not exercised then simply sell another put at expiration and repeat the process. If the option does get exercised then you have to buy 100 shares of $SPY, which is ok since you will gain capital on the ever increasing U.S market.

Finally, with the premium we farm from doing this we can start to buy puts on the $SPY to guarantee our downside. Do this process enough times and you will be able to buy a put in the $SPY which guarantees your downside on the position, or in other words hedges your bet.

Conclusion:

If you have the capital to engage in this kind of trade then its an easy way to hedge your capital on the $SPY while also raking in some juicy profit. The only risk to this position is that your shares get called away at exactly $390 and then you cant enter in before it jumps up to $392. On the flip side if your asset continues to drop heavily then you can be glad you sold at the strike price.

If the naked put (selling without cover) gets exercised then just wait for the U.S market to inflate and then repeat the process. You will “double-dip” on the percentage gain by doing this strategy.

As always if you like content like this then make sure you share, like, follow, and subscribe to our weekly newsletter.

P.S: This methodology applies to any asset with options available. Just be warned that the reason I chose $SPY is because the U.S market will increase in value. If your confident that another asset will continue to go up you can rake in a ton more but have more risk.

Best of Luck